Blue Hydrogen Market Size, Share, Trends and Forecast by Technology, End User, and Region, 2025-2033

Blue Hydrogen Market Size and Share:

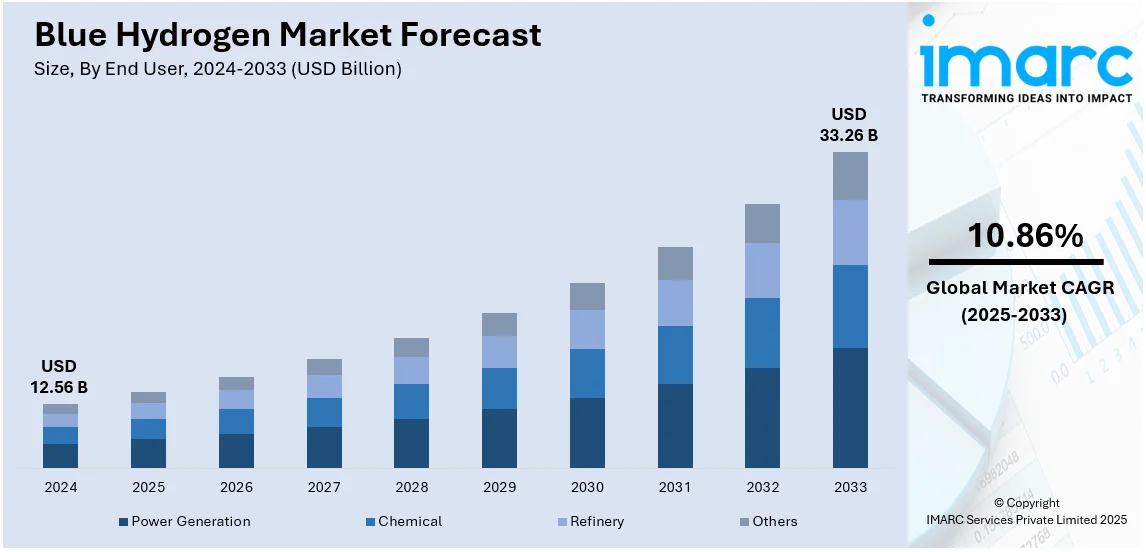

The global blue hydrogen market size was valued at USD 12.56 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 33.26 Billion by 2033, exhibiting a CAGR of 10.86% during 2025-2033. North America currently dominates the market, holding a significant market share of over 40.0% in 2024. The rising adoption of cleaner energy sources, increasing product applications in transportation and power generation, and inflating sales of hydrogen-powered fuel cell vehicles worldwide are some of the major factors augmenting the blue hydrogen market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 12.56 Billion |

|

Market Forecast in 2033

|

USD 33.26 Billion |

| Market Growth Rate 2025-2033 | 10.86% |

The global blue hydrogen market is advancing due to rising investments in carbon capture, utilization, and storage (CCUS) technologies, ensuring low-carbon hydrogen production. For instance, according to the report published by IEA on April 2024, the European Union granted over USD 1.5 Billion to CCUS projects under the Innovation Fund round and more than USD 500 Million to CO2 transport and storage projects under its Connecting Europe Facility initiative. Furthermore, growing requirements from industrial heat applications, particularly in steel and cement manufacturing, are resulting in an increased blue hydrogen market demand. Additionally, the increasing integration of blue hydrogen with ammonia production for energy exports is strengthening its commercial viability. Moreover, financial incentives from energy transition funds are accelerating project developments. In addition to this, the expansion of hydrogen pipeline infrastructure is facilitating large-scale distribution, which is also a crucial growth catalyst for the market. Also, strategic partnerships between oil and gas companies and clean energy firms are increasing project scalability, which is bolstering market growth.

