Blue Ammonia Market Size, Share, Trends and Forecast by Technology, Application, and Region, 2025-2033

Blue Ammonia Market Size and Share:

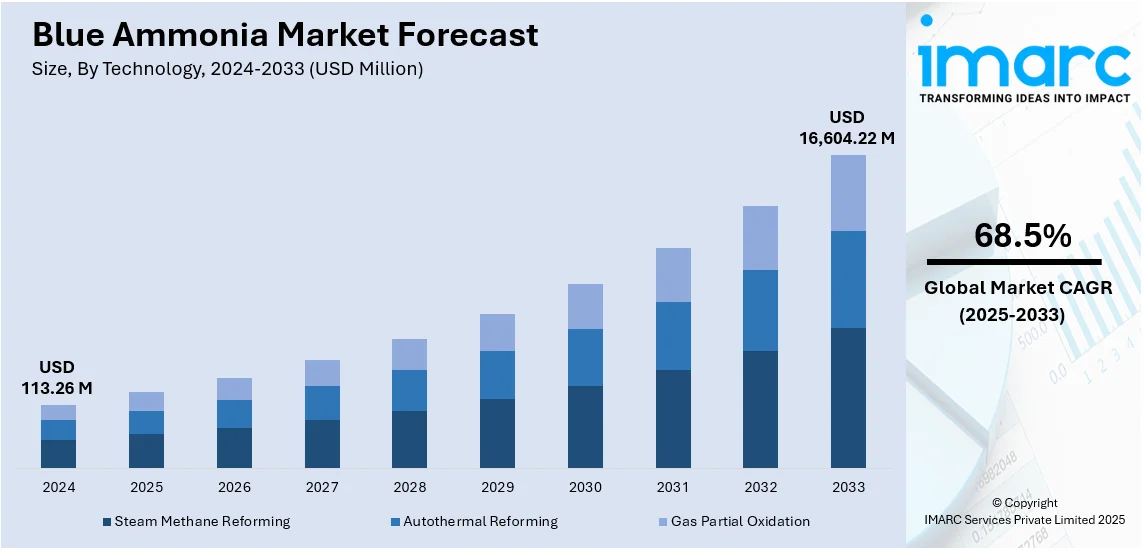

The global blue ammonia market size was valued at USD 113.26 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 16,604.22 Million by 2033, exhibiting a CAGR of 68.5% from 2025-2033. North America currently dominates the market, holding a market share of over 42.5% in 2024. This dominance is attributed to vast natural gas resources, carbon capture projects, government support, rising hydrogen demand, ammonia fuel adoption, and strong industrial decarbonization initiatives.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 113.26 Million |

| Market Forecast in 2033 | USD 16,604.22 Million |

| Market Growth Rate 2025-2033 | 68.5% |

Expanding demand for low-carbon ammonia is driving large-scale production projects with integrated carbon capture. New facilities aim to enhance supply while reducing emissions, supporting energy transition efforts in power generation, shipping, and industry. Advancements in carbon capture technology are strengthening ammonia’s role as a cleaner alternative in global decarbonization initiatives. For example, in July 2023, BASF and Yara Clean Ammonia conducted a joint study to develop a large-scale blue ammonia production facility with carbon capture along the US Gulf Coast. The proposed plant aims for a capacity of 1.2 to 1.4 Million Tons annually, capturing approximately 95% of CO₂ emissions, to meet the escalating global demand for low-carbon ammonia.

The United States is advancing offshore ammonia production by integrating floating storage and offloading technology with advanced engineering. This approach supports domestic decarbonization efforts, enabling large-scale, low-carbon ammonia output for industrial applications and the clean energy transition. For instance, in September 2024, McDermott and BW Offshore partnered to explore offshore blue ammonia production. This collaboration aims to develop low-carbon ammonia facilities on floating production storage and offloading (FPSO) units, leveraging McDermott's expertise in engineering and construction alongside BW Offshore's proficiency in FPSO solutions. The initiative seeks to contribute to the global shift toward sustainable energy by providing a viable pathway for offshore blue ammonia production.

Blue Ammonia Market Trends:

Expanding Low-Carbon Hydrogen and Ammonia Production

Global efforts to expand low-carbon hydrogen and ammonia production are gaining momentum, with projects focusing on large-scale output and carbon capture integration. These developments aim to support cleaner energy solutions for power generation and industrial use. Growing international partnerships indicate increasing investment in hydrogen-based alternatives, reinforcing commitments to reducing emissions and enhancing energy security. For instance, in September 2024, Mitsubishi Corporation and ExxonMobil signed a project framework agreement to enhance a low-carbon hydrogen project in Baytown, Texas. The facility plans the per day production of 1 Billion Cubic Feet of hydrogen, with approximately 98% of CO₂ removed, and over 1 Million Tons of low-carbon ammonia annually. Mitsubishi plans to utilize this ammonia in Japan for power generation and industrial applications.

