Baby Food and Infant Formula Ingredients Market Size, Share, Trends and Forecast by Ingredients and Region, 2025-2033

Baby Food and Infant Formula Ingredients Market Size and Share:

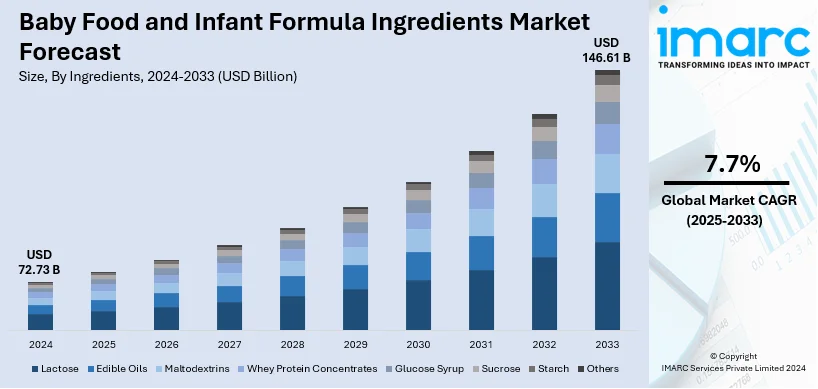

The global baby food and infant formula ingredients market size was valued at USD 72.73 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 146.61 Billion by 2033, exhibiting a CAGR of 7.7% from 2025-2033. Asia Pacific currently dominates the market holding a market share of over 46.7% in 2024. The market is driven by the region’s large and growing population, increasing birth rates, rising disposable incomes and heightened awareness of infant nutrition and health.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 72.73 Billion |

|

Market Forecast in 2033

|

USD 146.61 Billion |

| Market Growth Rate 2025-2033 | 7.7% |

The global baby food and infant formula ingredients market has witnessed tremendous growth owing largely to the growing birth rate globally and increasing disposable incomes mainly in emerging economies. According to the World Population Review data published in the year 2024, the world witnessed a staggering number of births in which an average of 362453 babies were born per day, that is roughly 15102 births per hour and 252 per minute. Increasing awareness on infant nutrition and early childhood development fuels the demand for quality fortified ingredients. Several technological advancements and innovations in ingredient formulations such as organic and hypoallergenic options also cater to the demand from health-conscious parents. The growth in distribution channels such as ecommerce and favorable regulatory frameworks further enhance the positive outlook for the market.

The primary growth drivers in the United States baby food and infant formula ingredients market are increased awareness of infant nutrition and the significance of early childhood development among parents. There is a growing demand for organic, natural, and non-GMO ingredients, given the fact that the consumer of today focuses much on health and safety of their child. For instance, in September 2024, Bobbie announced its intention to increase its retail reach by rolling out its USDA Organic and EU Certified formulas across nearly 500 Whole Foods Market locations. This strategic maneuver to meet surging demand for premium quality baby formula enhances Bobbie's commitment toward transparency and quality in infant nutrition. Advances in specialized formulation, such as hypoallergenic and fortified ones, address dietary requirements from diverse sources. In addition, stringent regulation standards ensure a high-quality product while higher disposable incomes will allow parents to spend more on premium products. The expansion in e-commerce and strong distribution networks also enhances market access and extension therefore creating a positive market outlook.

Baby Food and Infant Formula Ingredients Market Trends:

Rising Demand of Plant-Based and Vegan Formulas

The rising demand for vegan and plant-based formulas are mainly driven by the increasing environmental awareness and the growing number of consumers adopting vegan lifestyles. Parents nowadays are seeking suitable alternatives to traditional dairy based formulas in order to reduce their ecological footprint because plant-based ingredients typically require fewer resources and produce lower greenhouse gas emissions. There is also a growing incidence of lactose intolerance and milk allergies among infants prompting the demand for hypoallergenic and non-dairy product options. Advancements in nutritional science have enabled the development of plant-based formulas that provide essential nutrients ensuring that these alternatives meet the prerequisites of health and development needs in infants. For instance, in October 2024, Australian company Coco2 launched the world's first coconut based infant formula after the ten years of development. The product is mainly designed to mimic breast milk and is rich in essential nutrients, lauric acid and easier to digest. It addresses lactose intolerance and cow’s milk allergies targeting a growing market of plant-based alternatives.

