Automotive Infotainment Market Size, Share, Trends and Forecast by Product Type, Vehicle Type, Operating System, Installation Type, Sales Channel, Technology, Connectivity, and Region, 2025-2033

Automotive Infotainment Market Size and Share:

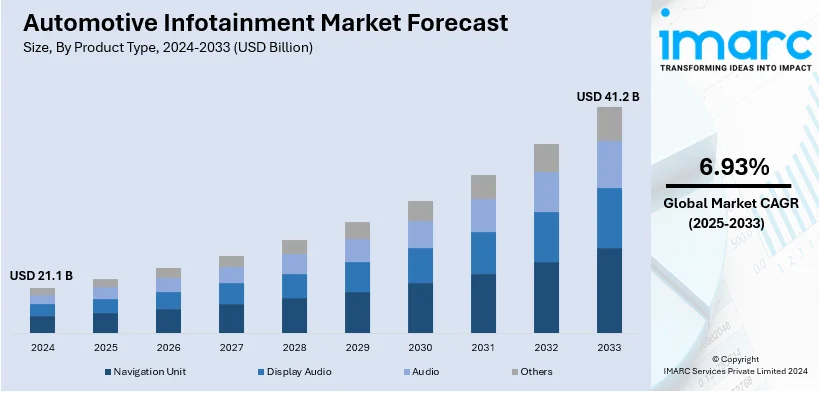

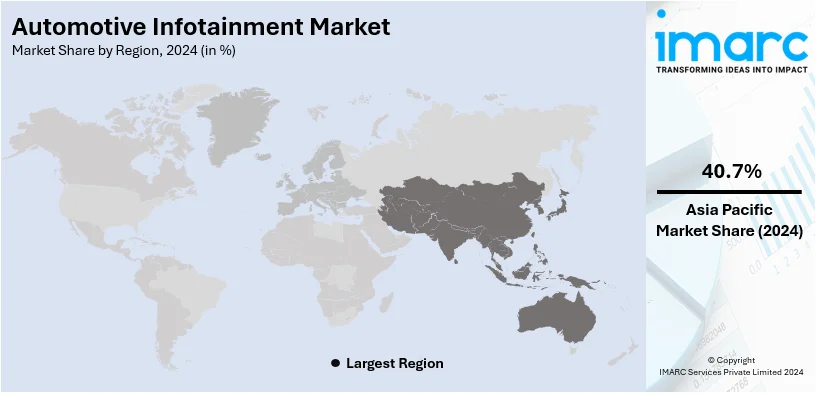

The global automotive infotainment market size was valued at USD 21.1 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 41.2 Billion by 2033, exhibiting a CAGR of 6.93% from 2025-2033. Asia Pacific currently dominates the market, holding a market share of over 40.7% in 2024. The market is driven by increasing demand for advanced infotainment systems due to smartphone integration, 5G-enabled connectivity, driver-assistance features, and loT, which together elevate comfort, safety, and convinienvce. Enhanced user interfaces, real-time updates, personalized content, and regulatory-backed innovation are shaping consumer expectations and driving the automotive infotainment market share.

Market Size & Forecasts:

- Automotive infotainment market was valued at USD 21.1 Billion in 2024.

- The market is projected to reach USD 41.2 Billion by 2033, at a CAGR of 6.93% from 2025-2033.

Dominant Segments:

- Product Type: Audio dominates the automotive infotainment market, attributed to its widespread demand for entertainment, communication, and seamless integration with vehicle systems.

- Vehicle Type: With a commanding 79.5% share, passenger cars lead the automotive infotainment market, accredited to higher user demand, technological integration, and preference for enhanced driving experiences.

- Operating System: LINUX represents the largest market share, accounting 60.0% in 2024. The dominance of the segment is driven by its open-source nature, flexibility, scalability, and strong developer community support.

- Installation Type: In-dash infotainment accounts for the majority of the automotive infotainment market share, with 65.4% in 2024, due to seamless integration, advanced features, aesthetic appeal, and convenience, offering a centralized control system for drivers.

