B2B Payments Market Size, Share, Trends and Forecast by Payment Type, Payment Mode, Enterprise Size, Industry Vertical, and Region, 2026-2034

B2B Payments Market Size and Share:

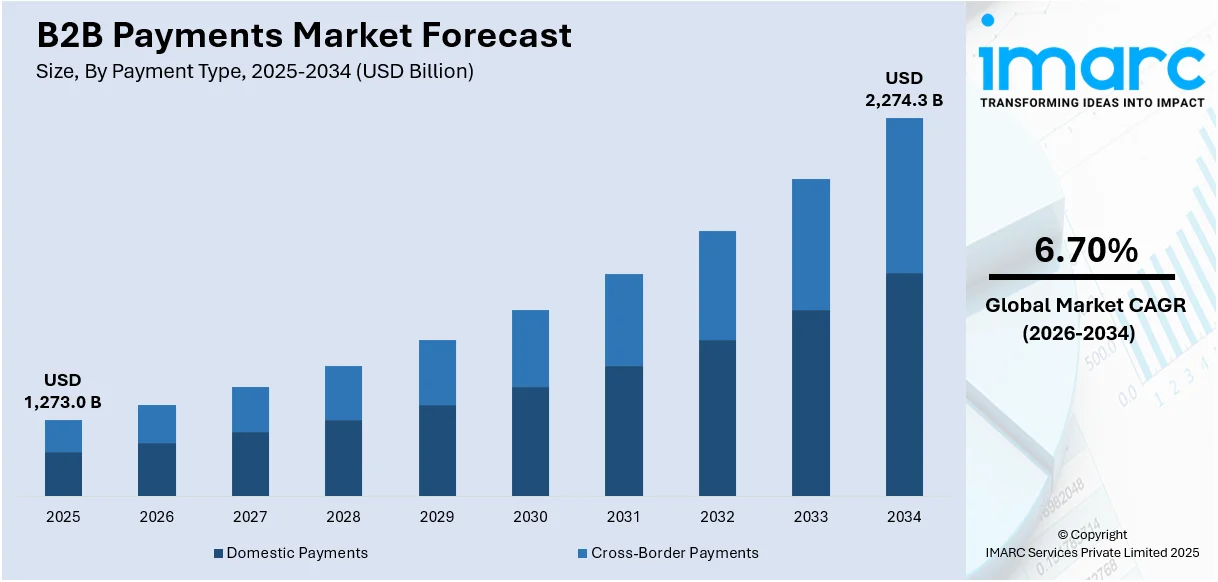

The global B2B payments market size was valued at USD 1,273.0 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 2,274.3 Billion by 2034, exhibiting a CAGR of 6.70% from 2026-2034. Asia Pacific currently dominates the market, holding a market share of over 36.7% in 2025. The market is primarily driven by the rising focus on enhancing financial decision-making and strategic planning, the implementation of robust security measures to protect sensitive payment data in transit and at rest, and the extensive utilization of mobile wallets to render payments.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 1,273.0 Billion |

| Market Forecast in 2034 | USD 2,274.3 Billion |

| Market Growth Rate 2026-2034 |

6.70%

|

The growth of the B2B payments market is driven the increasing adoption of digital payments and advancements in fintech, which enhance transaction speed and security. According to an article by DooFinder, the rise of e-commerce platforms, with over 30.7 million websites globally as of 2024, fuels the demand for seamless cross-border payments. Of these, over 26.5 million sites are actively functioning, highlighting e-commerce's dominance. Automation and integrated payment systems are increasingly adopted by businesses to streamline operations and minimize errors. Additionally, the growing focus on reducing operational costs and improving cash flow management is further accelerating market expansion. Regulatory advancements and the push for digitalization across industries is also supporting the sector's ongoing growth.

