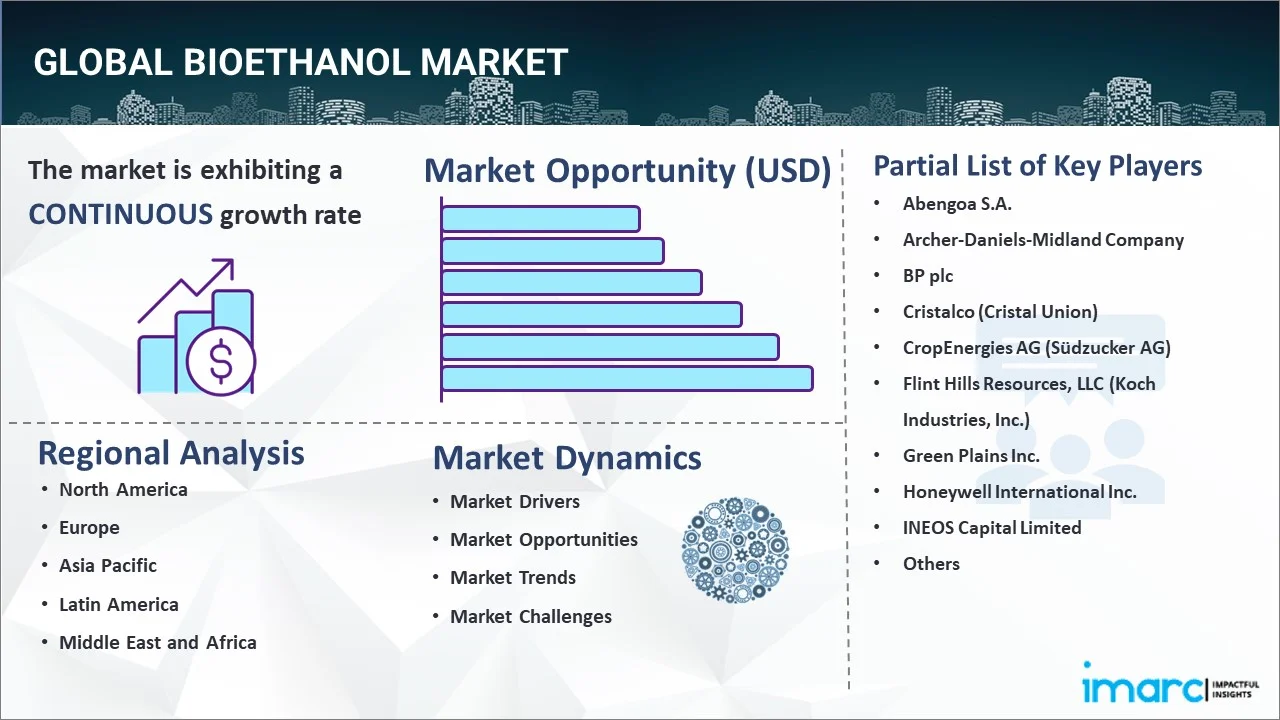

Bioethanol Market Size, Share, Trends and Forecast by Type, Fuel Blend, Generation, End Use Industry, and Region, 2025-2033

Bioethanol Market Size and Share:

The global bioethanol market size was valued at USD 10.71 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 18.67 Billion by 2033, exhibiting a CAGR of 6.05% from 2025-2033. Asia Pacific currently dominates the market, holding a market share of 40% in 2024. The market is driven by ongoing demand for renewable energy, stringent government policies promoting biofuels, and concerns over reducing greenhouse gas (GHG) emissions. Additionally, the rising crude oil prices and the push for energy security further encourage bioethanol adoption. Growth in the automotive sector, particularly the use of ethanol-blended fuels, boosts market expansion. Additionally, technological advancements in bioethanol production and rising awareness of sustainable alternatives to fossil fuels contribute significantly to bioethanol market share, creating opportunities across developed and emerging economies.

Market Size & Forecasts:

- Bioethanol market was valued at USD 10.71 Billion in 2024.

- The market is projected to reach USD 18.67 Billion by 2033, at a CAGR of 6.05% from 2025-2033.

Dominant Segments:

- Type: Starch-based ethanol represents the largest segment as it provides renewable energy, lowers greenhouse gases, supports rural economies, and lessens dependence on fossil fuels.

- Fuel Blend: E10 holds the biggest market share. It has 10% of ethanol and curbs greenhouse gas emission, enhances air quality, and decreases fossil fuel reliance. It promotes the use of renewable energy, stimulates rural economy via biofuel creation, and causes engines to run cleaner yet is suitable for most vehicles.