Incorporation of Functional Ingredients

Functional ingredients like probiotics, prebiotics and DHA are increasingly incorporated into baby food and infant formulas in order to enhance the overall health and developmental outcomes. Probiotics helps in establishing a healthy gut microbiome which is important for digestion and immune function reducing the risk of infections and allergies. In August 2024, moringa milk industry announced the approval of its probiotic strain Bifidobacterium infantis M-63 as a new food ingredient for infant foods in China. Prebiotics serves as food for beneficial bacteria promoting their growth and activity. DHA is an essential omega-3 fatty acid which is vital for brain and eye development supporting visual and cognitive functions. These enhancements cater to the growing demand for scientifically backed nutritionally superior products which ensures the optimal growth and long-term health for infants.

Rise in E-Commerce

The rapid expansion in ecommerce is significantly transforming the baby food and infant formula ingredients market by providing the parents with greater accessibility and convenience. According to the report published by the International Trade Administration (ITA), the global ecommerce sale is expected to reach USD 5.5 trillion by year 2027 with steady compound annual growth of 14.4%. Online sales channels offer a wide array of products which might not be available in local stores allowing the consumers to easily compare the brands, ingredients and prices according to their needs. Direct to consumer models enable manufacturers to build a stronger relationship with consumers offering a personalized recommendation and subscription services which ensures the consistent supply without the need for frequent shopping trips. This gradual shift does not only drive the sales growth but also fosters customer loyalty and expands the market reach across the world. Additionally, advancements in data analytics enhance targeted marketing and inventory management improving overall efficiency. Sustainability concerns are prompting brands to adopt eco-friendly packaging and ethically sourced ingredients appealing to environmentally conscious consumers. Furthermore, the integration of artificial intelligence in ecommerce platforms is enabling more personalized shopping experiences thereby increasing customer satisfaction and retention.

Baby Food and Infant Formula Ingredients Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global baby food and infant formula ingredients market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on ingredients and region.

Analysis by Ingredients:

- Lactose

- Edible Oils

- Maltodextrins

- Whey Protein Concentrates

- Glucose Syrup

- Sucrose

- Starch

- Others

Lactose leads the market with around 31.2% of market share in 2024. Lactose holds the largest segment of the market mainly due to its indispensable role as the primary carbohydrate source in infant nutrition. Resembling to the natural sugar found in breast milk lactose provides necessary energy for growth and development while aiding in absorption of vital minerals like phosphorus and calcium. The proven safety and digestibility of lactose makes it a highly sought after product for manufacturers and parents alike. For instance, in October 2024, Bobbie launched its Grass Fed Whole Milk Infant Formula in the United States. This affordable high-quality formula is made with whole milk from pasture raised cows and also meets the strict United States and European standards offering parents a nutritious option for their babies. Lactose also supports the healthy development of infant gut microbiome thereby enhancing the overall digestive health.

Regional Analysis:

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

In 2024, Asia Pacific accounted for the largest market share of over 46.7%. Asia Pacific holds the largest segment of the market mainly driven by its increasing population and high birth rates. Rising disposable incomes in emerging economies like China, India and Southeast Asia enables parents to invest in premium and specialized infant nutrition products. Rising awareness about the importance of early childhood nutrition and health is further fueling the demand for high quality fortified ingredients. Rapid urbanization and changing lifestyles across the region also contribute to the higher consumption of convenient baby food products. The region’s expanding ecommerce infrastructure and strong presence of key market players further enhances the market accessibility and penetration thereby solidifying Asia Pacific’s leadership in the sector. According to a report published by ITA, the Asia Pacific region leads the global ecommerce market with a 15% of annual growth rate surpassing the 14.5% of global average.