To get more information on this market Request Sample

The United States is emerging as a key regional market, which is experiencing significant growth, driven by the increasing demand for efficient, digital payment solutions that reduce reliance on traditional methods, such as checks. In line with this, the increasing implementation of cloud-based financial systems enhancing real-time payment processing and improving transparency is also creating a positive market outlook. For example, the X9.125 standard, published by The Accredited Standards Committee X9 Inc. on November 13, 2024, provides cloud management and security guidelines for U.S. financial institutions, ensuring secure, compliant, and auditable cloud systems. The rise in business-to-business e-commerce and cross-border transactions is further fueling demand for faster, cost-effective payments. Additionally, the emphasis on data security, fraud prevention, and government regulations promoting digital payments is continuously stimulating market expansion.

B2B Payments Market Trends:

Digital Transformation

The increasing digital transformation and the extensive utilization of online payment platforms in place of traditional paper-based methods which involve manual printing, postage, processes, and administrative overhead are improving the B2B payments market statistics. Additionally, the growing popularity of automated systems as they enable approval workflows, instant payments, and real-time tracking is supporting further market growth. Gartner predicts that over 50% of enterprises will use industry cloud platforms by 2028 to accelerate their business initiatives. In addition, the fact that international organizations are widely adopting digital platforms to easily make and receive payments worldwide will positively affect the market expansion. For instance, Vertiv, a provider of critical digital infrastructure and continuity solutions, announced the opening of its official store in Tokopedia, Indonesia's e-commerce platform. This is part of Vertiv's continuous expansion into the e-commerce space in Southeast Asia. Moreover, in September 2023, Visa Inc. declared its alliance with Swift to streamline international business-to-business (B2B) payments by enhancing connectivity between their networks that move Trillions in value globally.

Globalization and Cross-Border Transactions

The rise in globalization is leading to a rise in demand for cross-border payment solutions, which can be advantageous for international payment service providers. According to the World Bank report, India received USD 83 Billion in remittances in 2020, making it the top recipient globally. In comparison, China ranked second with USD 59.5 Billion in remittances. In addition, the growing collaboration between payment service providers, banks and fintech companies to develop new and innovative payment solutions is increasing the B2B payments market revenue. Moreover, digital payment platforms offer competitive exchange rates and tools for managing currency risk and reducing the financial complexities related to international trade, which is also catalyzing the global market. For example, a cross-border B2B platform called Joybuy was introduced by JD Worldwide, the international division of JD.com (Jingdong). Through the company's chosen supplier network, Joybuy links international retailers with top-notch Chinese factories. JD's B2B platform Joybuy will primarily cater to foreign clients, including vendors on e-commerce marketplaces, direct-to-consumer (DTC) sellers, and small- and medium-sized stores. Moreover, in April 2024, Cross-border payments platform, Nium, and payments processor, Thredd, have expanded their fintech partnership. This expansion allows Nium to issue virtual cards in the Asia-Pacific (APAC) region, thereby bolstering the growth of innovative B2B travel payment solutions.

Enhanced Security Measures

The widespread adoption of enhanced security measures, such as biometric verification, significantly reduces the risk of frauds in B2B payments. These methods ensure that only authorized personnel can initiate and approve payments, mitigating the threat of unauthorized transactions. Besides this, the elevating requirement for robust encryption technologies to protect sensitive payment data in transit and at rest, making sure information remains confidential and cannot be intercepted or compromised by cybercriminals, is positively influencing the market growth. In addition to this, blockchain technology is being leveraged to create immutable and transparent payment records that cannot be altered or deleted, providing an indisputable audit trail for financial transactions, which is propelling the B2B payments market demand forward. For instance, according to Merchant Savvy, a UK-based consulting firm, the frequency of global payment frauds is expected to increase incessantly and is most likely to cost USD 40.62 Billion by 2027. Moreover, Visa Inc. launched India’s roadmap to strengthen payment security. This program aims at securing India’s dynamic digital payments ecosystem from emerging threats and cyberattacks. Moreover, in April 2023, Citigroup Inc. announced its collaboration with Hokodo to deliver a best-in-class and frictionless B2B Buy Now, Pay Later (BNPL) solution that enables large global businesses to offer trade credit on e-commerce platforms and marketplaces.

B2B Payments Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global B2B payments market, along with forecast at the global, regional, and country levels from 2026-2034. The market has been categorized based on payment type, payment mode, enterprise size, industry vertical, and region.