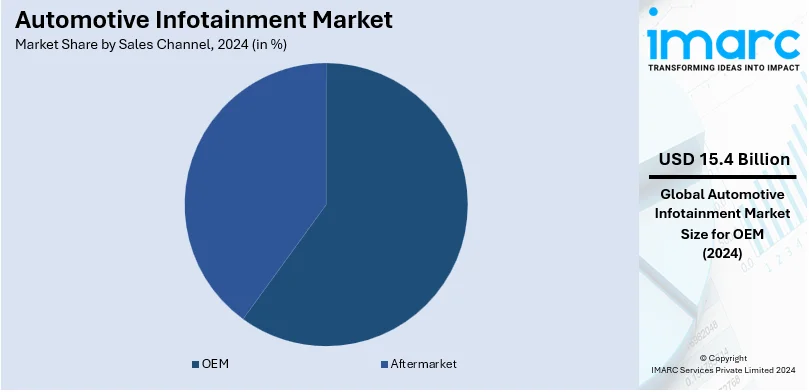

- Sales Channel: OEM holds the biggest market share, accounting 72.8% in 2024. The dominance of the segment is because of direct integration with vehicle manufacturing, ensuring compatibility, quality, and tailored customer experiences.

- Technology: Tethered dominates the automotive infotainment market, attributed to reliable, high-speed data transfer, seamless smartphone integration, and enhanced user experience through wired connections.

- Connectivity: Bluetooth represents the largest market share, accounting 35.9% in 2024. The dominance of the segment is attributed to its wireless convenience, universal compatibility, ease of use, and ability to support hands-free communication and streaming.

- Region: Asia Pacific leads the automotive infotainment market, holding a dominant 40.7% share. This regional advantage is driven by rapid automotive industry growth, increasing user demand, and advancements in infotainment technology integration.

Key Players:

- The leading companies in automotive infotainment market include Alps Alpine Co., Ltd, Continental AG, Denso Corporation, Garmin Ltd., HARMAN International, Marelli Holdings Co., Ltd., Mitsubishi Electric Corporation, Panasonic Corporation, Pioneer Corporation, Robert Bosch GmbH, and Visteon Corporation.

Key Drivers of Market Growth:

- Increased Time Spent in Vehicles: As traffic congestion increases, people spend more time in their cars, creating a higher demand for in-car entertainment and convenience. Infotainment systems are evolving to offer services like streaming, navigation, and hands-free communication to improve the driving experience.

- Seamless Smartphone Integration: Individuals increasingly seek infotainment systems that offer seamless smartphone connectivity, such as Apple CarPlay and Android Auto, for easy access to apps like navigation and streaming. This trend reflects the demand for integrated, user-friendly driving experiences that mirror smartphone capabilities.

- ADAS and Autonomous Vehicle Growth: The growth of advanced driver-assistance systems (ADAS) and autonomous vehicles is catalyzing the demand for more advanced infotainment systems that enhance safety and in-car experiences. These systems integrate features like real-time data display, entertainment, and communication to meet the needs of both drivers and passengers.

- Regulatory-Driven Innovation: Regulations on driver safety and interface design are shaping the evolution of infotainment systems, ensuring they minimize distractions and comply with global standards. These guidelines encourage innovation in safe, user-friendly systems, promoting features like hands-free operation, cybersecurity, and smart device integration while ensuring systems remain environmentally sustainable.

Future Outlook:

- Strong Growth Outlook: The automotive infotainment market is anticipated to experience strong growth owing to technological advancements, rising user need for connectivity, enhanced in-car experiences, and the integration of AI, voice control, and 5G.

- Market Evolution: The automotive infotainment market is evolving with advancements in connectivity, AI integration, voice recognition, and enhanced user interfaces, providing more personalized, intuitive, and seamless in-car experiences for individuals.

The global automotive infotainment market is driven by increasing consumer demand for advanced in-vehicle entertainment and connectivity solutions. Rising adoption of electric vehicles (EVs) and autonomous driving technologies has amplified the need for integrated systems offering navigation, media streaming, and real-time communication. For instance, according to the International Energy Agency, EVs sales are anticipated to reach approximately 17 million in 2024, globally. Moreover, advancements in artificial intelligence, augmented reality, and voice recognition enhance user experience and safety. Additionally, growing smartphone penetration and demand for seamless integration with in-car systems boost market growth. Furthermore, regulatory focus on driver safety and the rising preference for energy-efficient systems, particularly in the electric vehicle segment, also play a pivotal role in market expansion.

