Bleaching Agents Market Size, Share, Trends and Forecast by Product Type, Form, End-User Industry, and Region, 2025-2033

Bleaching Agents Market Size and Share:

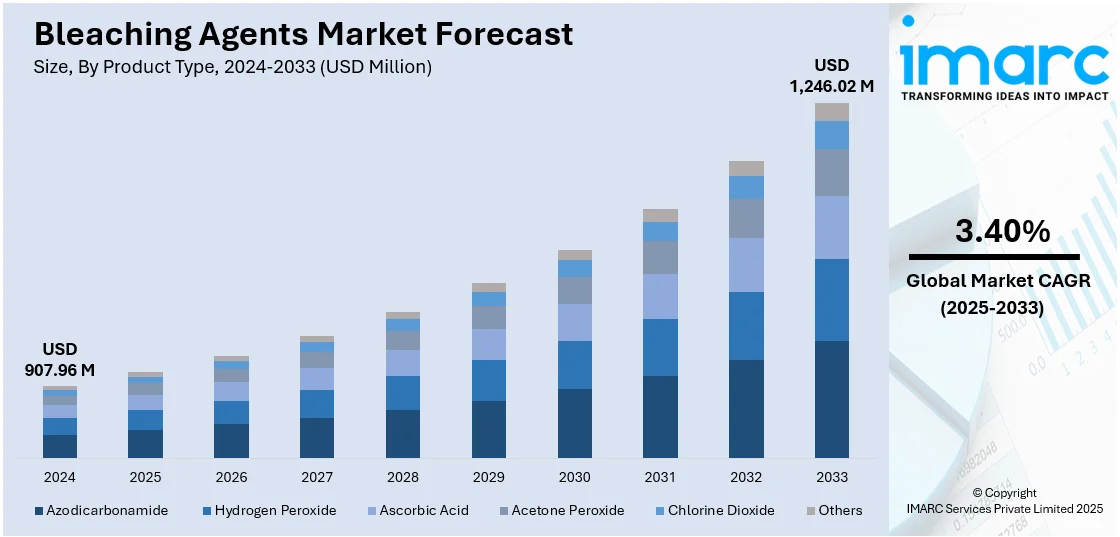

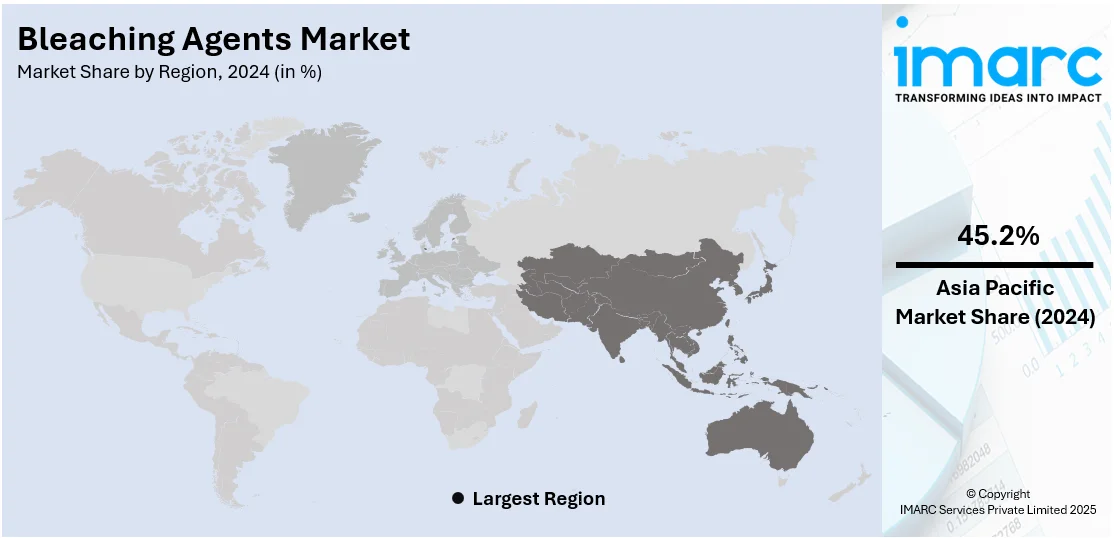

The global bleaching agents market size was valued at USD 907.96 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 1,246.02 Million by 2033, exhibiting a CAGR of 3.40% from 2025-2033. Asia Pacific currently dominates the market, holding a market share of 45.2% in 2024. The market is witnessing steady growth due to rising demand across industries like textiles, paper, and cleaning products. Innovations in eco-friendly and sustainable products are driving market dynamics with companies focusing on improving product efficiency and safety. The growing awareness about environmental concerns is also shaping product development, which is expected to expand further with a shift toward greener solutions, thereby contributing to the bleaching agents market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 907.96 Million |

