Biostimulants Market Size, Share, Trends and Forecast by Product Type, Crop Type, Form, Origin, Distribution Channel, Application, End-User, and Region, 2025-2033

Biostimulants Market Size and Share:

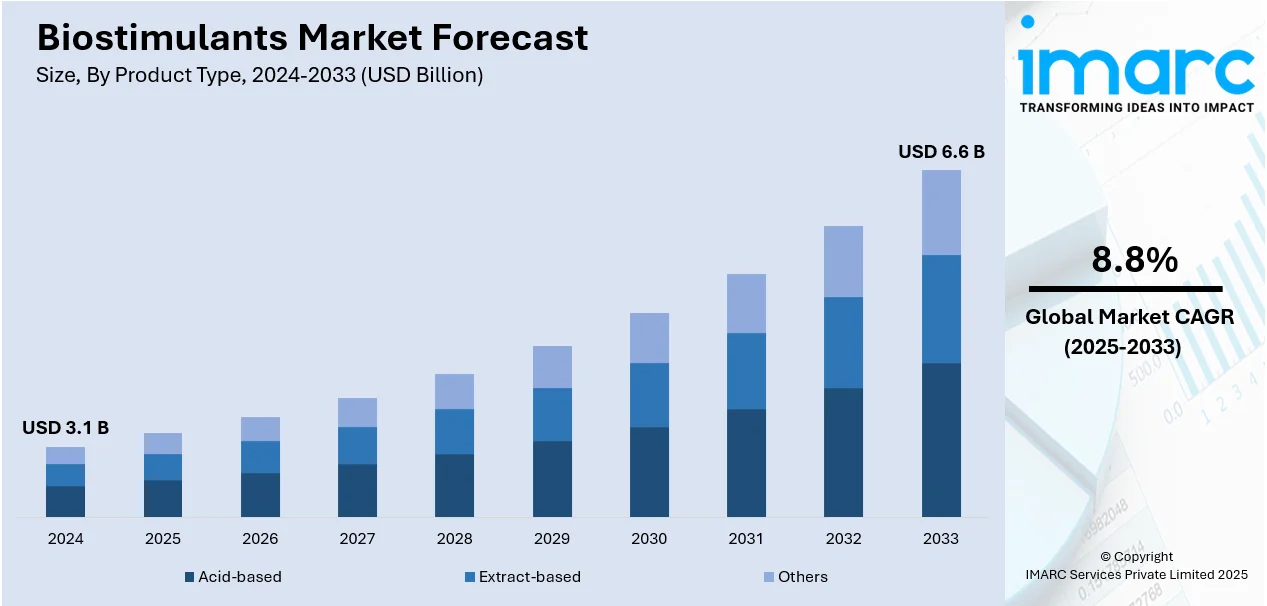

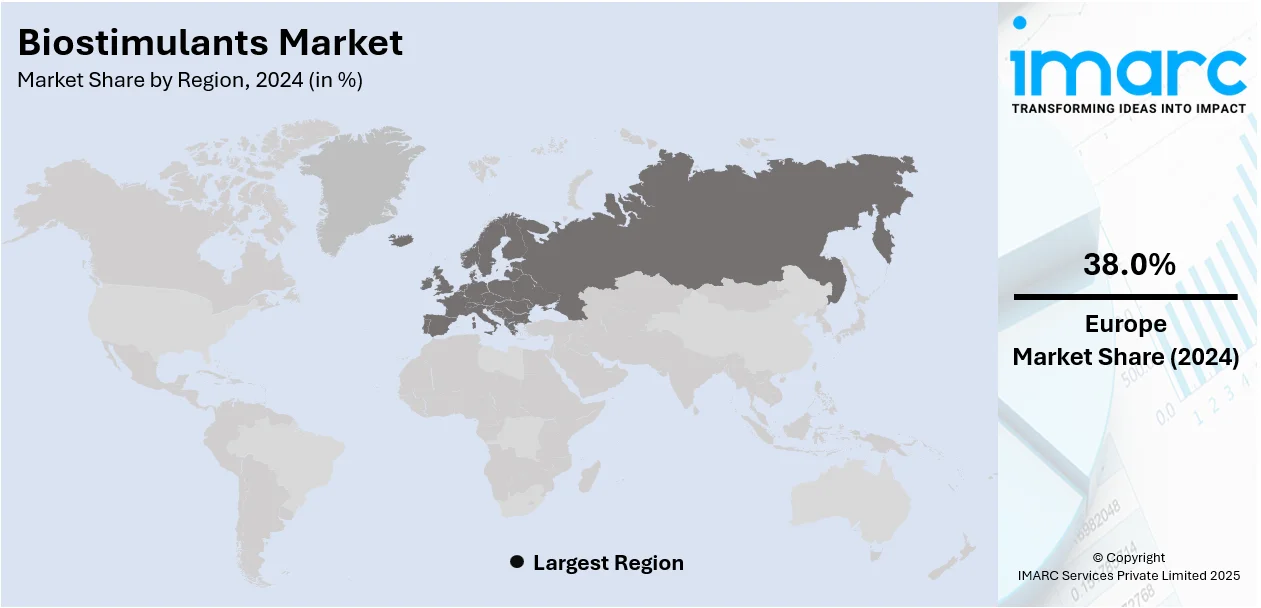

The global biostimulants market size was valued at USD 3.1 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 6.6 Billion by 2033, exhibiting a CAGR of 8.8% during 2025-2033. Europe currently dominates the market, holding a significant market share of over 38.0% in 2024. The market is expanding steadily due to the growing public demand for clean-label and organic food products, increased attention to bettering agricultural methods to lessen carbon emissions, and increased efforts by governments and international regulatory agencies to set clear guidelines.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 3.1 Billion |

|

Market Forecast in 2033

|

USD 6.6 Billion |

| Market Growth Rate 2025-2033 | 8.8% |

The biostimulants market is driven by an increasing demand for sustainable agriculture and higher crop productivity. Growing awareness about soil health, environmental concerns regarding chemical fertilizers, and the push for organic farming have fueled the adoption of biostimulants. Both rising global food requirements and crop adaptation needs for stress resistance have strengthened the use of biostimulants under changing climatic conditions. The market for biostimulants benefits from advances in biostimulant technology as well as governmental policies that encourage sustainable agriculture practices. Additionally, the expanding popularity of bio-based inputs among farmers and agro-industrial stakeholders plays a significant role. Emerging markets in Asia-Pacific and Latin America, along with ongoing R&D efforts to enhance product efficacy and cost-effectiveness, continue to shape the growth trajectory of the biostimulants market.

In the United States, the biostimulants market is driven by the growing demand for sustainable agricultural practices and improved crop yields. Farmers are increasingly adopting biostimulants to enhance soil health and reduce dependency on chemical fertilizers due to environmental concerns. The rise in organic farming and the need for stress-tolerant crops to combat climate variability also contribute significantly. For instance, in November 2024, Yara North America introduced the YaraAmplix biostimulant portfolio in the US and Canada, marking a major turning point in the company's dedication to developing a resilient, sustainable food system. The YaraAmplix portfolio, which is supported by more than five years of regional and international research & development, aims to improve crop resilience, nutrient uptake, and overall crop quality while encouraging healthier soils and greater resistance to environmental stresses. Government initiatives, regulatory support for eco-friendly inputs, and advancements in biostimulant technologies are further fueling growth. Additionally, heightened consumer awareness about organic and non-GMO produce and the expanding adoption of precision farming techniques are shaping the biostimulants market in the U.S.