- Generation: First generation accounts for the biggest bioethanol market share. It is derived from agricultural food crops, such as sugarcane and corn, provides sustainable energy, mitigates greenhouse gas emissions, and diminishes the reliance on fossil fuels.

- End Use Industry: Automotive and transportation represent the largest segment. Bioethanol is commonly applied in the automotive and transport industries as an additive or replacement of gasoline. It fuels flex-fuel vehicles, lowers carbon emissions, enhances engine performance, and facilitates cleaner combustion, leading to cleaner, more sustainable transport networks globally.

- Region: North America leads the bioethanol market. This is driven by favorable government policies, higher demand for cleaner transportation fuels, plentiful corn supplies, and expansion of infrastructure.

Key Players:

- The leading companies in market include Abengoa S.A., Archer-Daniels-Midland Company, BP plc, Cristalco (Cristal Union), CropEnergies AG (Südzucker AG), Flint Hills Resources, LLC (Koch Industries, Inc.), Green Plains Inc., Honeywell International Inc., INEOS Capital Limited, Petróleo Brasileiro S.A., POET LLC, Royal Dutch Shell plc, Valero Energy Corporation, etc.

Key Drivers of Market Growth:

- Environmental Consciousness: Increasing worry about climate change and air pollution is driving the use of cleaner, greener fuels such as bioethanol to lower greenhouse gas emissions.

- Government Incentives: National and state regulations, such as blending targets, subsidies, and renewable fuel standards, are promoting bioethanol production and utilization.

- Technological Innovation: Advances in fermentation technologies, enzyme productivity, and feedstock conversion are reducing the cost of bioethanol production and making it more sustainable.

- Abundance of Agriculture: Most abundant crops like corn, sugarcane, and wheat favor mass production of bioethanol, particularly in highly agricultural areas.

- Fuel Prices and Energy Security: As the world's fuel prices go up and down and fossil fuel reliance becomes a concern, bioethanol presents a locally produced, secure, and affordable solution.

Future Outlook:

- Strong Growth Outlook: The bioethanol market will continue to grow steadily with the help of advancements in production technologies, growing environmental regulations, and robust policy incentives supporting renewable fuels.

- Market Evolution: The market will transform from regional use to wider global application, and bioethanol will be included in a variety of fuel blends and used in multiple sectors of transportation and industry.

Bioethanol is a clear, colorless liquid produced from biomass by hydrolysis and sugar fermentation or using the chemical process of reacting ethylene with steam. It is biodegradable, less toxic, and does not cause environmental pollution as compared to conventional fuels. Consequently, it is gaining traction as a petrol substitute for road transport vehicles around the world. It is blended with petrol without modifying engine designs, which results in reduced greenhouse gas (GHG) emissions and air pollution. Presently, the ongoing research and development activities to produce bioethanol fuel using municipal solid waste are escalating the demand for bioethanol worldwide.

To get more information on this market, Request Sample

One key driver in the bioethanol market is the rising government support and regulatory policies promoting renewable fuels. Many countries have implemented blending mandates, requiring a certain percentage of ethanol to be mixed with gasoline to lower carbon emissions and reduce dependency on fossil fuels. Incentives such as tax benefits, subsidies, and funding for bioethanol production further encourage adoption. These policies not only stimulate demand for bioethanol but also push refiners and fuel distributors to expand ethanol usage. As governments continue prioritizing climate goals and energy security, supportive regulations remain a strong force behind bioethanol market growth.

The U.S. is a global leader in the bioethanol market, producing about 15.6 billion gallons in 2023 from nearly 200 plants across 23 states. This dominance is fueled by abundant corn production, advanced technologies, and strong policy support along with a market share of 82.30%. The Renewable Fuel Standard (RFS) ensures steady demand by mandating ethanol blending with gasoline. With large-scale agricultural output, corn-based ethanol remains the dominant segment, while growing investments in second-generation bioethanol from cellulosic feedstocks expand sustainability. Emphasis on reducing greenhouse gas emissions and achieving energy independence further strengthens the U.S. position. Supported by robust infrastructure, research, and government incentives, the U.S. continues to shape global bioethanol supply and trade.

