Biochar Market Size, Share, and Trends by Feedstock Type, Technology Type, Product Form, Application, Region, and Forecast 2026-2034

Biochar Market Size and Share:

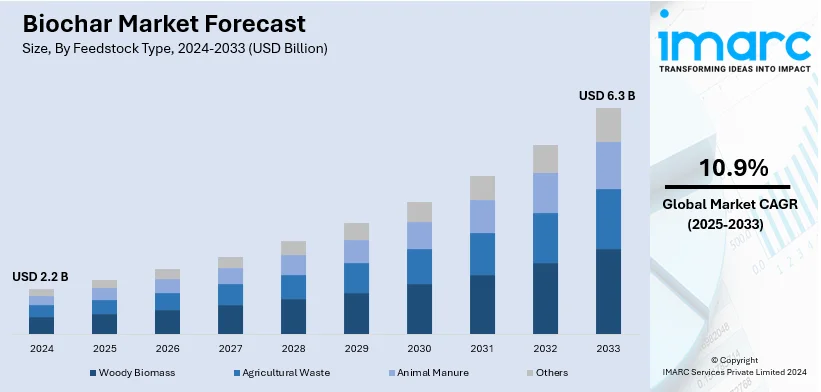

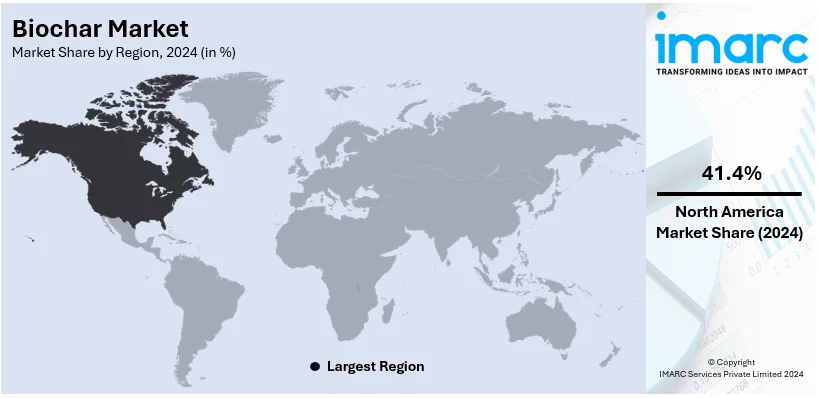

The global biochar market size was valued at USD 2.2 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 6.3 Billion by 2033, exhibiting a CAGR of 10.9% from 2025-2033. North America currently dominates the market, holding a significant market share of over 41.4% in 2024. Biochar is experiencing strong market growth driven by the increasing adoption of biochar in agriculture for soil improvement and carbon sequestration, heightening concerns about climate change and soil degradation, and several favorable government policies.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 2.2 Billion |

| Market Forecast in 2034 | USD 6.3 Billion |

| Market Growth Rate 2026-2034 | 10.9% |

The biochar market is expected to grow at a steady pace due to high rate of biochar utilization in the agriculture industry coupled with the alarming speed climate change and soil degradation. Rising concerns on climate change and soil degeneration along with favorable government policies are projecting towards the growth of biochar market scope. In addition biochar finds applications in various other agricultural practices like biodynamic agriculture, zero tillage farming and mixed farming. In addition, the various initiatives taken by governments around the world to support the use of biochar in agriculture to enhance fertility and productivity of soils give a positive market outlook for this industry. The increasing utilization of products in the construction sector, used for insulation purposes and implementation of biochar as a feed supplement, and extensive R&D by key players are some other factors driving market growth.

The U.S. market is witnessing exponential growth with growing sustainable agriculture practices. The market is also strongly supported by strict environmental regulations and carbon sequestration. The increasing demand for organic farming along with its advantages such as greater crop production and soil productivity are some of the other factors cashing the growth. Biochar is gaining popularity in wastewater treatment and can help fight climate change through carbon sequestration, thereby fueling market expansion. This is further supported by the renewable energy sector's interest in biochar as a biomass feedstock and the rising demand for biochar-based products in horticulture.

