Autopilot Systems Market Size, Share, Trends and Forecast by Product Type, Component, Platform, System, Application, and Region, 2025-2033

Autopilot Systems Market Size and Share:

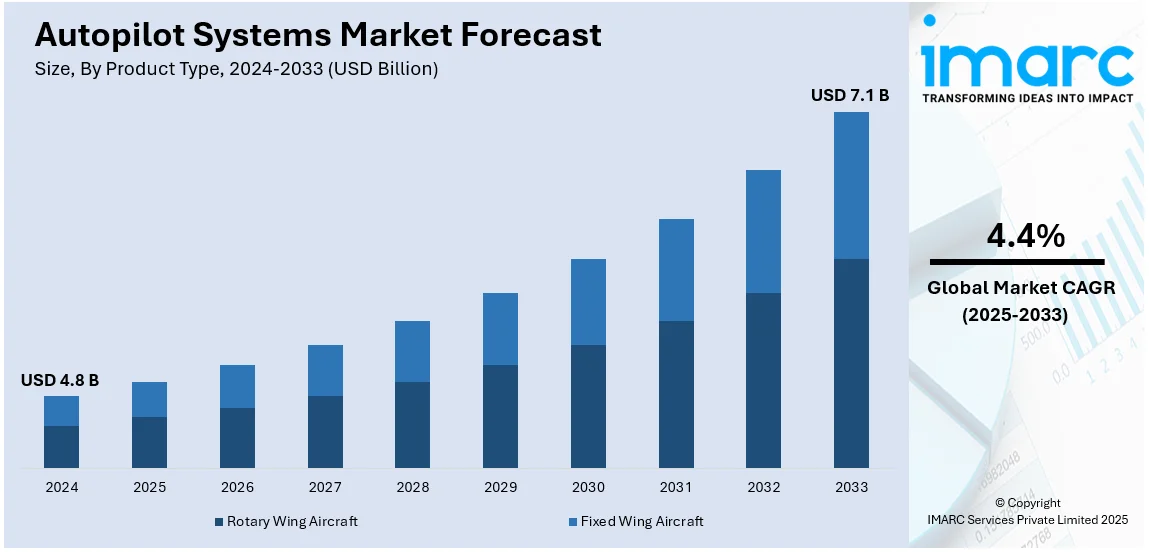

The global autopilot systems market size was valued at USD 4.8 Billion in 2024. Looking forward, the market is projected to reach USD 7.1 Billion by 2033, exhibiting a CAGR of 4.4% from 2025-2033. North America currently dominates the market, holding a market share of over 37.8% in 2024. The increasing adoption of autopilot systems as a means to enhance safety in transportation, improving operational efficiency and cost savings, significant advancements in technology, and rising demand for autonomous vehicles are some of the major factors propelling the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 7.1 Billion |

| Market Growth Rate (2025-2033) | 4.4% |

The marketplace for autopilots shows substantial expansion because of automated equipment progress and growing flight safety needs as well as expanding global air travel operations. Modern air transportation corporations and plane companies dedicate significant investment toward evolving autopilot systems, as these technologies offer improved efficiency, piloting ease, and better aircraft dependability. The implementation of artificial intelligence and machine learning is further enhancing autopilot capabilities, facilitating more targeted navigation and real-time decision-making. Additionally, the market demand for advanced autopilot solutions continues to rise as UAVs are increasing in popularity within commercial segments, defense operations, and logistics sectors. The combination of aviation regulations that promote automation along with automatic flight operations creation initiatives drive the autopilot systems market share.

The autopilot systems market is booming in the United States, supported by robust investments in aerospace technology, heightened demand for business and commercial aviation, and government-backed autonomous flight programs. Aircraft manufacturers and defense contractors in the country focus on developing advanced autopilot systems to strengthen flight safety and efficiency. The increasing use of UAVs for surveillance, cargo delivery, and emergency response is further driving autopilot systems market growth. For instance, in September 2024, the US Air Force awarded USD 3.6 Million to Reliable Robotics for test flights using autonomous flight systems. This supports cargo missions and commercial development to meet FAA and Department of Defense airworthiness standards under AFWERX’s TACFI program. Furthermore, with advancements in AI-driven autopilot solutions, the U.S. remains at the forefront of innovation in automated flight technology.

