Belts and Wallets Market Size, Share, Trends and Forecast by Product, Material, Distribution Channel, End User, and Region, 2025-2033

Belts and Wallets Market Size and Share:

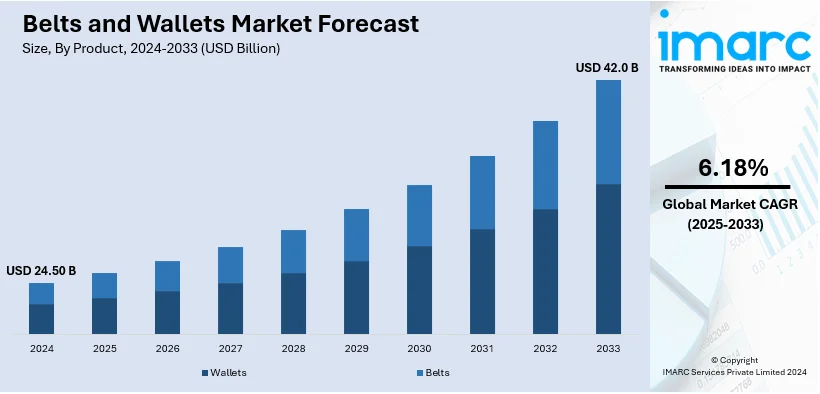

The global belts and wallets market size was valued at USD 24.50 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 42.0 Billion by 2033, exhibiting a CAGR of 6.18% from 2025-2033. Asia Pacific currently dominates the market, holding a market share of over 44.4% in 2024. The emerging fashion trends, easy product availability across e-commerce platforms, and recent development of smart wallets represent some of the key factors driving the market across Asia Pacific.

|

Report Attribute

|

Key Statistics |

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 24.50 Billion |

| Market Forecast in 2033 | USD 42.0 Billion |

| Market Growth Rate (2025-2033) | 6.18% |

The growing consumer spending on fashion and accessories is driving the demand for high-quality and stylish products in the belts and wallets market. With a focus on personal style, men and women are investing in premium belts and wallets to enhance their wardrobes. Further, the growth of online retail platforms has increased accessibility, offering more designs and brands to consumers worldwide. Another driving force of sustainability trends is eco-friendly consumers preferring recycled material or vegan leather as alternatives to original products. Customization and personalization options are another trend attracting customers who would look for specific designs. More modern technology in production, such as RFID-blocking wallets, adds to this demand because of rising concerns over digital security. These factors are driving the growth of the market across regions in combination with the growth of gift culture and brand-conscious consumers.

The United States has emerged as a key regional market for belts and wallets. The market is influenced by changing consumer preferences and increasing disposable income. Fashionable people are increasingly looking to purchase quality accessories that complete their outfits, thereby driving demand for premium belts and wallets. Further, the strong presence of online retail platforms and e-commerce has added to the accessibility of products by allowing consumers to get diverse choices and competitive prices all over the country. Sustainability is also coming in handy as eco-friendly customers are demanding belts and wallets that are made of recycled material or vegan leather. Furthermore, the increased interest in personalization has seen a rise in demand for bespoke belts and wallets made according to one's preference. The rise of RFID-blocking wallets aligns with consumer security needs. The digital age is giving way to a gifting culture and the importance of brand identity, making these factors combined drivers for growth in the U.S. market.

Belts and Wallets Market Trends:

Rising consumer spending on fashion accessories

The rising adoption of belts and wallets as a necessity fashion accessory is significantly boosting the market. Such accessories add functionality and improve personal style, professionalism, and individuality. The awareness and demand from consumers to complement their outfit accessories continue to grow. The growing availability of belts and wallets on different e-commerce platforms is further boosting the growth of the market. Consumer preferences are also changing, with an increased interest in unique designs that feature different colors, textures, styles, and materials. This trend represents a desire for uniqueness and exclusivity, and, in response, manufacturers should innovate and diversify their lines to help the market reach its high growth path.