Analysis by Payment Type:

- Domestic Payments

- Cross-Border Payments

Domestic payments stand as the largest component in 2025, holding around 65.2% of the market. Domestic payments comprise transactions that occur within the borders of the company. This segment is characterized by a high volume of payments, often involving businesses paying their local suppliers, employees, and service providers. Domestic payments are preferred by various individuals for their simplicity and familiarity, as they generally adhere to the national banking and payment infrastructure. For instance, PayU, the foremost provider of digital payment solutions in India, unveiled the introduction of its three revolutionary mobile app Software Development Kits (SDKs). These advancements are specifically crafted to meet the demand for smooth payment encounters on mobile gadgets, effectively enhancing transaction success rates by up to 56%.

Analysis by Payment Mode:

- Traditional

- Digital

Traditional leads the market with around 65.9% of market share in 2025. The traditional mode of payment remains the dominating segment in the market, representing the conventional methods that have been utilized for several years. Paper cheques, wire transfers, and cash transactions are some examples of the traditional mode of payments. Moreover, various businesses rely on conventional payment techniques, on account of their established processes and familiarity.

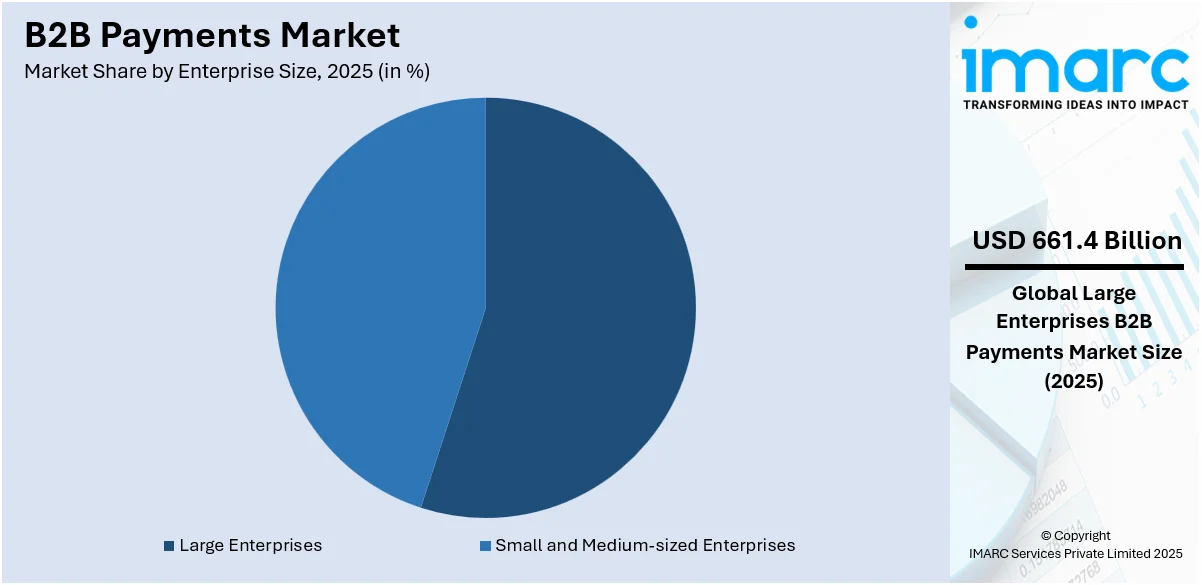

Analysis by Enterprise Size:

Access the comprehensive market breakdown Request Sample

- Large Enterprises

- Small and Medium-sized Enterprises

Large Enterprises leads the market with around 55.6% of market share in 2025. Large enterprises refer to well-established companies with substantial financial resources and a broad customer or supplier base. They often have complex payment needs, including managing a high volume of transactions, dealing with diverse suppliers and partners, and demanding sophisticated financial systems. Large enterprises adopt advanced payment technologies, such as electronic invoicing, supply chain financing, and customized payment solutions, to optimize their payment processes. Additionally, these companies have the resources to invest in comprehensive payment automation and security measures, ensuring efficiency and compliance in their B2B payments. For instance, Conduent Incorporated, a worldwide technology enterprise, introduced its latest digital integrated payments hub. This innovation is geared towards granting businesses and public sector agencies access to secure, efficient, and expedited methods for sending, receiving, or requesting payments.

