Blood Culture Test Market Size, Share, Trends and Forecast by Testing Method, Product, Technology, Application, End User, and Region, 2025-2033

Blood Culture Test Market Size and Share:

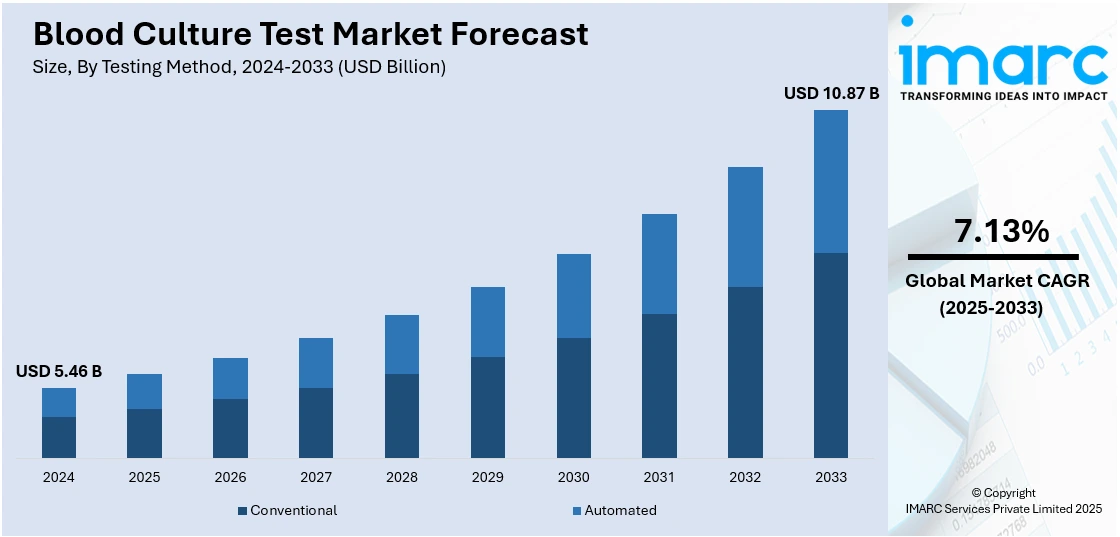

The global blood culture test market size was valued at USD 5.46 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 10.87 Billion by 2033, exhibiting a CAGR of 7.13% from 2025-2033. North America currently dominates the market, holding a significant market share of over 39.6% in 2024. The increasing number of bacterial and fungal infections in people, the growing rates of hospital-acquired infections (HAIs), and the evolving developments in diagnostic technology are some of the key drivers influencing the growth of the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 5.46 Billion |

| Market Forecast in 2033 | USD 10.87 Billion |

| Market Growth Rate 2025-2033 | 7.13% |

The global blood culture test market is primarily driven by the rising incidence of bloodstream infections, particularly sepsis, which remains a leading cause of morbidity and mortality worldwide. As the global population ages and chronic conditions such as diabetes and cancer increase, the risk of infections rises, driving demand for accurate diagnostic tests. For instance, it is estimated that 783 million people globally will be living with diabetes by 2045. Additionally, advancements in diagnostic technologies, such as automated systems and rapid culture methods, have improved test accuracy and efficiency, further propelling market growth. These innovations enable faster detection of pathogens, which is critical for timely treatment and improved patient outcomes.

The growing emphasis on precision medicine and early infection detection is a key driver for the blood culture test market in the United States. For instance, in June 2024, UC Davis Health researchers received a USD 5.6 million grant to enhance the All of Us Research Program, which supports precision medicine. By engaging diverse populations, the initiative aims to uncover genetic variations, advancing personalized healthcare and promoting equitable treatment for all, especially historically underrepresented communities. The healthcare sector is increasingly prioritizing precise diagnostic methods to tackle the escalating challenges of antibiotic-resistant bacteria and the growing prevalence of chronic illnesses. Blood culture examinations play a critical role in identifying pathogens responsible for infections, facilitating the development of tailored treatment plans that improve patient recovery outcomes and curb the spread of resistant strains. This emphasis is driving the demand for these diagnostic tests across healthcare facilities in the United States.