Technological developments and multifunctionality

Belt and wallet innovation coupled with technological developments and multifunctionality are changing the face of the market. The latest smart wallet with RFID-blocking technology helps consumers combat ever-growing fears about digital insecurity. These advanced products protect sensitive information on credit cards and passports from potential hackers, gaining popularity among tech-savvy consumers. Similarly, multifunctional belts that include features such as built-in storage compartments, hidden pockets, and tools like bottle openers, knives, and fire starters are appealing to practicality-focused buyers. These innovative designs blend style and utility, making them increasingly desirable. The market has integrated such advanced features because of its sensitivity to consumer needs for greater functionality without compromising aesthetics. These technologies meet the specific needs of the consumers but expand the scope of the product and promote further growth in attracting new market segments.

Sustainability initiatives and strategic marketing

One of the key emerging trends in belts and wallets markets is sustainability; as consumers, people are gradually turning more toward environmentally friendly materials and are becoming sensitive about using a product that could otherwise harm nature. Such requirements are getting fulfilled with increasing usage of vegan leather, cork, hemp, and recycled plastics among others. Promotional tactics have become aggressive role players to spread this market, which will remain significant well into the future. Social media campaigns, celebrity endorsements, and targeted advertisements are effectively increasing consumer engagement and brand visibility. Moreover, the rising expenditure capacities of consumers, along with the growing demand for customization and personalization, are driving market growth. Manufacturers are also investing in advanced product development to meet the diverse and evolving preferences of modern consumers. These factors collectively position the belts and wallets market to sustain further growth through the coming years, along with fostering greater consumer loyalty through innovative and ethical practices.

Belts and Wallets Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global belts and wallets market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on product, material, distribution channel, and end user.

Analysis by Product:

- Wallets

- Belts

Belts lead the market with a share of 58.5% due to the dual functionality of necessary functional items and fashionable accessories. Due to their wide usage in casual, formal, and professional settings, belts are part of wardrobes globally. There is a range of designs available, from minimalist, statement, and utility-driven ones, which cater to a wide audience. Increasingly, consumers are looking for belts that best express a personal style yet deliver functionality and durability. Multi-functional belts with secret pockets, bottle openers, or survival kits can be highly appealing to an adventure enthusiast or practical consumer. The premium and branded belt segment will gain momentum because of rising disposable incomes and a growing interest in quality. Offline stores significantly contribute to the sale of belts, especially for an experiential, hands-on experience, and online channels allow for customization options as well as easy access to designs worldwide, thus creating sustainable growth and market leadership.

Analysis by Material:

- Leather

- Non-Leather

Leather leads with 72.4% of the market share, mainly due to its unmatched durability, timelessness, and versatility, thus becoming the number one choice for belts and wallets, especially in luxury and premium categories. Leather products will go to consumers who appreciate craftsmanship and elegance usually linked with luxury brands. Innovations in leather production such as eco-friendly tanning processes and sourcing of raw materials, have opened more access to environmentally conscious consumers. The material can be used in different finishes including some that are smooth, gloss, textured, and matte, which makes the leather product relevant to different consumers. Furthermore, the durability of leather makes it a long-term product, which is justifiable for its premium price and attracts customers who are willing to spend on quality. The increasing consumer preference for personalization, such as embossed designs and unique textures, also enhances the market share of leather.

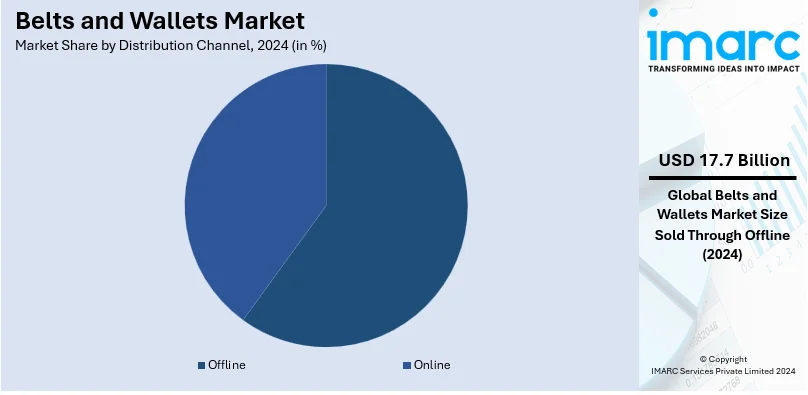

Analysis by Distribution Channel:

- Offline

- Online

Offline distribution channels hold the highest market share at 72.3%, which indicates the significance of offline channels in the belts and wallets industry. Physical retail stores offer an unmatched experience to shop as the consumer can evaluate quality, fit, and design. The tactile experience is much more important for accessories such as belts and wallets, where texture, color, and craftsmanship are critical factors in purchasing. Luxury and premium brands are highly dependent on the offline channel to offer services that enhance customer engagement and exclusivity. Department stores, specialist accessory retailers, and brand-owned stores comprise a substantial part of its revenue base through loyalty programs, in-store promotions, and curated collections. Offline channels also offer support to premium pricing approaches by offering a quality, authentic product experience that cannot easily be achieved in an online setting. The channel has a good prospect of remaining strong as brands continue their investment in immersive retail experiences.

Analysis by End User:

- Men

- Women

Men represent the largest market segment with a share at 65.4%. These are the people who constantly demand belts and wallets. The former is always a component of men's wardrobes, filling functional needs and keeping up with the overall professional and casual outfit. There are practically no instances where belts are not worn with formal. Wallets are another equally important thing for men, with specific features such as durability and compact design. In addition to this, wallets also must have secure compartments. This is largely driven by the trend toward premium and branded accessories for men, where style meets quality. Gifting culture along with the increase and wallets among men has helped them gain popularity. Retailers are paying attention to this group and are offering specific marketing strategies by designing collections specifically for working professionals, leisurewear, and luxury. This focus ensures sustained dominance of the men's segment in the market.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia-Pacific accounted for the largest market share of over 44.4%. The belts and wallets market are geographically divided into various regions, while Asia Pacific has emerged as the leading region, constituting the largest market share. In Asia Pacific, the key contributors are China, Japan, India, South Korea, Australia, Indonesia, and other countries because of increasing disposable incomes, a growing fashion-conscious population, and a strong retail sector. North America includes the United States and Canada; here, the demand for premium and luxury products is very high along with an established e-commerce network. Europe, covering countries like Germany, France, the United Kingdom, Italy, Spain, among others, demonstrates a relatively consistent growth due to the immense popularity of fashion and accessories in the region. In Latin America, Brazil and Mexico dominate the market, mainly due to urbanization and changing lifestyles. Other countries in Latin America contribute to potential market, though in a smaller way, driven by an increasing appetite for branded accessories and expanding retail infrastructure. In total, the belts and wallets market show a mixed pattern of growth across regions while Asia Pacific is at the forefront of international expansion.

Key Regional Takeaways:

United States Belts and Wallets Market Analysis

In 2024, The United States accounts for 77.8% of the belts and wallets market in North America. Consumers are increasingly favoring premium and sustainable materials, such as vegan leather and recycled fabrics, which are reshaping product offerings to align with eco-conscious trends. Brands are harnessing digital platforms and social media in active brand engagement with younger demographics through influencer collaborations and targeted campaigns. According to the Census Bureau, in 2020 there were over 73.1 Million children under age 18 or about 22.1% of the total U.S. population. In addition, producers are developing innovative multifunctional designs with integrated features such as RFID-blocking technology in wallets and adjustable, reversible belts to answer the demand for increased utility. The market is also gaining from increased gifting culture, where belts and wallets are being marketed as sophisticated, versatile gift items for various occasions, with attractive packaging and personalization options. Additionally, retailers are exploring the DTC approach and optimizing their e-commerce platforms with virtual try-ons and seamless customization tools that improve the overall experience for the consumer. Meanwhile, fashion casualism encourages the adoption of versatile accessories, with belts and wallets touted as style staples to match both formal and casual wear. These focused strategies are collectively ensuring the continued growth of the belts and wallets market in the United States.

Asia Pacific Belts and Wallets Market Analysis

The Asia-Pacific belts and wallets market is growing currently, driven by evolving consumer preferences for premium and sustainable products. Consumers are now turning toward green wallets and belts to use recyclable leather and plant-based alternative leathers, due to environmental consciousness. Fashion-conscious designs are becoming popular as a result of increased urbanization with greater disposable incomes that motivate consumers toward using style and branded accessories. According to the Government of China, in 2023, the nationwide per capita disposable income was USD 5,391.98. In the market, demand for gender-neutral and multifunctional items is growing rapidly since consumers value their purchases more for versatility than anything else. Increased e-commerce penetration helps to gain access to a wider product portfolio, with digital marketing campaigns targeting the younger population and those who are avid internet users. International brands are penetrating the emerging markets of India, Indonesia, and Vietnam by collaborating with local influencers to attract regional consumers. Domestic manufacturers are offering customization and affordable prices to suit diverse customers' preferences at a time when increased digital payment adoption is also making online wallet buys easier and seamless. Retailers are enhancing the shopping experience by incorporating augmented reality (AR) and virtual try-on features to allow customers to visualize product usage, further boosting sales in this competitive market.

