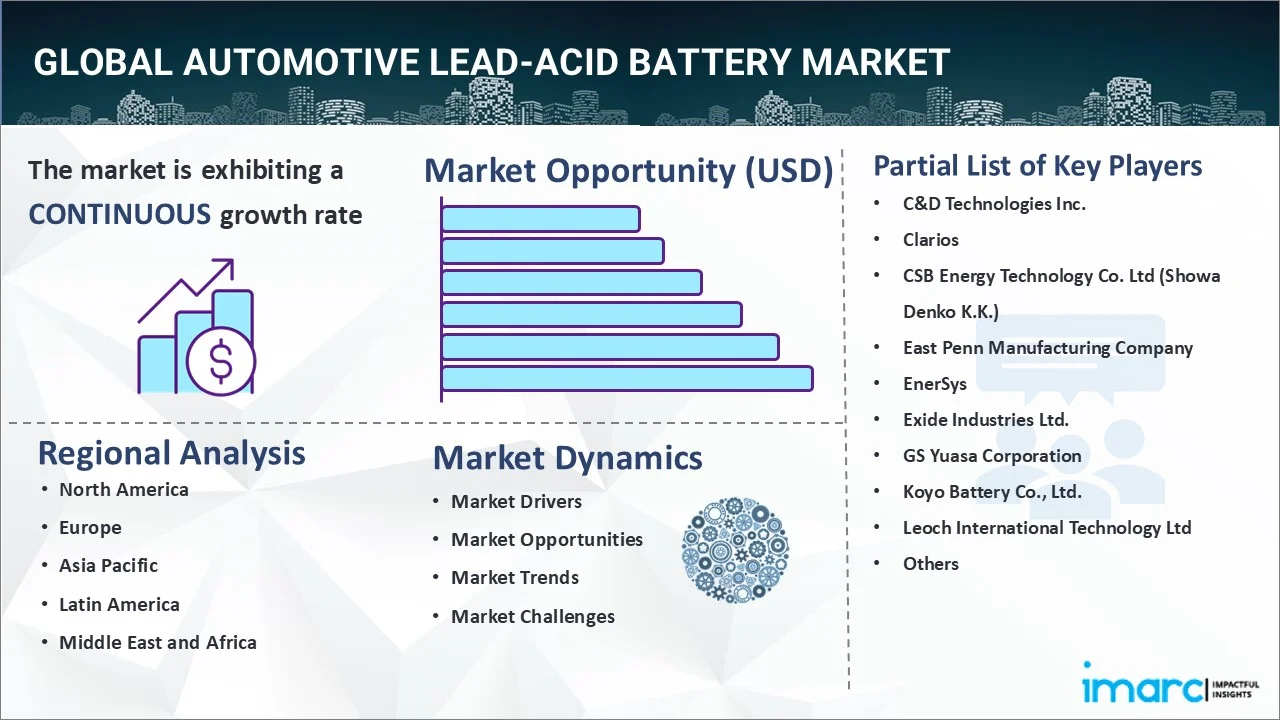

Automotive Lead-Acid Battery Market Report by Vehicle Type (Passenger Cars, Commercial Vehicles, Two-Wheelers, HEV Cars), Product (SLI Batteries, Micro Hybrid Batteries), Type (Flooded Batteries, Enhanced Flooded Batteries, VRLA Batteries), Customer Segment (OEM, Replacement), and Region 2025-2033

Market Overview:

The global automotive lead-acid battery market size reached USD 13.6 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 16.4 Billion by 2033, exhibiting a growth rate (CAGR) of 2.11% during 2025-2033. Asia-Pacific currently dominates the overall market. The stringent government regulations aimed at reducing emissions, rising demand for automobiles, the adoption of electric and hybrid vehicles, and rapid technological advancements are some of the factors propelling the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033 |

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 13.6 Billion |

| Market Forecast in 2033 | USD 16.4 Billion |

| Market Growth Rate 2025-2033 | 2.11% |

The growing use of lead-acid batteries in electric vehicles (EVs), especially for auxiliary functions, is one of the key factors positively influencing the market. Lead-acid batteries are employed for secondary operations, such as lighting, wipers, infotainment, and safety systems. Their ability to deliver consistent performance at a low cost makes them a practical choice for supporting systems in both electric and conventional vehicles. Cost-effectiveness remains a major factor, allowing manufacturers to offer reliable battery solutions without significantly increasing vehicle costs. Their established reliability and ease of availability further enhance their market presence. Lead-acid batteries also perform well across diverse climates, making them suitable for global vehicle applications. In addition, the strong recycling ecosystem surrounding lead-acid batteries supports environmental sustainability, which is important to both manufacturers and regulators.