Blood Culture Test Market Trends:

The Rising Incidences of Bacterial and Fungal Infections

The escalating number of bacterial and fungal infections and a growing geriatric population are primarily driving the growth of the blood culture test market. The European Centre for Disease Prevention and Control's report from January 2023 revealed that by December 31, 2022, there were 4,110,465 confirmed cases of dengue and 4,099 reported fatalities. Consequently, the increasing need for early detection of severe dengue-related complications is fueling the demand for blood tests, which are essential for the prompt diagnosis of the disease, thereby driving market growth. Timely identification of disease progression in severe dengue cases, coupled with access to appropriate medical treatment, can reduce fatality rates to under 1%. In addition, several major market players are launching innovative diagnostic solutions to address the increasing number of diagnoses.

The Increasing Prevalence of Hospital-Acquired Infections (HAIs)

HAIs are infections that patients contract while undergoing treatment for other health conditions in medical settings. The increasing numbers of patients in hospital stays are leading to escalating cases of HIAs, which in turn is bolstering the market for blood culture tests. Additionally, according to the WHO, nearly 235 million major surgical procedures are performed every year. In its 2020 Healthcare-Associated Infection Progress Report, the Centers for Disease Control and Prevention revealed that nearly 18,416 surgical site infections were reported in the United States that year. Among these, 6,094 infections were linked to colon surgeries, while 2,173 occurred during hip arthroplasty procedures. Such a surge in hospital-acquired infections is catalyzing the need for robust blood culture tests. Moreover, blood culture tests are essential in diagnosing and monitoring infectious diseases, thus escalating the demand for these tests with the growing number of HAI rates.

The Emerging Advancements in Diagnostic Technology

The increasing adoption of automated blood culture systems, which use advanced edge sensors and software algorithms to detect microbial growth in blood samples more rapidly and precisely than traditional methods, is acting as another significant growth-inducing factor for the market. Various key market players are extensively investing in research and development activities to introduce robust automated blood testing technologies. For instance, in December 2022, InsilicoMedicine introduced Life Star, the sixth generation of its Intelligent Robotics Drug Discovery Laboratory. This fully automated, AI-driven robotics lab is designed to conduct target discovery, develop precision medicine, perform compound screening, and support translational research. Similarly, in June 2023, Sun Pharmaceutical Industries revealed plans to boost its investment in research and development for both its specialty and generics sectors. The company stated that its current generics pipeline for the U.S. market includes 97 Abbreviated New Drug Applications (ANDAs), with 13 new drug applications pending approval from the U.S. FDA. In addition to this, various concerned regulatory authorities are also taking initiatives to enhance diagnostics, which is creating a positive outlook for the overall market. For example, the Centers for Medicare & Medicaid Services (CMS) is a regulatory authority in North America responsible for overseeing and regulating all human laboratory testing in the U.S. through the Clinical Laboratory Improvement Amendments (CLIA), which covers approximately 260,000 laboratory entities. Besides this, the integration of artificial intelligence (AI) and machine learning (ML) algorithms into blood culture analysis is enabling a quick analysis of vast datasets and predicting outcomes. This, in turn, assists healthcare professionals in making informed decisions.

Blood Culture Test Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global blood culture test market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on testing method, product, technology, application, and end user.

Analysis by Testing Method:

- Conventional

- Automated

Conventional testing stands as the largest component in 2024, holding around 65.4% of the market. Conventional tests are employed in hospitals, clinics, and healthcare facilities across the globe. They serve as a fundamental diagnostic tool to identify the presence of bacteria, fungi, or other microorganisms in the bloodstream of the patient. Moreover, as these tests are essential for physicians to identify the appropriate course of treatment, various key market players are launching technologically advanced blood tests. In January 2022, Eurofins' subsidiary empowerDX introduced the PFAS Exposure test in the United States, a direct-to-consumer, at-home testing kit designed to measure the levels of per- and polyfluorinated alkyl substances (PFAS) in an individual's blood, including 47 different PFAS chemical compounds. Besides this, conventional tests are reliable, providing healthcare professionals with a well-established and trusted method for detecting bloodstream infections. This level of reliability is augmenting the demand for conventional tests.