To get more information on this market, Request Sample

The United States exhibits a crucial role in the global automotive infotainment market, chiefly impacted by innovative automotive manufacturing and resilient customer demand for connected vehicles. The market heavily profits from the extensive deployment of advanced technologies including 5G connectivity, artificial intelligence (AI), and voice recognition. Moreover, major automakers and technology firm in the U.S. are heavily investing in research and development projects to offer leading-edge infotainment solutions, improving consumer safety as well as experience. Additionally, the magnifying preference for electric vehicles and implementation of stricter regulatory policies incentivize the incorporation of energy-saving, sustainable infotainment systems, establishing the U.S. as a key contributor to market advancements. For instance, as per industry reports, by the year 2030, every 1 in 5 cars sold in the U.S. will be electric.

Automotive Infotainment Market Trends:

Growing Demand for Connected Vehicles and Seamless Smartphone Integration

The integration of smartphones with vehicles, through platforms like Apple CarPlay and Android Auto, enables users to seamlessly access navigation, communication, and entertainment apps directly from their car’s display. The advent of 5G is enhancing these features, facilitating quicker vehicle-to-everything (V2X) communications, crucial for advanced driver-assistance systems (ADAS). Moreover, as personal demand for connected vehicles increases, car manufacturers are prioritizing the delivery of seamless, smartphone-like experiences, providing functionalities like streaming, social media access, and real-time navigation. Furthermore, the emergence of advanced interfaces, including voice activation, touch screens, and AI-driven customization, is improving user experiences, rendering vehicles more engaging and user-friendly. In 2025, Apple officially introduced CarPlay Ultra, its advanced infotainment system, beginning with new Aston Martin models in the US and Canada. CarPlay Ultra integrates thoroughly with vehicle systems to show speed, fuel information, and additional details, necessitating an iPhone 12 or newer with iOS 18.5. Hyundai, Kia, and Genesis will also support it soon.

Regulatory and Industry Standards Influencing Innovation

Regulations focused on minimizing driver distraction impact the design and features of these systems, necessitating compliance with various global standards. This includes regulations on screen placement, user interface complexity, and hands-free operation. Innovation in safe infotainment systems is encouraged by regulations such as UNECE R155 and R156, which regulate cybersecurity and software updates. Design procedures are influenced by functional safety standards like ISO 26262, which propel the development of fail-safe solutions. Guidelines that encourage AI and smart device integration, like CarPlay and Android Auto compatibility, also spur innovation. Additionally, environmental regulations are pushing for more sustainable infotainment systems, in terms of materials, manufacturing, and energy efficiency, particularly in the electric vehicle sector. Industry preferences for connectivity, generally including Wi-Fi and Bluetooth, guarantee compatibility with an extensive range of personal devices, encouraging an upgraded customer experience. The development of such standards is requisite for incorporating innovative technologies such as augmented reality (AR) in navigation applications. Together, such standardization and regulatory efforts not only steer the functionality and design of infotainment systems but also bolster advancements, ensuring systems are technologically upgraded, user-friendly, and environmentally friendly. Such innovations are steadily impacting the automotive infotainment market outlook positively.

Automotive Infotainment Market Growth Factors:

Increased Time Spent in Vehicles

With rising traffic congestion and longer commute times, individuals are spending additional time in their cars. For instance, INRIX, Inc., a worldwide frontrunner in transportation data and analytics, published the 2024 Global Traffic Scorecard that highlighted and ranked congestion and commuting patterns in almost 1,000 cities across 37 nations. Istanbul experienced 105 hours lost to traffic delays, leading the global rankings, followed by New York City (102 hours) and Chicago (102 hours). This change is influencing the demand for in-car entertainment and convenience options, as individuals aim to enhance their travel time for productivity or pleasure. Infotainment systems are being developed to meet this demand, providing an array of services, ranging from music and video streaming to live traffic updates and hands-free communication. Numerous contemporary cars are now fitted with options such as Apple CarPlay or Android Auto, allowing drivers to effortlessly connect their smartphones for navigation, entertainment, and communication.

