BFSI Security Market Size, Share, Trends and Forecast by Type, Physical Security Offering, Information Security Offering, Enterprise Size, End User, and Region, 2025-2033

BFSI Security Market Size and Share:

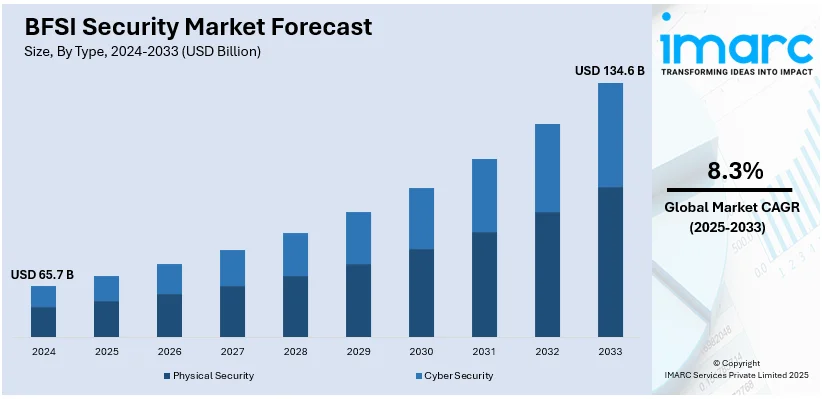

The global BFSI security market size was valued at USD 65.7 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 134.6 Billion by 2033, exhibiting a CAGR of 8.3% from 2025-2033. North America currently dominates the market in 2024, holding a market share of over 80.90% in 2024. The market is propelled by rapid digital transformation, growing cyber threats, necessities to fulfill with regulatory requirements, and increasing need for secure financial transactions, which has generated the demand for innovative security solutions in banking and financial institutions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 65.7 Billion |

|

Market Forecast in 2033

|

USD 134.6 Billion |

| Market Growth Rate (2025-2033) | 8.3% |

The BFSI security market is influenced by various major factors, with cybersecurity being the primary concern. With financial entities moving into digital technologies for the increasing use of mobile banking, cloud services, e-commerce, and more, their risks of cyber-attacks, data breaches, and fraud increase exponentially, causing them to invest in advanced protection techniques like encryption, multi-factor authentication, and even AI-driven threat detection. Stricter regulations such as GDPR and PCI DSS require banks to comply with their data protection standards, therefore further driving investment in security. The need for secure platforms is also growing because of the rise in fintech businesses and the trend of banking services becoming more digital. Additionally, increasing sophistication in physical security threats such as theft and terrorism makes it imperative for BFSI to opt for sophisticated physical security systems, which include video surveillance and access control systems.

The United States has emerged as a key regional market for BFSI security due to the growing trend of cyberattacks on financial firms. As banks, insurance companies, and fintech companies increase their digital footprint, they are more and more exposed to the chances of data breaches, fraud, and financial theft, further driving the demand for advanced cybersecurity solutions including encryption, multi-factor authentication, and AI-based threat detection systems. The strong regulatory framework, including GDPR and the CCPA, increases the demand for compliance-centric security solutions. Moreover, the rapid adoption of cloud technologies and mobile banking in the United States further creates vulnerabilities for financial organizations, and thereby, these organizations invest heavily in security measures. In addition, reliance on fintech innovations and digital payment platforms increases the demand for secure systems. Rising threats in physical security, such as insider threats and theft, further lead to investment in more advanced physical security systems, which include video surveillance and access control, thereby further enhancing the BFSI security market.

BFSI Security Market Trends:

Cloud-based Security Solutions Adoption

The United States Department of Homeland Security has played an instrumental role in building cyber across all sectors, which include state and local governments. During Fiscal Year 2022, under the Infrastructure Investment and Jobs Act, DHS set aside USD 185 Million to assist the state, local, and territorial governments in mitigating their information systems from these cyber risks and threats. Building on this promise, DHS announced another USD 374.9 Million for FY 2023 to further strengthen the State and Local Cybersecurity Grant Program (SLCGP). It would be used to fortify the cybersecurity infrastructure of state and local agencies, enabling them to protect more securely critical information systems and services. Even though such programs target generally state and local governments, they manifestly indicate how much the federal government commits toward the overall security of the nation through cyber security improvements. Improved security of the infrastructures at such levels thus indirectly benefits the BFSI sector. A more secure state and local environment will help partly contribute to a more secure digital ecosystem, increasing the resilience of financial institutions and their operations by making things more secure.