Europe Belts and Wallets Market Analysis

The belt and wallets market in Europe is currently being driven by a growing demand for sustainable and eco-friendly materials, as consumers are increasingly prioritizing environmentally responsible products. Brands are now more aggressively introducing recycled and biodegradable materials like vegan leather and plant-based alternatives in their product lines to address this preference. Customization options are also growing, as consumers seek exclusive, one-of-a-kind accessories that express their style. Luxury brands are extending their reach into the region, focusing specifically on high-income urban populations with premium products and limited-edition collections. At the same time, the market is transformed by digitalization; online platforms take an important role in leading sales through targeted advertising and experience e-commerce. International Trade Administration states that Europe is the third biggest retail e-commerce market globally with total revenues of USD 631.9 Billion. The demand for multifunctional designs, such as wallets with RFID protection and belts with interchangeable buckles, is steadily increasing due to the growing focus of consumers on practicality and convenience. Furthermore, the continued importance of gender-neutral fashion has been driving the designs of products, prompting brands to create versatile collections that can appeal to a wider variety of consumers. It also makes further shaping by European Union rules about product safety and sustainability which encourages manufacturers to adopt greener production practices and transparent supply chains.

Latin America Belts and Wallets Market Analysis

The belts and wallets market in Latin America is being driven by changing consumer preferences toward sustainable and locally sourced materials, which are shifting the production and marketing strategies of brands in the region. Brands are innovating designs and multi-functionality to meet the surging demand for products that make a fashion statement and have utility. Local craftsmen and small-scale manufacturers are taking full advantage of the growing trend of cultural-inspired, handcrafted accessories, thereby increasing their penetration in the domestic and international markets. E-commerce sites are extending their reach by providing customized and premium wallets and belts to the increasing number of online shopping consumers. Urbanization is also increasing the disposable income of the middle class, which is further leading to the purchase of branded and luxury products. UN-Habitat describes Mexico as a country that is almost 80 percent urbanized. Companies also use the trend of social media in using influencers and celebrities to promote their belts and wallets as fashionable accessories, thus making the product more attractive to a younger market. The developing retail landscape of the region is opening the door for penetration of the underserved markets into rural and semi-urban locations. Simultaneously, post-pandemic economic recovery efforts are motivating promotional campaigns and discounts, attracting budget-conscious consumers without sacrificing style or quality. Altogether, these factors are driving growth and innovation in the Latin American belts and wallets market.

Middle East and Africa Belts and Wallets Market Analysis

The Middle East and Africa belts and wallets market is growing with changing consumer preferences for premium and customized accessories that combine functionality with style. Sustainable or ethically produced belts and wallets are increasingly preferred by consumers, thus brands prefer ecological materials like vegan leather and recycled fabrics. The market is capitalizing on increasing disposable incomes, especially among the urban youth and working professionals, who are looking for luxury and designer products to complement their style. Digital transformation is reshaping the retail landscape, with e-commerce platforms and social media marketing actively engaging tech-savvy consumers while offering exclusive online collections and personalized experiences. According to the International Trade Administration, the UAE heads the GCC states as an eCommerce leader where the market grew by 53% in 2020. Regional players are continuously linking up with global brands introducing culturally resonant designs where traditional patterns and local artistry come into play. Moreover, manufacturers are now integrating emerging technologies like RFID-blocking wallets toward rising data security concerns. Retailers are increasing their footprints in malls and airports with flexible payment options to tap into various customer segments. The market is also responding to the trend of gifting, with belts and wallets increasingly being promoted as perfect gifts during festivals and other occasions. All these deliberate initiatives are cumulatively enhancing market attractiveness and supporting growth momentum.