The market in the United States is experiencing significant growth, driven by carbon capture advancements in depleted oil fields, which are promoting large-scale CO₂ storage. Besides this, federal tax credits under the Inflation Reduction Act are enhancing financial feasibility. Also, rising collaborations between private-sector players and government agencies are accelerating commercialization, which is an emerging blue hydrogen market trend. In line with this, increasing synergies between natural gas producers and hydrogen developers are reducing feedstock costs. Apart from this, infrastructure development grants for hydrogen production, transport and storage are fostering market expansion. For example, on January 17, 2025, the U.S. Department of Energy's Office of Clean Energy Demonstrations (OCED) announced funding for two Regional Clean Hydrogen Hubs. The Heartland Hydrogen Hub received USD 20 Million to initiate Phase 1 activities, aiming to produce clean hydrogen. The Mid-Atlantic Hydrogen Hub was awarded USD 18.8 Million for Phase 1, focusing on developing hydrogen production facilities utilizing both established and innovative electrolyzer technologies. The growing interest in hydrogen-powered long-haul trucking is driving fuel cell applications, which is also positively impacting the market.

Blue Hydrogen Market Trends:

Rising Adoption of Fuel Cell Vehicles

The growing uptake of fuel cell vehicles is one of the key drivers propelling the blue hydrogen market growth. As awareness of climate change and air pollution continues to rise, there is mounting pressure to curb greenhouse gas emissions and clean up the air. For example, in 2023, the European Union supported a package of Commission proposals to make the EU's climate, energy, transport, and tax policies greener by cutting net greenhouse gas emissions by at least 55% by 2030 compared with 1990 levels. FCVs provide an emission-free solution to conventional internal combustion engine-powered vehicles, only producing water vapor and heat as exhausts. For example, according to an article published by the U.S. Department of Energy, FCEV vehicles are hydrogen-powered and have zero harmful tailpipe emissions. Additionally, FCVs consume hydrogen as fuel, which generates an immediate demand for hydrogen. As the number of FCVs increases on the roads, so does the demand for hydrogen fuel. For example, according to statistics released by the International Energy Agency (IEA), more than 72,000 hydrogen fuel cell electric vehicles (FCEVs) were operating globally in 2022, up 40% from 2021. Blue hydrogen, which is manufactured from natural gas using carbon capture and storage (CCS) technology, can supply this demand while providing a low-carbon substitute for conventional fossil fuels. All these are significant growth-inducing factors for the market.

Growing Industrialization

As industrialization progresses, there is a growing demand for energy to power manufacturing processes, chemical production, and other industrial activities. For instance, according to an article published by the United Nations Industrial Development Organization in December 2023, the industrial sectors, which include waste management, mining, manufacturing, power, water supply, and other utilities, grew 2.3% globally. Blue hydrogen, produced from natural gas with carbon capture and storage (CCS) technology, can serve as a reliable and low-carbon energy source to meet this demand. Research indicates that blue hydrogen can achieve significant reductions in carbon dioxide equivalent (CO2-eq.) emissions, with estimates suggesting reductions ranging from 50% to 80% compared to traditional natural gas-based hydrogen production without CCS. Moreover, advancements in CCS technology and hydrogen production methods are making blue hydrogen production more efficient and cost-effective, which is enhancing the blue hydrogen market outlook. As industrialization drives demand for low-carbon energy solutions, continued innovation in CSS technology is further supporting the market expansion.

Increasing Government Initiatives

Governments across the globe are implementing policies to lower carbon emissions and encourage the use of renewable and low-carbon energy technologies. The policies tend to incorporate incentives, subsidies, and mandates to encourage the uptake of FCEVs. For example, as per an article released by the IRS, people can obtain credit of up to USD 7,500 under Internal Revenue Code Section 30D if they purchase fuel cell electric vehicles between 2023 and 2032. Besides this, governments offer funding and investment assistance for the development of the blue hydrogen market. This can be in the form of grants, loans, or public-private partnerships for financing research, demonstration projects, and infrastructure development. For example, in August 2022, the Russian government announced a plan to produce blue hydrogen locally. This approach was going to invest approximately USD 127 Million in the establishment of technology for blue hydrogen production, delivery, and storage in Russia. Equally, in December 2021, the European Parliament announced the inclusion of blue hydrogen produced from natural gas within the EU's Renewable Energy Directive and Gas Package. These drivers are having a positive impact on the value of the blue hydrogen market.