Escalating Adoption of AI and Machine Learning

Artificial Intelligence and Machine Learning have become an integral part of the cybersecurity frameworks of BFSI. So far, in the U.S. The Treasury Department views the introduction of AI systems into the financial sectors as a two-edged sword. Where on the one hand it offers chances to become expansively profitable, conversely, it enhances risks that result from concerns over data, bias, and third-party exposures. In this regard, the Treasury advises BFSI and the government to collaborate in setting standards for AI applications, sharing best practices in risk management, and deepening understanding of emerging AI and ML technologies. The partnership would thus help unlock the potential of AI and ML while controlling the risks that accompany them, hence enhancing the cybersecurity posture of the BFSI sector. A recent survey revealed that 78% of financial firms are deploying generative AI for at least one-use case, and 86% of respondents expect significant or moderate increases in model inventory due to the adoption of Generative AI. This bodes well for the increase in the adoption of AI and ML technologies in BFSI sectors. It is indeed high time to have robust frameworks for governance and risk management that help in the appropriate use of these technologies to derive optimal benefits.

Regulatory Compliance and Data Protection

Regulatory compliance and data protection are two of the critical priorities for the BFSI sector. The FFIEC provides guidelines for financial institutions to strengthen cybersecurity measures. Specific allocations or grants on data protection methods such as encryption and MFA were not able to be determined from the sources referenced. Furthermore, in July 2024, the U.S. Small Business Administration (SBA) launched new funding of $3 Million for the Cybersecurity for Small Businesses Pilot Program to further improve small business cybersecurity infrastructure. While such action supports small businesses, that may not be directly tied to the BFSI space's need for regulatory compliance. However, the move by the SBA further supports the greater cybersecurity space which indirectly helps the BFSI space by making the surroundings safer.

BFSI Security Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global BFSI security market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, physical security offering, information security offering, enterprise size and end user.

Analysis by Type:

- Physical Security

- Cyber Security

Cybersecurity holds the largest BFSI security market share because of the growing frequency and cleverness of cyberattacks aiming financial institutions. Strong cybersecurity protections like firewalls, encryption, and multi-factor authentication are becoming more and more necessary as financial services depend more and more on digital platforms for transactions. The market is pushed by a need to ensure sensitive financial information from cyber risks, by adhering to regulatory aspects and ensuring customer confidence. This forces financial houses to put more dollars into the adoption of artificial intelligence in cybersecurity technologies, and automated detection of threats. This creates growth for the segment under constant improvement due to emerging cyber threats.

Analysis by Physical Security Offering:

- System

- Physical Access System

- Video Surveillance System

- Perimeter Intrusion and Detection

- Physical Security Information Management

- Others

- Service

- Remote Monitoring Services

- Security Systems Integration Services

- Others

The service segment holds the maximum share due to the growing requirement for integrated security solutions. This can be attributed to remote monitoring services and security systems integration, as financial institutions demand continuous surveillance and effective management of security at different locations. This makes security a sophisticated threat to banks and insurance companies. They need the latest technologies, expert management, and 24/7 monitoring by outsourcing these services. The development of smart cities and more stringent security requirements further accelerate the need for comprehensive physical security services.

Analysis by Information Security Offering:

- Solution

- Identity and Access Management (IAM)

- Intrusion Detection System/Intrusion Prevention System (IDS/IPS)

- Data Loss Prevention (DLP)

- Disaster Recovery

- Distributed Denial of Service (DDoS)

- Antivirus/Antimalware

- Encryption

- Others

- Service

- Implementation and Integration Service

- Consulting Service

- Support and Maintenance Service

Solution leads the market with 70.2% of the market share. The largest share in the information security offering segment is taken up by identity and access management, which has been driven by increasing demand to secure user identity and access to sensitive financial data. As more financial institutions turn toward digital channels and mobile banking, IAM systems are an essential means of preventing unauthorized access and ensuring regulatory compliance. As cyberattacks, which target user credentials continue to rise, IAM solutions- advanced, that involve biometric authentication and multi-factor authentication are in growing demand. Financial institutions have lately zeroed in on protecting customers' data from fraud by making this market segment more potent.

Analysis by Enterprise Size:

- Large Enterprises

- Small and Medium Enterprises

The market is dominated by large enterprises with a market share of 60.7%, mainly due to the high use of digital infrastructure and its requirement for overall multi-layered security solutions. These organizations face complex cybersecurity threats that require advanced protection of massive volumes of sensitive data and financial transactions. Large enterprises invest in both physical and cyber security systems, including AI-driven cybersecurity solutions, integrated access control, and advanced video surveillance. The increased regulatory pressure, coupled with increasing concerns about cyberattacks and data breaches, is driving demand for sophisticated security solutions among large financial institutions.