Bioethanol Market Trends:

Increasing Government Policies and Renewable Fuel Standards

Government regulations, especially in Europe and North America, have been instrumental in improving the bioethanol market outlook. Initiatives such as the U.S. Renewable Fuel Standard (RFS) and Canada's Clean Fuel Standard establish targets for the use of renewable fuel, ensuring steady demand for bioethanol as a renewable gasoline substitute. Taxation benefits and subsidies also stimulate production and usage, triggering investments in bioethanol manufacturing plants. According to the bioethanol market analysis, these regulatory frameworks aim to reduce greenhouse gas (GHG) emissions and fossil fuel dependency, encouraging oil refineries to blend bioethanol with conventional fuels to meet environmental standards. Compliance with these mandates has become a key factor propelling market growth as nations pursue ambitious decarbonization goals. In India, the National Biofuels Policy 2018, revised in 2022, among other things, brought forward the goal of 20% ethanol blending in petrol to the Ethanol Supply Year (ESY) 2025-26 from 2030. Public Sector Oil Marketing Companies (OMCs) reached the goal of 10% ethanol blending in petrol in June 2022, completing it five months earlier than the target set for ESY 2021-22.

Rising Environmental and Consumer Demand for Sustainable Fuels

The increasing realization of climate change and environmental footprint has resulted in the higher demand for cleaner, renewable energy sources, thereby rising the bioethanol market price. Bioethanol, being made from plant materials, is significantly lower in carbon emissions compared to fossil fuels, and is thus appealing for those seeking to lower emissions. It has been reported that, bioethanol produced from sugar beet needs more energy and delivers around 50–60 % less CO2 as compared to gas. Bioethanol vehicles produce fewer pollutants, reflecting better air quality and public health advantages. With rising focus on sustainability, the position of bioethanol as a renewable fuel becomes more compelling. Complementing this, demand spurs innovation in production efficiency, crop yield, and bioethanol blends, making it even stronger in the renewable energy sector. The governing agencies are also taking proactive steps to launch biofuels. For instance, Petroleum Minister Hardeep S Puri highlighted India’s bioenergy progress at India Bio-Energy & Tech Expo 2024. Minister Shri Hardeep Singh Puri also emphasized the extensive distribution of E20 fuel, available at more than 15,600 retail locations throughout India. He praised the Pradhan Mantri JI-VAN Yojana for its vital function in offering financial assistance to advanced biofuel initiatives, which is essential for establishing a sustainable ethanol production framework.

Substantial Developments in Bioethanol Production Technologies

As per the bioethanol market report, progress in technology in bioethanol production, such as cellulosic bioethanol and enzyme engineering, is propelling the bioethanol market demand. Innovations allow for more effective utilization of feedstocks, such as farm waste, and lower production costs, which make bioethanol compete favorably with traditional fuels. Cellulosic bioethanol, which is made from non-food crop residues, minimizes competition for food, thereby extending bioethanol's sustainability advantage. Moreover, breakthroughs in biotechnology, including genetically modified yeasts and enhanced fermentation techniques, boost yields in production and raise process efficiency. These advancements render bioethanol a more and more feasible and scalable substitute for gasoline, promoting investments and driving the growth of the bioethanol market. In 2024, Arkema, a frontrunner in specialty materials, generated Ethyl Acrylate solely from bioethanol at its acrylic monomer plant in Carling, France. Arkema's bio-based ethyl acrylate contains a bio carbon content (BCC) of 40% and achieves a reduction of up to 30%* in product carbon footprint (PCF).

Bioethanol Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global bioethanol market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, fuel blend, generation and end use industry

Analysis by Type:

- Sugarcane-based Ethanol

- Cellulosic Ethanol

- Starch-based Ethanol

- Others

Starch-based ethanol dominates the market demand with a market share of 50.0% due to the abundant availability and cost-effectiveness of raw materials such as corn, wheat, and barley. Corn, in particular, serves as the primary feedstock in major producing regions like North America, ensuring consistent and large-scale supply. The production technology for starch-based ethanol is mature, efficient, and widely adopted, making it commercially viable compared to other feedstocks. Its established infrastructure and supply chains further enhance scalability and affordability. Additionally, supportive government policies and blending mandates promote corn-based ethanol as a reliable renewable fuel option. With growing demand for sustainable alternatives in the automotive and transportation sectors, starch-based ethanol continues to maintain its leading position in global bioethanol market analysis.