Automotive Lead-Acid Battery Market Trends:

Increasing demand for passenger and commercial vehicles

High demand for passenger and commercial vehicles is impelling the market growth. As more vehicles are produced and sold, the requirement for batteries to support ignition, lighting, and other electrical systems is rising. According to the SIAM, in India, the sales of passenger vehicles reached 3,14,934 units in December 2024. Lead-acid batteries continue to be the preferred choice for many manufacturers due to their affordability, availability, and proven performance. In both new vehicle production and aftermarket replacements, lead-acid batteries play a crucial role in ensuring consistent vehicle operation. Commercial vehicles, which often require higher power and durability, are driving the demand for robust battery solutions. With growing urbanization activities, rising incomes, and increased transportation needs, the production and use of vehicles is expanding steadily, leading to greater utilization of lead-acid batteries.

Advancements in technology

Advancements in technology are positively influencing the market. Modern enhancements in materials and design reduce charging time, improve energy density, and enhance resistance to vibration and corrosion. These improvements make lead-acid batteries more reliable and suitable for modern vehicles with high electrical demands. Technologies like enhanced flooded batteries (EFB) and absorbent glass mat (AGM) increase durability and support advanced features, such as start-stop systems. Battery management systems are more precise, helping users track battery health and usage. These innovations are making lead-acid batteries a strong competitor in both new and replacement markets. AI further enhances battery monitoring and maintenance, making lead-acid batteries even efficient in modern vehicles. The worldwide market for AI is expected to attain USD 1,811.8 Billion by the year 2030.

Growing need for aftermarket services

Rising demand for aftermarket services is propelling the market growth. As vehicles age, their original batteries wear out and require replacement, driving consistent demand in the aftermarket segment. Lead-acid batteries, being affordable and widely available, are the preferred choice for replacement in both passenger and commercial vehicles. Service centers and local garages often stock lead-acid batteries due to their compatibility with a wide range of vehicles and easy installation. Additionally, people trust these batteries because of their proven performance. With more vehicles staying on the road longer, the frequency of battery replacements is increasing, stimulating the market growth. The availability of warranties, doorstep installation, and battery recycling services is further supporting the rise in aftermarket demand for lead-acid batteries. In addition, fleet operators and transport companies continue to rely on lead-acid batteries for dependable performance in heavy-duty aftermarket services, where longevity is essential. According to industry reports, the global heavy-duty automotive aftermarket market is expected to grow at a CAGR of 3.01% during 2025-2033.

Key Growth Drivers of Automotive Lead-Acid Battery Market:

Growing use in backup and auxiliary applications

Rising use of lead-acid batteries in backup and auxiliary applications is offering a favorable market outlook. Modern vehicles increasingly rely on electrical systems for lighting, infotainment, air conditioning, power windows, and other accessories, especially when the engine is off. Lead-acid batteries are widely used to support these functions due to their ability to deliver stable power at low cost. In commercial vehicles and emergency response units, they provide reliable backup during engine shutdowns or power loss situations. They are also essential in vehicles equipped with start-stop systems, where frequent engine restarts require a dependable power source. Their quick recharge capability and durability under deep cycling conditions make them ideal for these auxiliary roles.

Suitability for varying climates

Suitability of lead-acid batteries for varying climates ensures consistent performance in both hot and cold weather conditions. Lead-acid batteries are designed to operate effectively across a wide temperature range, making them reliable for vehicles in diverse geographical regions. In cold climates, they provide strong cranking power to start engines, while in hot climates, their ability to tolerate high temperatures supports long-lasting operation. Their robust construction and chemical stability help reduce the risk of failure due to extreme weather, which gives both manufacturers and users confidence in their performance. This adaptability makes lead-acid batteries a practical choice for vehicles operating in challenging environments. As worldwide vehicle usage is expanding into more varied and extreme conditions, the dependable performance of lead-acid batteries continues to support their strong demand in the automotive market.