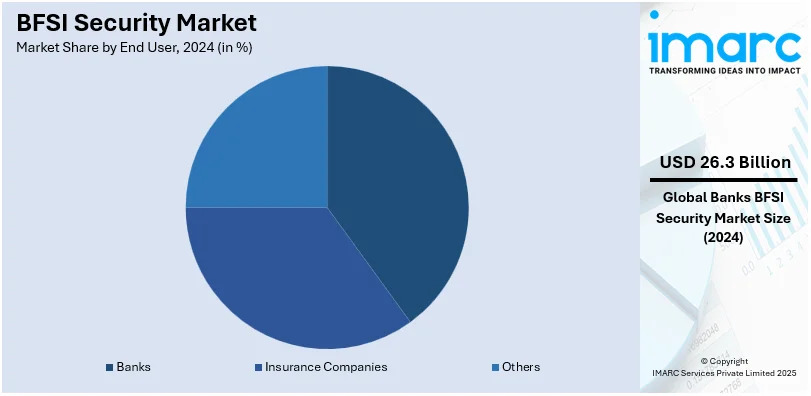

Analysis by End User:

- Banks

- Insurance Companies

- Others

Banks hold the largest market share of 40.0% in the BFSI security sector, driven by the critical need to protect vast amounts of sensitive financial data, customer information, and transaction systems. As banks increasingly digitize their services, the demand for robust cybersecurity and physical security systems intensifies. Banks are investing heavily in advanced cybersecurity solutions, like encryption, firewalls, and threat detection systems, as well as physical security measures like video surveillance and access control, with the rise of cyberattacks, frauds, and data breaches. Customer trust and regulatory compliance also contribute to this segment's growth.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America holds 38.9% of the market share in the BFSI security markets. The aerospace and energy sectors, being leading users of BFSI security solutions, require advanced systems to protect sensitive information and ensure regulatory compliance. Furthermore, the region experiences a strong presence of key technology and cybersecurity companies, providing a platform for innovation in the development of tailored security solutions for the BFSI industry. North America also boasts a strong infrastructure for research and development and is occupied by the highest-ranked universities and institutions researching cutting-edge materials science, artificial intelligence, and cryptography, which propel the development of advanced security technologies for the BFSI sector. With a strongly regulated environment across the region and cyber threats occurring frequently, the market for safe financial systems is seeing an increase.

The BFSI security market in the Asia Pacific is fueled by rapid digitalization, escalated internet penetration, and widespread adoption of e-commerce and mobile banking. Higher cyber threats and stringent regulations by the government on data protection are forcing financial institutions to invest in advanced security solutions. Furthermore, a growing financial services sector including fintech startups in the region is increasing the requirement for a strong cybersecurity framework to safeguard sensitive financial data and transactions.

Data protection regulations have been an increasing concern due to stricter regulation, thus driving BFSI security in the European market. Digital banks, mobile payment systems, and financial technologies are contributing to more and more applications of secured financial systems to meet customers' demands, and strict regulation compliance together with a sense of high cyber resilience makes BFSI secure in that region, resulting in much investment in such modern cybersecurity systems.

The BFSI security market in Latin America is expanding because of the rising change toward digital financial services and mobile banking. The rise in cybercrime, along with the need to comply with evolving data protection regulations, is driving financial institutions to prioritize cybersecurity. In addition, the growing fintech ecosystem in the region is increasing the demand for secure financial solutions, further driving BFSI security market growth.

Rapid economic development, increased internet penetration, and a growing reliance on digital banking are driving the BFSI security market in the Middle East and Africa. Cyber threats are rising and so is the necessity to comply with regulations. Therefore, financial institutions are spending on robust security systems. Moreover, government initiatives for modernizing financial infrastructures and promoting fintech innovations are contributing to the expansion of the market.

Key Regional Takeaways:

United States BFSI Security Market Analysis

In 2024, the United States accounts for over 80.90% of the BFSI security market in North America. The BFSI Security in the U.S. is under rapid growth as cyber threats intensify and regulatory frameworks update. The Identity Theft Research Center reported a record-high 3,205 breaches in 2023 in the U.S. against more than 353 Million individuals, which emphasizes the critical need for more advanced security measurements. As a result, banks are investing in next-generation security solutions, including AI-powered threat detection, real-time fraud prevention systems, and advanced encryption technology, to safeguard sensitive information. According to Forbes, cloud-based security leads as more than 80% of banks deploy the solution to take advantage of its scalability and increased security. Federal initiatives such as CISA's cybersecurity programs further supplement the support with industry-wide best practices. Major players such as IBM, Cisco, and Palo Alto Networks are innovating, and thus, robust cybersecurity frameworks are being ensured. With the increasing digitalization, along with consumer awareness about data protection, market growth is further fueled, positioning the U.S. at the top of BFSI Security solutions globally.