Driving Innovation in Clean Ammonia Production

Investment in low-carbon ammonia production is accelerating, with new projects integrating advanced air separation and hydrogen transport infrastructure. Expanding supply chains and pipeline networks support cleaner industrial applications, reducing emissions in key sectors. Strategic collaborations are driving efficiency in ammonia production, reinforcing its role as a viable solution for energy transition and decarbonization. In June 2024, ExxonMobil and Air Liquide collaborated to boost low-carbon ammonia production at Baytown, Texas. Air Liquide would supply oxygen and nitrogen through new air separation units, supporting efficient hydrogen production. The agreement enables hydrogen transportation via an existing pipeline network, reinforcing the shift toward cleaner ammonia for industrial applications.

Advancing Blue Ammonia for Decarbonization

Innovative partnerships are accelerating the development of blue ammonia with high CO₂ capture rates, strengthening its role in clean energy and industrial applications. Demand is rising across power, shipping, and manufacturing sectors, driving the adoption of integrated solutions for low-carbon ammonia production. These efforts support emission reductions and sustainable energy transitions worldwide. In May 2024, Johnson Matthey and thyssenkrupp Uhde signed a memorandum of understanding to jointly offer an integrated low-carbon ammonia solution, combining their expertise to produce blue ammonia with up to 99% CO₂ capture. This collaboration aims to meet the growing demand for low-carbon ammonia in the power, shipping, and industrial sectors, supporting global decarbonization efforts.

Blue Ammonia Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global blue ammonia market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on technology and application.

Analysis by Technology:

- Steam Methane Reforming

- Autothermal Reforming

- Gas Partial Oxidation

In 2024, steam methane reforming led the market by technology with 63.7% of the market share. Steam methane reforming (SMR) is leading the market by enabling cost-effective hydrogen production while integrating carbon capture to reduce emissions. SMR allows industries to transition to low-carbon ammonia using existing infrastructure. Rising demand from fertilizers, shipping, and energy sectors, along with global decarbonization goals, is accelerating the adoption of SMR-based blue ammonia production.

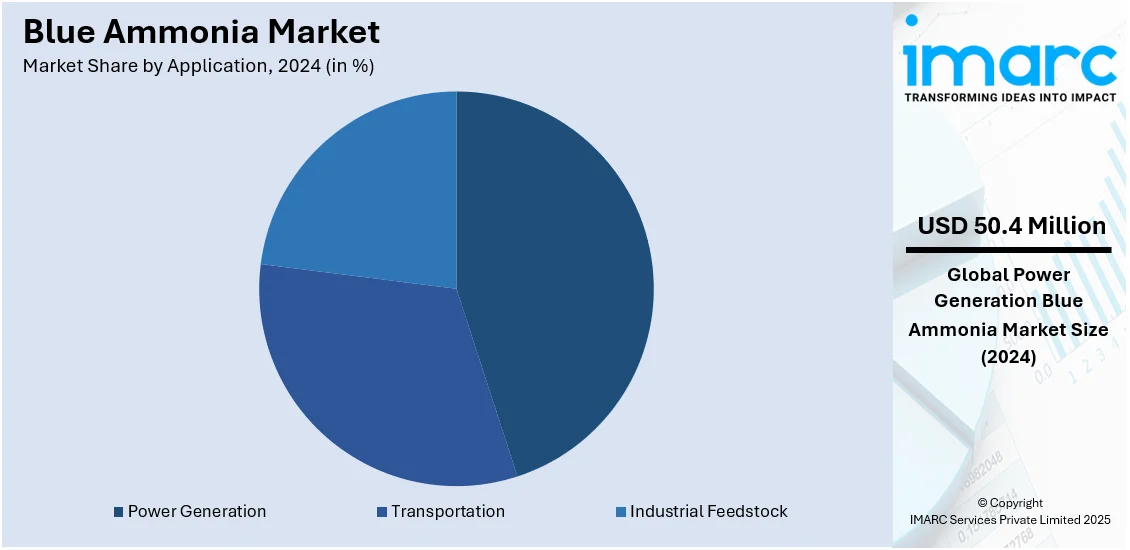

Analysis by Application:

- Transportation

- Power Generation

- Industrial Feedstock

In 2024, power generation led the market by application with 44.5% of the market share. The market is expanding as the power generation sector adopts low-carbon fuel alternatives. Blue ammonia serves as a hydrogen carrier and can be co-fired in power plants to reduce emissions. Growing demand for clean energy solutions, government decarbonization policies, and advancements in ammonia combustion technology are accelerating its adoption in power generation.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East

- Africa

In 2024, North America led the market by region, holding 42.5% of the market share. North America dominates the market due to abundant natural gas resources, advanced carbon capture infrastructure, and strong government incentives. Investments in low-carbon hydrogen production, rising demand for clean energy, and strategic partnerships with export markets further strengthen its position. The region’s commitment to industrial decarbonization accelerates the growth of blue ammonia production and adoption.