Economic efficiency and reliability

Lead-acid batteries offer a reliable power source at a lower price compared to other battery types, which helps reduce the overall cost of vehicles. Their affordability makes them especially popular in price-sensitive markets and among users seeking budget-friendly replacement options. Manufacturers prefer lead-acid batteries because they balance performance with low production costs, allowing them to maintain competitive pricing. Additionally, the mature manufacturing process and widespread availability of raw materials contribute to stable pricing and consistent supply. For users, the ability to get dependable performance at a lower cost adds value. This economic advantage keeps demand strong, especially in the growing vehicle aftermarket segment, where price plays a key role in purchase decisions.

Automotive Lead-acid Battery Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global automotive lead-acid battery market report, along with forecasts at the global and regional levels from 2025-2033. Our report has categorized the market based on the vehicle type, product, type, and customer segment.

Breakup by Vehicle Type:

- Passenger Cars

- Commercial Vehicles

- Two-Wheelers

- HEV Cars

Commercial vehicles dominate the market

The report has provided a detailed breakup and analysis of the market based on the vehicle type. This includes passenger cars, commercial vehicles, two-wheelers, and HEV cars. According to the report, commercial vehicles represented the largest segment.

The automotive lead-acid battery market is primarily led by the commercial vehicles segment, driven by the strong demand for trucks, buses, and delivery vans used in logistics and transportation. Commercial vehicles depend on lead-acid batteries to operate multiple systems, including engine ignition, lighting, and air conditioning, rendering these batteries essential for their functionality. Moreover, the vast aftermarket of the commercial vehicle sector creates significant demand for lead-acid batteries in terms of replacement and maintenance, fueling ongoing sales. Additionally, cost factors are significant in this area, since lead-acid batteries provide a cheaper energy storage option than other battery technologies such as lithium-ion. Correspondingly, the durability and dependability of lead-acid batteries render them ideal for the rigorous operating conditions of commercial vehicles, providing steady performance even in tough environments.

Breakup by Product:

- SLI Batteries

- Micro Hybrid Batteries

SLI batteries hold the largest share in the market

A detailed breakup and analysis of the market based on the product has also been provided in the report. This includes SLI batteries and micro hybrid batteries. According to the report, SLI batteries represented the largest segment.

The SLI (starting, lighting, and ignition) batteries segment leads the automotive lead-acid battery market since they are the major power source for starting the internal combustion engines of traditional vehicles. The batteries deliver the high cranking currents necessary to start the engine consistently. SLI batteries are also cheaper compared to their alternatives, thus becoming the go-to option in markets where price is still a major consideration for consumers. Although the use of electric and hybrid cars is increasing, most cars on the road are still powered by internal combustion engines, maintaining the demand for SLI batteries. Additionally, SLI batteries are used in auxiliary systems, including lighting and ignition, further increasing their application. The settled presence of SLI batteries in the automotive industry, along with their affordability and versatility, makes them the prevailing segment within the market.

Breakup by Type:

- Flooded Batteries

- Enhanced Flooded Batteries

- VRLA Batteries

Flooded batteries dominate the market

The report has provided a detailed breakup and analysis of the market based on the type. This includes flooded batteries, enhanced flooded batteries, and VRLA batteries. According to the report, flooded batteries represented the largest segment.

The flooded batteries segment leads the automotive lead-acid battery market due to their long-standing role in the automotive sector, establishing them as a reliable and tested energy storage option. For decades, automotive manufacturers have depended on flooded batteries, which have gained the confidence of consumers and OEMs due to their reliability and performance. Furthermore, they provide an economical choice for vehicle owners and manufacturers. In comparison to other forms of lead-acid batteries, flooded batteries come with a reduced upfront cost, which makes them easier to obtain for various vehicles, particularly in the mass-market category. They also excel in delivering high cranking power, making them perfect for starting vehicles with internal combustion engines. Their capability to provide strong current bursts guarantees dependable engine ignition, particularly in severe weather conditions. Additionally, the design of flooded batteries facilitates straightforward maintenance and servicing, since they can be replenished with distilled water, which extends their lifespan and lowers overall operational expenses.

Breakup by Customer Segment:

- OEM

- Replacement

OEM holds the largest share in the market

A detailed breakup and analysis of the market based on the customer segment has also been provided in the report. This includes OEM and replacement. According to the report, OEM accounted for the largest market share.

