Automotive Ecall Market Size, Share, Trends and Forecast by Type, Installation, Vehicle Type, and Region, 2025-2033

Automotive Ecall Market Size and Share:

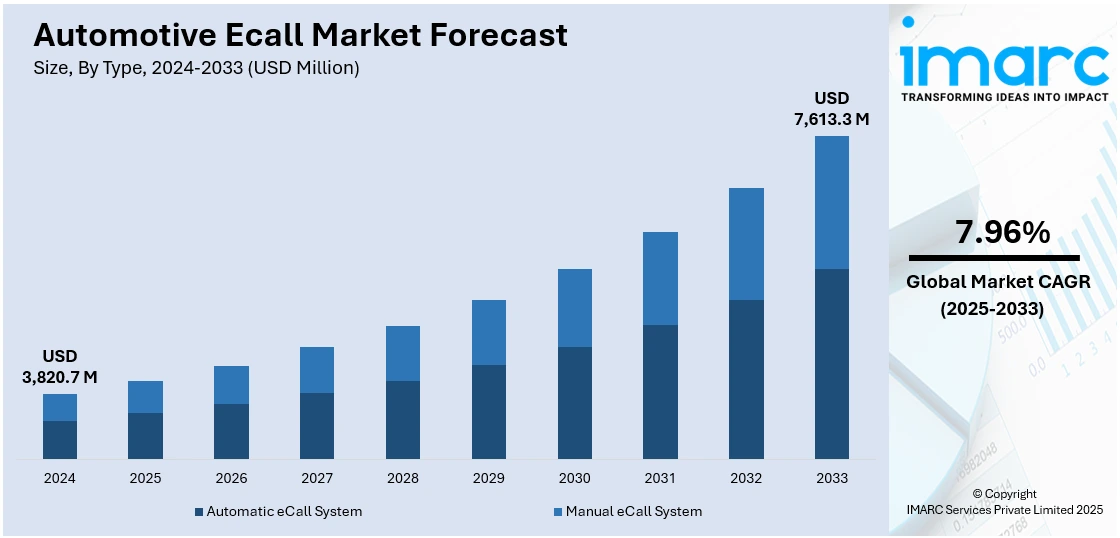

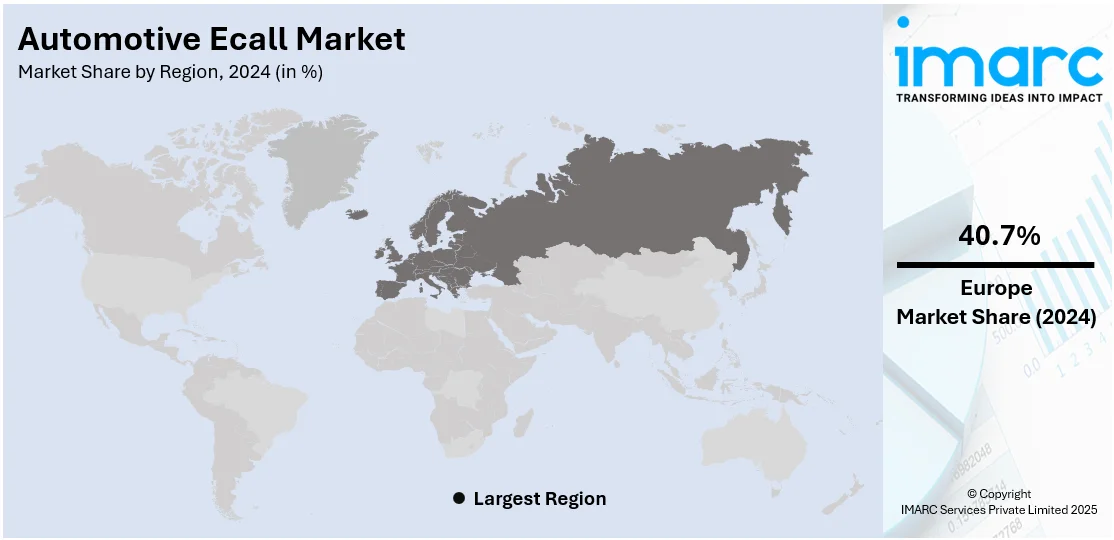

The global automotive eCall market size was valued at USD 3,820.7 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 7,613.3 Million by 2033, exhibiting a CAGR of 7.96% from 2025-2033. Europe currently dominates the market, holding a market share of over 40.7% in 2024. The increasing emphasis on passenger and road safety, the implementation of favorable government initiatives to mandate automotive eCall feature, rising expenditure capacities of consumers, and significant growth in the automotive industry represent some of the key factors driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 3,820.7 Million |

