Biobutanol Market Report by Raw Material (Cereal Crops, Sugarcane Bagasse, Waste Biomass, and Others), Application (Acrylates, Acetates, Glycol Ethers, Biofuel, and Others), End Use Industry (Transportation, Construction, Medical, Power Generation, and Others), and Region 2025-2033

Market Overview:

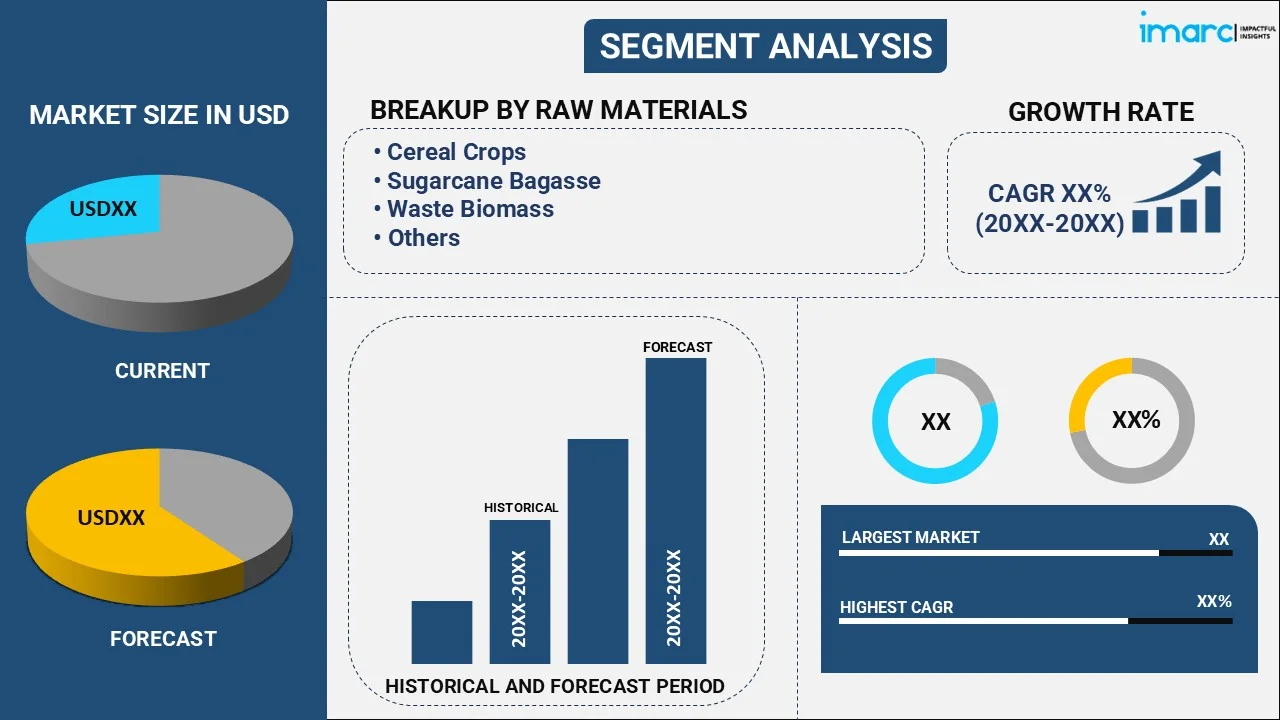

The global biobutanol market size reached USD 1.5 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 2.3 Billion by 2033, exhibiting a growth rate (CAGR) of 4.56% during 2025-2033.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 1.5 Billion |

|

Market Forecast in 2033

|

USD 2.3 Billion |

| Market Growth Rate 2025-2033 | 4.56% |

Biobutanol, or butyl alcohol, refers to a chemical compound used as a fuel in internal combustion (IC) engines or an organic solvent. It consists of four carbon atoms and is usually manufactured by microbial fermentation of starch, sugar and cellulosic feedstock. In comparison to the conventionally used ethanol and gasoline, it is non-corrosive in nature, immiscible in water, has higher energy content and flammability limits and lower vapor pressure. It also releases lesser quantities of hydrocarbons, nitrogen oxide and carbon monoxide upon combustion. As a result, biobutanol is widely used in the manufacturing of rubber, paints, coatings, resins, plasticizers, pharmaceuticals, food-grade extractants, chemical intermediates and herbicides.

To get more information on this market, Request Sample

The increasing demand for energy-efficient sources of fuel across the globe represents one of the key factors driving the growth of the market. With the increasing environmental concerns among the masses regarding the release of excessive greenhouse gasses (GHG) into the environment, there is a shifting preference towards alternative fuels and renewable energy sources, thereby driving the market growth. In line with this, widespread adoption of biobutanol for the manufacturing of chemicals, such as butyl acrylates, is also contributing to the market growth. It is also used for the production of acetates, acrylates, glycol ethers and other industrial solvents. Additionally, various advancements in the fermentation and cellulosic extraction technologies are favoring the market growth. Other factors, including increasing consumption of biofuels in the aviation industry and fleet transportation sector, along with the implementation of favorable government policies promoting the use of bio-based products, are anticipated to drive the market further.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each sub-segment of the global biobutanol market report, along with forecasts at the global, regional and country level from 2025-2033. Our report has categorized the market based on raw material, application and end use industry.

Breakup by Raw Material:

- Cereal Crops

- Sugarcane Bagasse

- Waste Biomass

- Others

Breakup by Application:

- Acrylates

- Acetates

- Glycol Ethers

- Biofuel

- Others

Breakup by End Use Industry:

- Transportation

- Construction

- Medical

- Power Generation

- Others

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players being Abengoa, Biocleave Limited, Bioenergy International, Butalco GmBH (Lesaffre), Butamax Advanced Biofuels LLC (BP and Corteva), Eastman Chemical Company, Gevo Inc., Metabolic Explorer SA, Solvay S.A. and W2 Energy Inc.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Segment Coverage | Raw Material, Application, End Use Industry, Region |

| Region Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Abengoa, Biocleave Limited, Bioenergy International, Butalco GmBH (Lesaffre), Butamax Advanced Biofuels LLC (BP and Corteva), Eastman Chemical Company, Gevo Inc., Metabolic Explorer SA, Solvay S.A. and W2 Energy Inc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The global biobutanol market was valued at USD 1.5 Billion in 2024.

We expect the global biobutanol market to exhibit a CAGR of 4.56% during 2025-2033.

The rising demand for biobutanol as an energy source in Internal Combustion (IC) engines and in the manufacturing of rubber, paints, resins, etc., as it is non-corrosive, immiscible, and less flammable, is primarily driving the global biobutanol market.

The sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across several nations, resulting in the temporary halt in numerous production activities for biobutanol.

Based on the application, the global biobutanol market has been segmented into acrylates, acetates, glycol ethers, biofuel, and others. Among these, acrylates currently exhibit a clear dominance in the market.

Based on the end use industry, the global biobutanol market can be divided into transportation, construction, medical, power generation, and others. Currently, transportation holds the majority of the total market share.

On a regional level, the market has been classified into North America, Asia-Pacific, Europe, Latin America, and Middle East and Africa, where Asia-Pacific currently dominates the global market.

Some of the major players in the global biobutanol market include Abengoa, Biocleave Limited, Bioenergy International, Butalco GmBH (Lesaffre), Butamax Advanced Biofuels LLC (BP and Corteva), Eastman Chemical Company, Gevo Inc., Metabolic Explorer SA, Solvay S.A., and W2 Energy Inc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)