Bio-Based Leather Market Size, Share, Trends and Forecast by Source, Application, Sales Channel, and Region, 2025-2033

Bio-Based Leather Market Size and Share:

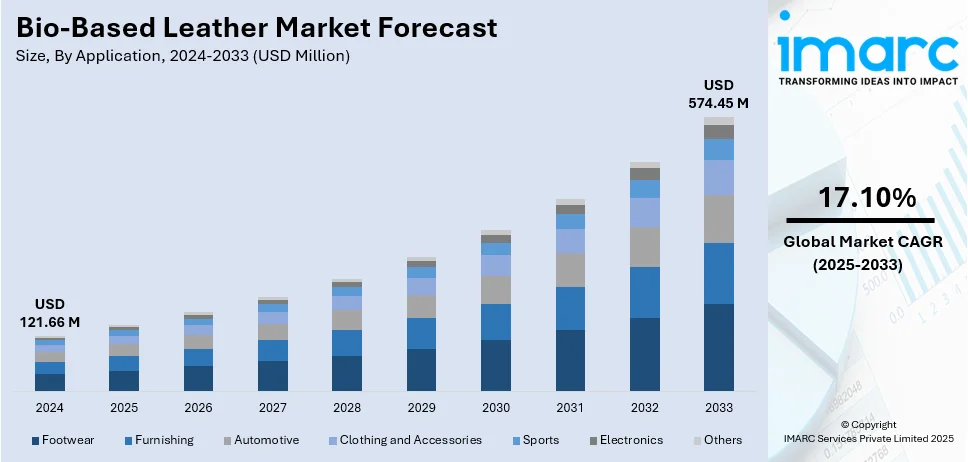

The global bio-based leather market size was valued at USD 121.66 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 574.45 Million by 2033, exhibiting a CAGR of 17.10% from 2025-2033. North America currently dominates the market, holding a market share of over 42.5% in 2024. The market is experiencing significant growth mainly due to increasing demand for sustainable alternatives in fashion, automotive and upholstery industries. Advancements in plant-based and microbial leather technologies along with regulatory support for ecofriendly materials are driving adoption. Companies are focusing on innovation and scalability to expand market reach influencing bio-based leather market share globally.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 121.66 Million |

| Market Forecast in 2033 | USD 574.45 Million |

| Market Growth Rate (2025-2033) | 17.10% |

The market for bio-based leather is being propelled by a growing consumer preference for sustainable and environmentally friendly options over traditional leather. Rising environmental concerns over synthetic and animal-based leather production have accelerated the adoption of bio-based materials derived from plant sources like pineapple leaves, mushrooms and apple peels. Additionally, stringent regulations on carbon emissions and chemical usage in leather manufacturing are pushing industries toward sustainable solutions. Growing investments in biotechnology and advancements in material science further support market expansion fostering innovation in bio-based leather production. For instance, in July 2024, UNCAGED Innovations secured $5.6 million in Seed funding for its grain-based sustainable leather co-led by Green Circle Foodtech Ventures and Fall Line Capital. The investment will enhance production and market entry. The company emphasizes the aim to disrupt traditional leather industries and promote environmentally friendly alternatives. These factors and industry collaborations are creating a positive bio-based leather market outlook across the world.

The United States bio-based leather market is driven by growing consumer preference for sustainable and cruelty-free products coupled with rising awareness of environmental impacts associated with traditional leather production. Stricter regulations on carbon emissions and chemical usage are encouraging manufacturers to adopt bio-based alternatives. Additionally, advancements in biotechnology and material science are enhancing the durability and aesthetic appeal of plant-based leather. Increased investments from fashion and automotive industries, along with a shift toward circular economy practices, are further fueling market growth. For instance, in October 2023, Asahi Kasei, a Japanese corporation announced its plans to invest in US-based startup NFW which produces non-petroleum-based leather alternatives for car interiors. This partnership aims to help global automakers reduce environmental impacts by developing biobased materials, marking the first initiative under Asahi Kasei's "Care for Earth" investment framework, with a $100 million allocation.

Bio-Based Leather Market Trends:

Rising Adoption of Plant Based Materials

The bio-leather market is witnessing a rise in the use of plant-based materials as environmentally friendly substitutes for conventional leather. Products such as mushrooms (mycelium), pineapple leaves (Piñatex), and apple peels are becoming popular due to their environmental friendliness, biodegradability, and low resource requirements. For instance, in June 2024, a PhD researcher at CU Denver is pioneering a sustainable leather alternative made from mushroom mycelium aiming to revolutionize the fashion industry. The research introduces a new paste substrate that promotes faster growth and yields providing an eco-friendly solution to both petroleum-based and animal-derived materials. This aligns with the modern sustainability goals of the industry. These plant-based alternatives lower the reliance on animal hides and synthetic materials, reducing environmental footprints. Biotechnology and materials science advancements are further enhancing their durability, texture, and flexibility to make them suitable for use in fashion, automotive, and upholstery.