|

Market Forecast in 2033

|

USD 7,613.3 Million |

| Market Growth Rate 2025-2033 | 7.96% |

A major driver in the automotive eCall market is the growing emphasis on vehicle and passenger safety. Governments and regulatory bodies across the globe are increasingly promoting the integration of automatic emergency call systems in vehicles to enhance road safety. ECall systems automatically notify emergency services when a serious accident occurs, reducing response times and potentially saving lives. This focus on improving post-accident care has pushed automakers to adopt and implement this technology in newer vehicle models. As awareness of road safety continues to rise, both consumers and manufacturers are showing greater interest in vehicles equipped with advanced emergency response systems.

In the U.S., the automotive eCall market is growing as safety and connectivity become greater priorities for drivers and manufacturers along with a market share of 86.90%. While not yet mandated nationwide, many automakers are integrating emergency call features into their vehicles to enhance response in critical situations. These systems automatically connect with emergency services when a severe collision occurs, improving the chances of timely assistance. The rise of connected vehicle technologies and advancements in in-car communication are supporting the expansion of eCall systems. Consumer interest in safety features, combined with industry innovation, continues to drive the adoption of eCall solutions across the American automotive market.

Automotive Ecall Market Trends:

Transition to Next-Generation eCall with 4G/5G Integration

The vehicle's eCall system is in transition as it phases out outdated network technologies to progress to higher-performance 4G and 5G systems. This move permits emergency call systems to relay more information quicker and more accurately. With enhanced support from networks, cars are capable of communicating greater amounts of finer-grained details to emergency services, including accurate location, state of the car, and even audio captured from within the car. Automakers are working together with telecom companies to allow easy integration of this technology. As newer networks become increasingly prevalent, eCall systems will enjoy improved connectivity, which translates to faster response times and improved communication during emergency situations, which makes the roads safer for all.

Emergence of Mobile-Based eCall Solutions

Mobile-based eCall solutions are gaining momentum, particularly in areas where vehicles lack built-in emergency systems. These systems leverage smartphone technology using sensors, global positioning system (GPS), and motion detection—to identify crashes and automatically alert emergency services with key information, including the driver’s location. This flexible and cost-effective solution is especially valuable for drivers of older vehicles or those in regions where factory-installed systems are uncommon. It helps extend critical safety features to a broader population, improving emergency responsiveness and road safety. Notably, the European Commission has reported that eCall systems can reduce emergency response times by 40% in urban areas and up to 50% in rural regions, potentially saving 2,500 lives annually. This underscores the importance of expanding eCall accessibility through mobile platforms, ensuring more drivers benefit from faster, life-saving assistance regardless of their vehicle type.

Integration with Insurance and Liability Frameworks

As eCall systems become more advanced, they’re playing a larger role in how insurance companies assess incidents. These systems provide real-time information about crashes like the time, location, and severity which helps insurers understand what happened more accurately and efficiently. This can lead to quicker claims processing and can also help reduce misunderstandings or disputes. Insurers may use this data to tailor policies based on driving behavior, encouraging safer habits. Additionally, the reliable data from eCall systems can support legal investigations by offering clear evidence about an accident. This integration is shaping how insurance and legal systems handle vehicle incidents, making processes smoother and more transparent for all parties.

Automotive Ecall Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global Automotive Ecall market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, installation, and vehicle type.

Analysis by Type:

- Automatic eCall System

- Manual eCall System

Automatic eCall systems hold the majority share of 77.2% the market due to their ability to provide immediate and reliable assistance without requiring driver input during emergencies. These systems automatically trigger a call to emergency services when sensors detect a serious collision, ensuring rapid response even if the driver is unconscious or unable to act. This hands-free operation significantly improves road safety and reduces response times. Governments and regulatory bodies, especially in regions like Europe, have strongly supported their adoption through legislation. Additionally, consumer demand for safety-enhancing technologies in vehicles continues to grow. Automakers are increasingly making automatic eCall systems standard in new models, contributing to their widespread use and dominance in the overall eCall market.

Analysis by Installation:

- Third Party Service (TPS) E-Call

- Standard E-Call

Third Party Service (TPS) eCall systems are managed by private service providers who handle emergency calls before connecting them to local emergency services. These solutions offer added features like concierge services and vehicle diagnostics. They are often used by premium car brands to enhance customer service and offer more control over data flow.