Key Regional Takeaways:

United States Blue Ammonia Market Analysis

In 2024, the United States accounted for 77.6% of the market share in North America. The U.S. blue ammonia market is advancing with a strong focus on low-carbon production and carbon capture integration. Energy and industrial sectors are accelerating the adoption of innovative process technologies to enhance efficiency and meet growing export demand. Strategic collaborations between technology providers and producers are driving investment in next-generation ammonia plants. Government incentives and policy support are further encouraging the expansion of carbon capture infrastructure, positioning the U.S. as a key player in the global shift toward clean ammonia. These initiatives reflect the country’s commitment to industrial decarbonization, ensuring long-term sustainability in ammonia production for domestic and international markets. In January 2024, KBR's blue ammonia technology was chosen by INPEX Corporation and LSB Industries for a 1.1 Million Tonnes per annum production of low-carbon ammonia and export project on the US Gulf Coast. KBR would provide technology licensing and proprietary engineering design for the plant, which aims to capture carbon emissions while maximizing yields.

Europe Blue Ammonia Market Analysis

The blue ammonia market in Europe is evolving with increased focus on large-scale supply agreements and government-backed initiatives to support low-carbon hydrogen derivatives. Competitive auctions are emerging as a mechanism to secure long-term contracts, ensuring stable supply chains for ammonia produced with carbon capture or renewable hydrogen. European demand for cleaner energy alternatives is driving investments in infrastructure that facilitate imports through key ports. With growing regulatory support and industrial adoption, international partnerships are strengthening, positioning blue ammonia as a crucial component in reducing emissions across energy-intensive sectors. In July 2024, Hintco GmbH selected Fertiglobe as the winner of the inaugural H2Global pilot auction for renewable ammonia, backed by the German government. Fertiglobe, a partnership between ADNOC and OCI, would supply up to 397,000 tons of renewable ammonia to the EU via the Port of Rotterdam between 2027 and 2033. The ammonia, produced using renewable hydrogen from Egypt Green Hydrogen, will be sold in standardized quantities through annual auctions.

Asia Pacific Blue Ammonia Market Analysis

In Australia, the blue ammonia market is progressing with increased investment in low-carbon production facilities. Companies are prioritizing large-scale project development, moving from early engineering phases to capacity expansion. With rising global demand for clean energy solutions, advanced ammonia production is gaining momentum, particularly in regions rich in natural gas and carbon capture potential. As industrial decarbonization gains priority, expanding blue ammonia capacity is becoming a key strategy to support energy security and supply cleaner alternatives. In February 2025, NH3 Clean Energy finalized the pre-front-end engineering and design (pre-FEED) phase for its WAH2 blue ammonia project in Western Australia. The company plans to expand the facility's capacity, reflecting a commitment to advancing low-carbon ammonia production.

Latin America Blue Ammonia Market Analysis

Latin America blue ammonia market is witnessing increased investment in large-scale hydrogen and ammonia projects, integrating renewable energy sources to support decarbonization. New facilities are being planned near key industrial and port regions to enhance production and export potential. With expanding low-carbon initiatives, the sector is positioning itself as a major player in global ammonia markets. In December 2024, AES Andes submitted an Environmental Impact Study for its proposed Inna project, a USD 10 Billion green hydrogen and ammonia initiative in Chile's Antofagasta region. The project aims to construct three solar farms, three wind farms, a battery energy storage system, and facilities for producing hydrogen and ammonia.

Middle East Blue Ammonia Market Analysis

The Middle East is strengthening its position as a key player in low-carbon ammonia production, with new projects integrating carbon capture technology to reduce emissions. Large-scale facilities are being developed to meet growing demand from international markets, particularly in Asia. These developments reinforce the region’s role in shaping the future of blue ammonia exports. In June 2024, Mitsui & Co., in partnership with ADNOC's TA'ZIZ, Fertiglobe, and GS Energy, commenced construction of an ammonia production facility in Al Ruwais, UAE. The plant aims to produce 1 Million Tons per year of ammonia with reduced CO₂ emissions starting in 2027.