The market is growing on account of favorable government initiatives coupled with increasing funding for biochar research and development (R&D). In addition, partnerships and collaborations of research institutes and Biochar manufacturers have further potently fueled the product demand in the United States. In June 2024, Strategic Environmental & Energy Resources, Inc. (SEER)’s product and manufacturing division, SEM received an initial order from Biochar Now, LLC to supply kilns and related equipment to Biochar Now's plant in Colorado for a total value of US$600,000. SEER also planned to establish a Texas joint venture plant with BCN for biochar production.

Biochar Market Trends:

Sustainable agricultural practices

The increasing adoption of biochar in agriculture is a pivotal driver of market growth. Biochar, derived from organic matter, has gained prominence for its ability to enhance soil quality and contribute to carbon sequestration as it can potentially remove up to 6% of global annual carbon emissions. When incorporated into the soil, biochar improves fertility by improving the cation exchange capacity (CEC), which facilitates nutrient retention and availability to plants. Furthermore, it enhances water retention, reducing the need for frequent irrigation and helping crops withstand periods of drought. This makes biochar an invaluable tool for sustainable farming practices, as it promotes higher crop yields and improved soil health and plays a vital role in mitigating climate change by locking carbon in the soil for extended periods. As global agriculture embraces sustainability and seeks environmentally friendly solutions, the adoption of biochar continues to rise, making it a central driver in the market’s growth trajectory. Additionally, biochar's capacity to reduce greenhouse gas emissions by sequestering carbon in the soil aligns with sustainable agriculture's growing focus on carbon-neutral and environmentally responsible farming practices, further driving its adoption. The biochar market price is witnessing a stable increase due to its growing popularity in sustainable agriculture and environmental management.

Rising environmental awareness

The increasing concern about climate change and soil degradation has become a major catalyst for the biochar market demand as a sustainable solution. Biochar plays a crucial role in mitigating climate change by sequestering carbon in the soil. As it locks carbon away for an extended period, it effectively reduces greenhouse gas emissions, aligning with global efforts to combat climate change. In 2022, the United States reported a total of 6,343 Million Metric Tons of greenhouse gas emissions. Moreover, biochar's application in soil restoration and remediation helps address the issue of degraded soils, which is a significant environmental concern. By enhancing soil fertility and structure, biochar supports the revival of ecosystems and promotes healthier plant growth, contributing to overall environmental conservation efforts. As environmental awareness continues to rise and sustainable practices become a global priority, biochar stands out as an eco-friendly and effective tool in the fight against climate change and the restoration of deteriorated landscapes. Its role in environmental sustainability positions it as a key driver in the biochar market. The biochar market value is poised to increase due to its pivotal role in climate change mitigation and soil restoration.

Escalating demand for waste management

One primary driver of the biochar market is its role in waste management. In 2020, the global direct expenditure on waste management reached approximately USD 252 Billion. The utilization of biomass and organic waste materials to produce biochar offers a sustainable and environmentally responsible solution to manage these waste streams. Biochar production involves the pyrolysis or thermal conversion of organic materials, such as agricultural residues, wood waste, and other biomass, into a stable carbon-rich product. This process diverts organic waste from landfills and transforms it into a valuable resource with various applications. Biochar, when added to soil, enhances its structure, fertility, and water retention capabilities, thereby improving soil health and productivity for agricultural and horticultural purposes. This dual benefit of waste reduction and the creation of a valuable soil amendment positions biochar as a key player in sustainable waste management practices and reinforces its role in fueling market expansion as environmental concerns and waste reduction goals continue to grow on a global scale. Biochar market revenue is driven by its pivotal role in sustainable waste management and soil enrichment practices.