Adoption of ADAS and Autonomous Vehicles

The rising use of ADAS and the progress in autonomous vehicles is propelling the growth of the automotive infotainment sector. As vehicles become more automated, the demand for advanced infotainment systems that improve the driving experience also grows. ADAS technologies, such as lane-keeping assistance, adaptive cruise control, and automatic braking depend on these systems for the display of real-time data and integration with various vehicle functions. Additionally, the rise of completely self-driving vehicles is driving the need for infotainment systems that emphasize entertainment, productivity, and communication, particularly as the driver's responsibilities lessen. These systems are anticipated to provide engaging content, video calls, and tailored media. For instance, as it is anticipated that fully autonomous vehicles (Level 4) will make up 2.5% of worldwide new car sales by 2030, infotainment systems will develop to incorporate additional entertainment options and ADAS features, such as collision alerts, to improve safety and user experience.

Automotive Infotainment Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global automotive infotainment market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product type, vehicle type, operating system, installation type, sales channel, technology and connectivity.

Analysis by Product Type:

- Navigation Unit

- Display Audio

- Audio

- Others

Audio is the leading segment in automotive infotainment, evolving from basic radio systems to sophisticated multi-speaker surround sound systems. Enhanced audio quality and immersive experiences are now expected in modern vehicles, driving manufacturers to invest in advanced audio technologies. Integration with streaming services and compatibility with various digital formats have become standard. Consumer demand for personalized audio experiences, such as individual sound zones and noise cancellation features, further stimulates market growth. The rise of voice recognition technology has also transformed how users interact with audio systems, prioritizing hands-free and safer controls. Additionally, the collaboration between car manufacturers and renowned audio brands underlines the significance of high-quality sound systems in boosting vehicle appeal.

Analysis by Vehicle Type:

- Passenger Cars

- Commercial Vehicles

Passenger cars lead the market with around 79.5% of market share in 2024. This segment has a very significant share in the market primarily because of the increase in demand for in-car connectivity and entertainment options. With the number of tech-savvy consumers growing, the expectations for infotainment features are also rising from navigation to streaming services, even at the entry level. This segment is also being boosted by the trend towards electric and hybrid vehicles, which are normally sold with state-of-the-art infotainment systems. The integration of safety features in these systems, such as rear-view cameras and parking assistance, is becoming critical for sales. Also, the development of autonomous vehicles will likely lead to passenger car infotainment, with the emphasis being on entertainment and productivity while traveling. This will challenge manufacturers to invest in infotainment solutions that can address future needs.

Analysis by Operating System:

- QNX

- LINUX

- Microsoft

- Others

LINUX leads the market with around 60.0% of market share in 2024. LINUX flexibility, robustness, and is open-source, which allows extensive customization, thereby making possible tailored user interfaces and features among manufacturers. An increased contribution from developers within the community ensures continuous improvement and innovation, and this has popularized LINUX among infotainment systems manufacturers. Compatibility of LINUX to a wide variety of hardware platforms and its ability to undertake the heavy computing required in modern infotainment systems make it preferred operating system. It also has an advantage with built-in security, which becomes very important for connected cars. Its scalability ranges from very simple to high-end applications, making it applicable across the widest possible vehicle range, a key reason for its widespread usage in automotive infotainment.

Analysis by Installation Type:

- In-Dash Infotainment

- Rear Seat Infotainment

In-dash infotainment lead the market with around 65.4% of market share in 2024. This segment serves as the central interface for audio, navigation, and vehicle controls. Its development into large, touchscreen displays has transformed vehicle interiors, offering a more interactive and user-friendly experience. These systems often integrate smartphone connectivity, allowing users to access apps, navigation, and communication features safely while driving. In-dash systems are increasingly becoming the hub for advanced driver-assistance systems (ADAS), providing critical information and alerts to the driver. The integration of AI and voice recognition technologies is enhancing the functionality of these systems, enabling drivers to control various features hands-free, thereby increasing safety and convenience. The competitive edge in the automotive market is often influenced by the sophistication of the in-dash infotainment system, making it a key focus for innovation and investment by manufacturers.