Competitive Landscape:

The baby food and infant formula ingredients market is highly competitive with key players focusing on innovation quality and regulatory compliance to strengthen their market position. For instance, in July 2024, Arla Foods received FDA approval for its whey protein hydrolysates for use in infant formula enhancing allergy management and gut comfort for US infants. Four ingredients from its Peptigen® and Lacprodan® ranges have been authorized for early life nutrition aiding in cow's milk allergy management. Regional players in emerging markets add competition by offering cost-effective locally tailored solutions. Strategic partnerships, mergers and acquisitions further intensify competition enabling companies to expand their global footprint.

The report provides a comprehensive analysis of the competitive landscape in the baby food and infant formula ingredients market with detailed profiles of all major companies, including:

- AAK AB

- Agrana Beteiligungs-AG

- Archer Daniels Midland (ADM)

- Arla Food Ingredients Group

- Cargill, Inc.

- Glanbia plc

- Ingredion Inc.

- Roquette Frères

- Tate & Lyle PLC

- Lactalis

Latest News and Developments:

- In September 2024, Happy Family Organics launched a new line of USDA and EU-Certified organic infant formulas featuring a patented blend of probiotics and prebiotics to support gut health.

- In June 2024, Sprout Organic an Australian infant nutrition brand announced its plans to launch in the UK addressing the scarcity of vegan infant formula amid regulatory challenges. With a unique blend of rice and sprouted pea protein the formula caters to allergy-sensitive toddlers.

- In April 2024, Else Nutrition launched its plant-based soy free infant formula and toddler drink in Australia marking its entry into the Asia Pacific market. The products made from almonds, buckwheat and tapioca address the needs of infants and toddlers. The company aims to educate the market about plant-based nutrition focusing on lactose intolerance and clean label options.

Baby Food and Infant Formula Ingredients Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Kilo Tons, Billion USD |

| Segment Coverage | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Ingredients Covered | Lactose, Edible Oils, Maltodextrins, Whey Protein Concentrates, Glucose Syrup, Sucrose, Starch, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | AAK AB, Agrana Beteiligungs-AG, Archer Daniels Midland (ADM), Arla Food Ingredients Group, Cargill, Inc., Glanbia plc, Ingredion Inc., Roquette Frères, Tate & Lyle PLC, Lactalis, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts and dynamics of the baby food and infant formula ingredients market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges and opportunities in the global baby food and infant formula ingredients market.

- The study maps the leading, as well as the fastest-growing regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power and the threat of substitution. It helps stakeholders to analyze the level of competition within the baby food and infant formula ingredients industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The baby food and infant formula ingredients market was valued at USD 72.73 Billion in 2024.

The baby food and infant formula ingredients market is projected to exhibit a CAGR of 7.7% during 2025-2033, reaching a value of USD 146.61 Billion by 2033.

The baby food and infant formula ingredients market is driven by rising awareness of infant nutrition, increasing working mothers and demand for convenient feeding options. Advancements in ingredient formulations, growth in premium organic products and regulatory support for fortified foods also contribute to market growth catering to parents' focus on safe, high-quality nutrition for infants.

Asia Pacific currently dominates the market, accounting for a share of around 46.7%. The dominance is driven by rising birth rates, increasing disposable incomes, urbanization, improved healthcare access, growing awareness of infant nutrition, and product innovations.

Some of the major players in the baby food and infant formula ingredients market include AAK AB, Agrana Beteiligungs-AG, Archer Daniels Midland (ADM), Arla Food Ingredients Group, Cargill, Inc., Glanbia plc, Ingredion Inc., Roquette Frères, Tate & Lyle PLC, and Lactalis, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)