Besides this, automotive ecall market scope highlights the standard eCall systems that automatically connect vehicles directly to public emergency services in the event of a serious crash. Mandated in many regions like the EU, these systems focus solely on safety, without extra services. They ensure rapid response times by bypassing intermediaries, offering a simple, regulation-driven solution for all new vehicles.

Analysis by Vehicle Type:

- Passenger Cars

- Commercial Vehicles

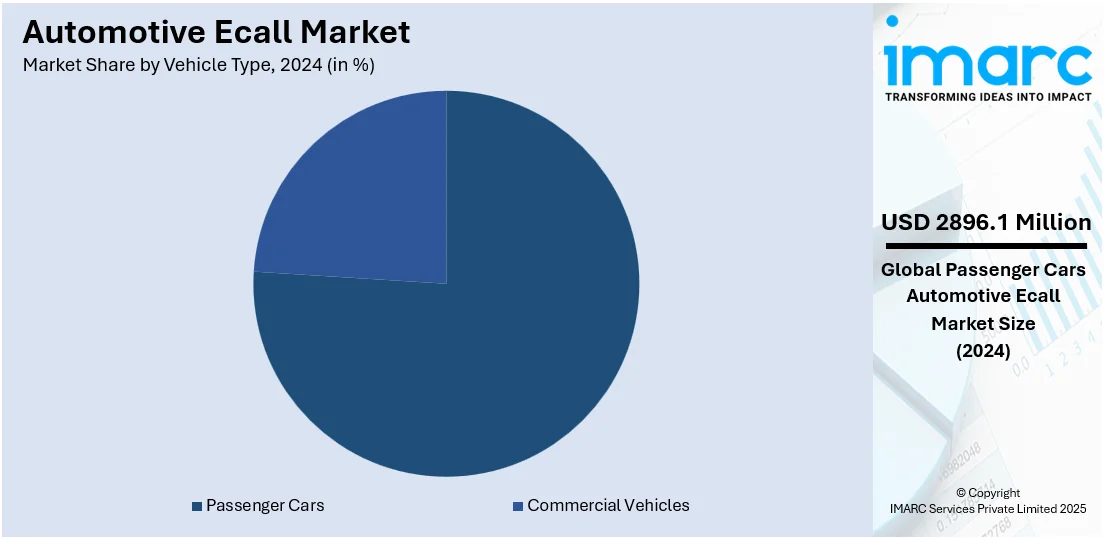

Passenger cars dominate the automotive eCall market along with a share of 75.8% due to their high production volume, widespread use, and growing consumer demand for advanced safety features. Automakers are increasingly integrating eCall systems into passenger vehicles to meet safety regulations and enhance their appeal to safety-conscious buyers. These vehicles are more likely to adopt connected technologies, making them ideal platforms for eCall implementation. Additionally, urbanization and rising traffic density have heightened the need for faster emergency response, especially for daily commuters and family vehicles. As eCall systems offer peace of mind and faster assistance in the event of accidents, their integration in passenger cars has become a priority, driving their dominance in the overall market share and contributing to the automotive ecall market growth.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Based on the automotive eCall market outlook, the Europe is holding a significant share of 40.7% largely driven by strong regulatory support and a clear focus on road safety. The European Union has been a major force behind this growth, with policies requiring all new vehicles to be equipped with eCall systems. This regulation has encouraged widespread adoption across automakers, ensuring that emergency response technologies become a standard feature. Additionally, Europe’s well-developed transportation infrastructure and emphasis on connected vehicle technology have supported this shift. Public awareness about road safety and quick emergency assistance has also played a key role. Together, these factors have positioned Europe at the forefront of the eCall market, pushing consistent innovation and integration across the region’s automotive industry.

Key Regional Takeaways:

North America Automotive Ecall Market Analysis

The market for automotive eCalls in North America is expanding steadily because to rising consumer demand for safer cars and developments in linked car technology. The integration of eCall systems into vehicles improves emergency response times and provides critical data to emergency services in the event of a crash. While not yet mandated on a national level, North American automakers are incorporating eCall features into their vehicles to enhance safety, boost customer satisfaction, and improve overall connectivity. This adoption is driven by growing awareness of the life-saving potential of eCall systems and their ability to streamline insurance claims processes by providing real-time data on accidents. Furthermore, the use of eCall systems helps insurers more accurately assess incidents, leading to quicker claims processing and fewer disputes. The regulatory environment also plays a crucial role, with initiatives in various states encouraging the adoption of safety technologies. As the market evolves, the continued expansion of connected and autonomous vehicle technologies, alongside advancements in telematics and IoT, is expected to accelerate eCall adoption. Overall, the North American automotive eCall market is poised for robust growth, driven by safety priorities, innovation, and regulatory support.