Analysis by Fuel Blend:

- E10

- E20 and E25

- E70 and E75

- E85

- Others

E10 accounts for the majority of shares of 55.0% in the bioethanol market due to its widespread acceptance, cost-effectiveness, and compatibility with existing vehicle engines and infrastructure. Containing 10% ethanol blended with 90% gasoline, E10 is an efficient and practical option for reducing carbon emissions without requiring engine modifications. Governments across several countries have mandated or encouraged the use of E10 as part of renewable fuel standards, boosting its demand. Its lower production costs compared to higher blends make it more accessible to both consumers and fuel distributors. The blend’s ability to enhance fuel performance while meeting emission targets ensures its dominance, especially in regions prioritizing sustainable yet affordable energy solutions.

Analysis by Generation:

- First Generation

- Second Generation

- Third Generation

First-generation bioethanol represents the majority of market shares of 70.0% owing to its well-established production processes, cost-effectiveness, and wide availability of feedstocks such as corn, sugarcane, and wheat. These raw materials are abundant and supported by mature agricultural systems, particularly in major producing regions like North America and Brazil. The technology for producing first-generation bioethanol is commercially viable and requires lower investment compared to advanced alternatives, making it the most widely adopted option. Additionally, government blending mandates and renewable energy targets continue to favor large-scale production using these conventional feedstocks. While advanced bioethanol is gaining traction, first-generation remains dominant due to its scalability, affordability, and crucial role in meeting immediate energy and environmental goals.

Analysis by End Use Industry:

- Automotive and Transportation

- Power Generation

- Pharmaceutical

- Food and Beverage

- Cosmetics and Personal Care

- Others

According to the bioethanol market forecast, the automotive and transportation hold the largest market share of 65.0% due to the sector’s heavy reliance on fuel consumption and the widespread adoption of ethanol-blended gasoline. Rising environmental concerns and stringent emission regulations drive the demand for cleaner, renewable alternatives to fossil fuels. Ethanol’s ability to reduce greenhouse gas emissions and improve octane levels makes it a preferred choice for blending with conventional fuels. Government mandates and incentives promoting ethanol usage in vehicles further strengthen its adoption. Additionally, increasing global vehicle production and rising fuel consumption in emerging economies amplify demand. As nations push toward sustainable mobility, the automotive and transportation sector remains the dominant consumer of bioethanol worldwide.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia Pacific is the leading region with a market share of 40.0% driven primarily by rapidly growing energy demand, supportive government policies promoting renewable fuels, and the presence of major bioethanol-producing countries such as China and India. The region’s focus on reducing greenhouse gas emissions and dependence on fossil fuels has accelerated bioethanol adoption in transportation and industrial sectors. Additionally, the abundant availability of feedstock like sugarcane, corn, and cassava supports large-scale production. Investments in advanced bioethanol technologies and increasing consumer awareness about sustainable energy further strengthen the market’s growth in Asia Pacific.

Key Regional Takeaways:

North America Bioethanol Market Analysis

The North America bioethanol market is a mature and significant segment of the global biofuels industry, primarily driven by the United States, which dominates regional production and consumption. The market’s growth is fueled by government mandates such as the Renewable Fuel Standard (RFS), which requires blending bioethanol with gasoline, and various state-level incentives promoting cleaner fuels. Corn is the primary feedstock, with advanced technologies improving conversion efficiency and production capacity. The transportation sector remains the largest end-user, as bioethanol helps reduce greenhouse gas emissions and dependence on fossil fuels. Additionally, investments in research and development are fostering the adoption of second-generation bioethanol derived from non-food biomass, enhancing sustainability. However, challenges such as feedstock price volatility, competition with food crops, and fluctuating crude oil prices can impact market stability. Despite these challenges, growing environmental awareness, regulatory support, and advancements in production technologies are expected to sustain steady growth in North America’s bioethanol market over the forecast period.

United States Bioethanol Market Analysis

The United States bioethanol market is primarily driven by the increasing demand for sustainable energy sources, as the country aims to reduce reliance on fossil fuels. In line with this, numerous government mandates, such as the Renewable Fuel Standard (RFS), are bolstering bioethanol adoption in transportation fuels. Furthermore, continual technological advancements in production processes, including improved fermentation and enzymatic methods, are enhancing yield efficiency. The growing environmental concerns and climate change awareness, which are driving the transition to renewable fuels, are propelling the market growth. Similarly, rising crude oil prices make bioethanol a competitive alternative to gasoline, while the expansion of flex-fuel vehicles (FFVs) is strengthening market demand. Additionally, the increasing use of bioethanol in aviation, particularly in sustainable aviation fuel (SAF), is stimulating market appeal. The US Department of Energy stated that the country aims to produce 3 billion gallons of sustainable aviation fuel (SAF) by 2030, with a goal of replacing all fossil jet fuel by 2050, reducing emissions, and creating 1 million jobs. Besides this, increasing investments in bioethanol infrastructure are also supporting distribution and availability, creating a more robust market.