Biostimulants Market Trends:

Increasing Demand for Sustainable Agriculture Practices

The global shift toward sustainable agriculture practices is impelling the growth of the market. As environmental concerns rise, there is a growing consensus on the need for eco-friendly agricultural solutions. This trend relies heavily on biostimulants, which are synthetic or natural compounds that improve plant nutrition and development. They provide a sustainable substitute for conventional chemical fertilizers, enhancing crop quality and productivity while lowering their negative effects on the environment. Biostimulants play a variety of roles in sustainable agriculture. They improve soil health, increase plant resistance to stress, and enhance nutrient absorption, all of which contribute to higher yields and better crop quality. This is especially crucial because of the world's population rises and food demands rise, agricultural systems are under increasing pressure to produce more with fewer resources. Recognizing the value of sustainable agriculture methods in accomplishing environmental and food security objectives, governments and international organizations are pushing them more and more. This is resulting in incentives and policies that favor the use of biostimulants. According to an industrial survey, 90% of farmers express awareness of sustainable farming practices. Furthermore, the demand for biostimulants is being driven by a shift in consumer tastes toward food that is produced responsibly and organically.

Advancements in Agricultural Technology and Plant Research

The market is propelled by significant advancements in agricultural technology and plant research. According to industrial reports, global agricultural research, and development (R&D) investments reached approximately USD 60 Billion in 2023. New opportunities for the creation and use of biostimulants are being created by the convergence of biotechnology and agriculture. Modern research is enabling a deeper understanding of plant biology, particularly how plants respond to abiotic stresses, such as drought, salinity, and extreme temperatures. This knowledge is crucial for developing effective biostimulants that can help plants overcome these challenges. Technological innovations are also making it possible to identify and isolate specific compounds that have biostimulant properties. These include various amino acids, peptides, enzymes, and other bioactive molecules. The efficacy and attractiveness of biostimulants are being substantially increased by the capacity to provide customized solutions for various crops and environmental circumstances. Collaborations between academic institutions, research organizations, and biostimulant manufacturers are also being fostered by the growing investment in agricultural research operations. These partnerships are crucial for the continuous development of new and improved biostimulant products. They also make it easier for research findings to be quickly translated into real-world field applications, which directly benefits farmers.

Regulatory Support and Standardization

The regulatory landscape is an essential factor positively impacting the market. Furthermore, governments and international regulatory organizations are working hard to create precise guidelines and standards for biostimulant products. Ensuring product quality and safety through standardization and regulation is essential, as it fosters end-user trust and promotes broader adoption. Differentiating biostimulants from other agricultural inputs such as pesticides and fertilizers is made easier by well-defined regulatory frameworks. This distinction is important for both manufacturers and users, as it provides clarity on the application, benefits, and limitations of these products. Regulations also guarantee that biostimulants fulfill specific safety and efficacy requirements, which is essential for safeguarding crop health and the environment. For instance, clear standards have been set by bodies like the European Union's Fertilizing Products Regulation (EU 2019/1009) that allow for streamlined market entry because of product quality and safety. Facilitating international trade is another important function of biostimulant standardization. With harmonized standards, manufacturers can more easily enter new markets, and farmers have access to a broader range of products. Furthermore, research and development (R&D) incentives are frequently included with regulatory assistance, which promotes creativity in the manufacturing of biostimulants. Governments and international bodies are increasingly recognizing the potential of biostimulants in achieving agricultural sustainability goals, leading to more supportive policies and funding opportunities.

Biostimulants Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on product type, crop type, form, origin, distribution channel, application, and end user.

Analysis by Product Type:

- Acid-based

- Humic Acid

- Fulvic Acid

- Amino Acid

- Extract-based

- Seaweed Extract

- Other Plant Extracts

- Others

- Microbial Soil Amendments

- Chitin and Chitosan

- Others

Acid-based leads the market with around 45.3% of market share in 2024. Acid-based biostimulants are well known for their ability to promote plant growth, improve nutrient uptake, and improve soil structure. Decomposed organic matter contains fulvic and humic acids, which are very useful for enhancing soil fertility and water retention. Additionally, they help minerals chelate, increasing their availability to plants. Conversely, amino acids are essential for plant metabolism and stress tolerance. They are necessary to produce proteins and can improve a plant's resistance to environmental challenges like drought and high heat. Acid-based biostimulants have a strong market position because of several benefits which make them extremely desirable in sustainable agriculture techniques.