Analysis by Sales Channel:

- OEM

- Aftermarket

OEM leads the market with around 72.8% of market share in 2024. This segment has gained prominence primarily due to their integration during the vehicle manufacturing process. These systems are designed to seamlessly integrate with the vehicle’s architecture, offering advantages in terms of design, functionality, and user interface. OEM infotainment systems often include proprietary technology, giving manufacturers a competitive edge and a unique selling proposition. They also ensure a higher level of quality and reliability, as they are specifically tailored for each vehicle model. The collaboration between automotive manufacturers and tech companies in developing these systems is indicative of their importance in enhancing brand value. Moreover, the ability to provide over-the-air (OTA) updates keeps these systems current, adding long-term value to the vehicle.

Analysis by Technology:

- Integrated

- Embedded

- Tethered

Tethered segment is leading due to its role in bridging smartphone functionality with the vehicle’s system. Tethered solutions allow users to connect their devices to the car's infotainment system via USB or Bluetooth, enabling access to music, navigation, and other apps. This connectivity offers the advantage of using the familiar interface and apps from the user's device, enhancing the in-vehicle experience. It's an economical alternative to fully integrated systems, making advanced infotainment features accessible to a broader range of consumers. As smartphone usage continues to grow, the demand for tethered infotainment solutions is expected to remain strong, especially in mid-range vehicles.

Analysis by Connectivity:

- Bluetooth

- Wi-Fi

- 3G

- 4G

- 5G

Bluetooth leads the market with around 35.9% of market share in 2024. This segment is chiefly driven by the widespread adoption of wireless connectivity. It enables hands-free calling, audio streaming, and data transfer between devices and the vehicle’s system, enhancing safety and convenience. Bluetooth’s role in facilitating voice commands has become increasingly important, allowing drivers to control various functions without taking their hands off the wheel. The technology’s universal compatibility with a vast range of devices makes it a staple in modern vehicles, from economy to luxury models. Continuous advancements in Bluetooth technology, such as improved data transfer speeds and connectivity range, are expected to further solidify its importance.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia Pacific accounted for the largest market share of over 40.7%. The automotive infotainment market in Asia-Pacific is expanding quickly as a result of rising consumer preference for connected technologies, urbanisation, and vehicle sales. With a 10% year-over-year rise in production volume from over 46 million units in 2021 to over 50 Million units in 2022 and over 55 Million units in 2023, the Asia-Pacific area is the largest automobile production region in the world. China (more than 30 million automobiles), Japan (almost 9 million vehicles), India (about 5.9 Million vehicles), South Korea (more than 4 Million vehicles), and Thailand (nearly 1.9 Million vehicles) were the top 5 automobile-producing nations. Demand is being fuelled by China's MIIT's prioritisation of infotainment systems and other smart car technology. Sales of mid-range and premium cars, which frequently contain cutting-edge infotainment systems, have increased because of rising disposable incomes in nations like India and Southeast Asia. The introduction of cutting-edge features like voice assistants and augmented reality (AR) navigation is fuelled by the presence of technologically sophisticated automakers like Toyota and Honda in Japan.

Key Regional Takeaways:

United States Automotive Infotainment Market Analysis

In 2024, United States accounted for 70.70% of the market share in North America. Growing customer demand for improved in-car entertainment, seamless connectivity, and cutting-edge navigation systems is propelling the automotive infotainment industry in the US. One of the main drivers of market expansion is the growing popularity of connected cars with intelligent infotainment systems coupled with rising number of new and innovative cars like electric vehicles. The U.S. Energy Information Administration reports that in the second half of 2023, sales of hybrids, plug-in hybrids, and BEVs in the United States hit their highest percentage of total LDV sales, at 17.9%. Out of the 459 distinct LDV models, manufacturers produced 20 new BEV models in 2023, primarily in the second half, for a total of 70 BEV types by year's end. Demand has also been fuelled by the improved user experience brought about by the incorporation of voice assistants like Google Assistant and Amazon Alexa into car infotainment systems. Another significant factor is the growing demand for electric cars (EVs). Prominent EV manufacturers like Tesla integrate advanced infotainment systems with features like integrated app ecosystems, huge touchscreen displays, and over-the-air (OTA) upgrades. Infotainment adoption is also being fuelled by consumer demand for cars with heads-up displays (HUDs) and advanced driver-assistance systems (ADAS).