Biochar Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global biochar market, along with forecasts at the global, regional, and country levels from 2026-2034. The market has been categorized based on feedstock type, technology type, product form, application, and region.

Analysis by Feedstock Type:

- Woody Biomass

- Agricultural Waste

- Animal Manure

- Others

Woody biomass leads the market with around 50% market share in 2024. Woody biomass feedstock, including materials like wood chips and sawdust, dominates the biochar market due to its widespread availability and favorable characteristics. It is driven by the forestry industry's byproducts, such as logging residues and wood processing waste. Sustainable forestry practices also contribute to the abundance of woody biomass, making it a preferred choice for biochar production. Its high carbon content and low moisture levels make it an efficient source for producing high-quality biochar, which in turn, supports soil improvement, carbon sequestration, and environmental sustainability.

Analysis by Technology Type:

- Slow Pyrolysis

- Fast Pyrolysis

- Gasification

- Hydrothermal Carbonization

- Others

Slow pyrolysis leads the market with over 56% market share in 2024. Slow pyrolysis represents the largest segment in the biochar market due to its efficiency and versatility, driven by its ability to carefully heat feedstock materials in an oxygen-limited environment, resulting in high-quality biochar with a porous structure. This method is favored for its capability to maximize carbon retention and minimize emissions, making it environmentally friendly. Slow pyrolysis benefits from its adaptability to various feedstock types, including woody biomass and agricultural waste, offering a wide range of applications in soil improvement, carbon sequestration, and environmental remediation.

Analysis by Product Form:

- Coarse and Fine Chips

- Fine Powder

- Pellets, Granules and Prills

- Liquid Suspension

Fine powder leads the market with over 41% market share in 2024. Fine powder biochar is favored for its high surface area, making it ideal for blending with soil and compost. It is gaining immense popularity due to its ability to improve nutrient and water retention in soils, making it suitable for precision agriculture and horticulture applications. Additionally, it can be easily mixed with fertilizers for customized nutrient delivery.

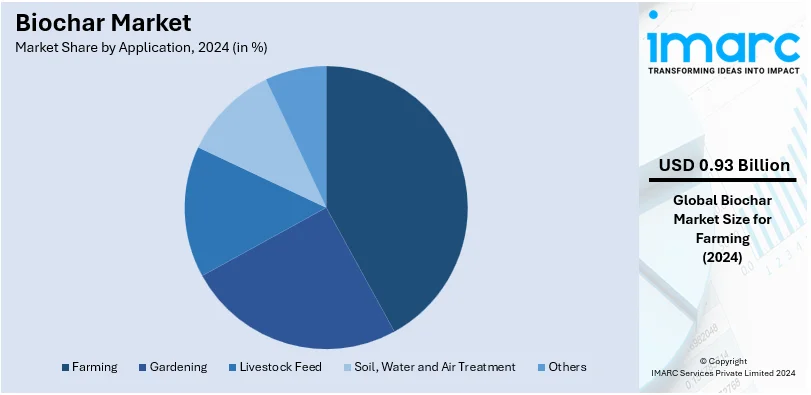

Analysis by Application:

- Farming

- Gardening

- Livestock Feed

- Soil, Water and Air Treatment

- Others

Farming leads the market with around 42% market share in 2024. Farming dominates the biochar market, fueled by the need for sustainable agriculture practices. Biochar enhances soil fertility, nutrient retention, and water-holding capacity, resulting in improved crop yields and reduced fertilizer requirements. The drive for eco-friendly farming, reduced greenhouse gas emissions, and soil health preservation further promote biochar's adoption in the agricultural sector.

Analysis by Region:

- North America

- Europe

- Asia Pacific

- Middle East and Africa

- Latin America

In 2024, North America accounted for the largest market share of over 41%. North America dominates the biochar market due to the increasing focus of the region’s research institutions and associations on biochar technology. Collaboration between the agricultural industry and biochar producers further accelerates its adoption. Moreover, the region's carbon offset initiatives and commitment to reducing greenhouse gas emissions drive biochar's role in carbon sequestration projects. According to a biochar market report, the growing demand for sustainable agricultural practices and carbon sequestration solutions further solidifies North America's leading position in the market.