United States Automotive Ecall Market Analysis

The United States automotive eCall market is experiencing significant growth due to regulatory mandates and advanced vehicle safety technologies. Consumer awareness and integration of eCall systems in connected vehicles are key factors in market expansion. Robust telecommunication infrastructure supports seamless emergency response services, while advancements in artificial intelligence and IoT improve system capabilities. The growing production of high-end and electric vehicles with built-in eCall features fuels market growth. Collaborations between manufacturers and telematics providers enhance system efficiency, and cloud-based emergency response systems offer real-time accident detection and communication. As demand for autonomous and connected mobility grows, eCall adoption is expected to increase, ensuring enhanced passenger safety. Furthermore, government incentives and initiatives promoting vehicle safety regulations are contributing to the market's positive outlook. Notably, the U.S. Department of Transportation announced 257 fiscal year (FY) 2024 Safe Streets and Roads for All (SS4A) grant awards, totaling USD 172 Million, to support local, regional, and tribal communities in enhancing road safety. Such initiatives align with the growing emphasis on emergency response solutions, further driving eCall system adoption.

Europe Automotive Ecall Market Analysis

The Europe automotive eCall market is experiencing steady growth, primarily driven by stringent safety regulations and the widespread adoption of connected car technologies. The region has well-established automotive safety policies that mandate the inclusion of eCall systems in new vehicles, boosting market demand. Rising consumer preference for smart safety solutions and real-time emergency assistance is further propelling growth. Automotive manufacturers are integrating advanced telematics solutions, enhancing the reliability and efficiency of eCall services.The EU wants to cut the number of road fatalities and serious injuries in half by 2030 and get closer to zero by 2050, according to the European Court of Auditors. This ambitious goal is accelerating the adoption of advanced vehicle safety technologies, including eCall systems, as they play a crucial role in reducing emergency response times and mitigating accident impacts. Technological advancements, such as AI and cloud-based emergency response systems, are enhancing eCall functionality. Intelligent transportation systems, V2X investments, and 5G networks are also improving efficiency. The market is expected to expand due to automotive safety standards.

Asia Pacific Automotive Ecall Market Analysis

The Asia Pacific automotive eCall market is witnessing rapid growth due to increasing vehicle production and rising awareness about road safety. The integration of eCall systems in connected vehicles is gaining momentum as automakers focus on enhancing safety features. Telematics and Internet of Things developments are increasing system accuracy and emergency reaction times. The expansion of smart transportation infrastructure and the rise of electric and autonomous vehicles are driving the adoption of built-in eCall technology. Next-generation communication networks, including 5G, are expected to enhance eCall functionality. Collaborations between automotive and telecom industries and urbanization are also strengthening market growth. According to the Australasian Fleet Management Association, Australia is facing a burgeoning crisis of rising road deaths, with 1,300 people involved in fatal road crashes in 2024.

Latin America Automotive Ecall Market Analysis

The Latin America automotive eCall market is expanding due to increased vehicle connectivity and awareness about emergency response solutions. Telematics infrastructure expansion supports eCall adoption, while advanced safety features and technological advancements like AI-driven crash detection improve system effectiveness. The rise of electric vehicles also accelerates demand for built-in emergency assistance solutions. The deployment of improved telecommunication networks is enhancing eCall reliability, ensuring faster response times. The market is also benefiting from growing investments in smart mobility solutions and intelligent transportation systems. According to reports, a planned investment of BRL 18 Billion, aligned with the goals of the UN Decade of Action for Road Safety 2021-2030, is expected to further support road safety initiatives, driving the adoption of advanced emergency response technologies such as eCall systems.