Analysis by Product:

- Consumables

- Blood Culture Media

- Aerobic Blood Culture Media

- Anaerobic Blood Culture Media

- Fungi/Yeast Blood Culture Media

- Mycobacteria Blood Culture Media

- Assay Kits and Reagents

- Blood Culture Accessories

- Blood Culture Media

- Instruments

- Automated Blood Culture Systems

- Supporting Laboratory Equipment

- Incubators

- Colony Counters

- Microscopes

- Gram Stainers

- Software and Services

Consumables lead the market with around 60.4% of market share in 2024. Consumables are employed at various essential junctures in the blood culture process. The American Cancer Society's 2022 statistics reported approximately 1,918,030 new cancer cases in the United States that year. The rising prevalence of diseases like cancer highlights the growing need for precision medicine, which in turn drives the demand for cell culture products and consumables essential for their development, fueling market growth. Moreover, various leading market players are increasingly focusing on research and development activities to develop improved cell culture products. In February 2022, KromaTiD introduced a complete range of services for cell and blood culture growth, isolation, processing, and quality control. The introduction of these products and services by companies like KromaTiD contributes to the rising demand for cell culture products and consumables, which is expected to drive the growth of this market segment.

Analysis by Technology:

- Culture-based Technology

- Molecular Technology

- Microarray

- PCR

- PNA-FISH

- Proteomic Technology

- Others

Culture-based technology leads the market with around 66.5% of market share in 2024. Culture-based technology allows for the detection and identification of microbial pathogens, such as bacteria and fungi, in the blood samples of patients, which is essential in diagnosing bloodstream infections (BSIs) that can be life-threatening. As a result, various key companies are extensively investing in research activities to enhance culture-based technology. For example, in June 2022, Evonik introduced the cQrex portfolio of cell culture ingredients aimed at enhancing efficiency and productivity in bioprocesses for producing monoclonal antibodies, vaccines, viral vectors, and therapeutic cells. Similarly, in February 2022, CellulaREvolution secured GBP 1.75 million in funding to expedite the launch of its continuous cell culture technology. Furthermore, culture-based technology offers a high level of sensitivity. It can distinguish between several strains of microorganisms, allowing healthcare providers to customize their treatment strategies accordingly.

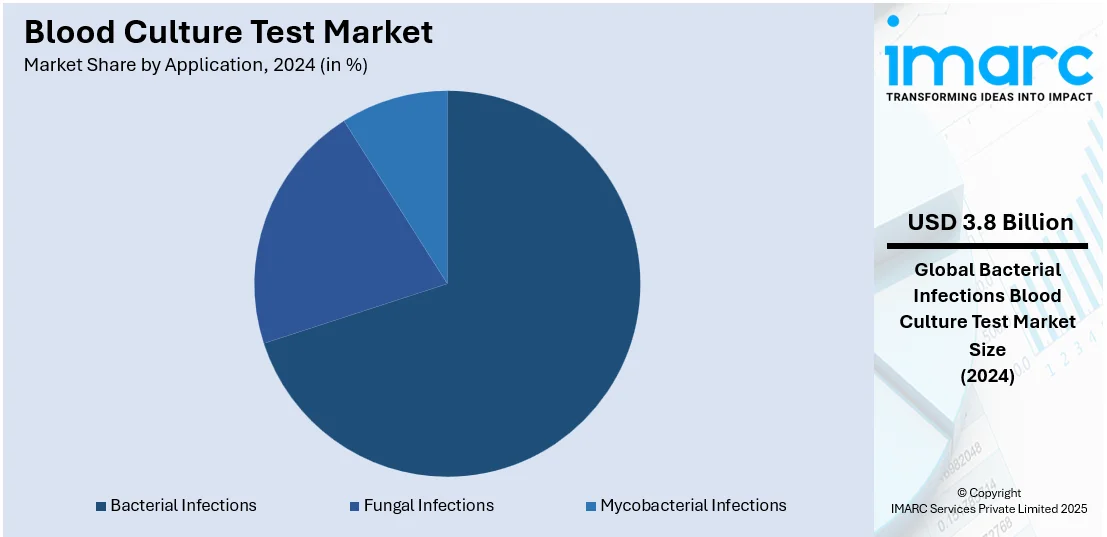

Analysis by Application:

- Bacterial Infections

- Fungal Infections

- Mycobacterial Infections

Bacterial infection leads the market with around 70.2% of market share in 2024. Bacterial infections are a prevalent concern in the healthcare sector. These infections can manifest in various forms, from mild to severe, and often require timely and accurate diagnosis for effective treatment. As a result, various healthcare institutions and pharmaceutical companies are increasingly investing in robust blood culture testing solutions. For example, in June 2022, Basilea Pharmaceutica Ltd reported positive topline results from the Phase III ERADICATE study, which assessed the effectiveness of ceftobiprole in treating adult patients with bacterial bloodstream infections caused by Staphylococcus aureus (SAB). Similarly, in May 2022, Nabriva Therapeutics PLC reached an agreement to extend its exclusive partnership with Merck & Co. Inc. subsidiaries for the promotion and distribution of SIVEXTRO (tedizolid phosphate), an antibiotic in the oxazolidinone class used to treat acute bacterial skin and skin structure infections (ABSSSI), in the United States until December 31, 2026. Moreover, ongoing technological advancements have enhanced the sensitivity and specificity of these tests, increasing their reliability in accurately detecting bacterial infections.

Analysis by End User:

- Hospital Laboratories

- Reference Laboratories

- Research Laboratories

- Others

Hospital laboratories lead the market with around 53.8% of market share in 2024. Hospital laboratories are equipped with advanced technology and several resources, enabling them to conduct tests with a high degree of accuracy and efficiency. These laboratories often deliver more reliable results compared to other laboratories, due to which hospital laboratories are the go-to choice for healthcare professionals. Various healthcare facilities are investing in the establishment and expansion of advanced hospital laboratories. For example, in September 2021, Roche Diagnostics' Indian division introduced the Cobas Pure Integrated Solutions Analyzer, an advanced system designed to meet the needs of various laboratories and hospitals across the country.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 39.6%. The North American market is driven by the growing healthcare infrastructure that includes numerous networks of hospitals, clinics, and laboratories. Furthermore, the presence of a well-established healthcare insurance system in the region, ensuring that a substantial portion of the population has access to medical services, including blood culture testing, is also contributing to the region's growth. Furthermore, the introduction of technologically advanced blood tests in the United States is expected to positively influence market growth. For instance, in January 2022, Eurofins' subsidiary empowerDX launched the PFAS Exposure test in the U.S., a direct-to-consumer, at-home test designed to measure the levels of Per- and Polyfluorinated Alkyl Substances (PFAS) in an individual's blood and assess 47 of the PFAS "forever" chemical compounds. Moreover, in August 2021, Smart Meter introduced a glucose monitor specifically designed for managing gestational diabetes. This device offers an easy and reliable method for testing, monitoring, and managing blood glucose levels, ensuring that healthcare providers have immediate access to test results. Additionally, regulatory agencies in North America enforce stringent standards for healthcare products and services, fostering trust in these tests and making them the preferred option for both healthcare professionals and patients.

Key Regional Takeaways:

United States Blood Culture Test Market Analysis

The United States accounted for 80.4% of the market share in North America in 2024. The United States leads the North American blood culture test market, bolstered by a robust healthcare infrastructure, widespread adoption of advanced diagnostics, and a growing geriatric population highly susceptible to infections. According to data from the Centers for Disease Control and Prevention (CDC), there are more than 1.7 million healthcare-associated infections in the U.S. each year, fueling the demand for rapid and accurate blood culture testing solutions. Furthermore, the World Health Organization reports approximately 250,000 cases of bloodstream infections (BSIs) annually in the country, highlighting the significant burden of such conditions.

Furthermore, data from the U.S. Census Bureau shows that the population aged 65 and older increased by 38.6% between 2010 and 2020, reaching 55.8 million, which represents the fastest growth rate since the late 19th century. This demographic shift has amplified the demand for effective diagnostic tools to address age-related vulnerability to infections. These factors, combined with the presence of leading market players and increasing investments in R&D, have cemented the U.S. as a dominant force in the global blood culture test market.