Blue Hydrogen Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global blue hydrogen market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on technology and end user.

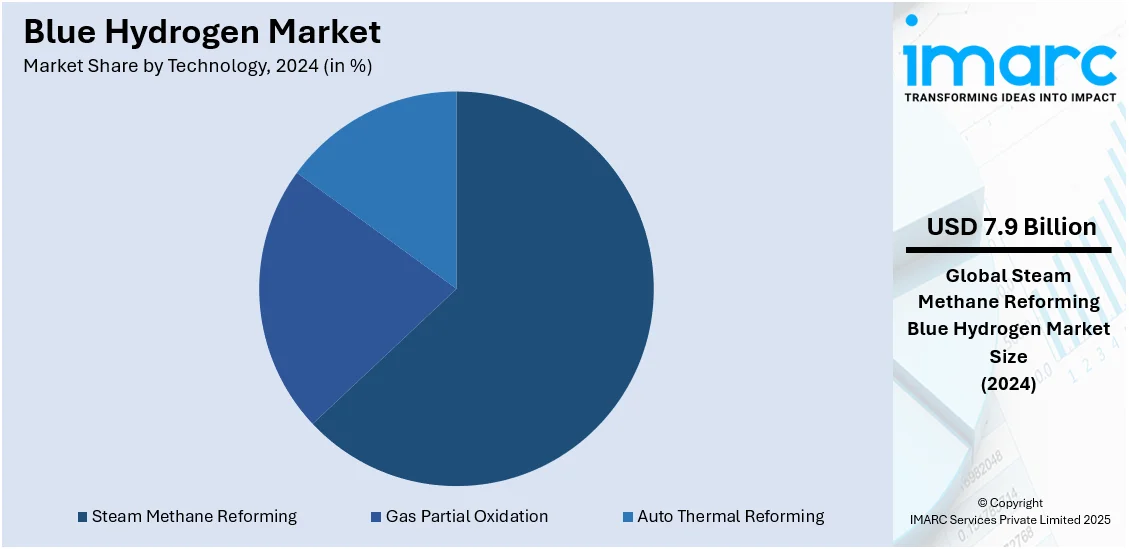

Analysis by Technology:

- Steam Methane Reforming

- Gas Partial Oxidation

- Auto Thermal Reforming

Steam methane reforming leads the market with around 62.6% of market share in 2024. Blue hydrogen is largely produced through steam methane reforming (SMR) of natural gas, which involves reacting methane (CH4) with high-temperature steam (H2O) to produce hydrogen (H2) and carbon monoxide (CO). In addition, steam methane is also used in power generation. Natural gas-fired power plants often utilize steam methane reforming to produce hydrogen, which can then be used in fuel cells for electricity generation. Moreover, governments, energy companies, and other stakeholders are investing in the development of hydrogen infrastructure, including production facilities, storage facilities, transportation networks, and end-use applications. This infrastructure development is crucial for scaling up the production and use of hydrogen, including blue hydrogen, and it drives demand for steam methane as a feedstock for hydrogen production. Rising mergers and acquisition activities are also supporting the demand for steam methane. For instance, in December 2023, PTT Global Chemical Public Company Limited (GC) signed a Memorandum of Understanding (MOU) with Mitsubishi Heavy Industries Asia Pacific Pt. Ltd. (MHI-AP) to collaborate on the technologies needed to develop a large-scale petrochemical complex to support Thailand's carbon neutrality by 2050. One of the primary goals associated with the agreement is to determine how CCS technology may be best utilized and optimized for the Steam-Methane Reforming (SMR) process.

