Blockchain in BFSI Market Report by Type (Private, Public, Consortium, Hybrid), Component (Platform, Services), Application (Digital Currency, Record Keeping, Payments and Settlement, Smart Contracts, Compliance Management, and Others), End User (Banking, Insurance, Non-Banking Financial Companies (NBFCs)), and Region 2025-2033

Global Blockchain in BFSI Market:

The global blockchain in BFSI market size reached USD 2.1 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 59.0 Billion by 2033, exhibiting a growth rate (CAGR) of 42.43% during 2025-2033. The market is experiencing steady growth driven by the increasing demand for secure and efficient transactional processes, the rising need for regulatory compliance and operational efficiency in the heavily regulated financial sector, and the integration of blockchain with AI, IoT, and cloud computing. At present, North America holds the largest market share, driven by the presence of a robust technological infrastructure and security mechanisms.

| Report Attribute | Key Statistics |

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 2.1 Billion |

|

Market Forecast in 2033

|

USD 59.0 Billion |

| Market Growth Rate (2025-2033) | 42.43% |

Blockchain in BFSI Market Analysis:

- Major Market Drivers: The increasing demand for secure transactions and efficient regulatory compliance is driving the market's growth. Moreover, the widespread adoption of blockchain across various financial institutions, aiming to enhance security and operational efficiency is acting as another growth-inducing factor.

- Key Market Trends: The growing emphasis on enhancing cybersecurity and reducing fraud is propelling the demand for blockchain in BFSI. In addition to this, advancements in blockchain technology, particularly its integration with AI, IoT, and cloud computing, are pivotal in driving the blockchain in BFSI market growth.

- Competitive Landscape: Some of the prominent blockchain in BFSI market companies include Accenture plc, AlphaPoint, Amazon Web Services Inc., Auxesis Services & Technologies (P) Ltd., Infosys Limited, International Business Machines Corporation, and Oracle Corporation, among many others.

- Geographical Trends: According to the blockchain in BFSI market dynamics, North America exhibits a clear dominance in the market. Consumers in the region are increasingly seeking transparent and secure financial services, driving institutions to adopt blockchain for enhanced service delivery.

- Challenges and Opportunities: Rising data privacy and security concerns, and high initial costs associated with the implementation of blockchain solutions are hampering the market's growth. However, blockchain’s immutable ledger provides a robust solution for detecting and preventing fraudulent activities by ensuring the integrity and transparency of transactions, which further reinforces the blockchain in BFSI market outlook.

- Uses of Blockchain in the BFSI industry: In the BFSI industry, blockchain can be implemented to enhance operational efficiency, reduce costs, and improve customer experiences. The applications of blockchain in the industry include smart contracts, cross-border payments, trade finance, supply chain finance, Know Your Customer (KYC), tokenization, and Central Bank Digital Currencies (CBDCs).

Blockchain in BFSI Market Trends:

Rising Adoption of Digital Currencies

The growing acceptance and use of cryptocurrencies like Bitcoin, Ethereum, and newer digital assets have gained interest in blockchain technology. For instance, according to IMARC, the global cryptocurrency market size reached USD 2,255.2 Billion in 2023. Looking forward, IMARC Group expects the market to reach USD 5,552.8 Billion by 2032, exhibiting a growth rate (CAGR) of 10.2% during 2024-2032. As more individuals and institutions engage with digital currencies, the demand for blockchain solutions that support and facilitate these transactions has increased. These factors are expected to propel the blockchain in the BFSI market in the coming years.

Increased Demand for Secure Transactions

With the use of blockchain in the BFSI sector, there's a rising demand for secure, transparent, and efficient transactional processes. For instance, according to an article published by Pymnts, more than 35% of banking consumers want their financial institutions (FIs) to implement advanced visible security measures for high-risk financial transactions. Blockchain technology offers an unparalleled level of security through its decentralized and immutable ledger system, which effectively minimizes the risks of fraud, data breaches, and cyber-attacks. These factors are further positively influencing the blockchain in the BFSI market forecast.