Europe BFSI Security Market Analysis

The BFSI Security market in Europe is propelled by increasing cyber threats and stringent regulatory frameworks like GDPR. EU agency dedicated to improving cybersecurity (ENISA) has identified seven prime cybersecurity threats in 2024, where threats against availability are leading followed by ransomware and threats against data. ENISA's report analyzed several thousand publicly reported cybersecurity incidents, focusing on the vulnerability of financial institutions. Germany, France, and the UK are investing much in their sophisticated cyber security measures to counter these threats. For example, Germany committed USD 10.24 Billion to cybersecurity in 2023. Financial institutions are embracing novel approaches like AI-based fraud detection and biometric authentication for stronger security. Atos and Kaspersky Lab lead the market progressions while the government-sponsored programs drive R&D in adopting blockchain for secure transactions. These initiatives along with the rising adoption of digital banking make Europe one of the most important geographic markets for BFSI Security.

Asia Pacific BFSI Security Market Analysis

The BFSI Security market in Asia Pacific is growing fast with increased digitalization and cyber threats. Cyberattacks at financial institutions have increased from 6,168 in 2018 to 429,847 in 2023 as per the Indian Computer Emergency Response Team, CERT-In. In addition, the report by an Indian consulting firm indicates that more than 45% of Indian businesses face an increase of over 50% in the attacks. Also, 67% of the government and essential services reported an increase in cyberattacks. Innovations in AI-based threat detection and blockchain technology are seen across the region. Cybersecurity spending in China increased to USD 25 Billion in 2023, thus depicting advanced security systems. Initiatives such as the "Digital India" in India and the "Cybersecurity Law" in China are driving this secure digital environment. The combination of local and global players, coupled with the growing consumer confidence in digital platforms, has made Asia Pacific a significant player in the global BFSI Security market.

Latin America BFSI Security Market Analysis

The BFSI Security market in Latin America is growing at a very high rate due to the increase in cyber threats and the adoption of strict data protection laws. In 2022, Brazil experienced an attempted cyberattack of 103.16 Billion, which is 16% more than the last year, according to Fortinet. Ransomware attacks surged by 51%, making Brazil the most targeted country in Latin America. These incidents, including phishing schemes, point out a pressing need for strong cybersecurity strategies. General Data Protection Law, enacted in 2021, sets tight parameters about how data should be collected and stored, pushing firms into making investments in advanced protection devices and threat detection mechanisms. Adopts cloud technology, and enhanced network security - two trends are altering the regional security landscape. Financial institutions and businesses are focusing on cybersecurity to protect sensitive information, build consumer trust, and comply with regulatory requirements to provide a secure digital space and promote market growth.

Middle East and Africa BFSI Security Market Analysis

The market in the Middle East is growing at a fast pace because of the rising digital transformation and the increase in cyber threats. According to the National Cybersecurity Authority (NCA), the cybersecurity market in Saudi Arabia was estimated to be around USD 3.5 Billion in 2023, which clearly shows that investment in protecting critical sectors has been massive in this region. Financial institutions are trying to use advanced solutions like biometric authentication, AI-driven threat detection, and secure cloud infrastructure to combat cyber risks. The UAE is taking the lead in regional initiatives through the Dubai Cyber Security Strategy that enforces strong digital frameworks. Other countries in the region embrace regulatory measures that enhance data protection while ensuring they meet the world's standards. Government collaboration with top cyber firms, such as Palo Alto Networks, is driving innovation. With increasing customer awareness about the importance of data security and strategic attempts from many ends, the Middle East will be one of the fastest-growing regions for BFSI Security.

Competitive Landscape:

BFSI security sector players in the market are aggressively developing new strategies for enhancing cybersecurity solutions against increasing and developing cyber threats. Companies have taken into focus and focused their effort on creating advanced solutions to develop, including multi-factor authentication, end-to-end encryption, biometric authentication, and AI-based threat detection systems. They are also focusing on achieving global security standards and other regulations such as GDPR, PCI DSS, and SOX, which ensure proper and safe handling of personal, financial, and transaction-related data. In addition, players are increasingly using blockchain technology to prevent fraud, implement safe digital payment systems, and enhance clarity. Scalability serves as the primary advantage of cloud-based security solutions, which deliver protection against cyberattacks flexibly and efficiently. These organizations also have strategic partnerships with specialized cybersecurity firms, integrating real-time monitoring and response capabilities, to quickly identify and mitigate emerging threats and thus strengthen their overall defense infrastructure.