Analysis by Crop Type:

- Cereals and Grains

- Fruits and Vegetables

- Turf and Ornamentals

- Oilseeds and Pulses

- Others

Fruits and Vegetables leads the market with around 51.1% of market share in 2024. Fruits and vegetables hold the largest share in the biostimulants market due to their high economic value and sensitivity to quality and yield. Biostimulants are crucial for these perishable and in-demand crops because they increase crop yield, stress tolerance, and nutrient uptake. Farmers use biostimulants to achieve strict quality standards and ensure sustainable practices since consumers are increasingly choosing fresh, organic produce. Furthermore, the growing need for year-round fruit and vegetable production in a variety of climates encourages the use of biostimulants, which maximize growth and reduce environmental effects to ensure profitability and competitiveness in the market.

Analysis by Form:

- Dry

- Liquid

Liquid leads the market with around 63.8% of market share in 2024. Liquid biostimulants hold the largest share in the biostimulants market due to their ease of application and superior effectiveness. They work well with a variety of foliar spray and irrigation systems, guaranteeing even dispersion and improved plant absorption. Higher concentrations of active chemicals are frequently found in liquid formulations, allowing for more accurate dosage and quicker action. They are also adaptable, work well with a variety of crops, and may be used at various stages of growth. Farmers are also drawn to their ease of handling, storing, and combining with other agrochemicals. Because of their adaptability and effectiveness, liquid biostimulants are the recommended option for agricultural applications.

Analysis by Origin:

- Natural

- Synthetic

Natural leads the market with around 63.6% of market share in 2024. Natural biostimulants made using organic sources like seaweed, microbial extracts and plants. The rising preference for natural biostimulants stems from an increasing demand for sustainable farming practices and organic food. They are perceived as safe for crops as well as soil in the environment since they are environment-friendly. It contributes significantly to soil health improvement, plant growth, and crop resistance to stresses without the negative impacts associated with synthetic products. Natural biostimulants are extremely diverse, from seaweed extracts, humics substances, and beneficial microbial formulations.

Analysis by Distribution Channel:

- Direct

- Indirect

Direct leads the market with around 65.2% of market share in 2024. The direct distribution channel is the largest segment in the biostimulants market. This involves manufacturers or producers selling biostimulants directly to consumers without any intermediaries, such as farmers, horticulturists, and agronomists. A closer relationship between producer and consumer helps manufacturers grasp and meet customers' needs more precisely. In addition to this, it offers personalized support which helps enhance customer satisfaction and loyalty. It also leads to cost savings for both producer and consumer accrue from avoiding margins held by intermediaries.

Analysis by Application:

- Foliar Treatment

- Soil Treatment

- Seed Treatment

Foliar treatment leads the market with around 79.3% of market share in 2024. Foliar treatment involves directly spraying biostimulants onto the leaves of plants. The main benefit of foliar treatment is that nutrients are quickly absorbed through the leaves, giving the plant instant advantages. This technique works particularly well for improving plant health, boosting stress tolerance throughout crucial growth stages, and promptly resolving nutrient imbalances. Farmers frequently use foliar application of biostimulants to improve crop performance because it is very effective and may be timed to match the unique requirements of the crop. Foliar treatments' convenience and efficacy in contemporary agriculture are further enhanced by their ease of integration with other crop management techniques, such as disease and pest control.