Analysis by End User:

- Power Generation

- Chemical

- Refinery

- Others

Chemicals leads the market in 2024. The chemical industry is a major consumer of hydrogen as a feedstock for various processes. Hydrogen is used in the production of a wide range of chemicals, including ammonia, methanol, and various synthesis gases. These chemicals serve as building blocks for a plethora of products, such as fertilizers, plastics, and pharmaceuticals. Ammonia, in particular, is essential for fertilizers and emerging energy applications, while methanol is widely used in chemicals, plastics, and fuels. The industry's reliance on hydrogen-intensive processes makes the transition to blue hydrogen critical for reducing emissions while maintaining operational efficiency. Additionally, chemical manufacturers are increasingly integrating blue hydrogen into their sustainability strategies, driven by regulatory mandates and corporate carbon reduction commitments. This shift enhances the demand for large-scale blue hydrogen projects, reinforcing its role in industrial transformation. For instance, in November 2023, Air Products and Chemicals announced to build blue hydrogen plant in the Netherlands. The plant will be operational in 2026.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 40.0%. Some of the factors driving the North America blue hydrogen market included the shifting focus toward decarbonizing various industries, depleting fossil fuel resources, rising sales of fuel cell electric vehicles in the region, etc. Moreover, both federal and state governments in North America have set ambitious goals to reduce greenhouse gas emissions. Blue hydrogen, produced with carbon capture and storage (CCS) technology, offers a pathway to decarbonize sectors that are hard to electrify directly, such as heavy industry and transportation. As a result, policies aimed at reducing carbon emissions are driving investment in blue hydrogen production infrastructure. For instance, the United States has also set a goal for 100% clean electricity in 2035. Apart from this, the governments across various countries in North America are promoting FCEV, which is further proliferating the demand for blue hydrogen. For instance, in March 2021, the Canadian Minister of Natural Resources declared that USD 46,000 would be given to the Canadian Hydrogen and Fuel Cell Association (CHFCA) in order to support the promotion of the benefits of hydrogen fuel cell electric vehicles (FCEVs), which include fast refueling times that make them an excellent option for the trucking and bus industries.

Key Regional Takeaways:

United States Blue Hydrogen Market Analysis

The United States holds a substantial share of the North America blue hydrogen market with 89.60% in 2024. The blue hydrogen market in the United States is expanding rapidly, fueled by federal incentives, decarbonization goals, and rising industrial demand. The Inflation Reduction Act (IRA) of 2022 and the Department of Energy’s (DOE) Hydrogen Shot initiative are accelerating investments in low-carbon hydrogen production, making the U.S. a key player in the global hydrogen economy. For instance, in 2024, ExxonMobil partnered with Air Liquide to advance low-carbon hydrogen and ammonia production at its Baytown, Texas facility. The project will capture 98% of CO2 emissions and generate 1 billion cubic feet of hydrogen per day and 1 million tons of ammonia per year. A dependable supply chain will be ensured by Air Liquide's pipeline network, which will deliver 9,000 metric tons of oxygen and 6,500 metric tons of nitrogen every day. Furthermore, the country’s abundant natural gas reserves provide a strong foundation for blue hydrogen projects, with companies adopting carbon capture, utilization, and storage (CCUS) technologies to reduce emissions. Besides this, various key industries, such as refining, ammonia production, and steel manufacturing, are integrating blue hydrogen to meet net-zero targets, thereby positively influencing the market. Additionally, hydrogen hubs funded by the Bipartisan Infrastructure Law are enhancing production and distribution networks. Moreover, growing investment by major energy firms in large-scale blue hydrogen plants, aiming to strengthen domestic supply, is positioning the U.S. as a global leader in hydrogen exports.

Europe Blue Hydrogen Market Analysis

The blue hydrogen market in Europe is experiencing steady growth, driven by strong policy support, carbon pricing mechanisms, and a commitment to hydrogen economy development. The European Union’s (EU) Hydrogen Strategy aims to accelerate low-carbon hydrogen production, with blue hydrogen serving as a transitional solution alongside green hydrogen. The RePowerEU plan emphasizes on reducing dependence on Russian gas and expanding hydrogen infrastructure across Europe. Similarly, Germany, the United Kingdom, and the Netherlands are leading investments in CCUS-equipped hydrogen plants and dedicated hydrogen pipelines, while Norway and the UK are incorporating carbon capture technologies into offshore natural gas projects to enable low-carbon hydrogen production. Meanwhile, industrial hubs in France, Belgium, and Spain are developing hydrogen refueling stations and ammonia production, supporting decarbonization across multiple industries. For example, in February 2025, Spain secured EUR 72.7 Million in European funding under the Connecting Europe Facility (CEF) – Alternative Fuels Infrastructure Facility (AFIF) for eight projects, including 589 EV charging points (150–350 kW), 26 hydrogen refueling stations (300–700 bar), and port decarbonization initiatives. These subsidies will mobilize EUR 400 Million in investments, reinforcing Spain’s commitment to sustainable transport and renewable energy while contributing to Europe’s broader hydrogen economy development goals.