Technological Advancements

Technological innovations in bio-fabrication and material science are transforming the bio-based leather industry by improving its durability, texture and performance. Technologies like microbial fermentation, genetic engineering and nanotechnology are facilitating the manufacture of quality leather alternatives with greater tensile strength, flexibility and water resistance. For instance, in February 2025, Modern Synthesis raised $5.5 million to enhance its production of bio-based textiles including alternatives to animal leather and plastic materials. Utilizing nanocellulose from fermentation, the company aims to provide sustainable solutions for the fashion industry, which is facing new regulations and a growing demand for environmentally friendly options. There is development of sophisticated processing methods by companies to purify plant-based materials such as mycelium and fruit peel so they are closer to leather. These developments are propelling wider use in fashion, automotive, and upholstery applications.

Expanding Application

The bio-based leather market is expanding across various industries including fashion, automotive and furniture due to its aesthetic appeal and functional benefits. In fashion major brands are incorporating plant-based leather into shoes, bags and accessories to meet rising sustainability demands. For instance, in October 2024, MCM launched a vegan tote made from Mirum, a groundbreaking plant-based leather alternative as part of its sustainable luxury collection. This eco-friendly bag boasts a 95% lower carbon footprint than traditional leather. MCM aims to set a new standard in luxury fashion through innovative, sustainable practices. The automotive sector is adopting bio-leather for car interiors offering a premium look with a lower environmental footprint. In furniture bio-leather is being used for upholstery providing durability and elegance while aligning with eco-conscious consumer preferences and industry sustainability goals.

Bio-Based Leather Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global bio-based leather market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on source, application and sales channel.

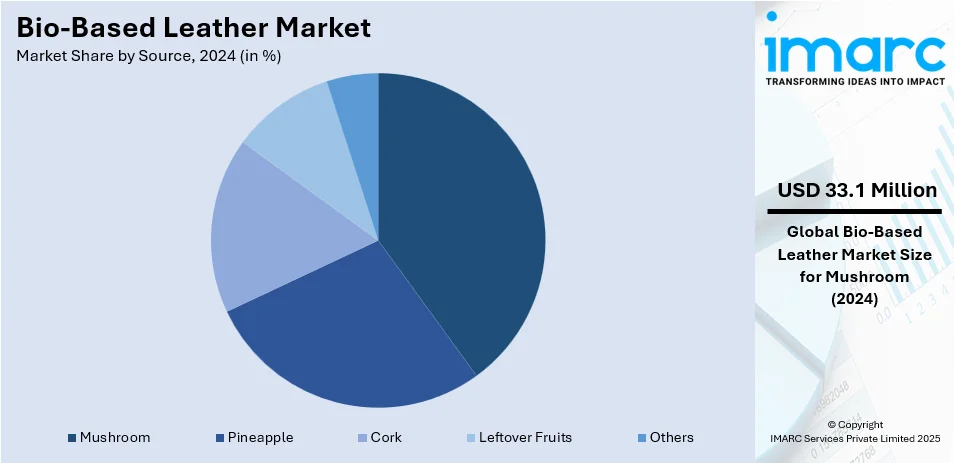

Analysis by Source:

- Mushroom

- Pineapple

- Cork

- Leftover Fruits

- Others

Mushroom leads the market with around 27.2% of market share. Mushroom-based leather is leading the bio-based leather market due to its sustainability, biodegradability and resemblance to traditional leather. Made from mycelium it provides a durable, eco-friendly alternative without the environmental impact of animal-derived leather. Advanced processing techniques enhance its texture, strength and versatility making it suitable for fashion, automotive and furniture applications. Increasing consumer preference for sustainable materials along with stricter environmental regulations is driving demand positioning mushroom-derived leather as a key innovation in the ecofriendly materials industry.

Analysis by Application:

- Footwear

- Furnishing

- Automotive

- Clothing and Accessories

- Sports

- Electronics

- Others

Clothing and accessories lead the market with around 46.7% of market share. Clothing and accessories dominate the bio-based leather market due to rising demand for sustainable fashion and cruelty-free alternatives. Bio-based leather offers durability, flexibility and aesthetic appeal making it ideal for footwear, handbags, jackets and wallets. Fashion brands are increasingly adopting eco-friendly materials to meet consumer expectations and regulatory standards. Advancements in bio-fabrication improve texture, strength, and performance, further boosting its use. Growing awareness of environmental impact and ethical sourcing strengthens the market position of bio-based leather in fashion.