|

Market Forecast in 2033

|

USD 1,246.02 Million |

| Market Growth Rate 2025-2033 | 3.40% |

Major drivers in the bleaching agents market are the rising demand for processed food and beverages, where bleaching agents are utilized to ensure product quality and appearance. The rising application of bleaching agents in textile, paper, and pulp industries for whitening and brightening is also driving market growth. Moreover, environmental issues are driving the use of eco-friendly bleaching agents, which is further driving innovation. The growing personal care and cosmetic markets also drive market demand for effective and safe bleaching products.

The major drivers in the United States bleaching agents market are the high demand for processed foods and beverages, where bleaching agents are used to preserve color and freshness. According to the data published by the United States Department of Agriculture (USDA), in 2024, US processed food exports are projected to reach $38.84 billion from 11.15 metric tons, with a 3-year average of $37.86 billion and a compound growth of 2.9% since 2015. The textile and paper industry growth is also a major factor, as bleaching agents find extensive use for whitening and brightening. Growing consumer inclination towards green products is driving the creation of environmentally friendly bleaching solutions. The growing demand for personal care and cosmetic products further propels market growth.

Bleaching Agents Market Trends:

Eco-Friendly Formulations

The demand for eco-friendly bleaching agents is rising as consumers and industries become increasingly aware of environmental impact. Sustainable, non-toxic and biodegradable alternatives are gaining traction in the market, especially in food, textile and paper industries. For instance, in April 2024, Evonik launched the carbon-neutral hydrogen peroxide in Europe accompanied by a “Way to GO2” sustainability certificate enabling customers to minimize Scope 3 emissions. This independently certified initiative maintains product quality while supporting sustainability in production. Wella Company is among the first to utilize this eco-friendly hydrogen peroxide in its products. These formulations reduce harmful emissions and minimize environmental footprint aligning with global sustainability goals. With increasing regulatory pressures and consumer preference for greener products, the bleaching agents market forecast indicates a significant shift towards ecofriendly and safer bleaching solutions in the coming years.

Technological Advancements

Technological advancements in bleaching agents are driving the development of more efficient and high-performance formulations. These innovations aim to improve bleaching effectiveness while reducing the need for excessive chemical usage, which leads to lower environmental impact. Newer formulations offer better control over the bleaching process, increasing energy efficiency and reducing waste. As industries focus on sustainability, these advancements are becoming essential. For instance, in June 2024, Nuberg EPC announced its partnership with PT Hidrogen Peroxida Indonesia to construct a state-of-the-art Hydrogen Peroxide plant in Banten, featuring advanced technology, with a capacity of 40,000 MTPA. This project marks Nuberg's entry into the Indonesian market, promoting sustainable practices and economic growth in the region through innovative technology and local job creation. The bleaching agents market outlook indicates continued growth in demand for these technologically enhanced, eco-friendly solutions.

Automation in Production

The adoption of automation in the production of bleaching agents is revolutionizing the manufacturing process. Automated systems streamline operations, reducing manual labor, and enhancing consistency and precision in product quality. By optimizing production efficiency, automation helps reduce operational costs and increase output capacity. Additionally, automation enables real-time monitoring and adjustments, ensuring better resource utilization and minimizing waste. As industries strive for cost-effective and efficient operations, automation in bleaching agent production plays a crucial role in meeting market demands.

Bleaching Agents Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global bleaching agents market, along with forecast at the global and regional levels from 2025-2033. The market has been categorized based on product type, form, and end-user industry.