Asia Pacific Blue Hydrogen Market Analysis

The Asia Pacific market is gaining momentum due to rising energy demand, decarbonization policies, and strong government incentives in key economies such as China, Japan, South Korea, and Australia. According to an IEA report, Southeast Asia is projected to contribute 25% of global energy demand growth by 2035, second only to India, with demand surpassing the European Union’s by 2050. Electricity consumption is expected to rise 4% annually, driven by increasing air conditioning usage amid frequent heatwaves. Furthermore, Japan and South Korea have established national hydrogen roadmaps, supporting the development of blue hydrogen production facilities with CCUS technologies. China, the world’s largest hydrogen producer, is integrating blue hydrogen into its steelmaking and chemical industries, thereby impacting the market dynamics. Moreover, Australia is utilizing natural gas resources to become a major hydrogen exporter, while India is adopting hydrogen blending in refining and fertilizer production. Besides this, supportive large-scale initiatives such as HyNet in South Korea and Japan’s Hydrogen Supply Chain Initiative are further reinforcing blue hydrogen’s role in transitioning to a low-carbon economy.

Latin America Blue Hydrogen Market Analysis

Latin America's blue hydrogen market is rapidly developing, driven by the region's natural gas availability, export potential, and commitment to industrial decarbonization. According to a report by the World Economic Forum, Latin America has the potential to supply 25-33% of global hydrogen demand. The current production costs in the region range between USD 3.70 and USD 5.90 per kilogram, which is below the global average of USD 3.80 to USD 8.50 per kilogram. By 2030, Argentina and Chile aim to significantly reduce production costs to between USD 1.20 and USD 1.50 per kilogram, positioning them as some of the most cost-effective hydrogen producers globally. Brazil, for its part, is exploring the use of hydrogen in sectors such as petrochemicals and transport. Meanwhile, Chile, already a leader in green hydrogen, views blue hydrogen as a transitional technology.

Middle East and Africa Blue Hydrogen Market Analysis

The Middle East and Africa (MEA) region is rapidly emerging as a blue hydrogen hub, leveraging abundant natural gas reserves and strategic investments in hydrogen exports. The UAE plans to invest USD 163 Billion in clean energy by 2050, with its National Hydrogen Strategy focusing on low-emission industries, climate neutrality, and global leadership by 2031. Saudi Arabia, the UAE, and Oman are developing large-scale blue hydrogen projects with CCUS technologies, with Saudi Aramco and ADNOC leading partnerships to position the Gulf as a major hydrogen exporter. Furthermore, Oman’s ‘Blue Horizons’ project, led by Shell, will drive regional production. In Africa, Algeria and South Africa are exploring blue hydrogen for domestic industries and export markets. Besides this, investment flows from Europe and Asia are increasing as international energy players secure long-term hydrogen supply agreements, reinforcing MEA’s pivotal role in the global hydrogen economy.

Competitive Landscape:

The blue hydrogen market is growing more competitive as governments urge low-carbon energy alternatives. Major players are investing in big projects, using carbon capture, utilization, and storage (CCUS) to reduce emissions. Industry stakeholders are entering into strategic alliances with energy companies, industrial gas producers, and infrastructure developers to build production capacity and distribution networks. Ongoing technological improvements in steam methane reforming (SMR) and auto thermal reforming (ATR) are enhancing efficiency and lowering costs, further escalating competition in the market. Furthermore, policy incentives, including subsidies and tax credits, are impacting market positioning, with businesses vying to access government-sponsored funding for ventures. The market is also witnessing competition from competing hydrogen production processes, especially green hydrogen, and is compelling blue hydrogen producers to cut costs. In addition, regional considerations such as the availability of natural gas and CCUS infrastructure are key in establishing competitive differentials in various markets.