Analysis by Sales Channel:

- Online

- Offline

Offline The offline segment leads the bio-based leather market due to strong consumer preference for physical inspection before purchase. Retail stores, boutiques, and brand outlets offer tactile experiences, allowing buyers to assess texture, durability, and quality. High-end fashion stores and automotive showrooms also drive demand by showcasing bio-based leather products. Additionally, offline channels provide personalized customer service, building trust and brand loyalty. Despite the growth of e-commerce, the offline market remains dominant due to the premium nature of bio-based leather products.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East

- Africa

In 2024, North America accounted for the largest bio-based leather market share of over 42.5%. North America holds the largest share in the bio-based leather market due to strong consumer demand for sustainable products, advanced manufacturing capabilities, and supportive regulatory frameworks. The region's well-established fashion, automotive, and furniture industries drive adoption, while increasing environmental awareness fuels the shift from conventional leather. Research and development in bio-fabrication technologies further enhance product quality and scalability. Rising investment in eco-friendly materials and the presence of key market players strengthen North America’s position as the leading market for bio-based leather.

Key Regional Takeaways:

United States Bio-Based Leather Market Analysis

In 2024, the United States accounted for over 84.10% of the bio-based leather market in North America. The United States bio-based leather market is experiencing strong growth mainly driven by rising consumer demand for sustainable alternatives to traditional leather. Increasing environmental concerns and regulatory policies promoting ecofriendly materials are key factors boosting adoption. The market benefits from technological advancements in plant based and microbial leather production with companies leveraging agricultural by-products and fungi-based processes. For instance, in March 2024, Sappi North America announced its partnership with Biophilica to launch Treekind® a groundbreaking plastic-free leather alternative. Made from 100% biobased materials it is home compostable, non-toxic and PETA vegan certified. The collaboration utilizes Sappi's textured release paper enhancing Treekind's authentic leather-like appearance and feel setting a new standard in sustainable materials. Major brands and fashion houses are incorporating biobased leather into their product lines further driving bio-based leather market demand. Government initiatives supporting sustainable material development and increasing investment in circular economy models are shaping industry trends. The automotive and footwear industries are leading applications with growing acceptance in upholstery and accessories. Key players in the U.S. are focusing on scalability, durability and cost-effectiveness to compete with conventional leather. The market outlook remains positive with continuous research in bio fabrication and consumer preference shifts toward cruelty-free biodegradable materials fostering long-term growth opportunities in the United States.

Europe Bio-Based Leather Market Analysis

The Europe bio-based leather market is expanding due to stringent environmental regulations, growing consumer awareness and rising adoption of sustainable materials by fashion and automotive industries. Countries like Germany, France, Italy and the UK are leading the shift with major brands integrating bio-based leather into their product lines. Advances in plant-based and microbial leather technologies supported by government initiatives and circular economy policies are driving growth. Demand from footwear, upholstery and luxury goods sectors is increasing. With continuous innovation and investment Europe remains a key market for bio-based leather offering strong opportunities for sustainable material development and commercialization. For instance, in September 2024, Danish firm Beyond Leather Materials announced its partnership with Covestro to create LEAP® a leather alternative made from over 85% apple waste. Utilizing Covestro's low-VOC INSQIN® technology this eco-friendly material offers durability and aesthetic appeal catering to various industries including fashion and automotive, while promoting sustainability and waste upcycling.

Asia Pacific Bio-Based Leather Market Analysis

The Asia Pacific bio-based leather market is growing rapidly due to increasing environmental concerns, government sustainability initiatives, and rising demand from fashion, automotive, and footwear industries. For instance, in October 2024, Allen Solly launched a new PETA-approved vegan handbag collection featuring sustainable materials such as bio-based apple and cactus leather. Priced between Rs. 4,500 and Rs. 10,000 the collection combines stylish design with ethical responsibility using recycled materials and minimal metal to promote both fashion and environmental sustainability. Countries like China, Japan, India, and South Korea are investing in plant-based and microbial leather production, driven by consumer preference for eco-friendly materials. Leading manufacturers are focusing on cost-effective, scalable solutions to compete with conventional leather. With strong industrial growth and innovation in sustainable textiles, Asia Pacific is emerging as a major hub for bio-based leather production and adoption.

Latin America Bio-Based Leather Market Analysis

The Latin America bio-based leather market is expanding driven by sustainability initiatives, rising eco-conscious consumer demand and strong leather industries in Brazil and Mexico. The region is witnessing increased adoption in footwear, automotive and fashion sectors. Companies are investing in plant-based alternatives leveraging abundant agricultural resources to develop cost-effective, biodegradable leather solutions for domestic and export markets. For instance, in December 2024, Latin American startups Polybion and Mabe Bio announced their plans to revolutionize leather production with sustainable, circular alternatives derived from food waste and mycelium. By utilizing local resources, they aim to replace traditional leather while reducing environmental impacts, empowering rural communities, and fostering local economies in the process.

