Baby Apparel Market Size, Share, Trends and Forecast by Product, Material, Distribution Channel, Application, End User, and Region, 2025-2033

Baby Apparel Market Size and Share:

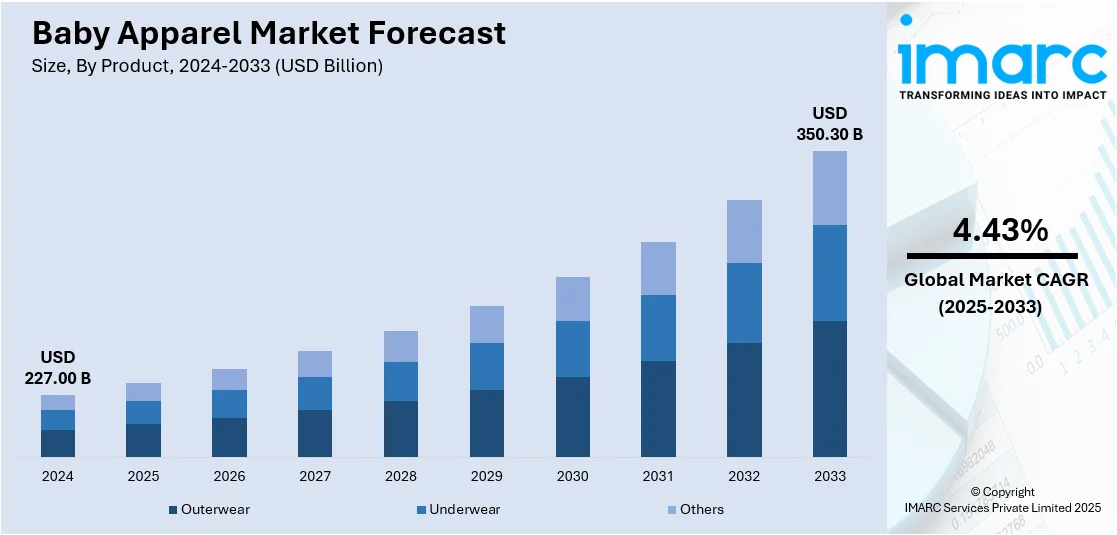

The global baby apparel market size was valued at USD 227.00 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 350.30 Billion by 2033, exhibiting a CAGR of 4.43% during 2025-2033. North America currently dominates the market, holding a significant market share of 33.6% in 2024. The market is expanding due to increasing demand for sustainable and eco-friendly clothing options. Parents' growing focus on comfort, safety, and organic materials is driving the market. The rise of e-commerce platforms further supports the global baby apparel market share, enhancing accessibility and consumer reach.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 227.00 Billion |

| Market Forecast in 2033 | USD 350.30 Billion |

| Market Growth Rate 2025-2033 | 4.43% |

The market for baby apparel is going through a shift towards sustainability, driven by increased consumer demand for sustainable and ethically produced infant clothes. Parents are becoming increasingly aware of the impact of the products they purchase on the environment, resulting in increased demand for infant apparel made from organic, biodegradable, and non-toxic materials. This requirement for sustainable materials, such as organic cotton, bamboo, and hemp, is driving the growth of the baby clothing market globally. Responding, businesses are becoming transparent and ensuring that their product lines contain no chemicals, such as pesticides and flame retardants. Another growing trend is eco-friendly packaging, with businesses opting for recyclable and minimal packaging options to reduce waste. As parents increasingly seek products in tune with their values, they will shell out extra money for clothes that not only protect their babies but also the environment. In the US, innovations in technology are having a profound impact on the baby clothing sector, enriching product selection and the consumer buying experience.

A significant trend is the incorporation of smart fabrics into baby wear, which may be temperature-regulating, moisture-wicking, or even health-monitoring. Such advancements are enhancing the functionality and comfort of baby wear, optimizing it for different weather conditions and baby requirements. Moreover, the US e-commerce industry is being aided by technology in the form of augmented reality (AR), making it possible for parents to digitally test or see how baby garments will fit them or appear on their children prior to buying. This minimizes uncertainty and boosts customer satisfaction during online purchases. Artificial intelligence (AI) is also getting involved, with companies leveraging it to forecast fashion trends and manage inventory so that baby clothes ranges remain trendy and sought after.