Autopilot Systems Market Trends:

Enhancing Safety

Safety stands as a paramount factor driving the adoption of autopilot systems in transportation industries. Human errors function as a main cause in aviation accidents as well as automotive and marine accidents. Autopilot systems reduce human error risks since they execute tasks with exceptional accuracy thus lowering the probability of human-caused errors. These systems operate in aviation to provide stability while flying, manage navigation, and respond automatically to unplanned events to enhance aviation security for passengers alongside crew members. Advanced driver-assistance systems (ADAS) enabled with autopilot features in the automotive sector prevent collisions and monitor both safety distances alongside blind-spot regions. According to survey, 82% of Indian drivers sampled are willing to invest in ADAS-equipped vehicles, primarily by safety benefits. Similarly, in marine vessels, autopilot systems prevent collisions and enable continuous tracking in adverse weather conditions. Furthermore, the incorporation of cutting-edge sensors and algorithms enabled advanced autopilot systems to make real-time decisions, reinforcing safety benchmark across all transportation modes.

Improving Efficiency and Cost Savings

Autopilot systems contribute significantly to improving operational efficiency and reducing costs in transportation industries. In commercial aviation, autopilot systems optimize flight paths, control altitude, and maintain precise airspeeds, leading to reduced fuel consumption and lower operating expenses. These efficiency gains translate into cost savings for airlines, ultimately benefiting consumers through potentially lower ticket prices. In the automotive sector, the development of autonomous driving capabilities holds the promise of decreased traffic congestion, shorter travel times, and reduced fuel consumption. Estimated reduction on main engine fuel consumption is 0.25% to 1.5%, through effective autopilot and rudder settings. As vehicles communicate with each other and traffic infrastructure, they can better navigate routes, avoiding congested areas and optimizing travel efficiency. For shipping companies, autopilot systems enable more streamlined routes and fuel-efficient operations, enhancing the economic viability of maritime transportation.

Advancements in Technology

The relentless progress in technology, particularly in sensors, artificial intelligence, and computing power, plays a pivotal role in driving the sophistication and capabilities of autopilot systems. High-precision sensors, such as cameras, radar, and LiDAR, provide real-time data about the environment, enabling autopilot systems to make informed decisions and react swiftly to dynamic situations. For instance, Qantas has utilized AI since 2018 for dynamic flight routing and fuel management, achieving a 2% fuel saving, equivalent to USD 92 Million annually. Artificial intelligence and machine learning algorithms enable these systems to continuously learn from data, improving their performance over time and handling complex scenarios with greater efficiency. Furthermore, advancements in computing power allow for faster data processing, ensuring quick and accurate responses from autopilot systems. As technology continues to evolve, autopilot systems are poised to become even more robust, reliable, and capable, propelling the transformation of transportation industries and paving the way for a safer, more efficient, and autonomous future.

Autopilot Systems Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global autopilot systems market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product type, component, platform, system, and application.

Analysis by Product Type:

- Rotary Wing Aircraft

- Fixed Wing Aircraft

The market for rotary wing aircraft encompasses a wide range of vehicles, including helicopters and vertical take-off and landing (VTOL) aircraft. These aircraft are characterized by their ability to lift off and land vertically, making them highly versatile for various applications. Rotary wing aircraft find extensive use in civil aviation for passenger transport, emergency medical services, law enforcement, and search and rescue missions. They are also crucial in military operations, providing reconnaissance, troop transport, and combat support capabilities. The demand for rotary wing aircraft is driven by their ability to access remote or congested areas where fixed-wing aircraft may have limitations. Additionally, the rise of urban air mobility (UAM) and drone delivery services is further fueling the demand for innovative rotary-wing platforms to cater to future transportation needs.