Europe Automotive Infotainment Market Analysis

The market for automotive infotainment in Europe is mostly driven by strict government rules for car safety and the increasing use of advanced driving functions. Infotainment systems with these functions are indirectly promoted by the General Safety Regulation of the European Commission, which requires sophisticated safety features like intelligent speed assistance and emergency lane-keeping systems. Additionally, innovation in high-end infotainment technologies is fuelled by Europe's dominance in the production of luxury automobiles, which includes companies like BMW, Mercedes-Benz, and Audi. The region's adoption of infotainment is growing due to the move towards electric and hybrid automobiles and consistent growth in sales. Europe's (including the UK's) automobile sales and production can be said to be quite close. In 2021, there were almost 17 Million cars sold, followed by a brief drop to roughly 15 million in 2022 and a significant increase of 18.7% to over 18 Million in 2023. In terms of sales, Germany, the UK, France, Italy, and Spain were the top five nations. The demand for smart navigation systems and energy management interfaces built into entertainment units is rising in nations with robust EV markets, such as Germany and Norway.

Latin America Automotive Infotainment Market Analysis

Growing car ownership and increased consumer desire for feature-rich yet reasonably priced automobiles are driving growth in the Latin American automotive infotainment market. In 2023, Mexico produced over 4 Million vehicles, and Brazil produced around 2.3 Million. Mexico and Brazil are among the world's largest producers of motor vehicles. The presence of international automakers like Ford, Volkswagen, and General Motors, as well as growing automotive manufacturing, have made Brazil and Mexico the major markets. The International Organisation of Motor Vehicle Manufacturers (OICA) reports that the demand for infotainment systems has increased because of a steady increase in vehicle production in Latin America. Thanks to growing disposable incomes, consumers in the area are choosing cars with entertainment amenities, smartphone integration, and navigation more and more.

Middle East and Africa Automotive Infotainment Market Analysis

The growing popularity of premium cars and growing consumer demands for intelligent in-car features are driving the automotive infotainment industry in the Middle East and Africa. High-end cars with cutting-edge infotainment systems are highly preferred in wealthy markets like the United Arab Emirates and Saudi Arabia. Adoption of entertainment systems is also being aided by the popularity of electric and hybrid cars, especially in the Gulf Cooperation Council (GCC) nations. Growing urbanisation and better road infrastructure in Africa are encouraging more people to buy cars, which is raising demand for entertainment systems in both the new and aftermarket markets. The incorporation of navigation and driver-assistance technologies is being supported by governments in nations like South Africa, who are encouraging car safety and digitisation.

Competitive Landscape:

Key players in the market are actively engaging in research and development to introduce innovative and more user-friendly systems. They are focusing on integrating advanced technologies like artificial intelligence, voice recognition, and augmented reality to enhance user experience and safety. Partnerships with technology giants and startups are prevalent, aiming to leverage expertise in software and connectivity for cutting-edge solutions. For instance, in February 2024, L&T Technology Services (LTTS) announced a strategic partnership with Marelli, a leading automotive technology supplier, to transform automotive infotainment and information cluster design using Marelli's cutting-edge Digital Twin solutions. This collaboration leverages LTTS's expertise to streamline software development and reduce costs, paving the way for Software Defined Vehicles (SDV). Additionally, these companies are also investing in adapting their products to comply with diverse global regulatory standards and consumer preferences. Moreover, there is a significant emphasis on developing sustainable, energy-efficient systems, especially for the burgeoning electric vehicle segment, to align with global environmental concerns.

The report provides a comprehensive analysis of the competitive landscape in the automotive infotainment market with detailed profiles of all major companies, including:

- Alps Alpine Co., Ltd

- Continental AG

- Denso Corporation

- Garmin Ltd.

- HARMAN International

- Marelli Holdings Co., Ltd.

- Mitsubishi Electric Corporation

- Panasonic Corporation

- Pioneer Corporation

- Robert Bosch GmbH

- Visteon Corporation

Latest News and Developments:

- May 2025: Hyundai Motor Group enhanced its connected car services (CCS) for over 10 million subscribers by deploying its proprietary HCloud platform within Equinix’s global data centers in Seoul, Los Angeles, and Frankfurt. Leveraging Equinix IBX and Fabric, Hyundai integrated HCloud with public clouds like AWS, enabling a hybrid multicloud infrastructure that reduces latency, improves app responsiveness, and ensures scalable, secure connectivity. This strategic move supports Hyundai’s transition to software-defined vehicles, aiming to deliver personalized, smarter, and safer in-car experiences while targeting 20 million CCS users by 2026.