Key Regional Takeaways:

United States Biochar Market Analysis

The United States accounted for a market share of 75% in the North America market in 2024. The growing emphasis on carbon sequestration, soil health enhancement, and sustainable farming methods is the main factor propelling the biochar industry in the United States. Biochar is being utilized extensively in agriculture to counteract soil deterioration resulting from intensive farming because of its proven capacity to improve soil fertility and water retention. In order to encourage farmers to use biochar as a component of regenerative agriculture, the U.S. Department of Agriculture (USDA) and private groups are funding research on the subject.

The market for biochar is also driven by its ability to sequester carbon, which supports national and local efforts to slow down global warming. The use of biochar in enterprises looking to lower their carbon footprint has been accelerated by initiatives like the 45Q tax credit, which provides incentives for carbon capture and storage projects. Furthermore, biochar's market appeal has grown as more people become aware of its uses in waste management and the creation of renewable energy. Pyrolysis is becoming more popular as a method of producing biochar since it reduces waste and produces biofuel. The market for biochar is further supported by the expansion of organic farming in the United States, which stands at 17,445 certified organic farms in 2021, according to the data by United States Department of Agriculture. This is because organic farmers are looking for sustainable soil additives to increase production.

Europe Biochar Market Analysis

The market in this region is expanding due to the abundance of forestry waste in Europe. The European regulations on organic waste disposal and high disposal prices help generate money from the waste, thereby encouraging market growth. Carbon sequestration and soil amendment properties of biochar have enhanced the adoption of biochar in agricultural and horticulture applications. The other factors contributing to market growth include the growing demand from the wastewater and dairy waste management sector and the increasing demand for organic food products. In countries including Italy, The Italian Biochar Association aims to promote the use of biochar in reducing gas emissions and increasing crop productivity. Additionally, the European Union's Common Agricultural Policy (CAP) promotes the use of soil enhancers like biochar to improve agricultural productivity while reducing environmental impact.

There is a huge availability of forestry waste, which is expected to drive the studied market across the region. European regulations on organic waste disposable are also set to support the market’s growth and generate high revenue. In this regard, biochar production is considered an effective method for organic waste management. Further, several private and government funding on biochar demonstration projects contribute heavily to the biochar market’s growth.

Asia Pacific Biochar Market Analysis

Growing agricultural demands, the need for sustainable soil management, and growing awareness of mitigating the effects of climate change are all driving the Asia-Pacific biochar market's rapid expansion. With the widespread use of biochar in agriculture to improve soil fertility and lessen reliance on chemical fertilizers, nations like China, India, and Japan are witnessing significant growth. There is a huge potential market for biochar because of the region's substantial agricultural industry, which accounts for more than 10% of GDP in many nations.

There is growing interest in using biochar to manage crop wastes and lessen open-field burning, which is a major cause of air pollution in nations like India. The industry is expanding because of government programs encouraging environmentally friendly agricultural methods and investments in renewable energy projects. Biochar's varied uses in the region are demonstrated by its growing use in waste management and urban landscaping in Japan.

Latin America Biochar Market Analysis

The region's focus on enhancing soil fertility and halting deforestation is driving the biochar business. Known for their intensive agricultural practices, nations like Brazil and Argentina are increasingly using biochar as a soil amendment to increase crop yields and lessen their environmental effect. The region's attempts to fight climate change, especially in protecting the Amazon rainforest, are in line with biochar's function in sequestering carbon. Additionally, biochar is being adopted in a variety of agricultural methods due to rising knowledge of its potential in waste management and animal production.