The original equipment manufacturer (OEM) segment leads the automotive lead-acid battery industry since they are the major providers of batteries to vehicle manufacturers during manufacturing. They thus enjoy long-term agreements, bulk orders, and preferred supplier positions, enjoying a large market share. The vehicle manufacturers find it convenient to procure batteries from OEMs since they have an established track record of delivering consistent and high-quality products, with ease of integration into their vehicles.

Apart from this, OEMs also tend to work hand in hand with automakers at the vehicle design stage, tailoring batteries to exact performance specifications and ensure optimal compatibility. This too reinforces their leadership in the market. Furthermore, the extensive distribution network and after-sales service support provided by OEMs ensure customer loyalty and induce automakers to have long-term relationships.

Breakup by Region:

- Asia Pacific

- North America

- Europe

- Middle East and Africa

- Latin America

Asia Pacific exhibits a clear dominance, accounting for the largest automotive lead-acid battery market share

The report has also provided a comprehensive analysis of all the major regional markets, which include Asia Pacific, North America, Europe, Middle East and Africa, and Latin America. According to the report, Asia Pacific represented the largest market share.

The automotive lead-acid battery market is predominantly led by the Asia Pacific region, which is home to several of the globe's largest automotive industries. Countries such as China, Japan, India, and South Korea are at the forefront of vehicle manufacturing and sales. This strong automotive production network generates a huge need for lead-acid batteries to energize the large array of traditional vehicles. Additionally, the Asia Pacific region is undergoing swift urbanization and industrial growth, which increases the demand for commercial vehicles and infrastructure development. Research on the automotive lead-acid battery market emphasizes Asia Pacific's leadership, fueled by vehicle manufacturing, urban development, and industrial expansion.

In line with this, the region's massive population and increasing disposable income levels propel automotive ownership, further fueling the demand for lead-acid batteries in personal and commercial vehicles. Additionally, the adoption of electric vehicles and hybrid vehicles is gaining momentum in the region, with lead-acid batteries being utilized in specific hybrid configurations, contributing to automotive lead-acid battery market growth. Besides this, the region's expanding logistics and transportation sectors necessitate efficient battery solutions for commercial vehicles, further bolstering the market.

Competitive Landscape:

The competitive landscape of the automotive lead-acid battery market is characterized by intense rivalry among numerous players vying for market share. These companies operate across various regions, offering a wide range of lead-acid battery solutions for automotive applications. Factors such as product quality, performance, pricing, and brand reputation play a crucial role in distinguishing competitors in this market. As demand for sustainable transportation grows, the competition among battery manufacturers to supply efficient and eco-friendly batteries for electric and hybrid vehicles intensifies.

Moreover, technological advancements and innovations in lead-acid battery designs and manufacturing processes add to the competitive dynamics. Companies also focus on expanding their global presence, establishing strategic partnerships, and investing in research and development to gain a competitive edge. With the automotive industry's continuous evolution, players in the lead-acid battery market continually strive to position themselves as industry leaders by delivering reliable, cost-effective, and environmentally conscious solutions to meet the diverse needs of automotive manufacturers and consumers alike.

The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- C&D Technologies Inc.

- Clarios

- CSB Energy Technology Co. Ltd (Showa Denko K.K.)

- East Penn Manufacturing Company

- EnerSys

- Exide Industries Ltd.

- GS Yuasa Corporation

- Koyo Battery Co., Ltd.

- Leoch International Technology Ltd

- PT. Century Batteries Indonesia

- Robert Bosch GmbH

- Thai Bellco Battery Co. Ltd.

Automotive Lead-Acid Battery Market News:

- February 2025: Satya Intl partnered with Duracell to introduce cutting-edge battery solutions in Asia and Africa. They would provide lead-acid, tubular, inverter, and UPS batteries using the Duracell brand. Satya Intl sought to take advantage of the increasing need for premium automotive products, particularly in India, where they held a strong market position.

- December 2024: Assurance Intl revealed its forthcoming battery production plant in Haryana, India. The facility was engineered to effectively fulfill high-volume requirements, with an annual production capacity of 1 Million two-wheeler batteries, 0.3 Million automotive batteries, 0.25 Million tubular batteries, and 0.10 Million solar batteries. Outfitted with cutting-edge technologies, it would manufacture a diverse array of battery types, including AGM, sealed lead-acid, lithium-ion, tubular, and gel-based options, addressing various industrial requirements with an emphasis on performance and durability.