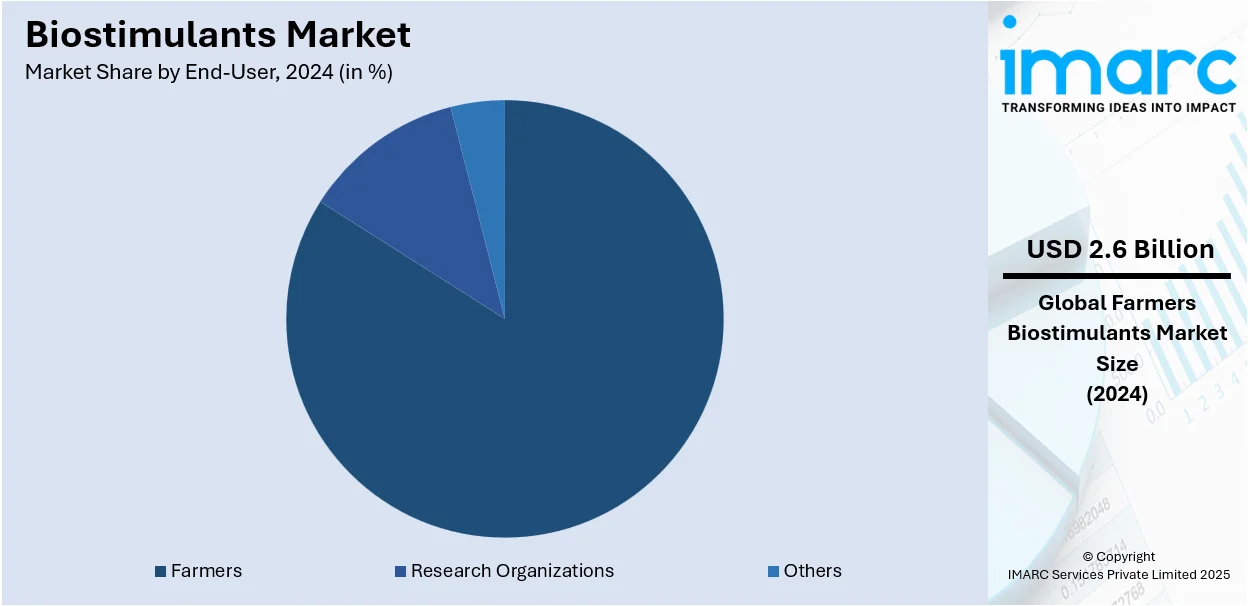

Analysis by End-User:

- Farmers

- Research Organizations

- Others

Farmers leads the market with around 84.2% of market share in 2024. Biostimulants are used by farmers to improve yields, enhance crop growth, and boost resistance to environmental stresses. Farmers have biostimulants in their integrated crop management strategies as a sustainable alternative to conventional chemical fertilizers and pesticides. The adoption of biostimulants is driven by the increasing awareness about their advantages, including improved soil health, better nutrient uptake, and greater resilience for crops. Biostimulants are diverse enough to cater to different crop types and farming practices-from small organic farms to large monoculture farms.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Europe accounted for the largest market share of over 38.0%. The biostimulants market in Europe is rapidly growing with the support of the change in farming towards sustainable agriculture and the environmental policies. As indicated by the European Commission, the Common Agricultural Policy (CAP) allocated over EUR 50 Billion (USD 52.02 Billion) in 2023 to support ecological farming and the adoption of green technologies. Among its country comparables, Italy, France, and Spain lead this growth. According to an industrial report, more than 300,000 hectares of farmland have entered a "first-class life" with biostimulants. These represent not only a more efficient supply of nutrients but also some element of resistance to environmental stress. Industry leaders, especially Syngenta and Valagro, continue making strides in this field; the former launched its series of new biostimulant formulations recently. Additionally, stringent regulation in the EU about the use of pesticides has given impetus to the market for green alternatives, making Europe a world leader in biostimulant innovation and production.

Key Regional Takeaways:

North America Biostimulants Market Analysis

The biostimulants market in North America is driven by the rising need to enhance crop productivity while minimizing environmental impact, along with heightened focus on sustainable agriculture. Biostimulants are being used by farmers to enhance crop resilience, nutrient efficiency, and soil health to meet the difficulties presented by climate change and harsh weather. The use of biostimulants as environmentally friendly inputs in farming operations has been further stimulated by the growing demand for organic and non-GMO produce. With the support of intensive research and development, technological developments in biostimulant formulations are improving product efficacy and affordability, opening up new markets for farmers. Strong laws governing chemical fertilizers and government programs supporting regenerative and sustainable agriculture are also important motivators. The market is being shaped by the rise of precision agriculture and growing knowledge of the benefits of biostimulants in enhancing crop quality and stress tolerance. Key regional players are also introducing innovative products tailored to North American crops and climatic conditions.