The market for fixed-wing aircraft includes traditional airplanes and drones (unmanned aerial vehicles). Fixed-wing aircraft are characterized by their forward motion generated by the interaction of their wings with the air, providing lift. They are widely used in commercial aviation for long-distance passenger and cargo transport, offering high cruising speeds and fuel efficiency. In the defense sector, fixed-wing aircraft play a crucial role in providing strategic airlift, conducting aerial reconnaissance, and performing combat missions. Additionally, the growing application of drones for various purposes, including surveillance, agricultural monitoring, and package delivery, has significantly expanded the fixed-wing aircraft market. The continuous advancements in aircraft design, materials, and propulsion technologies are driving the demand for more efficient, eco-friendly, and capable fixed-wing aircraft across both civilian and military domains, aligning with the autopilot systems market outlook for enhanced automation and operational efficiency.

Analysis by Component:

- GPS (Global Positioning System)

- Gyroscope

- Software

- Actuators

Software leads the market as it plays a pivotal role in enabling and enhancing the functionality of various systems and devices. In the context of autopilot systems, software serves as the brain behind the operation, interpreting data from sensors, analyzing the environment, and making real-time decisions to control the vehicle or aircraft's movements. The continuous advancements in artificial intelligence, machine learning, and algorithms have empowered autopilot systems with higher levels of autonomy and adaptability, further driving the demand for sophisticated software solutions. Additionally, software is crucial in providing a customizable and scalable approach to autopilot systems. Manufacturers and operators can tailor the software to specific requirements, whether in aviation, automotive, or marine sectors, allowing for versatility across different applications and industries. Furthermore, software updates and improvements can be remotely deployed, enhancing the system's capabilities and addressing potential issues efficiently. Moreover, the integration of software also facilitates connectivity and data exchange between autopilot systems and other components, such as sensors, actuators, and control units. This seamless integration results in a comprehensive, holistic approach to automation, enabling effective communication and coordination within complex transportation ecosystems.

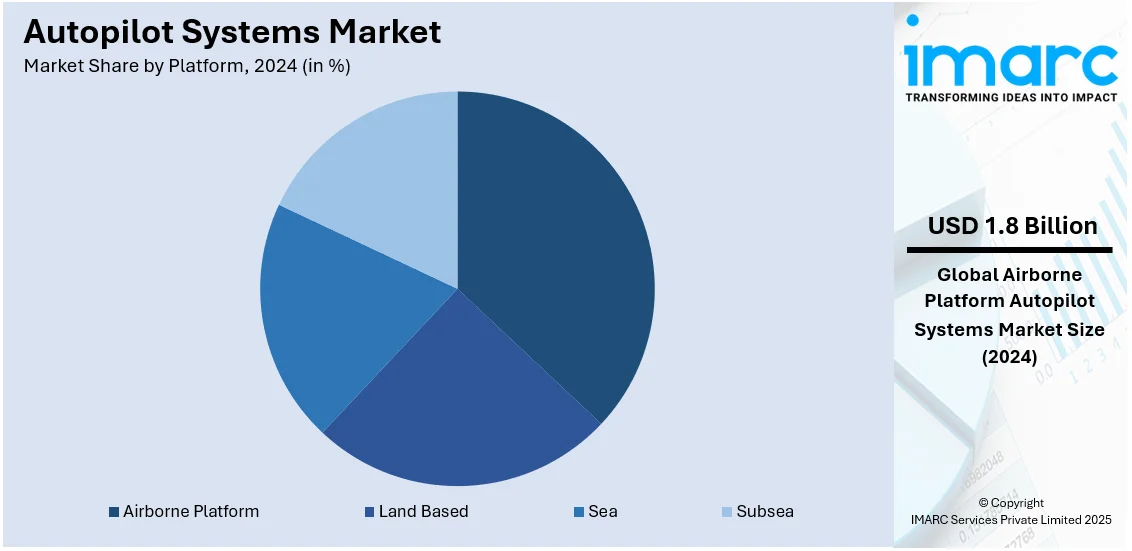

Analysis by Platform:

- Airborne Platform

- Land Based

- Sea

- Subsea

Airborne platform leads the market with around 36.8% of market share in 2024. Airborne platforms, which include both manned and unmanned vehicles, hold a significant advantage over other segments in terms of versatility and mobility. In the aviation industry, manned airborne platforms such as commercial airplanes, helicopters, and military aircraft dominate passenger and cargo transportation, making them a substantial part of the market. Additionally, the use of airborne platforms for aerial surveys, photography, and surveillance in various sectors like agriculture, environmental monitoring, and infrastructure inspection further contributes to their prominence. Moreover, the growing adoption of unmanned aerial vehicles (UAVs) or drones has further propelled the airborne segment's dominance, driving autopilot systems market demand as automation enhances operational efficiency. Drones find applications in diverse fields, including aerial photography, filmmaking, e-commerce deliveries, disaster management, and monitoring of remote areas. Their ability to access hard-to-reach locations, conduct missions autonomously, and capture high-quality data has driven their widespread adoption across both commercial and consumer markets.

Analysis by System:

- Attitude and Heading Reference System

- Flight Director System

- Flight Control System

- Avionics System

- Others

The attitude and heading reference system (AHRS) is a significant segment in the aerospace industry. AHRS is a critical component that provides vital information regarding the aircraft's orientation, including pitch, roll, and yaw, as well as its heading. It uses advanced sensors, such as accelerometers, gyroscopes, and magnetometers, to accurately measure and track the aircraft's movements in real-time. AHRS plays a pivotal role in providing essential data to other systems, such as the flight control system, navigation system, and autopilot, ensuring precise and stable flight operations. The increasing demand for modern avionics, unmanned aerial vehicles (UAVs), and commercial aircraft is driving the growth of the AHRS market as the aviation industry seeks advanced and reliable systems for improved situational awareness and flight safety.

The flight director system (FDS) is another crucial segment in aviation. The FDS is an integral part of the cockpit avionics, providing pilots with guidance and commands to achieve specific flight paths and maneuvers. By processing data from various aircraft systems and avionics, the FDS presents the flight crew with guidance cues on the primary flight display (PFD), aiding in the execution of precise and efficient flight operations. The FDS works in coordination with the autopilot system and is particularly valuable during complex flight situations, such as take-offs, approaches, and landings. Furthermore, as airlines and aircraft operators focus on enhancing flight efficiency and safety, the demand for sophisticated FDS technology has seen significant growth, making it a prominent market segment in the aviation industry.

The flight control system (FCS) is a key component in both manned and unmanned aircraft. The FCS is responsible for managing and regulating the aircraft's flight surfaces, such as ailerons, elevators, rudders, and flaps, to ensure stable and controlled flight. In manned aircraft, the FCS receives input from the pilot through the control yoke or stick and assists in translating these inputs into appropriate movements of flight control surfaces. Moreover, in the case of unmanned aircraft and drones, the FCS operates autonomously, receiving data from onboard sensors and autopilot systems to maintain desired flight paths and execute mission objectives. As the aviation industry progresses towards autonomous and remotely operated vehicles, the demand for advanced FCS technology is on the rise, making it a prominent and evolving market segment.

The avionics system segment holds a key position in the global autopilot systems market, driven by advancements in digital flight control, navigation, and automation technologies. Modern avionics integrate sensors, flight management systems, and AI-driven algorithms to enhance autopilot precision and reliability. Additionally, increasing demand for real-time data processing, situational awareness, and automated decision-making in commercial, military, and UAV applications supports market expansion. Moreover, regulatory compliance with aviation safety standards and ongoing investments in AI-powered avionics further strengthen the segment’s growth, ensuring improved flight efficiency, safety, and operational capabilities across global aviation sectors.