Analysis by Product Type:

- Azodicarbonamide

- Hydrogen Peroxide

- Ascorbic Acid

- Acetone Peroxide

- Chlorine Dioxide

- Others

Chlorine dioxide stand as the largest product type in 2024, holding around 41.5% of the market. According to bleaching agents market report, chlorine dioxide stands as the largest product type in the bleaching agents market due to its widespread use across various industries, including textiles, pulp and paper, and water treatment. Known for its strong bleaching properties, chlorine dioxide is highly effective in removing stains, brightening products, and disinfecting surfaces. It is also preferred over traditional bleaching agents for its lower environmental impact and reduced harmful by-products. As industries increasingly prioritize sustainability, chlorine dioxide’s demand continues to lead the market for bleaching agents.

Analysis by Form:

- Powder

- Liquid

Liquid leads the market with around 70.7% of market share in 2024. Liquid bleaching agents lead the market due to their versatility, ease of application, and superior efficiency in various industries, including textiles, paper, and food processing. The liquid form allows for precise dosage, making it ideal for large-scale industrial use. It is also easier to handle and transport compared to solid or powdered forms. With the growing demand for more efficient and eco-friendly solutions, liquid bleaching agents continue to dominate the market, driven by their effectiveness and convenience in diverse applications.

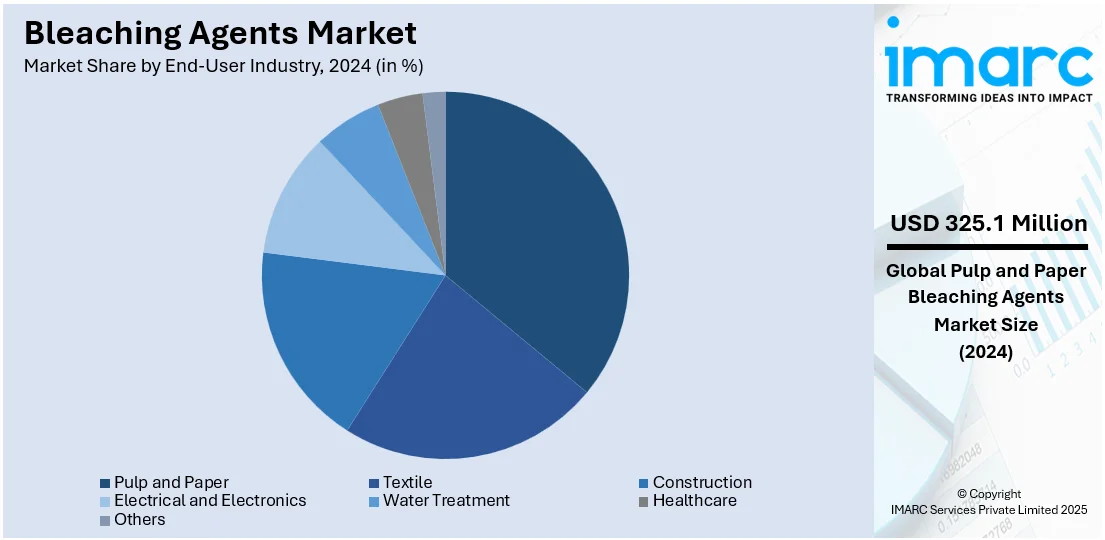

Analysis by End-User Industry:

- Pulp and Paper

- Textile

- Construction

- Electrical and Electronics

- Water Treatment

- Healthcare

- Others

Pulp and paper leads the market with around 35.8% of market share in 2024. The pulp and paper industry leads the bleaching agents market due to its high demand for bleaching agents to whiten and brighten paper products. Bleaching agents, such as chlorine dioxide and hydrogen peroxide, are essential in the paper manufacturing process to achieve the desired brightness and quality. As environmental regulations push for greener practices, the demand for eco-friendly bleaching agents in this sector is growing. The pulp and paper industry's ongoing expansion and need for efficient, sustainable solutions continue to drive the market for bleaching agents.

Regional Analysis:

- Asia Pacific

- Europe

- North America

- Middle East and Africa

- Latin America

In 2024, Asia-Pacific accounted for the largest market share of over 45.2%. Asia-Pacific accounts for the largest share of the bleaching agents market due to its strong presence in industries like textiles, paper, and food processing, which are major consumers of bleaching agents. The region’s rapid industrialization, coupled with growing manufacturing activities, especially in countries like China, India, and Japan, drives demand. Additionally, rising consumer awareness of product quality and sustainability further boosts market growth. The increasing need for eco-friendly and efficient bleaching solutions in Asia-Pacific is expected to continue driving the bleaching agents market growth.