Europe Blood Culture Test Market Analysis

Europe plays a key role in the global blood culture test market, fueled by growing healthcare investments, heightened awareness of sepsis management, and a strong emphasis on addressing antimicrobial resistance. The European Centre for Disease Prevention and Control (ECDC) estimates that around 4.3 million patients in hospitals across the EU/EEA acquire at least one healthcare-associated infection (HAI) each year during their hospital stay. These infections significantly contribute to the burden on healthcare systems and emphasize the need for effective diagnostic and infection control measures. Blood culture tests play a critical role in the early detection and management of bloodstream infections (BSIs) resulting from HAIs, enabling timely and targeted therapeutic interventions. This highlights the growing demand for advanced blood culture diagnostic solutions in Europe to address the challenges posed by healthcare-associated infections. By 2050, it is projected that the EU-27 will have close to half a Million centenarians, reflecting a significant shift in the region's demographic profile. In addition, the median age in the EU-27 is projected to increase by 4.5 years, reaching 48.2 years by 2050. This aging population underscores the increasing prevalence of age-related vulnerabilities, including bloodstream infections (BSIs) and sepsis, which are more common in older individuals. Additionally, the presence of leading diagnostic companies and increased R&D efforts, have positioned Europe as a key player in the global blood culture test market.

Asia Pacific Blood Culture Test Market Analysis

The Asia-Pacific region is witnessing a rapid demographic shift, with the United Nations Fund for Population Activities predicting the number of older individuals to triple by 2050, reaching 1.3 billion. Countries like Thailand, Japan, and China are witnessing a notable rise in aging populations, fueled by declining fertility rates and longer life expectancies. This demographic transformation is boosting demand for clinical laboratory services focused on geriatric care, disease management, and health monitoring, with a particular emphasis on diagnosing and managing infections in vulnerable populations. In Japan, this trend is further exacerbated by a surge in cases of streptococcal toxic shock syndrome (STSS), a dangerous bacterial infection with a mortality rate of up to 30%. As of June 2024, 977 cases of STSS had been recorded, surpassing last year’s record-high infections, according to Japan's Health Ministry. The ongoing outbreak saw 77 fatalities between January and March, highlighting the need for enhanced diagnostic and infection management systems. The National Institute of Infectious Diseases reported 97 fatalities from STSS in 2023, making it the second-highest fatality rate in the past six years. These alarming statistics emphasize the critical role of advanced diagnostic tools, such as blood culture tests, in early detection and effective treatment of bloodstream infections and other life-threatening conditions.

Latin America Blood Culture Test Market Analysis

The blood culture test market in Latin America is expanding, driven by an increasing prevalence of infectious diseases, improving healthcare infrastructure, and rising awareness about early diagnostic tools. Countries like Brazil, Mexico, and Argentina are key contributors to the market, owing to their large populations and growing investments in healthcare systems. According to NIH statistics, in Brazilian intensive care units (ICUs), sepsis prevalence is 30% and hospital mortality rate for ICU patients is 55%. Studies from Colombia and Argentina also reported mortality rates for septic shock ranging from 45.6% to 51%. Governments and private healthcare providers are increasingly focusing on enhancing diagnostic capabilities, including the adoption of blood culture systems, to address this issue. As healthcare access improves across the region, the blood culture test market in Latin America is poised for steady growth, driven by increased investments in diagnostics and infection management.

Middle East and Africa Blood Culture Test Market Analysis

The Middle East and Africa (MEA) region represents an emerging market for blood culture tests, with growth driven by an increasing burden of infectious diseases, rising antimicrobial resistance, and improving healthcare access in developing economies. In resource-constrained areas within the region, bloodstream infections (BSIs) and sepsis often go undiagnosed or are diagnosed late, contributing to higher mortality rates. The World Health Organization (WHO) reports that infectious diseases continue to be a major cause of death in many African countries. Specifically, tuberculosis (TB) was the second leading cause of death from a single infectious agent, with nearly 2.5 million people affected and 424,000 lives lost in 2022. Governments and international health organizations are investing in improving laboratory capabilities, including the deployment of portable and cost-effective diagnostic systems. Furthermore, the rising prevalence of HAIs is prompting healthcare providers to adopt advanced diagnostic methods like blood culture systems to improve patient outcomes.

Competitive Landscape:

The global blood culture test market is highly competitive, with key players including diagnostic companies and medical device manufacturers offering advanced technologies for pathogen detection. Market leaders focus on delivering rapid, accurate results through automated systems, improved culture mediums, and enhanced identification methods. Competition is driven by innovations such as real-time PCR-based techniques and AI-powered diagnostic tools. Additionally, the rising demand for point-of-care testing and the need for faster diagnostics in critical care settings are fueling growth. Companies differentiate themselves by offering robust customer support, cost-effective solutions, and compliance with regulatory standards, ensuring their continued market presence in an increasingly crowded space. For instance, in August 2024, Orlando Health Orlando Regional Medical Center (ORMC), located in Central Florida, is the first hospital to use Abbott's innovative i-STAT TBI blood test, providing results in just 15 minutes. Developed with the Department of Defense, this rapid test helps assess patients with mild traumatic brain injuries, offering significant advancements in emergency care for quicker, more accurate diagnoses.