Analysis by Application:

- Commercial

- Civil

- Military

Commercial leads the market due to the extensive and diverse utilization of autopilot systems across various industries for commercial purposes. Autopilot systems offer numerous benefits in terms of safety, efficiency, and cost-effectiveness, driving their significant adoption in commercial applications. In the aviation industry, commercial airlines heavily rely on autopilot systems to ensure smooth and stable flights. Autopilots assist pilots in managing aircraft during cruise phases, allowing them to focus on navigation, communication, and other critical tasks. Autopilot systems also contribute to fuel efficiency by optimizing flight paths and controlling engine parameters. In the automotive sector, autopilot systems, particularly advanced driver-assistance systems (ADAS), play a pivotal role in commercial vehicles, such as trucks and delivery vans. These systems aid in lane-keeping, adaptive cruise control, and collision avoidance, enhancing driver safety and reducing the risk of accidents in commercial transport operations. Moreover, the emergence of autonomous commercial vehicles, such as robotaxis and autonomous shuttles, is further bolstering the demand for autopilot systems. These vehicles are poised to revolutionize the transportation industry, offering cost-effective and efficient mobility solutions for passengers and cargo transportation. Additionally, the commercial marine sector utilizes autopilot systems to navigate ships and vessels safely and efficiently. Autopilots enable precise course tracking and heading control, ensuring smooth operations during long voyages and optimizing fuel consumption.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 37.8%. North America has a well-established aerospace and defense industry, with major players and manufacturers driving innovation in autopilot systems. The region is home to renowned aircraft manufacturers, such as Boeing and Lockheed Martin, which continuously invest in research and development of advanced avionics, including autopilot technologies. Moreover, North America's emphasis on safety and regulations has provided a conducive environment for the development and deployment of autopilot systems. Regulatory bodies, such as the Federal Aviation Administration (FAA) and the National Highway Traffic Safety Administration (NHTSA), work closely with industry stakeholders to establish standards and guidelines for the safe integration of autopilot technologies.

Key Regional Takeaways:

United States Autopilot Systems Market Analysis

In 2024, United States accounted for 84.30% of the market share in North America. The growing adoption of autopilot systems in the aviation sector is fuelled by the increasing presence of established manufacturers in the United States. According to reports, there are approximately 1,509 aircraft, engine & parts manufacturing businesses in the US as of 2023. These manufacturers are advancing cutting-edge technology, leading to improved system reliability, precision, and overall safety in aircraft. The competitive nature of the industry encourages continuous innovation, as companies work to enhance their flight systems. Moreover, the need for better fuel efficiency and the push toward reducing operational costs have also contributed to the wider implementation of autopilot systems. These systems reduce the need for human intervention, offering cost savings while maintaining a high standard of operational safety. The aviation industry's expansion, driven by an increase in air traffic and growing demand for advanced technology, further accelerates the integration of autopilot systems into both commercial and military aircraft, highlighting the region’s pivotal role in shaping the future of autonomous flight technologies.

Europe Autopilot Systems Market Analysis

The adoption of autopilot systems in applications such as Flight Director System and Flight Control System is accelerating due to rising air traffic in European region. According to reports, year 2023 recorded 10.2 Million flights, +10% compared to 2022. This increase is prompting the aviation industry to focus on enhancing operational efficiency, safety, and reliability during flights. Advanced autopilot systems are being integrated to manage navigation, altitude, and speed with greater precision, reducing pilot workload and improving flight performance. The emphasis on automating critical functions has driven innovation in system capabilities, enabling seamless communication with onboard avionics and external systems. Additionally, the growing complexity of airspace management has created a demand for technologies that ensure smoother operations under varying flight conditions. These systems also support fuel optimization and route planning, which align with broader goals of operational cost reduction and environmental sustainability. The aviation sector's adoption of such systems reflects a commitment to meeting stringent safety standards and improving passenger experiences. Enhanced training programs for pilots and crew further complement the effective implementation of these technologies. As a result, the focus on upgrading existing aircraft and the development of next-generation aircraft equipped with sophisticated autopilot solutions is steadily rising, highlighting the importance of integrating automation for safer and more efficient aviation operations. This trend is expected to reshape how the industry manages increasing flight demands.