Technological Advancements

The continuous evolution and integration of blockchain technology with other cutting-edge technologies such as Artificial Intelligence (AI), Internet of Things (IoT), and cloud computing are significant drivers in the BFSI sector. For instance, in July 2024, Grayscale launched a new digital asset fund focusing on artificial intelligence (AI) tokens. The Grayscale Decentralized AI Fund was designed to capture the growth of protocols at the intersection of blockchain and artificial intelligence, thereby boosting the blockchain in BFSI market revenue.

Global Blockchain in BFSI Industry Segmentation:

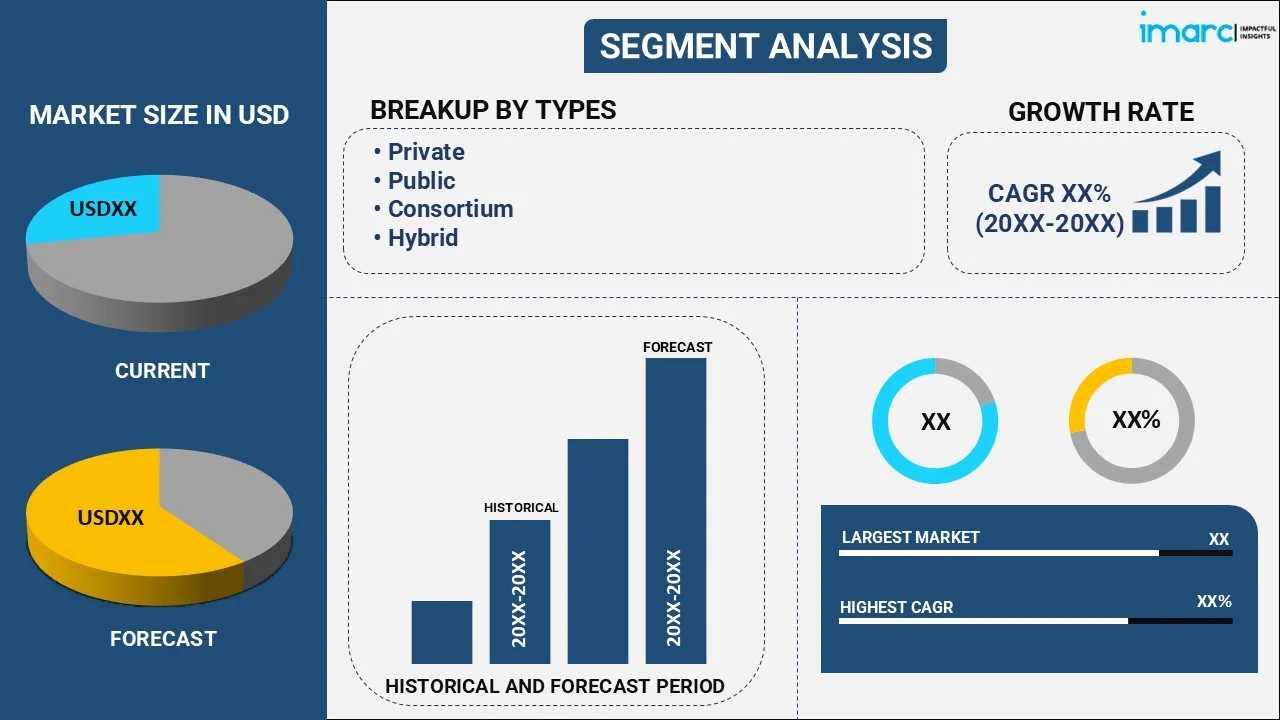

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on type, component, application, and end user.

Breakup by Type:

- Private

- Public

- Consortium

- Hybrid

Public accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the blockchain in BFSI market based on the type. This includes private, public, consortium, and hybrid. According to the report, public represented the largest segment.