- May 2025: LG Display announced plans to showcase cutting-edge automotive display technologies at SID Display Week 2025, emphasizing future mobility under the theme "Driving the future." Highlights include a Stretchable display that expands up to 50%, merging screens and buttons for enhanced usability; a 57-inch Pillar-to-Pillar ultra-large display spanning the dashboard; and an 18-inch Slidable OLED screen that retracts into the ceiling. These innovations offer superior image quality, durability in extreme conditions, and safety features like Switchable Privacy Mode, reinforcing LG Display’s leadership in premium automotive displays.

- April 2025: LG Electronics and MediaTek unveiled the world’s first Android-based Concurrent Multi-User (CMU) framework at Auto Shanghai 2025, revolutionizing in-vehicle infotainment (IVI) systems. This innovative solution allows multiple passengers to simultaneously use different displays on a single Android OS, enhancing content consumption in Software-Defined Vehicles. The CMU framework reduces system resource demands by replacing multiple virtual machines with one OS, enabling personalized user experiences, independent Bluetooth support, parental controls, and seamless media sharing. Integrated with MediaTek’s latest automotive chip, it offers automotive OEMs cost-efficient, reliable, and sophisticated IVI solutions.

- April 2025: TomTom enhanced navigation for smart’s in-vehicle solutions, integrating advanced mapping and routing technologies to improve driver experience. This collaboration leverages TomTom’s precise maps, real-time traffic data, and AI-powered navigation features, enabling smarter, safer, and more efficient journeys. The integration supports seamless in-dash navigation with up-to-date information, optimized routes, and intuitive user interfaces tailored for smart vehicles. This partnership highlights TomTom’s commitment to delivering cutting-edge automotive navigation solutions that elevate connected car experiences and mobility innovation.

- March 2025: Hyundai Motor Group launched its new mobility software brand, Pleos, marking a shift toward software-defined vehicles (SDVs) and cloud-based mobility. Pleos integrates a proprietary vehicle OS, next-gen infotainment system (Pleos Connect), cloud infrastructure, fleet management, and mobility optimization. It supports autonomous driving, connectivity, and real-time data analysis. The open development platform Pleos Playground fosters app ecosystem growth. Hyundai also introduced the Next Urban Mobility Alliance for public-private urban mobility solutions and announced collaborations with Google, Uber, Samsung, and others, aiming for Level 2+ autonomous driving by 2027 and broad SDV adoption by 2030.

- March 2025: Cinemo launched the CARS Connect Suite, enhancing the Android Automotive OS (AAOS) in-car experience with three new products: CARS Connect Direct, Audio, and Camera. These enable effortless, app-free device pairing, multi-zone audio allowing passengers to enjoy personalized media, and BYOD-enabled video calls using passenger device cameras. The suite integrates built-in and brought-in devices, boosting entertainment, productivity, and connectivity. This innovation simplifies multi-device support for automakers, elevating passenger experience by merging personal and vehicle systems seamlessly.

- January 2025: DXC Technology partnered with Ferrari to develop advanced Human Machine Interface (HMI) software for next-generation vehicles, including the F80 supercar launched in October 2024. DXC’s bespoke software powers the F80’s infotainment and digital cockpit, delivering a seamless, high-performance experience with real-time data and immersive visuals for both road and track use. This collaboration leverages DXC’s automotive expertise to enhance usability and innovation, aiming to transform the driver experience and maintain Ferrari’s market leadership in automotive technology.

- January 2025: Sony Honda Mobility (SHM) and HERE Technologies partnered to enhance SHM’s AFEELA electric vehicles with advanced, connected, software-defined features. Leveraging HERE’s unified mapping architecture and Navigation SDK, AFEELA’s digital cockpit will offer state-of-the-art visualization, augmented reality, EV range management, and personalized in-car guidance. The collaboration also integrates HERE SDK Explore into AFEELA’s mobile app, ensuring seamless connectivity and real-time updates. This partnership aims to transform mobility, making vehicles an intuitive extension of drivers’ digital lives and advancing safer, smarter journeys.