Middle East and Africa Automotive Ecall Market Analysis

The Middle East and Africa automotive eCall market is growing due to the adoption of connected car technologies and advancements in vehicle safety systems. Consumer awareness about road safety and emergency response solutions is driving demand for eCall-equipped vehicles. AI and IoT innovations are improving efficiency and safety features in vehicle models, boosting market expansion, and the growing focus on intelligent transportation systems and connected mobility solutions creates new opportunities. Notably, the Saudi Arabia connected car market size reached USD 2.3 Billion in 2024, and according to IMARC Group, it is projected to reach USD 9.6 Billion by 2033, with a CAGR of 15.1% during 2025-2033. This rapid expansion in the connected car segment is expected to drive further adoption of eCall solutions across the region.

Competitive Landscape:

The competitive landscape of the automotive eCall market dynamics is influenced by innovation, compliance with regulations, and the incorporation of sophisticated technologies. Firms compete on improving system precision, user interface, and faster connectivity to emergency services. The market is driven by changing government regulations, necessitating companies to conform to regional safety standards. Telematics, IoT, and cloud-based integrations are becoming major differentiators, enabling providers to provide end-to-end solutions. Collaborations between automakers, technology developers, and telecom providers are also making competition even fiercer. As retrofittable and mobile-based solutions become increasingly popular, even new players are entering the market and making it more innovative. Overall, competition revolves around providing easy-to-use, real-time, and reliable safety solutions that improve emergency response and vehicle connectivity.

The report provides a comprehensive analysis of the competitive landscape in the automotive eCall market with detailed profiles of all major companies, including:

- Robert Bosch GmbH

- STMicroelectronics N.V.

- Texas Instruments Incorporated

- Thales Group

- u-blox AG

Latest News and Developments:

- February 2025: Rohde & Schwarz and u-blox successfully validated u-blox’s automotive GNSS module for compliance with China's new GB/T positioning standard. The test ensured accuracy and reliability using the R&S SMBV100B GNSS simulator. The solution will be showcased at Mobile World Congress 2025, benefiting automotive manufacturers targeting the Chinese market.

- February 2025: Flairmicro received assistance from TÜV Rheinland Greater China in obtaining Next Generation eCall (NG eCall) certification for their T-Box device in accordance with EU Regulation 2015/758. Issued by Luxembourg’s SNCH, the certification ensures compliance with 4G/5G standards, enhancing emergency response capabilities. TÜV Rheinland reinforced its role in global vehicle safety certification.

- December 2024: Deutsche Telekom, Qualcomm, and Cetecom Advanced launched a pilot project to prepare mobile networks for Next Generation eCall (NG eCall). Using LTE, the system enables faster emergency response, multimedia data transmission, and real-time assessment. The initiative supports vehicle manufacturers and emergency call centers in testing NG eCall capabilities across Germany.

- September 2024: By successfully recertifying its EU eCall test solution with Cetecom Advanced, Rohde & Schwarz ensured adherence to the most recent regulations. Both companies collaborated on a Next Generation eCall test solution using 4G/5G networks. The R&S CMX500 platform was chosen for NG eCall conformance tests, supporting industry adoption ahead of the 2026 mandate.

- May 2024: BMW has added its Intelligent Emergency Call system to several 2024 motorcycles in the U.S. and Canada, including the R 1250 GS Adventure. The system can detect crashes and automatically contact emergency services, transmitting location data. The feature is standard or optional on multiple models, enhancing rider safety.

Automotive Ecall Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Automatic eCall System, Manual eCall System |

| Installations Covered | Third Party Service (TPS) E-Call, Standard E-Call |

| Vehicle Types Covered | Passenger Cars, Commercial Vehicles |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Robert Bosch GmbH, STMicroelectronics N.V., Texas Instruments Incorporated, Thales Group, u-blox AG, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the automotive eCall market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global automotive eCall market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the automotive eCall industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The automotive eCall market was valued at USD 3,820.7 Million in 2024.

The automotive eCall market was valued at USD 7,613.3 Million in 2033, exhibiting a CAGR of 7.96% during 2025-2033.

Key factors driving the automotive eCall market include stringent government regulations mandating emergency call systems, increasing consumer demand for vehicle safety, advancements in connected vehicle technologies, and the growing focus on reducing response times in emergencies. These factors combine to enhance safety and efficiency in road incident management.

Europe currently dominates the automotive eCall market due to strict safety regulations, including the mandatory installation of eCall systems in all new vehicles. Strong government support, advanced automotive infrastructure, and high consumer awareness about road safety have accelerated adoption, making Europe a leader in emergency response technology integration.

Some of the major players in the automotive eCall market include Robert Bosch GmbH, STMicroelectronics N.V., Texas Instruments Incorporated, Thales Group, u-blox AG, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)