United States Biostimulants Market Analysis

In 2024, the United States accounted for the market share of over 87.00%. The U.S. biostimulants market is on the rise due to rising demand for sustainable agricultural practices and higher crop yields. As reported by the U.S. Department of Agriculture (USDA), the agricultural output in 2023 had touched USD 374 Billion, with biostimulants turning out to be a primary answer for enhancing soil health and boosting crop productivity. Growing adoption of organic farming above 4.1 million acres of organic crop acres cultivated in 2022 contributes to further speeding up demand of biostimulants. Innovative solutions for corteva Agriscience as well as BASF based on seaweed-based biostimulants along with plant growth regulators will keep market growth strong through government policies on the other hand supporting sustainable farming with regulation towards environment. The increasing demand for organic food and eco-friendly farming ensures a steady rise in biostimulant applications in the agricultural sector.

Asia Pacific Biostimulants Market Analysis

The Asia Pacific biostimulants market is registering rapid growth due to growth in agricultural production and the increase in demand for sustainable agriculture farming. The Ministry of Agriculture and Rural Affairs of China reported that the country's agricultural output reached nearly USD 1.22 Trillion (Yuan 8.71 Trillion) in 2023 with high growth in the use of biostimulants to enhance crop resistance and productivity. In India, the 2023 budget of USD 15.5 Billion put forth by the government for agricultural modernization will be on the lines of biostimulant-based solutions. Another driver is the growing middle class and demand from consumers for higher quality food items, which, along with higher awareness about climate change-related impacts, further propels the market. UPL Limited and Adama are front-runners in the market for biostimulant solutions, especially in the rice and vegetable farming domain. Government initiatives and partnerships with global players contribute to an increasingly integrated biostimulants ecosystem in the region.

Latin America Biostimulants Market Analysis

The biostimulants market in Latin America is seeing tremendous growth due to agricultural exportation increases and sustainable agriculture efforts. An industrial report stated, the largest producer of agricultural products in Latin America, had a total value of USD 154 Billion in agricultural production for the year 2022. More farmers use biostimulants as the trend to increase productivity while achieving environmental sustainability in their farm outputs. Argentina and Chile are also in high demand for biostimulants, mainly in grapevine and soybean cultivation. The international markets' demand for organic products and the need for solutions against soil degradation and climate change are the major drivers for the market. Market leaders like Yara International and ICL Group are investing more in the region to satisfy these demands. This further encourages the usage of biostimulants in the region, through government subsidies and research funding on sustainable agricultural practices.

Middle East and Africa Biostimulants Market Analysis

Middle East and African regions are gradually expanding because of agricultural challenges and the urgent need for sustainable farming practice. Agriculture in Saudi Arabia accounted for 2.7% of the GDP according to the CIA in the year 2023, with the agricultural sector being key in arid climates; there's a critical role that the biostimulants play in improving soil fertility and crop resilience, something quite essential for productivity in the regions. Countries like Egypt and South Africa are now implementing biostimulant solutions for water scarcity, as well as yield efficiency. The companies Biolchim and Koppert Biological Systems have invested in the region for sustainable practices. Strategic collaborations with governments, along with infrastructure development, provide additional momentum to the biostimulants market, towards the objective of enhancing agricultural output in resource-constrained environments.

Competitive Landscape:

Key players in the market are actively engaging in various strategic initiatives to strengthen their market position. To innovate and broaden their product offerings and guarantee that they satisfy all the needs of contemporary agriculture, these companies are also making significant investments in research and development (R&D). Partnerships and collaborations with other companies and research institutes are frequent and are intended to use the combined knowledge and technology for cutting-edge product development. These companies are also concentrating on establishing new manufacturing facilities and extending their worldwide reach through mergers and acquisitions (M&As), especially in areas with strong development potential. In keeping with the worldwide movement toward environmentally friendly and sustainable farming methods, they are also actively taking part in sustainability projects.

The market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Ag BioTech, Inc.

- Agrinos AS

- BASF SE

- Bayer AG

- Biolchim Spa

- FMC Corporation

- Futureco Bioscience

- Koppert B.V.