Baby Apparel Market Trends:

Rising Demand for Safe and Organic Baby Clothing

There is a growing awareness among parents about the importance of using safe and organic materials in baby clothing, which is fueling the market's expansion. Parents are becoming increasingly aware of the potential risks associated with conventional fabrics, including skin irritations, allergies, and exposure to harmful chemicals such as pesticides and flame retardants. Since babies have skin that is much thinner and more sensitive than adults, they are more vulnerable to these irritants. As a result, there is an increasing preference for baby apparel made from natural and organic materials such as cotton, bamboo, and hemp. These fabrics are hypoallergenic, safe, and free of toxic substances, making them ideal for babies with sensitive skin. Additionally, many parents are now seeking eco-friendly options that are produced sustainably, aligning with the growing demand for environmentally conscious products. This trend toward safer, more sustainable baby clothing is driving the market’s positive outlook.

Thriving E-commerce Sector

The wide availability of baby apparel through online and offline distribution channels across the globe is impelling the growth of the market. In addition, people are increasingly preferring online shopping due to its enhanced convenience and wide range of product choices. Apart from this, online platforms allow parents to browse and shop for baby clothing from the comfort of their homes and at any time. This convenience is particularly crucial for busy parents who may not have time to visit physical stores. According to the US Census Bureau (USCBN), e-commerce sales in Q1 2025 rose by 6.1% from the same quarter in 2024, accounting for 16.2% of total retail sales, signaling the sector’s growing role in consumer behavior. Moreover, e-commerce assists in expanding the reach of baby apparel brands worldwide. In line with this, small brands can reach a global audience without the need for a physical presence in multiple locations. Additionally, e-commerce allows people to compare prices across multiple retailers, enabling more informed purchasing decisions. They can also read product reviews and make choices based on the experiences and recommendations of other parents. Furthermore, these baby apparel market trends are positively contributing to industry expansion.

Increasing Social Media Influence

The escalating demand for baby apparel on account of the rising social media influence on individuals is contributing to the growth of the market. In line with this, social media platforms and parenting influencers are playing a pivotal role in purchasing decisions. Moreover, these platforms allow baby apparel brands to showcase their products to a wider consumer base. With 31.7 Million active users in Canada alone in early 2025, representing nearly 79.4% of the population, as per ITA, social commerce has become a powerful tool for brand engagement. Besides this, brands are creating visually appealing content featuring adorable infants dressed in their clothing. This attracts a dedicated following of parents and caregivers who engage with the content through likes, shares, and comments. In addition, parenting influencers regularly review and recommend baby apparel brands, which is positively influencing the market. Apart from this, these recommendations provide real-world insights into the quality, comfort, and style of products. Additionally, influencers often set trends by creating stylish outfits for babies, which encourages parents to seek out similar clothing options. Furthermore, brands are increasingly utilizing social media to build loyalty among people.

Baby Apparel Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global baby apparel market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on product, material, distribution channel, application, and end user.

Analysis by Product:

- Outerwear

- Underwear

- Others

As per the baby apparel market outlook, in 2024, the outerwear segment led the market, accounting for 62.8% of the total market share. Outerwear includes a wide range of clothing designed to protect babies from external elements. It encompasses items such as jackets and coats, onesie and rompers, sweaters and cardigans, snowsuits and winter accessories, and swimwear. In addition, jackets and coats are essential for keeping babies warm during cold weather. Besides this, onesies and rompers are one-piece outfits that are suitable for various weather conditions. Sweaters and cardigans provide extra warmth and style for babies. Furthermore, snowsuits and winter accessories are widely utilized for extreme cold.

Underwear consists of clothing worn beneath the outer layers for comfort and hygiene. It includes items, such as bodysuits, diaper covers, undershirts and sleepwear, and pajamas and sleepsuits. Bodysuits are often used as underwear or base layers for babies. Additionally, diaper covers are designed to go over diapers and help prevent leaks while keeping babies dry. Besides this, pajamas and sleepsuits are specifically designed for nighttime comfort.

Analysis by Material:

- Cotton

- Wool

- Silk

In 2024, the cotton segment led the baby apparel market, accounting for 58.7% of the total market share. Cotton is a favorite among baby clothing because it is soft, breathable, and hypoallergenic, so it is best for sensitive skin of babies. Cotton clothes consist of basic items such as onesies, tees, body suits, and sleepwear. Also, most parents now look for eco-friendly, chemical-free clothes for their babies, thus putting cotton in a favored position.