Asia Pacific Autopilot Systems Market Analysis

The adoption of autopilot systems is accelerating, fuelled by increased investments in the aviation sector and rising demand for air travel. According to Press Information Bureau, Government of India, over the last decade, India's aviation sector has seen remarkable expansion. The country’s operational airports have risen from 74 in 2014 to 157 in 2024, with plans to reach 350-400 by 2047. Meanwhile, the number of domestic air travelers has more than doubled, prompting Indian airlines to notably grow their fleets. Advancements in avionics technologies have enhanced the precision and reliability of autopilot systems, making them an integral component of modern aircraft. The focus on improving flight safety and reducing pilot workload is driving the integration of these systems in both commercial and private aviation. Air passenger growth has created a need for more efficient flight operations, where autopilot systems play a crucial role in optimizing navigation, fuel management, and overall efficiency. Additionally, the expanding aviation infrastructure supports the deployment of advanced flight control technologies, fostering their widespread implementation. Airlines and aircraft manufacturers are prioritizing automation to address operational challenges, streamline pilot responsibilities, and enhance passenger experience.

Latin America Autopilot Systems Market Analysis

In Latin America, military spending is contributing to the growing adoption of autopilot systems. With defense forces seeking enhanced operational efficiency and safety, there is an increasing demand for autonomous systems in surveillance, reconnaissance, and other military applications. For instance, military spending in Central America and the Caribbean in 2023 was 54 % higher than in 2014. Autopilot systems are becoming integral in both unmanned aerial vehicles and other defense technologies, reducing the need for human intervention in high-risk missions. This growing reliance on autonomous technology is further fuelled by national defense strategies that prioritize modernization and technological advancement. As defense budgets increase, there is a stronger push to adopt autopilot systems to maintain competitive advantage and improve overall mission effectiveness.

Middle East and Africa Autopilot Systems Market Analysis

The growing adoption of autopilot systems in the Middle East and Africa is largely driven by the expansion of commercial transport operations such as trucks and delivery vans. For instance, Saudi Arabia's logistics sector, valued at USD 57 Billion by 2030, benefits autopilot systems adoption with Vision 2030-backed infrastructure, including 4.5 Million Ton air cargo target, enhancing transport efficiency for growing trade across Asia, Europe, and Africa. As the demand for efficient logistics and transportation networks grows, businesses in the region are integrating autonomous systems into their fleets to optimize fuel consumption, enhance safety, and reduce labor costs. These systems allow for more reliable and precise operations, ensuring that goods are transported efficiently across vast distances.

Competitive Landscape:

Major aerospace and defense companies’ active participation within the autopilot systems market to develop advanced automation technologies, which boost safety standards, operational efficiency, and strengthen market dynamics. The market leaders are investing into artificial intelligence, sensor integration, and machine learning technologies to generate more specific adaptive autopilot approaches. Moreover, the market develops through strategic partnerships together with mergers and acquisitions which allow companies to achieve greater capabilities and market reach. Additionally, manufacturers aim to improve autonomous flight technologies because of growing demand for unmanned aerial vehicles (UAVs). For instance, in August 2023, the AIRL at IISc Bangalore developed an indigenous industrial-grade drone autopilot system using Vega Microcontrollers under the Digital India RISC-V Program, advancing India’s self-reliance in unmanned aerial systems with MeITY’s support. Furthermore, the market participants demonstrate strong investments to research and development that leads to constant improvements in system reliability and functionality to stay competitive.

The report provides a comprehensive analysis of the competitive landscape in the autopilot systems market with detailed profiles of all major companies, including:

- Bae Systems PLC

- Cloud Cap Technology Inc.

- Furuno Electric Co. Ltd.

- Garmin International Inc.

- Genesys Aerosystems Group Inc.

- Honeywell International Inc.

- Lockheed Martin Corporation

- Micropilot Inc.

- Rockwell Collins Inc.

- Trimble Inc.