Key Regional Takeaways:

North America Bleaching Agents Market Analysis

The North American bleaching agents market is experiencing growth driven by the rising demand for hygienic packaging in the food processing industry. Expanding applications in textile processing, particularly with eco-friendly fabric treatments, are further supporting market development. Additionally, the continuous consumption in the paper sector, especially for pulp-based hygiene products like tissues and diapers, is fueling demand. Investments in industrial laundry and commercial cleaning services are increasing the use of high-performance bleaching chemicals. Innovations in specialty chemicals for cosmetic formulations are also contributing to niche market demand. The emphasis on fast-acting disinfectants in public facilities is reinforcing market penetration, while the growing regulatory focus on water treatment is driving the adoption of oxidizing agents in municipal water treatment plants, further influencing market dynamics.

United States Bleaching Agents Market Analysis

In 2024, the United States accounted for 86.80% of the bleaching agents market in North America. The United States bleaching agents market is primarily driven by the rising demand for hygienic packaging in the food processing industry. In line with this, expanding applications in textile processing, particularly in eco-friendly fabric treatments, are further supporting market expansion. As per an industry report, between 2022 and 2024, over 23.1% of “Made in the USA” products with recycled cotton used the term “sustainable,” and 16.2% mentioned “eco-friendly,” compared to under 2% for items made from regular cotton. The growth in demand for pulp-based hygiene products such as tissues and diapers continuously stimulating consumption in the paper sector is supporting market development. Furthermore, increasing investments in industrial laundry and commercial cleaning services heightening the use of high-performance bleaching chemicals, are propelling market growth. Additionally, ongoing innovation in specialty chemicals tailored for cosmetic formulations is contributing to niche demand in the market. The growing emphasis on high-performance, fast-acting disinfectants in public facilities is reinforcing market penetration across institutional and transportation segments. Besides this, heightened regulatory focus on water reuse and recycling promoting the adoption of oxidizing agents in municipal water treatment plants, is impacting the market trends.

Europe Bleaching Agents Market Analysis

The bleaching agents market in Europe is advancing due to the growing implementation of strict EU regulations on sanitation and hygiene compelling institutional and commercial adoption. Similarly, rising demand for sustainable and biodegradable cleaning solutions encouraging the development of eco-certified bleaching products, is impelling the market. An industry survey showed that 60% of UK consumers are willing to pay more for eco-friendly cleaning products. The UK's net-zero carbon emissions goal by 2050 is also driving businesses to implement more sustainable cleaning practices. The growth of the European textile recycling industry creating demand for specialized bleaching formulations compatible with repurposed fibers, is further supporting market development. Furthermore, the increasing urban wastewater treatment mandates under EU directives are accelerating the heightened adoption of advanced oxidizing agents. Besides this, the expansion of organic and clean-label bakery segments fueling the use of food-grade bleaching agents in flour treatment, is fostering market expansion. Additionally, ongoing innovation in bio-based bleaching chemistries attracting environmentally conscious manufacturers, is enhancing the market accessibility. Moreover, a growing preference for high-quality dental and cosmetic whitening products is bolstering niche demand in the market.

Latin America Bleaching Agents Market Analysis

In Latin America, the bleaching agents market is supported by the expansion of textile and garment manufacturing hubs, particularly in Brazil and Mexico. According to the Brazilian Textile and Apparel Industry Association (Abit), textile production in Brazil grew by 3.6%, while apparel output rose by 1.7% in 2024. Furthermore, rising health and hygiene awareness across urban populations increasing household consumption of disinfectant-based cleaning products, is propelling market development. Similarly, growth in the regional food processing industry, driving the use of food-grade bleaching agents in flour and bakery applications, is expanding the market scope. Moreover, increasing government investments in rural water purification initiatives encouraging the adoption of chlorine-based agents for safe drinking water access, are providing an impetus to the market.