Wool is another important fabric, prized for its temperature control, keeping warm during colder seasons and cool during hotter temperatures. Wool baby clothing, including sweaters, cardigans, blankets, and sleeping sacks, are becoming increasingly popular because of their softness and natural insulation.

Silk is frequently selected for such occasions or as an undergarment because it has a smooth finish and hypoallergenic properties. Silk infant wear such as christening gowns, nightwear, and blankets are highly valued for being very easy on sensitive skin while providing rich comfort.

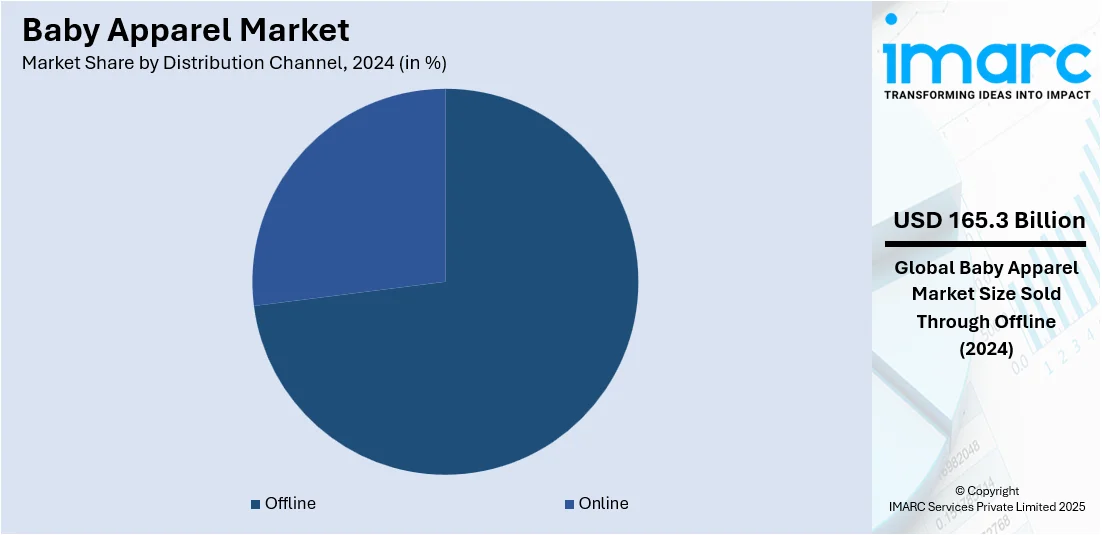

Analysis by Distribution Channel:

- Online

- Offline

In 2024, the offline segment led the market, accounting for 72.8% of the total market share. Offline channels consist of brick-and-mortar stores such as baby boutiques, department stores, supermarkets, and standalone shops. Baby boutiques specialize in providing a high-end selection of baby clothes, whereas department stores appeal to consumers of all budgets. Supermarkets and hypermarkets offer simple baby clothes, making them perfect for regular purchases.

Online retailers provide a convenient experience, where parents can shop and buy baby clothes while at home. Online retailers give access to diverse products, brands, and prices, with the added benefit of seamless price comparisons, customer reviews, and the right to make an informed choice.

Analysis by Application:

- 0-12 Months

- 12-24 Months

- 2-3 Years

In 2024, the 0-12 months segment led the baby apparel market, as these apparel includes a wide range of clothing items specially crafted for newborns and babies in their first year of life. Newborn baby clothes prioritize basic articles like onesies, sleepers, bibs, and swaddle blankets, which are made for comfort, safety, and convenience. These items are specifically designed to meet the specific needs of babies in their first year.

For children in the 12-24 month age bracket, fashion is created to fit the enhanced mobility and autonomy characteristic of this period. The products under this category include tops, bottoms, dresses, and outerwear, all providing comfort and durability, with more variety in colors and friendly motifs.

Baby clothing for the 2-3 year age range meets the increasing requirements of toddlers, with emphasis on dresses and clothing appropriate for play, preschool, and outdoor wear. T-shirts, shorts, dresses, and shoes typically have active designs that incorporate bright colors and popular themes.