Analysis by Industry Vertical:

- BFSI

- Manufacturing

- IT and Telecom

- Metals and Mining

- Energy and Utilities

- Others

Manufacturing leads the market with around 23.6% of market share in 2025. The manufacturing industry encompasses several businesses that are involved in the production of goods, including automotive, consumer electronics, industrial equipment, etc. Manufacturers often engage in complex supply chain networks, making efficient B2B payments crucial. This segment emphasizes streamlined payment processes to oversee supplier payments, procure raw materials, and facilitate distribution effectively, thereby elevating the B2B payments market recent price. As manufacturing processes become increasingly automated and globalized, the adoption of digital payment solutions and supply chain financing is escalating within this sector. For instance, Rupifi, a B2B payment application provider, raised USD 25 Million in a series-A round funding, led by Tiger Global Management, LLC, and Bessemer Venture Partners. Rupifi plans to utilize this funding to build complete B2B checkout products and omnichannel mobile-first B2B payments solutions for distributors, merchants, and sellers.

Regional Analysis:

To get more information on the regional analysis of this market Request Sample

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2025, Asia-Pacific accounted for the largest market share of over 36.7%. Asia Pacific represents the largest market as per the B2B payments market overview, owing to its expanding e-commerce operations, the proliferation of smartphones, and the launch of favorable government policies and incentives. In addition to this, the growing fintech ecosystem and the widespread adoption of blockchain-based platforms and supply chain finance are positively influencing the growth of the market in this region. For instance, Peer Connexions, a B2B E-commerce platform created to represent the industry's shift toward digital commerce, is released by Tech Data India. Peer Connexions gives resellers unmatched ease, enabling Tech Data to support and facilitate their company more effectively. The portal allows its channel partners access to technical, commercial, and product catalogs, price and inventory status, promotions, and special offers. It also enables them to sign up and do business around the clock on a common platform.

Key Regional Takeaways:

United States B2B Payments Market Analysis

The United States accounts for 70.40% of the market share in North America. The B2B market in the USA is driven by several key factors. Technological advancements, particularly in automation and AI, have significantly improved efficiency in supply chains, customer relationship management, and data analytics, allowing businesses to better meet the needs of their clients. The growing adoption of cloud computing and software as a service (SaaS) solution is revolutionizing business operations, offering greater flexibility, scalability, and cost-effectiveness. Additionally, the trend toward digital transformation and e-commerce is accelerating B2B sales, making it easier for companies to connect, transact, and manage relationships with suppliers and customers. According to the Bureau of Economic Analysis (BEA), in 2021, the U.S. digital economy contributed significantly to the country's overall economic performance. It accounted for USD 3.70 Trillion in gross output, USD 2.41 Trillion in value added, which represented 10.3% of the U.S. gross domestic product (GDP). Additionally, the digital economy provided USD 1.24 Trillion in compensation and supported 8.0 Million jobs. A stable economic environment and the large size of the U.S. market, combined with innovation and an increasingly diverse industrial base, further boost B2B opportunities.

Europe B2B Payments Market Analysis

The Europe B2B payment market is driven by several key factors, including the growing adoption of digital payment solutions, advancements in technology, and the need for improved efficiency and security in financial transactions. According to Amazon, the growth of AI in European business is continuously growing. European businesses have seen a 32% rise in AI adoption over the past year, with approximately one-third now leveraging AI technologies. As businesses increasingly shift towards electronic payment systems, the demand for faster, more secure, and cost-effective payment methods is expected to increase. Moreover, the rise of e-commerce and the increasing trend of business digitization are fueling the demand for innovative payment solutions such as blockchain, contactless payments, and automated clearing systems. Government initiatives and regulatory frameworks, such as the European Union's PSD2 (Payment Services Directive 2), are further accelerating the market growth by encouraging competition, enhancing transparency, and promoting the adoption of secure, interoperable payment solutions across the region. Also, in December 2023, The European Commission 2024 approved an amendment to the EU Digital Europe Program, allocating a substantial USD 829.09 Million, thereby favoring the market growth.