Competitive Landscape:

Current activities among the players in the belts and wallets market include innovation, sustainability, and strategic marketing for attracting consumers' interests in addition to market share penetration. Market leaders have advanced designs on product offerings to achieve multi-functionality - like a belt with inner compartments or a wallet containing RF-blocking materials to reach security and technology-savvy customers. Sustainability has become the main area of focus, with companies starting to use eco-friendly materials, such as vegan leather, cork, and recycled plastics, to meet the ever-increasing demand for more eco-friendly products. Market players are using e-commerce platforms to expand their reach and provide customized solutions, such as personalized designs and tailored fits. Aggressive marketing campaigns, social media promotions, and celebrity endorsements are being used to enhance brand visibility and appeal to younger demographics. Companies are also partnering with fashion influencers and releasing limited-edition collections to create exclusivity and generate sales. All these activities enhance product portfolios and strengthen market positions in a competitive landscape.

The report provides a comprehensive analysis of the competitive landscape in the belts and wallets market with detailed profiles of all major companies, including:

- Aditya Birla Management Corporation Pvt. Ltd.

- Burberry PLC

- Diesel Fashion India Reliance Pvt. Ltd

- Guccio Gucci S.p.A. (KERING)

- Levi Strauss & Co.

- Marshall wallet (abc international)

- PUMA SE

- Ralph Lauren Corp.

- Titan Company

- Tommy Hilfiger (PVH Corp)

Latest News and Developments:

- December 2022: ESSEN collaborated with Friends with Frank which happens to be a three-piece belt collaboration. Both these brands share quality craftsmanship and design. Moreover, this collection has been crafted from premium LWG-Gold certified leathers and recycled metal hardware.

- August 2023: Brand Concepts Ltd, a leading fashion retail house for lifestyle accessories, travel gear, and handbags in India, entered into a partnership with United Colors of Benetton, which is one of the world's most popular fashion companies, to launch an exclusive collection of travel accessories and small leather items such as belts and wallets for men and women in the Indian market.

Belts and Wallets Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Wallets, Belts |

| Materials Covered | Leather, Non-Leather |

| Distribution Channels Covered | Offline, Online |

| End Users Covered | Men, Women |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Aditya Birla Management Corporation Pvt. Ltd., Burberry PLC, Diesel Fashion India Reliance Pvt. Ltd, Guccio Gucci S.p.A. (KERING), Levi Strauss & Co., Marshall wallet (abc international), PUMA SE, Ralph Lauren Corp., Titan Company, Tommy Hilfiger (PVH Corp), etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the belts and wallets market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global belts and wallets market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the belts and wallets industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Belts and wallets are essential accessories that bring functionality together with style. They secure clothing, making an outfit complete, while a wallet organizes and safeguards cash, cards, and personal items. Such accessories are essential and reflect personal taste, hence, staples in both fashion and everyday life for both men and women.

The belts and wallets market was valued at USD 24.50 Billion in 2024.

IMARC estimates the belts and wallets market to exhibit a CAGR of 6.18% during 2025-2033.

The belts and wallets market is driven by the rising consumer spending on fashion and accessories, online retail platforms, sustainability trends, customization options, and modern technology. Consumers are investing in premium products, preferring eco-friendly alternatives, and seeking specific designs. The market is also driven by gift culture and brand-conscious consumers.

In 2024, belts represent the largest segment driven by the dual functionality of necessary functional items and fashionable accessories.

Leather leads the market owing to its unmatched durability, timelessness, and versatility, thus becoming the number one choice for belts and wallets, especially in luxury and premium categories.

Offline is the leading segment as they offer an unmatched experience to shop as the consumer can evaluate quality, fit, and design.

Men dominate the segment as they always remain as a component of men's wardrobes, filling functional needs and keeping up with the overall professional and casual outfit].

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Asia Pacific currently dominates the global market.

Some of the major players in the global belts and wallets market include Aditya Birla Management Corporation Pvt. Ltd., Burberry PLC, Diesel Fashion India Reliance Pvt. Ltd., Guccio Gucci S.p.A. (KERING), Levi Strauss & Co., Marshall Wallet (ABC International), PUMA SE, Ralph Lauren Corp., Titan Company, and Tommy Hilfiger (PVH Corp), etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)