- Micromix Plant Health ltd

- Miller Chemical & Fertilizer, LLC

- Syngenta

- UPL Limited

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Recent Developments:

- August 2024: The Fertilizer Institute has awarded its third Biostimulant Certification to Valent BioSciences for its Transit® 500 biostimulant. The Agronomy Conference, held in St. Louis, gave recognition to efficacy, safety, and compliance with the U.S. Biostimulant Industry Guidelines following in-depth assessments by TFI and third-party reviewers.

- April 2024: BioConsortia secured USD 15 Million in funding led by Otter Capital. The funds will be used for the development of nitrogen-fixing and nematicidal seed treatment products, further enhancing BioConsortia's leadership in microbial gene-editing.

- April 2024: Acadian Plant Health collaborated with Koppert USA to increase U.S. access to biostimulants. The partnership allows for increased availability of the product and technical support to further innovative agriculture.

- October 2023: BASF SE announced its plan to build a new fermentation plant for biological and biotechnology-based crop protection products at its Ludwigshafen site.

- February 2023: Bayer AG and Kimitec announced a new partnership focused on facilitating the development and commercialization of biological crop protection solutions and biostimulants.

Biostimulants Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Crop Types Covered | Cereals and Grains, Fruits and Vegetables, Turf and Ornamentals, Oilseeds and Pulses, Others |

| Forms Covered | Dry, Liquid |

| Origins Covered | Natural, Synthetic |

| Distribution Channels Covered | Direct, Indirect |

| Applications Covered | Foliar Treatment, Soil Treatment, Seed Treatment |

| End-Users Covered | Farmers, Research Organizations, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Ag BioTech, Inc., Agrinos AS, BASF SE, Bayer AG, Biolchim Spa, FMC Corporation, Futureco Bioscience, Koppert B.V., Micromix Plant Health ltd, Miller Chemical & Fertilizer, LLC, Syngenta, UPL Limited, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the biostimulants market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global biostimulants market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyse the level of competition within the biostimulants industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

Biostimulants are natural or synthetic substances applied to plants or soils to enhance growth, yield, and stress tolerance. They improve nutrient uptake, strengthen resistance to environmental stressors, and promote healthier soils. Unlike fertilizers, biostimulants work by stimulating biological processes, contributing to sustainable agriculture and better crop productivity.

The global biostimulants market was valued at USD 3.1 Billion in 2024.

IMARC estimates the global biostimulants market to exhibit a CAGR of 8.8% during 2025-2033.

The global biostimulants market is driven by the demand for sustainable agriculture, rising food needs, and environmental concerns over chemical fertilizers. Increased adoption of organic farming, crop resilience to climate change, advancements in biostimulant formulations, and government support for eco-friendly practices further boost market growth.

According to the report, acid-based represented the largest segment by product type, due to their proven effectiveness in improving nutrient uptake, soil health, and crop resilience, along with wide applicability across diverse crops and farming systems.

Cereals and grains leads the market by crop type due to their global cultivation, critical food demand, and the need for improved yields, stress tolerance, and sustainable farming practices.

Dry is the leading segment by form, due to their longer shelf life, ease of storage and transport, cost-effectiveness, and versatility in application methods, making them a preferred choice for farmers globally.

Natural is the leading segment by origin, due to increasing demand for eco-friendly, organic farming practices. They promote soil health, reduce chemical dependency, and align with sustainability trends in agriculture.

Direct is the leading segment by distribution channel, due to their ease of use, immediate effect on plant growth, and targeted action on specific growth stages, making them highly efficient and cost-effective for farmers.

Foliar treatment is the leading segment by application, due to its rapid absorption by plants, quick results in enhancing growth, and effectiveness in addressing nutrient deficiencies and stress.

Farmers is the leading segment by end-user, as they are tailored to address specific crop needs, enhance yield, improve soil health, and provide cost-effective, sustainable solutions for agricultural productivity.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Europe currently dominates the global market.

Some of the major players in the global biostimulants market include Ag BioTech, Inc., Agrinos AS, BASF SE, Bayer AG, Biolchim Spa, FMC Corporation, Futureco Bioscience, Koppert B.V., Micromix Plant Health ltd, Miller Chemical & Fertilizer, LLC, Syngenta, UPL Limited, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)