Analysis by End User:

- Girls

- Boys

In 2024, the boys led the baby apparel market, driven by a combination of factors. There is a growing preference among parents for fashionable, practical, and long-lasting clothing for their male infants. This demand has been supported by the expansion of branded collections and a broader selection of styles and designs. Increased attention to the safety and quality of materials used in boys' clothing, along with the convenience of online shopping, has also contributed to the strong growth in this segment.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America led the baby apparel market, accounting for 33.6% of the total market share. North America holds the largest share of the market for baby clothing, driven by growing demand for organic and premium baby clothing. The rise of e-commerce websites, which provide convenience, has also stimulated growth in the region. Asia Pacific is another prominent sector with an established textile industry and an increasing number of babies, further increasing demand for fashionable and secure baby clothing.

Europe is a dominant player in the market, primarily driven by the increasing demand for high-quality, eco-friendly baby clothing. The specialty boutiques and department stores in the region, which provide assembled collections, enhance its market strength. In Latin America, growing awareness of safe and quality baby products is driving growth, with a focus on clothing made from comfortable and secure fabrics.

The Middle East and Africa region is promising due to an increasing trend towards trendy and stylish baby wear. Retail chains from all over the world, malls, and websites are contributing to the expansion of the market, enabling it to develop here.

Key Regional Takeaways:

United States Baby Apparel Market Analysis

The US baby apparel market is experiencing significant growth, driven by rising birth rates among millennials and the increasing popularity of events such as baby showers and milestone photography. Parents are showing a strong preference for fashionable and expressive clothing for their infants, influenced by broader fashion trends. Based on the baby apparel market forecast, US parents are expected to spend around USD 20,384 in the first year of their baby's life, a large portion of which is spent on apparel, highlighting the importance of infant fashion. Digital platforms are also enhancing the customization and personalization of baby clothes. Influencer marketing and parenting blogs are influencing purchasing choices, while subscription-based clothing services offer added convenience and value. The market is further driven by the increasing demand for gender-neutral designs, which are sparking innovation in baby apparel. The rise of e-commerce, with fast delivery and easy returns, continues to redefine how consumers shop for baby clothes. Retailers are expanding their offerings to include premium, ethically sourced fabrics as curated baby wardrobes become increasingly popular.

Europe Baby Apparel Market Analysis

The European baby apparel market is experiencing steady growth as parents increase their spending on high-quality, stylish clothing for their babies. Urban families are prioritizing aesthetic appeal, fabric durability, and practicality in their clothing choices. A survey by Ergo Baby revealed that 90% of parents overspend on baby products, with 53% of millennial parents in Europe being affected. The popularity of minimalist and Scandinavian-inspired baby clothing has influenced the design and color schemes of baby apparel. Seasonal fashion drops designed specifically for babies demonstrate a growing influence of adult fashion trends on baby wear. Strict textile regulations ensure that baby clothes meet safety and comfort standards, further boosting the market. Collaborations between artists and designers are also helping brands stand out and engage with consumers. The increasing use of digital retail tools, such as virtual try-ons and AI-powered size recommendations, is enhancing the shopping experience for parents.

Asia Pacific Baby Apparel Market Analysis

The Asia Pacific baby apparel market is expanding rapidly, driven by urbanization and the shift to nuclear family structures. The rapid adoption of digital technologies has revolutionized how consumers shop for baby clothes, with mobile-first strategies becoming increasingly important. India, with its significant birth rate of around 26 Million children annually, represents a major market opportunity. As the region adopts global fashion trends, demand for modern and culturally diverse baby clothing designs is on the rise. Rising disposable incomes among the middle class are enabling parents to update their babies' wardrobes frequently. The expansion of organized retail in semi-urban and rural regions is increasing accessibility to baby clothing. Additionally, changes in lifestyles, such as the rise of indoor crèches and early preschool programs, are driving demand for comfortable and practical clothing. Growing brand awareness among new parents has led to increased interest in limited-edition baby clothing collections with unique designs.

Latin America Baby Apparel Market Analysis

The Latin American baby apparel market is gaining momentum due to a rising focus on aspirational lifestyles and image-conscious parenting. Fashion-forward retail outlets are becoming increasingly prevalent in urban areas, offering a diverse range of babywear styles. In Brazil, the population of children aged 0-6, which accounts for approximately 19 Million individuals, is a key driver of demand for baby apparel. There is a growing trend of incorporating cultural pride and heritage-inspired designs into modern baby clothing, blending tradition with contemporary styles. The influence of television and digital media on parenting trends is shaping demand for themed clothing collections, particularly those featuring popular characters. Babywear is increasingly viewed as a lifestyle statement, with many parents opting for coordinated family outfits. The rise of digital payment platforms and influencer-driven social selling is fueling online baby apparel purchases in the region.