Middle East and Africa Biochar Market Analysis

The need to address issues of food security, water shortages, and soil degradation is driving the market across the Middle East and Africa. Biochar is very popular in agriculture in these areas because of its capacity to increase water retention in parched soils. Applications of biochar to improve agricultural output in difficult environments are being investigated by nations like South Africa, Kenya, and the United Arab Emirates. Research and deployment of biochar technologies are also being fueled by international partnerships and financial support from institutions such as the World Bank and the United Nations. The market footprint is progressively growing throughout the region owing to awareness efforts and trial programs in rural areas.

Competitive Landscape:

Numerous key players in the market are actively engaging in research and development (R&D) to enhance the quality and versatility of biochar products. They are investing in advanced production technologies to ensure efficient and sustainable biochar manufacturing processes. Additionally, these industry leaders are focusing on expanding their market presence through strategic collaborations and partnerships with agricultural and forestry organizations. They are also emphasizing eco-friendly farming practices and promoting the benefits of biochar in improving soil health, increasing crop yields, and mitigating climate change. Several key players are actively participating in carbon offset initiatives and advocating for biochar's role in carbon sequestration projects, aligning with global sustainability goals. Overall, they are driving innovation and awareness to position biochar as a crucial element in sustainable agriculture and environmental conservation.

The market research report provides a comprehensive analysis of the competitive landscape. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Agri-tech Producers

- Diacarbon Energy Inc

- Cool Planet

- Pacific Biochar

- Phoenix Energy

- Biomacon GmbH

- Vega Biofuels

- Terra Char

- Avello Bioenergy

- Genesis Industries

- Interra Energy Services

- Element C6

- Carbon Gold Ltd

- Biochar Solution Ltd

Latest News and Developments:

- January 2025: Google partnered with Indian startup Varaha to purchase 100,000 tons of biochar carbon credits by 2030. This largest biochar deal in history aligns with Google's net-zero goals and promotes scalable carbon removal. Varaha's innovative biochar production supports climate action and sustainable practices.

- January 2025: UK-based CapChar launched a public consultation for its new Biochar Carbon Code, aiming to set a benchmark for biochar carbon removal. The code integrates end-to-end solutions with pyrolysis technology and dMRV software, enhancing carbon sequestration and soil regeneration. Tailored for UK agriculture, it emphasizes robust standards and diverse feedstock compatibility.

- December 2024: ofi, in partnership with LOTTE, Fuji Oil, and MC Agri Alliance, announced its first cocoa biochar project in Dankwa County, Ghana. The initiative converts cocoa pod husks into biochar, improving soil health and reducing carbon emissions. It aligns with ofi's Cocoa Compass sustainability goals and 2050 Net Zero target.

- October 2024: Treehouse California Almonds and Sitos Group announced a $9 million biochar facility in Delano, California, set to be operational by late 2025. The facility will convert almond shells into biochar, improving soil health, reducing carbon emissions, and supporting sustainable agriculture.

- October 2024: Varaha launched India's first carbon dioxide removal credits for industrial biochar through Puro.Earth. Using corn residues, the project captures carbon while improving soil health and biodiversity. Supported by advanced MRV technology, it aligns with global net-zero goals.

- September 2024: Samunnati launched the Carbon Incubator Facility "Biochar" during its Fourth National FPO Conclave in Hyderabad. The initiative empowers Farmer Producer Organizations (FPOs) to integrate biochar projects, enhancing soil health, crop resilience, and carbon sequestration while supporting sustainable agriculture.

- June 2024: Supercritical launched the world’s first live pricing and availability platform for biochar carbon removal projects. This innovation enhances transparency and accessibility in the carbon removal market, backed by a rigorous 118-point vetting process. It supports high-quality biochar solutions, aiding net-zero strategies and climate action.

- December 2023: Carbonfuture entered into an offtake agreement with Microsoft to supply biochar carbon removal credits (BCR) from its Exomad Green Concepción project in Bolivia. The project was planned to deliver more than 32,000 tonnes of carbon dioxide removal credits to Microsoft by June 2024, supporting the company’s commitment to achieving its carbon-negative sustainability objectives.