The report provides a comprehensive analysis of the competitive landscape in the blue hydrogen market with detailed profiles of all major companies, including:

- Air Liquide S.A

- Air Products and Chemicals Inc.

- Aker Solutions ASA

- Aquaterra Energy Ltd.

- Bp P.L.C.

- Dastur Energy

- ExxonMobil Corporation

- INEOS Group Limited

- Johnson Matthey

- Linde plc

- Saudi Arabian Oil Co.

- Shell plc

- Technip Energies N.V.

- Uniper SE

Latest News and Developments:

- August 2024: Shell chose Wood to supply pre-FEED services for the "Blue Horizons" project in Oman. The country’s first large-scale blue hydrogen and ammonia facility. The project includes CO₂ capture, a 200 km pipeline, and marine storage. Completion is expected in 2025, supporting Oman’s zero-carbon fuel adoption.

- July 2024: White & Case LLP advised Aramco on acquiring a 50% share in Blue Hydrogen Industrial Gases Company (BHIG), an Air Products Qudra subsidiary. The deal supports low-carbon hydrogen production in Jubail, Saudi Arabia, advancing Aramco’s decarbonization and new energy portfolio.

- July 2024: Aon and Zurich Insurance Group introduced a clean hydrogen insurance program that covers green and blue hydrogen projects with up to $250 million in capital expenditures. The facility offers comprehensive risk coverage, including construction, business interruption, and carbon capture technologies, supporting the net-zero transition and sustainable energy development.

- May 2024: Equinor, Centrica, and SSE Thermal collaborated for a number of low-carbon hydrogen projects along the Humber's north bank. Equinor and Centrica proposed a blue hydrogen production project.

- April 2024: Sulzer announced to supply two customized hydraulic power recovery turbines in order to support the blue hydrogen plant in Texas, USA, which would be operational in 2025.

Blue Hydrogen Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | Steam Methane Reforming, Gas Partial Oxidation, Auto Thermal Reforming |

| End Users Covered | Power Generation, Chemical, Refinery, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Air Liquide S.A, Air Products and Chemicals Inc., Aker Solutions ASA, Aquaterra Energy Ltd., Bp P.L.C., Dastur Energy, ExxonMobil Corporation, INEOS Group Limited, Johnson Matthey, Linde plc, Saudi Arabian Oil Co., Shell plc, Technip Energies N.V., Uniper SE, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the blue hydrogen market from 2019-2033.

- The blue hydrogen market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the blue hydrogen industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The blue hydrogen market was valued at USD 12.56 Billion in 2024.

The blue hydrogen market is projected to exhibit a CAGR of 10.86% during 2025-2033, reaching a value of USD 33.26 Billion by 2033.

The market is driven by increasing demand for low-carbon hydrogen in industries like refining, chemicals, and power generation. Additionally, favorable government incentives, advancements in carbon capture, and rising investments in hydrogen infrastructure support the growth of the market. Natural gas availability and policies promoting carbon neutrality further boost adoption. Also, strategic collaborations between energy companies for large-scale blue hydrogen projects facilitate market expansion.

North America currently dominates the blue hydrogen market, accounting for a share of 40.0% in 2024. The dominance is fueled by supportive government policies, significant carbon capture and storage (CCS) projects, and abundant natural gas reserves. Moreover, investments from energy giants and initiatives like the U.S. Hydrogen Earthshot further propel regional market growth.

Some of the major players in the blue hydrogen market include Air Liquide S.A, Air Products and Chemicals Inc., Aker Solutions ASA, Aquaterra Energy Ltd., Bp P.L.C., Dastur Energy, ExxonMobil Corporation, INEOS Group Limited, Johnson Matthey, Linde plc, Saudi Arabian Oil Co., Shell plc, Technip Energies N.V., and Uniper SE, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)