Middle East and Africa Baby Apparel Market Analysis

The baby apparel market in the Middle East and Africa is steadily progressing, driven by a youthful population and evolving parenting practices that emphasize sustainable clothing. A survey reveals that 52% of UAE consumers are willing to pay a premium for sustainable babywear brands. The demand for stylish, culturally sensitive baby clothing is rising as more families participate in community gatherings and celebrations. Greater internet penetration and exposure to global fashion trends are contributing to the popularity of modern designs that also adhere to modest fashion sensibilities. The growing importance of early gifting during childbirth ceremonies is increasing demand for high-quality, visually appealing baby clothes. Premium babywear brands are expanding their reach through boutique retail outlets in high-traffic commercial areas, benefiting from the region's evolving preferences for infant fashion.

Competitive Landscape:

The market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Bed Bath & Beyond Inc.

- Burberry

- Carter’s Inc.

- Cotton On Group

- Gianni Versace S.r.l

- H & M Hennes & Mauritz AB

- Hanesbrands Inc.

- Industria de Diseño Textil S.A.

- Ralph Lauren Corporation

- The Children's Place Inc.

- Truworths

Latest News and Developments:

- May 2025: JCPenney launched an exclusive baby apparel line with PROUDLY, co-founded by Gabrielle Union and Dwyane Wade. The collection featured inclusive, hypoallergenic, and stylish essentials made for diverse families. Emphasizing comfort, quality, and affordability, the launch marked PROUDLY’s expansion into apparel and strengthened its collaboration with JCPenney’s inclusive retail offerings.

- January 2025: Babyshop, part of Dubai’s Landmark Group, entered India with a flagship store in Chennai, offering curated baby essentials, apparel, and global brands. The brand emphasized quality, affordability, and innovation with services like My Baby Expert and stroller testing, while expanding through omni-channel platforms like Myntra and Flipkart for nationwide reach.

- January 2025: Boots expanded its collaboration with Mollie King by launching the ‘Maybe Junior’ clothing line for children aged 18 months to six years, adding 29 new pieces. This followed the success of their ‘Maybe Baby’ line. Both collections reflected King’s creative input and were rolled out across hundreds of UK stores.

- January 2025: Chicco opened its largest flagship store in India at Ambience Mall, Gurgaon, introducing baby apparel for newborns to six-year-olds as a new category. The store showcased a wide range of baby care products, aligning with the brand’s plan to expand its retail presence across major and mini metros in India.

Baby Apparel Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Outerwear, Underwear, Others |

| Materials Covered | Cotton, Wool, Silk |

| Distribution Channels Covered | Online, Offline |

| Applications Covered | 0-12 Months, 12-24 Months, 2-3 Years |

| End Users Covered | Girls, Boys |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Bed Bath & Beyond Inc., Burberry, Carter’s Inc., Cotton On Group, Gianni Versace S.r.l, H & M Hennes & Mauritz AB, Hanesbrands Inc., Industria de Diseño Textil S.A., Ralph Lauren Corporation, The Children's Place Inc., Truworths, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the baby apparel market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global baby apparel market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the baby apparel industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The baby apparel market was valued at USD 227.00 Billion in 2024.

The baby apparel market is projected to exhibit a CAGR of 4.43% during 2025-2033, reaching a value of USD 350.30 Billion by 2033.

The baby apparel market is driven by higher birth rates in emerging economies, increasing interest in infant well-being, and rising demand for fashionable, functional clothing. The shift toward organic fabrics and the growth of online shopping also play a key role.

In 2024, North America dominated the baby apparel market accounting for 33.6% of the total market share, driven by strong purchasing power, a preference for branded clothing, and rising interest in premium infant wear. The region’s widespread digital retail access further boosted its position in the market.

Some of the major players in the global baby apparel market include Bed Bath & Beyond Inc., Burberry, Carter’s Inc., Cotton On Group, Gianni Versace S.r.l, H & M Hennes & Mauritz AB, Hanesbrands Inc., Industria de Diseño Textil S.A., Ralph Lauren Corporation, The Children's Place Inc., Truworths, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)