Latest News and Developments:

- January 2025: Rotor Technologies has developed the Sprayhawk, a giant agricultural drone designed for heavy lifting and crop spraying. The Sprayhawk integrates advanced autopilot systems, LiDAR, GPS, and industrial vision cameras, allowing precise remote operation. Built on the Robinson R44 helicopter airframe, it replaces passenger seats with specialized equipment for its tasks. Currently in the final development stage, Sprayhawk has demonstrated successful flights, including spraying at the Ag Aviation Expo.

- January 2025: The Royal Navy's new Proteus drone, designed by Leonardo, will soon begin testing as an advanced anti-submarine system. This autonomous, hydrogen-powered aircraft, weighing three tonnes, uses AI and autopilot systems to deliver sonobuoys for detecting underwater threats. Developed under approximately USD 75 Million contract, Proteus offers versatile payload options and cutting-edge technologies like 3D printing. A test flight is planned for mid-2025, marking a significant leap in unmanned military aviation.

- November 2024: AeroVironment Inc. (AV) announced its USD 4.1 Billion acquisition of BlueHalo LLC, creating a global defense technology leader. This merger enhances AV's capabilities in autopilot systems, autonomous technology, and multi-domain defense solutions. BlueHalo’s expertise spans Space, C-UAS, AI/ML, and electronic warfare, addressing critical defense priorities. The all-stock transaction positions the combined company as a key player in next-generation defense technologies.

- October 2024: The Airbus H130 is set to soar to new heights with an advanced 3-axis autopilot system, developed in collaboration with Garmin. This cutting-edge technology, slated for release next year, promises to enhance the flight experience for pilots and operators alike. The integration of this autopilot system marks a significant milestone in helicopter innovation.

- June 2024: Joby Aviation achieved a 523-mile flight with its hydrogen-electric vertical take-off and landing aircraft, marking a milestone in emissions-free regional travel. The aircraft, developed in collaboration with H2FLY, produces only water as a by-product. The technology aligns with Joby’s roadmap for clean aviation and leverages its battery-electric expertise. Additionally, Joby’s acquisition of Xwing advances autopilot systems for future autonomous flights.

- February 2024: StandardAero, in partnership with Thales, begins installing the world’s first full 4-axis autopilot for H125 helicopters, named StableLight. Based on Thales’ Compact Autopilot System, StableLight enhances safety with features like terrain avoidance and auto hover while reducing pilot workload. This innovation marks a significant leap in H125 performance and flight control.

Autopilot Systems Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Rotary Wing Aircraft, Fixed Wing Aircraft |

| Components Covered | GPS (Global Positioning System), Gyroscope, Software, Actuators |

| Platforms Covered | Airborne Platform, Land Based, Sea, Subsea |

| Systems Covered | Attitude and Heading Reference System, Flight Director System, Flight Control System, Avionics System, Others |

| Applications Covered | Commercial, Civil, Military |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Bae Systems PLC, Cloud Cap Technology Inc., Furuno Electric Co. Ltd., Garmin International Inc., Genesys Aerosystems Group Inc., Honeywell International Inc., Lockheed Martin Corporation, Micropilot Inc., Rockwell Collins Inc., Trimble Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the autopilot systems market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global autopilot systems market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the autopilot systems industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The autopilot systems market was valued at USD 4.8 Billion in 2024.

IMARC estimates the autopilot systems market to exhibit a CAGR of 4.4% during 2025-2033.

The rising demand for automation and safety in aviation and marine industries, growing adoption of autonomous and semi-autonomous vehicles, advancements in artificial intelligence (AI), sensor fusion, and machine learning (ML), increasing military and defense investments in unmanned aerial and marine systems, and expansion of commercial drone applications are the primary factors driving the autopilot systems market.

North America currently dominates the market due to strong defense and aerospace investments, particularly in the U.S., along with advanced research and development (R&D) in autonomous technologies.

Some of the major players in the autopilot systems market include Bae Systems PLC, Cloud Cap Technology Inc., Furuno Electric Co. Ltd., Garmin International Inc., Genesys Aerosystems Group Inc., Honeywell International Inc., Lockheed Martin Corporation, Micropilot Inc., Rockwell Collins Inc., Trimble Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)