Europe Bioethanol Market Analysis

The bioethanol market in Europe is experiencing growth propelled by the European Union’s strict renewable energy policies, which mandate a higher share of biofuels in transportation. In accordance with this, the EU’s Green Deal and Fit for 55 package are designed to reduce emissions, boosting bioethanol demand. Similarly, ongoing technological advancements in bioethanol production, such as improved enzymatic processes and better feedstock utilization, are enhancing production efficiency. The rising consumer awareness of climate change and sustainability, accelerating demand for eco-friendly fuels, is impelling the market. Furthermore, the increasing availability of feedstocks like agricultural residues and waste oils supporting a sustainable supply chain, is expanding the market reach. The various economic incentives and subsidies for biofuel production are further encouraging market expansion. Additionally, the growing adoption of flexible-fuel vehicles (FFVs) in Europe is fostering increased bioethanol consumption. Moreover, increased investment in bioethanol infrastructure, including advanced distribution and storage systems, is improving market accessibility. As such, in April 2025, XFuel secured EUR 7.7 Million from the European Innovation Council to scale its waste-to-fuel technology. The company produces low-carbon drop-in fuels for transport, offering a sustainable alternative to fossil fuels.

Asia Pacific Bioethanol Market Analysis

The Asia Pacific market is largely driven by various government policies promoting renewable energy and biofuel adoption, such as mandatory ethanol blending targets in India and China. As of March 2025, India has increased ethanol blending in petrol to nearly 18%. The government aims for 20% blending by 2025-26, supported by various policies, incentives, and feedstock utilization to encourage production. In addition to this, the region’s growing economic development and increasing vehicle ownership are fueling market demand. The ongoing advancements in bioethanol production, particularly improvements in enzyme efficiency and feedstock utilization, are enhancing production scalability and reducing costs. Furthermore, the growing emphasis on energy security and reducing oil dependence is bolstering market growth. Apart from this, the expansion of bioethanol infrastructure, including distribution and storage networks, is improving the accessibility of ethanol-blended fuels, thereby providing an impetus to the market.

Latin America Bioethanol Market Analysis

In Latin America, the bioethanol market is advancing due to supportive government policies, such as Brazil’s Proalcool program, which incentivizes renewable energy production. Similarly, the region’s favorable climate for sugarcane cultivation ensures a steady supply of feedstock, promoting production capacity. The increasing demand for cleaner transportation fuels, driven by environmental concerns, is further amplifying bioethanol adoption. Moreover, the expansion of bioethanol infrastructure, including processing plants and distribution networks, is enhancing availability and consumer acceptance, impacting the market trends. Accordingly, in June 2025, Mexico’s ASA invested MXN 300 Million to build a Sustainable Aviation Fuel blending plant in Cancún, supporting net-zero aviation emissions by 2050 and modernizing airport infrastructure.

Middle East and Africa Bioethanol Market Analysis

The Middle East and Africa market is gaining momentum due to growing energy diversification strategies, with many countries aiming to reduce dependence on fossil fuels. Furthermore, the various national bioethanol initiatives promoting renewable energy sources and enhancing sustainability in the transportation sector are accelerating market expansion. Additionally, the increasing concerns over air pollution and environmental sustainability are pushing the adoption of biofuels and enhancing market appeal. Moreover, continual technological advancements in bioethanol production are improving cost-efficiency, providing an impetus to the market. As such, in December 2024, Aramco, TotalEnergies, and SIRC partnered to assess the development of a sustainable aviation fuel production unit in Saudi Arabia. The collaboration will convert local residues, such as used cooking oil and animal fats, to SAF.

Competitive Landscape:

The competitive landscape is characterized by intense rivalry among producers, technological innovation, and regional dominance. Market players compete on feedstock availability, production efficiency, and cost-effectiveness. The sector is highly fragmented, with participants ranging from large-scale producers with integrated operations to smaller regional firms catering to local demand. Strategic collaborations, mergers, and partnerships are common to strengthen supply chains and expand market presence. Continuous investment in advanced bioethanol technologies, such as second-generation and cellulosic production, adds to competition. Regional policies, blending mandates, and fluctuating raw material prices also influence competitiveness, driving companies to innovate, optimize production processes, and explore sustainable feedstocks to maintain a competitive edge.

The report provides a comprehensive analysis of the competitive landscape in the bioethanol market with detailed profiles of all major companies, including:

- Abengoa S.A.