Asia Pacific B2B Payments Market Analysis

The B2B market in the Asia-Pacific region is experiencing robust growth, driven by a rapid shift toward digital transformation and increasing adoption of e-commerce platforms. According to Digital India, as of October 31, 2023, India boasts over 888 Million broadband users, reflecting significant progress in digital connectivity across the country. To further bridge the digital divide, India has been actively enhancing its digital infrastructure, with a network of 5,90,020 Common Service Centres (CSCs). Notably, 4,68,773 of these CSCs are located in rural areas, enabling greater access to digital services and technologies for underserved communities. Countries like China, India, and Japan are at the forefront of this transformation, where businesses are increasingly leveraging technology to streamline operations, enhance customer engagement, and optimize supply chains. The region’s fast-growing middle class is also contributing to the expansion of both B2B and B2C sectors, creating new opportunities for businesses to engage in cross-border trade. According to the World Economic Forum, in 2020, approximately 2 Billion people in Asia were part of the middle class, a number that is projected to grow to 3.5 Billion by 2030. Additionally, government initiatives in countries like China and India to promote digital infrastructure and innovation are acting as catalysts for B2B growth. The rise of manufacturing hubs in Southeast Asia, particularly in Vietnam and Thailand, is also augmenting the demand for raw materials, machinery, and industrial equipment, further driving B2B demand in the region.

Latin America B2B Payments Market Analysis

The B2B payment market in Latin America is being driven by several key factors, including the increasing adoption of digital payment solutions and the need for more efficient cross-border transactions. As businesses in the region seek to streamline their operations and improve cash flow management, they are increasingly relying on digital platforms for payments, invoicing, and reconciliation. The shift towards e-commerce and the rise of e-invoicing regulations in countries like Brazil and Mexico are further driving demand for more automated and secure B2B payment solutions. Additionally, the growing fintech ecosystem in the region, along with the increasing penetration of mobile phones and internet access, is enabling businesses of all sizes to adopt digital payment methods. According to data from the Associação Brasileira das Entidades dos Mercados Financeiro e de Capitais (Anbima), the growth of Brazilian private credit funds has significantly outpaced the broader fund industry. Between 2020 and September 2024, Brazilian private credit funds and FIDCs (Receivables Investment Funds) grew by 230% and 210%, respectively, while the overall Brazilian funds industry experienced a growth rate of 54%.

Middle East and Africa B2B Payments Market Analysis

The B2B payment market in the Middle East and Africa (MEA) region is driven by several factors, including rapid digital transformation across industries and the increasing adoption of fintech solutions. As businesses in the region embrace digitalization, there is a growing need for faster, more secure, and cost-effective payment systems. A key driver of the B2B payment market in the MEA region is the increasing adoption of digital processes to streamline business operations. For instance, in 2023, Saudi Aramco introduced a new process for handling Bills of Lading (BoLs) to enhance efficiency. Under this initiative, agents are no longer required to physically visit the Shipping Unit office to sign BoLs. Instead, they receive an email containing all the necessary shipment documentation to validate and sign the BoL digitally. This shift towards digital solutions not only improves operational efficiency but also facilitates faster and more secure business transactions, further driving the demand for advanced B2B payment systems in the region. Supportive government policies and initiatives promoting financial inclusion and the growth of digital economies are further accelerating the adoption of B2B payment platforms. Finally, heightened concerns over security and fraud prevention are driving the integration of advanced technologies, such as blockchain and AI, into payment systems to enhance transaction safety and efficiency.

Competitive Landscape:

The global market is highly competitive, with key players actively pursuing strategies to enhance their offerings and stay ahead. They are investing heavily in technology, particularly in developing user-friendly and secure digital payment platforms, which is one of the B2B payments market recent opportunities. These platforms often incorporate features like real-time payments, automated invoicing, and data analytics to streamline B2B transactions. Additionally, many top companies are expanding their global reach through partnerships and acquisitions, enabling them to provide comprehensive cross-border payment solutions. Furthermore, a strong focus on compliance and security measures is evident, with investments in robust fraud detection and prevention systems to ensure the safety of B2B transactions. Moreover, leading companies in the B2B payments market are committed to innovation and customer-centric solutions to meet the changing needs of businesses worldwide.