Middle East and Africa Bleaching Agents Market Analysis

The market in the Middle East and Africa is gaining momentum attributed to expanding infrastructure for municipal water treatment, particularly in water-scarce regions aiming to ensure safe supply. In addition to this, the growing hospitality and tourism sectors, increasing the demand for commercial-grade cleaning and disinfectant solutions, are expanding the market reach. According to Emirates NBD, Dubai's hospitality sector saw a 9.2% year-on-year growth in 2024, welcoming a record 18.72 million visitors. Furthermore, the rising awareness of personal and public hygiene, driven by government health campaigns, is contributing to higher household usage of bleaching agents. Besides this, the rapid development of textile and leather processing clusters, especially in North Africa, fueling demand for specialized bleaching chemicals used in industrial applications, is positively influencing the market.

Competitive Landscape:

The bleaching agents market features a competitive environment, with many companies providing a variety of products for different industrial uses, such as textiles, paper, and cleaning supplies. Key factors influencing competition include product effectiveness, affordability, and environmental sustainability. Businesses are placing greater emphasis on developing innovative, eco-friendly, and safer bleaching agents in response to the rising consumer demand for sustainable options. Market players also differentiate themselves by expanding their product portfolios and enhancing supply chain capabilities. Strategic mergers, acquisitions, and partnerships are common as companies seek to strengthen their market positions and reach new customer segments.

The report provides a comprehensive analysis of the competitive landscape in the bleaching agents market with detailed profiles of all major companies, including:

- BASF

- Aditya Birla Chemicals

- Evonik

- Solvay

- Akzonobel

- Hawkins, Inc.

- Siemer Milling

- Peroxychem

- Supraveni Chemicals

- Spectrum Chemicals

- Engrain

- Gujarat Alkalies and Chemicals

- Unilever

- The Procter & Gamble Company

- The Clorox Company

Latest News and Developments:

- April 2025: Valmet announced that it would supply Grasim Industries with a new bleach plant and rebuild its brown stock washing and evaporation units at its Karnataka, India site. The project involved ozone bleaching technology and eight new evaporator effects, with installation scheduled for early 2026.

- March 2025: Domestos expanded its Power Foam range with Bleach Foam, its first variant containing bleach. Featuring a 360-degree spray and thick foam for superior cleaning and whitening, the 450ml product is reportedly particularly effective on toilets and bathroom surfaces.

- March 2025: Nouryon launched Eka HP Puroxide, the Nordics’ first low-carbon footprint hydrogen peroxide. Produced in Sweden using fossil-free hydrogen and renewable electricity, the product reduced carbon emissions by up to 90%, helping pulp, mining, and water treatment industries meet Scope 3 reduction targets across Europe.

Bleaching Agents Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Azodicarbonamide, Hydrogen Peroxide, Ascorbic Acid, Acetone Peroxide, Chlorine Dioxide, Others |

| Forms Covered | Powder, Liquid |

| End-User Industries Covered | Pulp and Paper, Textile, Construction, Electrical and Electronics, Water Treatment, Healthcare, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | BASF, Aditya Birla Chemicals, Evonik, Solvay, Akzonobel, Hawkins, Inc., Siemer Milling, Peroxychem, Supraveni Chemicals, Spectrum Chemicals, Engrain, Gujarat Alkalies and Chemicals, Unilever, The Procter & Gamble Company and The Clorox Company, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the bleaching agents market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global bleaching agents market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the bleaching agents industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The bleaching agents market was valued at USD 907.96 Million in 2024.

The bleaching agents market is projected to reach USD 1,246.02 Million by 2033, exhibiting a CAGR of 3.40% from 2025-2033.

Key factors driving the bleaching agents market include the increasing demand for hygienic packaging in the food processing industry, expanding applications in textile processing, the growing use of bleaching agents in pulp-based hygiene products, rising investments in industrial cleaning services, and innovations in eco-friendly and high-performance bleaching solutions.

Asia Pacific dominates the bleaching agents market due to rapid industrial growth, increasing textile production, and rising demand for eco-friendly and sustainable bleaching solutions in various sectors.

Some of the major players in the bleaching agents market include BASF, Aditya Birla Chemicals, Evonik, Solvay, Akzonobel, Hawkins, Inc., Siemer Milling, Peroxychem, Supraveni Chemicals, Spectrum Chemicals, Engrain, Gujarat Alkalies and Chemicals, Unilever, The Procter & Gamble Company and The Clorox Company, etc

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)