- Archer-Daniels-Midland Company

- BP plc

- Cristalco (Cristal Union)

- CropEnergies AG (Südzucker AG)

- Flint Hills Resources, LLC (Koch Industries, Inc.)

- Green Plains Inc.

- Honeywell International Inc.

- INEOS Capital Limited

- Petróleo Brasileiro S.A.

- POET LLC

- Royal Dutch Shell plc

- Valero Energy Corporation

Latest News and Developments:

- June 2025: Toyota launched a pilot facility in Fukushima Prefecture to produce second-generation bioethanol from non-edible biomass like rice straw and forestry by-products. This project, using engineered yeast for efficient ethanol conversion, supports Japan’s low-carbon transition and energy security, contributing to the global decarbonization of transport.

- June 2025: Praj Industries secured a strategic partnership with Paraguay’s Enersur S.A. for a fully integrated BioRefinery Project. Praj will assist in developing and implementing the biorefinery, producing ethanol and co-products like DDGS, corn oil, biogas, bio-bitumen, and sustainable aviation fuel (SAF).

- April 2025: Assam Bio Ethanol Private Limited (ABEPL) announced the upcoming commercial launch of a bamboo-based bio-refinery in Numaligarh. With an INR 200-Crore investment, the facility will produce 49 KTPA of ethanol and byproducts, benefiting 30,000 rural households and supporting the national push for ethanol-blended fuels.

- April 2025: Corden BioChem invested in restarting a decommissioned bioethanol plant in Podari, Romania. The plant will initially produce first-generation bioethanol and later expand to include fermentation products. The project aims to support Romania’s biofuel goals, create jobs, and contribute to the green transition in the region.

- February 2025: BPCL and the National Sugar Institute (NSI) partnered to advance sweet sorghum-based bioethanol production. BPCL invested INR 5 Crores for research into optimizing yields, refining processes, and exploring biomass for compressed biogas. This collaboration supports India’s ethanol program, promotes sustainable agriculture, and enhances energy security.

- January 2025: ADVANTA and Baidyanath Biofuels signed an MOU to use ADVANTA’s high-quality maize hybrids for bioethanol production, supporting India’s 20% ethanol blending target by 2025-26. The collaboration focuses on enhancing maize yields, providing farmer training, and promoting sustainable practices to boost ethanol production.

Bioethanol Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Sugarcane-based Ethanol, Cellulosic Ethanol, Starch-based Ethanol, Others |

| Fuel Blends Covered | E10, E20 and E25, E70 and E75, E85, Others |

| Generations Covered | First Generation, Second Generation, Third Generation |

| End Use Industries Covered | Automotive and Transportation, Power Generation, Pharmaceutical, Food and Beverage, Cosmetics and Personal Care, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Abengoa S.A., Archer-Daniels-Midland Company, BP plc, Cristalco (Cristal Union), CropEnergies AG (Südzucker AG), Flint Hills Resources, LLC (Koch Industries, Inc.), Green Plains Inc., Honeywell International Inc., INEOS Capital Limited, Petróleo Brasileiro S.A., POET LLC, Royal Dutch Shell plc and Valero Energy Corporation |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the bioethanol market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global bioethanol market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the bioethanol industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The bioethanol market was valued at USD 10.71 Billion in 2024.

The bioethanol market is projected to exhibit a CAGR of 6.05% during 2025-2033, reaching a value of USD 18.67 Billion by 2033.

The bioethanol market is driven by rising demand for renewable energy, government policies supporting biofuel blending, and efforts to reduce greenhouse gas emissions. Abundant feedstock availability, energy security concerns, and growth in the automotive sector further boost demand. Technological advancements in bioethanol production also strengthen market expansion globally.

Asia Pacific currently dominates the bioethanol market, accounting for a share of 40.0% driven by high energy demand, supportive government policies, and efforts to reduce carbon emissions. Abundant feedstock like sugarcane and corn, along with investments in advanced production technologies, further bolster the region’s bioethanol production, making it the largest and fastest-growing market globally.

Some of the major players in the Bioethanol market include Abengoa S.A., Archer-Daniels-Midland Company, BP plc, Cristalco (Cristal Union), CropEnergies AG (Südzucker AG), Flint Hills Resources, LLC (Koch Industries, Inc.), Green Plains Inc., Honeywell International Inc., INEOS Capital Limited, Petróleo Brasileiro S.A., POET LLC, Royal Dutch Shell plc and Valero Energy Corporation, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)