The report provides a comprehensive analysis of the competitive landscape in the B2B payments market with detailed profiles of all major companies, including:

- American Express Company

- Bank of America Corporation

- Capital One

- Citigroup Inc.

- JPMorgan Chase & Co.

- Mastercard Inc.

- Payoneer Inc.

- PayPal Holdings Inc.

- Paystand Inc.

- Stripe Inc.

- Visa Inc.

- Wise Payments Limited

Latest News and Developments:

- August 2024: Easebuzz launched a B2B payments platform in collaboration with NPCI Bharat BillPay, designed to enhance interoperability and streamline payment processes. The platform aims to automate various aspects of business transactions, providing a seamless and efficient solution for businesses to manage their payments.

- November 2024: The Melio payments platform secured USD 150 Million in venture capital funding, further fueling its expansion in the B2B payments space. This funding will enable Melio to enhance its services and scale its platform to meet the growing demand for streamlined payment solutions.

- April 2024: Paystand, a blockchain-enabled B2B payments network, has acquired spend management software provider Teampay. The transaction creates a B2B payments powerhouse whose continued goal is to revolutionize payments by expanding the largest, fastest, and most cost-efficient B2B payments network.

- April 2024: Cross-border payments platform, Nium, and payments processor, Thredd, have expanded their fintech partnership. This expansion allows Nium to issue virtual cards in the Asia-Pacific (APAC) region, thereby boosting the growth of innovative B2B travel payment solutions.

- April 2024: A B2B credit card platform, Pliant, is planning to expand after raising US USD 19 Million. The funding round was led by PayPal Ventures and brings the Berlin-based Pliant’s total Series A financing to worth of USD 53 Million.

B2B Payments Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Payment Types Covered | Domestic Payments, Cross-Border Payments |

| Payment Modes Covered | Traditional, Digital |

| Enterprise Sizes Covered | Large Enterprises, Small and Medium Sized Enterprises |

| Industry Verticals Covered | BFSI, Manufacturing, IT and Telecom, Metals and Mining, Energy and Utilities, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | American Express Company, Bank of America Corporation, Capital One, Citigroup Inc., JPMorgan Chase & Co., Mastercard Inc., Payoneer Inc., PayPal Holdings Inc., Paystand Inc., Stripe Inc., Visa Inc., Wise Payments Limited, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the B2B payments market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global B2B payments market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the B2B payments industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

B2B payments refer to the financial transactions between businesses, typically for goods, services, or invoice settlements. These payments can be made through various methods such as bank transfers, credit cards, or digital platforms. Efficient and secure processing is crucial for business operations, especially in large or cross-border transactions.

The B2B payments market was valued at USD 1,273.0 Billion in 2025.

IMARC estimates the global B2B payments market to exhibit a CAGR of 6.70% during 2026-2034.

The market is driven by the increasing adoption of digital payment solutions, automation, and cloud-based financial systems. The rise of eCommerce and cross-border transactions fuels demand for faster, secure payments. Additionally, advancements in data security, fraud prevention, and regulatory developments are also key drivers.

In 2025, domestic payments represented the largest segment by payment type, driven by high transaction volumes and simplicity in local business transactions.

Traditional payment mode leads the market, attributed to the familiarity and established processes within businesses for payments such as cheques and wire transfers.

The large enterprises is the leading segment by enterprise size, driven by their complex payment needs, high transaction volumes, and ability to invest in advanced payment technologies.

The manufacturing industry is the leading segment by industry vertical, driven by the industry's complex supply chain networks, which require efficient B2B payment processes for supplier payments, raw material procurement, and distribution facilitation.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Asia Pacific currently dominates the global market.

Some of the major players in the global B2B payments market include American Express Company, Bank of America Corporation, Capital One, Citigroup Inc., JPMorgan Chase & Co., Mastercard Inc., Payoneer Inc., PayPal Holdings Inc., Paystand Inc., Stripe Inc., Visa Inc., and Wise Payments Limited, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)