Africa Blue Ammonia Market Analysis

Blue ammonia production in Africa is expanding with large-scale investments integrating carbon capture to reduce emissions. New facilities are enhancing fertilizer and methanol output while strengthening regional supply chains. Industrial decarbonization efforts are driving increased adoption of low-carbon ammonia solutions. In January 2025, SUISO launched a USD 1.7 Billion blue ammonia project in South Africa, integrating carbon capture to lower emissions. The facility would produce fertilizers and methanol, supporting industrial decarbonization and regional supply chains.

Competitive Landscape:

The blue ammonia market is advancing rapidly through strategic collaborations, government incentives, and R&D investments. Companies are securing agreements to expand production capacity and improve carbon capture efficiency. Governments are funding low-emission projects and offering regulatory support to accelerate adoption. Research focuses on optimizing ammonia synthesis and integrating hydrogen technologies. Partnerships between energy firms and industrial players are increasingly common, facilitating large-scale blue ammonia deployment for fuel and chemical applications.

The report provides a comprehensive analysis of the competitive landscape in the blue ammonia market with detailed profiles of all major companies, including:

- Yara International

- Saudi Arabian Oil Co.

- OCI

- CF Industries Holdings, Inc.

- QATAR FERTILISER COMPANY

- Shell

- ExxonMobil Corporation

- LSB Industries

- ITOCHU Corporation

- ADNOC Group

Latest News and Developments:

- December 2024: ExxonMobil, in partnership with Abu Dhabi's ADNOC, announced plans to commence operations of a low-carbon hydrogen and blue ammonia facility at its Baytown, Texas complex by 2029. ADNOC acquired a 35% stake in the project, which aims to produce up to 1 Billion Cubic Feet of low-carbon hydrogen daily, capturing approximately 98% of associated CO₂ emissions.

- November 2024: QatarEnergy initiated the construction of the world's largest blue ammonia plant in Mesaieed Industrial City, investing USD 1 Billion. The facility would produce 1.2 Million Tons of low-carbon ammonia annually and capture 1.5 Million Tons of CO₂ per year. Scheduled to commence production in Q2 2026, this project aligns with QatarEnergy's strategy to expand its clean energy portfolio and support global CO₂ emission reduction efforts.

- November 2024: PT Pupuk Indonesia (Persero) introduced the Green Ammonia Initiative from Aceh (GAIA) at COP29, integrating natural gas-based ammonia with renewable hydrogen. While primarily a green ammonia project, the hybrid model aligns with blue ammonia developments by reducing carbon emissions in conventional ammonia production. This initiative strengthens Indonesia's role in sustainable energy and supports its net-zero emissions target by 2060.

- August 2024: OCI Global agreed to sell its 1.1 Million Metric Tonnes per year Clean Ammonia project in Beaumont, Texas, to Woodside Energy Group Ltd for USD 2.35 Billion. OCI would oversee the construction and staffing until the facility becomes operational.

Blue Ammonia Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | Steam Methane Reforming, Autothermal Reforming, Gas Partial Oxidation |

| Applications Covered | Transportation, Power Generation, Industrial Feedstock |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East, Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Yara International, Saudi Arabian Oil Co., OCI, CF Industries Holdings, Inc., QATAR FERTILISER COMPANY, Shell, ExxonMobil Corporation, LSB Industries, ITOCHU Corporation, ADNOC Group, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the blue ammonia market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global blue ammonia market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the blue ammonia industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The blue ammonia market was valued at USD 113.26 Million in 2024.

The blue ammonia market is projected to exhibit a CAGR of 68.5% during 2025-2033, reaching a value of USD 16,604.22 Million by 2033.

Carbon neutrality goals, government incentives, rising hydrogen demand, ammonia as a fuel, carbon capture advancements, industrial decarbonization, maritime sector adoption, and fertilizer industry sustainability initiatives are driving the growth of the blue ammonia market.

North America currently dominates the blue ammonia market, accounting for a share of 42.5% in 2024 . Abundant natural gas reserves, strong carbon capture infrastructure, government incentives, rising hydrogen economy, industrial decarbonization initiatives, growing maritime fuel adoption, increasing ammonia export potential, and investments from energy giants drive North America's dominance in the blue ammonia market.

Some of the major players in the blue ammonia market include Yara International, Saudi Arabian Oil Co., OCI, CF Industries Holdings, Inc., QATAR FERTILISER COMPANY, Shell, ExxonMobil Corporation, LSB Industries, ITOCHU Corporation, ADNOC Group, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)