Middle East and Africa Bio-Based Leather Market Analysis

The Middle East and Africa bio-based leather market is growing, driven by rising sustainability awareness and increasing demand in fashion, automotive, and upholstery sectors. For instance, in October 2024, the Turkish company Scays Group announced the launch of Wastea a vegan leather alternative made from tea waste. This innovative material is ecofriendly, durable and customizable addressing environmental concerns while supporting a circular economy. Wastea finds applications in fashion, furniture and automotive industries promoting sustainable practices and empowering tea farmers. Countries like UAE and South Africa are witnessing innovation in plant-based leather production. Government initiatives and eco-friendly consumer preferences are fostering market expansion across the region.

Competitive Landscape:

The bio-based leather market is highly competitive, driven by innovation in plant-based and microbial leather alternatives. Companies are focusing on sustainability, durability, and scalability to meet growing demand from fashion, automotive, and furniture industries. Advancements in biotechnology, material engineering, and eco-friendly production processes are key differentiators. Market players are forming strategic partnerships, securing funding, and expanding production capabilities to enhance competitiveness. Regulatory support for sustainable materials and increasing consumer preference for cruelty-free products are accelerating market growth. The industry is witnessing new entrants and established firms investing in R&D, leading to a dynamic and evolving competitive landscape.

The report provides a comprehensive analysis of the competitive landscape in the bio-based leather market with detailed profiles of all major companies, including:

- Ananas Anam

- Bolt Threads Inc.

- ECCO Leather

- Fruitleather Rotterdam

- Modern Meadows

- MycoWorks

- Natural Fiber Welding Inc.

- Toray Industries Inc.

- Ultrafabrics

- VEGEA

Latest News and Developments:

- In November 2024, Pangea launched two new sustainable automotive leathers, Pulvera and Verita, which are nearly 90% bio-based and reduce environmental impact. Pulvera features a circular manufacturing process, while Verita is compostable and utilizes metal-free tanning. These innovations align with global sustainability goals, reinforcing Pangea's commitment to eco-friendly materials in the automotive industry.

- In October 2024, Mitsubishi Chemical Group’s plant-derived polyol BioPTMG, was adopted by Kahei Co., Ltd. for use in bio-synthetic leather products. These sustainable items including bags will be available at "tonto" and showcased at the 4th Sustainable Material Expo in Japan.

- In August 2024, Volkswagen announced its partnership with German start-up Revoltech GmbH to develop a 100% bio-based leather alternative made from industrial hemp. The innovative material named LOVR aims to provide sustainable surface solutions for car interiors by 2028 utilizing residues from the hemp industry and ensuring recyclability or compostability at end-of-life.

- In June 2024, Germany's DITF and FILK developed a bio-based synthetic leather using polybutylene succinate (PBS) for both the fiber and coating. This innovation meets sustainability criteria, offering a fully recyclable and biodegradable alternative to traditional materials, aligning with the EU's Sustainable Products Initiative for eco-friendly textiles.

Bio-Based Leather Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sources Covered | Mushroom, Pineapple, Cork, Leftover Fruits, Others |

| Applications Covered | Footwear, Furnishing, Automotive, Clothing and Accessories, Sports, Electronics, Others |

| Sales Channels Covered | Online, Offline |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Ananas Anam, Bolt Threads Inc., ECCO Leather, Fruitleather Rotterdam, Modern Meadows, MycoWorks, Natural Fiber Welding Inc., Toray Industries Inc., Ultrafabrics, and VEGEA, etc |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the bio-based leather market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global bio-based leather market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the bio-based leather industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The bio-based leather market was valued at USD 121.66 Million in 2024.

IMARC estimates the bio-based leather market to reach USD 574.45 Million by 2033, exhibiting a CAGR of 17.10% during 2025-2033.

Rising demand for sustainable and cruelty-free alternatives, strict environmental regulations, advancements in bio-fabrication technologies, and increasing adoption in fashion, automotive, and furniture industries are driving the bio-based leather market. Growing consumer awareness, corporate sustainability commitments, and improved material durability further support market expansion and commercial viability.

North America currently dominates the market. Strong consumer demand for sustainable materials, advanced bio-fabrication technologies, and established industries in fashion, automotive, and furniture contribute to its leading position.

Some of the major players in the bio-based leather market include Ananas Anam, Bolt Threads Inc., ECCO Leather, Fruitleather Rotterdam, Modern Meadows, MycoWorks, Natural Fiber Welding Inc., Toray Industries Inc., Ultrafabrics, and VEGEA, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)