- January 2025: Panasonic Automotive Systems (PAS) and Qualcomm Technologies expanded their collaboration at CES 2025 to revolutionize in-vehicle experiences using Qualcomm’s Snapdragon Cockpit Elite platform. This platform, featuring the Qualcomm Oryon CPU, Adreno GPU, and Hexagon NPU, enables advanced AI, generative AI, immersive multimedia, gaming, and 3D graphics within PAS’s Cockpit Domain Controllers and High-Performance Compute systems. The partnership supports software-defined vehicles, emphasizing safety, security, and flexible, human-centric cabin experiences. Integration begins for rollout in vehicles starting early 2026, setting new standards in connected car technology.

- January 2025: Qualcomm Technologies and Alps Alpine expanded their collaboration to integrate Qualcomm’s latest Snapdragon Cockpit platform into Alps Alpine’s automotive products. This partnership aims to revolutionize in-car experiences with advanced computing, connectivity, and generative AI for personalized, intelligent cabins. Alps Alpine will use the platform to enhance its High-Performance Reference Architecture, powering sophisticated human-machine interfaces, sensor integration, and connectivity. Features include e-mirrors, advanced input/output devices, and individualized sound zones, setting new standards for safety, comfort, and entertainment in vehicles.

Automotive Infotainment Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Navigation Unit, Display Audio, Audio, Others |

| Vehicle Types Covered | Passenger Cars, Commercial Vehicles |

| Operating Systems Covered | QNX, LINUX, Microsoft, Others |

| Installation Types Covered | In-Dash, Rear Seat Infotainment |

| Sales Channels Covered | OEM, Aftermarket |

| Technologies Covered | Integrated, Embedded, Tethered |

| Connectivities Covered | Bluetooth, Wi-Fi, 3G, 4G, 5G |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico, Turkey, Saudi Arabia, Iran, United Arab Emirates |

| Companies Covered | Alps Alpine Co., Ltd, Continental AG, Denso Corporation, Garmin Ltd., HARMAN International, Marelli Holdings Co., Ltd., Mitsubishi Electric Corporation, Panasonic Corporation, Pioneer Corporation, Robert Bosch GmbH, Visteon Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the automotive infotainment market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global automotive infotainment market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the automotive infotainment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Automotive infotainment refers to integrated in-vehicle systems combining entertainment and information functionalities. These systems provide features like audio, video, navigation, connectivity, and voice control, enhancing driver convenience and passenger experience. Automotive infotainment systems are pivotal in modern vehicles, driving advancements in connectivity and user-friendly interfaces for a seamless driving experience.

The automotive infotainment market was valued at USD 21.1 Billion in 2024.

IMARC estimates the global automotive infotainment market to exhibit a CAGR of 6.93% during 2025-2033.

The market is driven by increasing consumer demand for enhanced in-car connectivity and the integration of advanced technologies such as AI and IoT, along with the rising adoption of electric and autonomous vehicles. Additionally, the growing preference for personalized entertainment and navigation solutions in passenger and commercial vehicles further influences market growth.

In 2024, audio represented the largest segment by product type, driven by consumer demand for high-quality in-car entertainment.

Passenger cars lead the market by vehicle type, driven by the rising production of passenger vehicles.

LINUX is the leading segment by operating system, driven by its open-source nature and customization capabilities.

In 2024, in-dash infotainment represented the largest segment by installation type, driven by convenience and integration with vehicle systems.

OEM is the leading segment by sales channel, driven by the preference for factory-installed systems.

In 2024, tethered represented the largest segment by technology, driven by the increasing need for real-time connectivity and efficient internet use.

Bluetooth leads the market by connectivity, owing to its seamless pairing and widespread compatibility.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Asia Pacific currently dominates the global market.

Some of the major players in the global automotive infotainment market include Alps Alpine Co., Ltd, Continental AG, Denso Corporation, Garmin Ltd., HARMAN International, Marelli Holdings Co., Ltd., Mitsubishi Electric Corporation, Panasonic Corporation, Pioneer Corporation, Robert Bosch GmbH, Visteon Corporation, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)