The report provides a comprehensive analysis of the competitive landscape in the blood culture test market with detailed profiles of all major companies, including:

- Abbott Laboratories

- Danaher Corporation

- Becton, Dickinson and Company

- bioMeriux SA

- Bruker Corporation

- Luminex Corporation

- Merck KGaA

- Siemens Healthcare GmbH

- F.Hoffmann-La Roche Ltd.

- T2 Biosystems Inc.

- Thermo Fisher Scientific Company

Latest News and Developments:

- April 2025: DiaSorin revealed that it had obtained FDA 510(k) clearance for its Liaison Plex Gram-Negative Blood Culture Assay, the second of three multiplex molecular panels intended for pathogen identification in blood cultures on the Liaison Plex platform. This assay detects 27 pathogens, including 19 gram-negative bacteria and eight key resistance gene targets, such as Escherichia coli, Klebsiella pneumoniae, Pseudomonas aeruginosa, among others.

- March 2025: Accelerate Diagnostics submitted its WAVE System and gram-negative test kit for FDA 510(k) clearance. The system delivers rapid antimicrobial susceptibility testing (AST) results in ~4.5 hours directly from blood cultures, enabling same-shift targeted therapy. This addresses sepsis (49 million annual cases, 11 million deaths) and antimicrobial resistance (1.32 million annual deaths), potentially reducing healthcare costs ($62 billion/year U.S. sepsis burden). The WAVE complements existing FDA-cleared solutions like the Pheno system (7-hour AST) and Arc system (automated sample prep), enhancing lab efficiency and patient outcomes.

- February 2025: Biogenix Inc. Pvt. Ltd. introduced the Bugz32, a fully automated blood culture instrument with a 32-position capacity, aimed at microbiology labs. Designed to deliver fast, accurate, and reliable results, the Bugz32 is part of the company's broader portfolio of diagnostic instruments and kits.

- November 2024: Copan introduced HEMO, an automated system created to optimize the processing of positive blood cultures by automating sample transfer and tracking.

Blood Culture Test Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Testing Methods Covered | Conventional, Automated |

| Products Covered |

|

| Technologies Covered |

|

| Applications Covered | Bacterial Infections, Fungal Infections, Mycobacterial Infections |

| End Users Covered | Hospital Laboratories, Reference Laboratories, Research Laboratories, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Abbott Laboratories, Danaher Corporation, Becton, Dickinson and Company, bioMeriux SA, Bruker Corporation, Luminex Corporation, Merck KGaA, Siemens Healthcare GmbH, F.Hoffmann-La Roche Ltd., T2 Biosystems Inc., Thermo Fisher Scientific Company, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the blood culture test market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global blood culture test market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the blood culture test industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The blood culture test market was valued at USD 5.46 Billion in 2024.

The blood culture test market is projected to exhibit a CAGR of 7.13% during 2025-2033, reaching a value of USD 10.87 Billion by 2033.

The global blood culture test market is driven by the increasing prevalence of bloodstream infections, rising sepsis cases, and advancements in diagnostic technology. The growing demand for rapid, accurate pathogen detection, along with improving healthcare infrastructure and increasing awareness of infectious diseases, is further propelling the market’s expansion globally.

North America currently dominates the blood culture test market, accounting for a share of 39.6%. The market is fueled by a robust healthcare infrastructure, including hospitals, clinics, and labs, along with a strong insurance system ensuring broad access to medical services like blood culture testing. Additionally, strict regulatory standards enhance trust in these healthcare solutions.

Some of the major players in the blood culture test market include Abbott Laboratories, Danaher Corporation, Becton, Dickinson and Company, bioMeriux SA, Bruker Corporation, Luminex Corporation, Merck KGaA, Siemens Healthcare GmbH, F.Hoffmann-La Roche Ltd., T2 Biosystems Inc., and Thermo Fisher Scientific Company.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)