The report provides a comprehensive analysis of the competitive landscape in the BFSI security market with detailed profiles of all major companies, including:

- Axis Communications AB

- Booz Allen Hamilton Holding Corporation

- Check Point Software Technologies Ltd.

- Cisco Systems Inc.

- Honeywell International Inc.

- Intel Corporation

- International Business Machines Corporation (IBM)

- Microsoft Corporation

- Robert Bosch GmbH

- Seico Inc.

- Sophos Ltd.

- Trend Micro Incorporated

Latest News and Developments:

- December 2024: Triton said it agreed to acquire Bosch Group's Security and Communications Technology, or BSCT, business. The agreement is anticipated to close by the middle of 2025, subject to all required regulatory approvals and other customary circumstances. BSCT is a leading security and communication solutions provider.

- September 2024: Booz Allen Hamilton was said to lead the US government's cyber security efforts through over 8,000 cyber professionals and nearly 300 active projects. The company's portfolio ranges from offensive and defensive missions and quantum initiatives to Billion-dollar contracts with both the public and private sectors.

- September 2024: Check Point Software acquires Cyberint Technologies, a company that will strengthen the threat intelligence of the firm. The advanced capabilities of Cyberint will be integrated into the Check Point Infinity Platform to improve collaborative threat prevention and expand managed services by enhancing its security operations.

- June 2024: Honeywell, in a statement to the media, said that an acquisition of Carrier's Global Access Solutions business for around $4.95 Billion can only make it strengthen the number one position in providing solutions to security in the new world of the digital age. Its Building Automation segment goes great, and cloud-based security offerings are supplemented by LenelS2, Onity, and Supra.

- April 2024: Axis Communications launches open, cloud-based video surveillance management platform - Axis Cloud Connect- an offering built with more sophisticated features to secure remote access and also features auto-update, plus device management from any easily reached over a Million installed cameras supported by either the applications from Axis or its third-party partner.

BFSI Security Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Physical Security, Cyber Security |

| Physical Security Offerings Covered |

|

| Information Security Offerings Covered |

|

| Enterprise Sizes Covered | Large Enterprises, Small and Medium Enterprises |

| End Users Covered | Banks, Insurance Companies, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Axis Communications AB, Booz Allen Hamilton Holding Corporation, Check Point Software Technologies Ltd., Cisco Systems Inc., Honeywell International Inc., Intel Corporation, International Business Machines Corporation, Microsoft Corporation, Robert Bosch GmbH, Seico Inc., Sophos Ltd., Trend Micro Incorporated, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the BFSI security market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global BFSI security market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the BFSI security industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

BFSI security is simply the protection of the banking and financial services sector, together with insurance, from any cyber threats, frauds, or data breaches. It means the implementation of advanced technologies and strategies designed to safeguard sensitive financial information, maintain regulatory compliance, and protect the integrity and trust of financial institutions and their clients.

The global BFSI security market was valued at USD 65.7 Billion in 2024.

IMARC estimates the global BFSI security market to exhibit a CAGR of 8.3% during 2025-2033.

The market is driven by rapid digital transformation, rising cyber threats, requirements to comply with regulatory requirements, and rising demand for secure financial transactions, which has created the demand for advanced security solutions in banking and financial institutions.

In 2024, cyber security represented the largest segment due to the increasing frequency and sophistication of cyberattacks targeting financial institutions.

Service leads the market due to the growing requirement for integrated security solutions.

The solution is the leading segment, driven by increasing demand to secure user identity and access to sensitive financial data.

In 2024, large enterprises represented the largest segment due to the high use of digital infrastructure and its requirement for overall multi-layered security solutions.

Bank leads the market driven by the critical need to protect vast amounts of sensitive financial data, customer information, and transaction systems.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global BFSI security market include Axis Communications AB, Booz Allen Hamilton Holding Corporation, Check Point Software Technologies Ltd., Cisco Systems Inc., Honeywell International Inc., Intel Corporation, International Business Machines Corporation, Microsoft Corporation, Robert Bosch GmbH, Seico Inc., Sophos Ltd, Trend Micro Incorporated, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)