Public blockchains, the largest segment in the market, are characterized by their open and decentralized nature, allowing anyone to participate without restrictions. These blockchains are typically used for applications where transparency and immutability are paramount, such as in cryptocurrencies such as Bitcoin. The key advantage of public blockchains is their high level of security, stemming from extensive network distribution. In the BFSI sector, while public blockchains are less commonly adopted due to privacy concerns, they are gaining traction in areas that demand transparency and where the benefits of decentralization and security outweigh the need for privacy.

Breakup by Component:

- Platform

- Services

Platform holds the largest share in the industry

A detailed breakup and analysis of the blockchain in BFSI market based on the component has also been provided in the report. This includes platform and services. According to the report, platform accounted for the largest market share.

In the market, the platform segment holds the largest share, underscoring its fundamental role in providing the necessary infrastructure for deploying blockchain solutions. This segment includes the core blockchain technology that underpins various applications, ranging from cryptocurrency transactions to complex financial operations. The dominance of the platform segment is attributed to the increasing demand for blockchain platforms that are secure, scalable, and capable of handling the high transaction volumes typical in the BFSI sector. These platforms are the backbone of blockchain applications, offering essential features such as immutability, transparency, and decentralized ledger systems.

Breakup by Application:

- Digital Currency

- Record Keeping

- Payments and Settlement

- Smart Contracts

- Compliance Management

- Others

Smart contracts represent the leading market segment

The report has provided a detailed breakup and analysis of the blockchain in BFSI market based on the application. This includes digital currency, record keeping, payments and settlement, smart contracts, compliance management, and others. According to the report, smart contracts accounted for the largest market share.

The smart contracts segment occupies the largest share of the market, reflecting their critical role in automating and streamlining complex contractual processes. Smart contracts are self-executing contracts with the terms of the agreement directly written into lines of code. In the BFSI sector, they offer immense potential in automating routine and complex tasks, reducing the need for intermediaries, and ensuring compliance and transparency. This automation capability is especially beneficial in areas like loan processing, claims management in insurance, and compliance with regulatory requirements. The efficiency, accuracy, and cost-effectiveness of smart contracts are driving their adoption, making them a pivotal application in the blockchain landscape for financial services.

Breakup by End User:

- Banking

- Insurance

- Non-Banking Financial Companies (NBFCs)

Banking exhibits a clear dominance in the market

A detailed breakup and analysis of the blockchain in BFSI market based on the end user has also been provided in the report. This includes banking, insurance, and non-banking financial companies (NBFCs). According to the report, banking accounted for the largest market share.

In the market, the banking segment holds the largest share, underscoring the substantial impact of blockchain technology in this area. Banks are increasingly adopting blockchain to enhance various aspects of their operations, such as transaction processing, compliance management, fraud prevention, and customer identity verification. The technology's ability to provide secure, transparent, and efficient transactional processes is particularly appealing in the banking sector, where trust and security are paramount. Blockchain's potential to reduce operational costs and streamline processes is also a significant factor driving its adoption in banking. With the ongoing digital transformation in the financial sector, the role of blockchain in banking is expected to expand further, embracing new applications and innovations.

Breakup by Region:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America leads the market, accounting for the largest blockchain in BFSI market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America accounted for the largest market share.

North America dominates the market, largely due to the region's advanced technological infrastructure, early adoption of blockchain technologies, and the presence of major financial and technological players. The U.S. and Canada are leading in this space, with numerous initiatives and investments aimed at exploring and integrating blockchain in various financial services. This region's market growth is fueled by a combination of technological advancements, supportive regulatory frameworks, and a strong focus on innovation in financial services. The widespread acceptance of blockchain solutions in banking, insurance, and other financial services in North America indicates a continued growth trajectory for this market segment. Apart from this, the rise of digital currencies and cryptocurrencies has accelerated the adoption of blockchain technology. For instance, more than 20% of individuals in the United States held cryptocurrency.