- August 2022: Phoenix Energy introduced Carbon Manager™, a cloud-based Smart Building application designed to simplify carbon intensity measurement and reporting for enterprises, specifically focusing on Scope 2 emissions sources. This innovative solution not only enables efficient carbon tracking but also offers actionable insights to help organizations mitigate their carbon footprint, benefiting their business operations and the environment. Phoenix Energy's commitment to providing Enterprise Energy Management (EEM) Software and Solutions underscores their dedication to sustainable and eco-friendly practices in the corporate sector.

- June 2022: Airex Energy became a partner in the BDO Zone Strategic Alliance, joining a group of companies focused on advancing bioenergy projects. The alliance aimed to reduce risks associated with biobased development in BDO Zones. Airex Energy specializes in biomass carbonization systems, which produce bio-coal pellets and biochar, supporting clean energy alternatives and carbon sequestration. This partnership emphasized the role of biomass-based technologies in sustainable industrial processes and climate mitigation efforts.

- April 2022: Biomacon GmbH partnered with First Climate AG to launch the First Climate biochar program across Switzerland, Austria, France, and Germany. This collaborative initiative aims to combat greenhouse gas emissions by promoting the use of biochar, a carbon-sequestering soil amendment. By introducing biochar into agricultural practices and soil management, the program seeks to mitigate carbon emissions and enhance soil health, aligning with global sustainability goals. This partnership underscores the commitment to environmental conservation and the adoption of innovative solutions to address climate change challenges in these European countries.

Biochar Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Feedstock Types Covered | Woody Biomass, Agricultural Waste, Animal Manure, Others |

| Technology Types Covered | Slow Pyrolysis, Fast Pyrolysis, Gasification, Hydrothermal Carbonization, Others |

| Product Forms Covered | Coarse and Fine Chips, Fine Powder, Pellets, Granules and Prills, Liquid Suspension |

| Applications Covered | Farming, Gardening, Livestock Feed, Soil, Water and Air Treatment, Others |

| Regions Covered | Asia Pacific, Europe, North America, Middle East and Africa, Latin America |

| Companies Covered | Agri-tech Producers, Diacarbon Energy Inc, Cool Planet, Pacific Biochar, Phoenix Energy, Biomacon GmbH, Vega Biofuels, Terra Char, Avello Bioenergy, Genesis Industries, Interra Energy Services, Element C6, Carbon Gold Ltd, Biochar Solution Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative biochar market analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global biochar market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the biochar industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

Biochar is a carbon-rich material produced by heating organic matter (such as wood, crop residues, or manure) in a low-oxygen environment—a process called pyrolysis. It is similar to charcoal but is specifically made for use in soil and environmental applications rather than as a fuel. Biochar has gained attention for its potential to improve soil health, enhance agricultural productivity, and mitigate climate change.

The biochar market was valued at USD 2.2 Billion in 2024.

IMARC estimates the global biochar market to exhibit a CAGR of 10.9% during 2025-2033.

Biochar is experiencing strong market growth driven by the increasing adoption in agriculture for soil improvement and carbon sequestration, heightening concerns about climate change and soil degradation, and several favorable government policies.

According to the report, woody biomass represented the largest segment by feedstock type, driven by its widespread availability and favorable characteristics.

Slow pyrolysis leads the market by technology type owing to its exceptional efficiency and versatility.

Fine powder is the leading segment by product form, driven by its suitability in soil improvement.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global biochar market include Agri-tech Producers, Diacarbon Energy Inc., Cool Planet, Pacific Biochar, Phoenix Energy, Biomacon GmbH, Vega Biofuels, Terra Char, Avello Bioenergy, Genesis Industries, Interra Energy Services, Element C6, Carbon Gold Ltd., Biochar Solution Ltd., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)