- November 2024: Exide Technologies, a top provider of innovative and eco-friendly battery solutions for automotive and industrial sectors, unveiled the newest inclusions in its AGM lineup, increasing coverage for almost one Million more vehicles in Europe. Exide’s latest AGM EK454 and EK457 batteries were supported by extensive testing, offering customers and workshops exceptional assurance in their reliability. Both batteries completed demanding cycle tests and health evaluations, validating their compliance with the M3 classification that certified superior endurance and cycle longevity for lead-acid batteries utilized in start-stop systems.

- November 2024: Amara Raja Energy and Mobility Ltd planned to commence commercial operations at its new lead acid battery recycling facility in Tamil Nadu by the end of November, aiming to boost the percentage of recycled lead materials used in production. The recycling facility was anticipated to meet 25-30% of the company’s total raw material needs in the long run. The plant featured state-of-the-art technologies like a de-sulphurization unit and oxy-fuel systems to considerably lower CO2 emissions and decrease lead levels in slag, promoting both efficiency and environmental sustainability.

- October 2024: Kinetic Green introduced a special edition of its ‘Safar Smart electric three-wheeler,’ accessible in lead-acid and lithium battery options, providing improved features, including a music system and floor mats for an extra charge. The firm collaborated with Cholamandalam Finance and ReVfin Finance to offer appealing financing choices for clients.

- August 2024: Mahindra Last Mile Mobility unveiled the brand-new e-Alfa Plus, an electric three-wheeler crafted for transportation in both urban and rural areas. The vehicle was equipped with a 150 Ah lead-acid battery, providing a peak power of 1.95 kW, and delivered an actual range exceeding 100 km on a single charge.

Automotive Lead-Acid Battery Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Vehicle Types Covered | Passenger Cars, Commercial Vehicles, Two-Wheelers, HEV Cars |

| Products Covered | SLI Batteries, Micro Hybrid Batteries |

| Types Covered | Flooded Batteries, Enhanced Flooded Batteries, VRLA Batteries |

| Customer Segments Covered | OEM, Replacement |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | C&D Technologies Inc., Clarios, CSB Energy Technology Co. Ltd (Showa Denko K.K.), East Penn Manufacturing Company, EnerSys, Exide Industries Ltd., GS Yuasa Corporation, Koyo Battery Co., Ltd., Leoch International Technology Ltd, PT. Century Batteries Indonesia, Robert Bosch GmbH, Thai Bellco Battery Co. Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the automotive lead-acid battery market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global automotive lead-acid battery market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the automotive lead-acid battery industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global automotive lead-acid battery market was valued at USD 13.6 Billion in 2024.

We expect the global automotive lead-acid battery market to exhibit a CAGR of 2.11% during 2025-2033.

The rising adoption of electric vehicles, along with the growing demand for automotive lead-acid batteries as they offer high current delivery, resistance to corrosion and abrasion, and low internal impedance, is primarily driving the global automotive lead-acid battery market.

The sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across several nations, resulting in the temporary closure of numerous manufacturing units for automotive lead-acid batteries.

Based on the vehicle type, the global automotive lead-acid battery market has been segmented into passenger cars, commercial vehicles, two-wheelers, and HEV cars. Currently, commercial vehicles hold the largest market share.

Based on the product, the global automotive lead-acid battery market can be divided into SLI batteries and micro hybrid batteries, where SLI batteries currently exhibit a clear dominance in the market.

Based on the type, the global automotive lead-acid battery market has been categorized into flooded batteries, enhanced flooded batteries, and VRLA batteries. Among these, flooded batteries account for the largest market share.

Based on the customer segment, the global automotive lead-acid battery market can be bifurcated into OEM and replacement. Currently, OEM holds the majority of the global market share.

On a regional level, the market has been classified into Asia Pacific, North America, Europe, Middle East and Africa, and Latin America, where Asia Pacific currently dominates the global market.

Some of the major players in the global automotive lead-acid battery market include C&D Technologies Inc., Clarios, CSB Energy Technology Co. Ltd (Showa Denko K.K.), East Penn Manufacturing Company, EnerSys, Exide Industries Ltd., GS Yuasa Corporation, Koyo Battery Co., Ltd., Leoch International Technology Ltd, PT. Century Batteries Indonesia, Robert Bosch GmbH, and Thai Bellco Battery Co. Ltd.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)