Competitive Landscape:

Key players in the market are actively engaging in a range of strategic activities to strengthen their market position and capitalize on the growing demand for blockchain solutions. These activities include investments in research and development to innovate and improve blockchain platforms, forming strategic partnerships and collaborations with other technology firms and financial institutions to expand their market reach and enhance their service offerings. Additionally, many are focusing on enhancing the security features and scalability of their platforms to cater to the diverse needs of the financial sector. They are also actively participating in regulatory discussions and compliance efforts to align their solutions with evolving legal frameworks. By adapting to market trends and customer needs, these players are driving technological advancement and shaping the future landscape of financial services.

The market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Accenture plc

- AlphaPoint

- Amazon Web Services Inc.

- Auxesis Services & Technologies (P) Ltd.

- Infosys Limited

- International Business Machines Corporation

- Oracle Corporation

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Blockchain in BFSI Market Recent Developments:

- July 2024: Grayscale launched a new digital asset fund focusing on artificial intelligence (AI) tokens. The Grayscale Decentralized AI Fund was designed to capture the growth of protocols at the intersection of blockchain and artificial intelligence.

- June 2024: Mastercard launched crypto credentials to simplify digital transactions. Mastercard's Crypto Credential integrates blockchain technology into traditional financial services. It is designed to simplify and safeguard cryptocurrency transactions.

- January 2024: Qila launched its Blockchain-As-A-Service (BaaS) platform. The platform, which includes innovative solutions, such as PrivaSea and GoTrust, focuses on delivering secure identity data storage through blockchain technology.

Blockchain in BFSI Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Private, Public, Consortium, Hybrid |

| Components Covered | Platform, Services |

| Applications Covered | Digital Currency, Record Keeping, Payments and Settlement, Smart Contracts, Compliance Management, Others |

| End Users Covered | Banking, Insurance, Non-Banking Financial Companies (NBFCs) |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Accenture plc, AlphaPoint, Amazon Web Services Inc., Auxesis Services & Technologies (P) Ltd., Infosys Limited, International Business Machines Corporation, Oracle Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC's report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, blockchain in BFSI market forecast, and dynamics of the market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global blockchain in BFSI market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the blockchain in BFSI industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global blockchain in BFSI market was valued at USD 2.1 Billion in 2024.

We expect the global blockchain in BFSI market to exhibit a CAGR of 42.43% during 2025-2033.

The rising integration of connected devices with the Internet of Things (IoT), cloud computing, and Artificial Intelligence (AI) solutions, as these advanced technologies help in minimizing unauthorized access to sensitive data of users, is primarily driving the global blockchain in BFSI market.

The sudden outbreak of the COVID-19 pandemic has led to the increasing adoption of blockchain in BFSI to protect the privacy of user data against cyberattacks, money laundering, cyber frauds, etc., during the remote working scenario.

Based on the type, the global blockchain in BFSI market has been segmented into private, public, consortium, and hybrid. Among these, public currently holds the majority of the total market share.

Based on the component, the global blockchain in BFSI market can be divided into platform and services. Currently, platform exhibits a clear dominance in the market.

Based on the application, the global blockchain in BFSI market has been categorized into digital currency, record keeping, payments and settlement, smart contracts, compliance management, and others. Among these, smart contracts currently account for the largest market share.

Based on the end user, the global blockchain in BFSI market can be bifurcated into banking, insurance, and Non-Banking Financial Companies (NBFCs). Currently, banking exhibits a clear dominance in the market.

On a regional level, the market has been classified into North America, Asia-Pacific, Europe, Latin America, and Middle East and Africa, where North America currently dominates the global market.

Some of the major players in the global blockchain in BFSI market include Accenture plc, AlphaPoint, Amazon Web Services Inc., Auxesis Services & Technologies (P) Ltd., Infosys Limited, International Business Machines Corporation, Oracle Corporation, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)