Botulinum Toxin Market Size, Share, Trends and Forecast by Type, Application, End User, and Region, 2026-2034

Botulinum Toxin Market Size and Share:

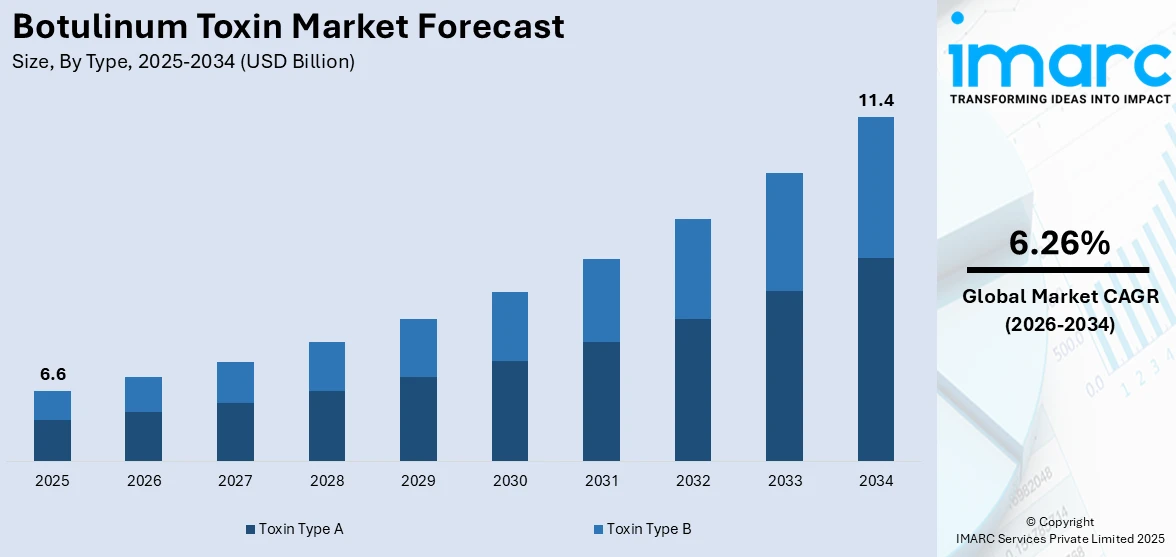

The global botulinum toxin market size was valued at USD 6.6 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 11.4 Billion by 2034, exhibiting a CAGR of 6.26% from 2026-2034. North America currently dominates the market, holding a market share of 66.34% in 2025. The rising demand for non-surgical targeted solutions that help manage symptoms of muscle dystrophy is fueling the market growth in the region. Apart from this, the ongoing clinical research activities are contributing to the expansion of the botulinum toxin market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 6.6 Billion |

| Market Forecast in 2034 | USD 11.4 Billion |

| Market Growth Rate (2026-2034) | 6.26% |

At present, people are choosing non-surgical cosmetic treatments to reduce wrinkles and improve appearance, thereby driving the demand for botulinum toxin. Besides this, there is a rise in the awareness and acceptance of aesthetic procedures among both men and women. Botulinum toxin also finds more utilization in treating medical conditions like migraines, muscle stiffness, and excessive sweating. Apart from this, as the population is aging, the need for both cosmetic and therapeutic uses is increasing. Inflating disposable incomes, especially in developing countries, are making these treatments more affordable. Improved formulations and easier access to treatment options are also supporting the market growth.

To get more information on this market Request Sample

The United States has emerged as a major region in the botulinum toxin market owing to many factors. The increasing demand for cosmetic treatments is offering a favorable botulinum toxin market outlook. Many people are choosing non-invasive options like Botox to reduce wrinkles and fine lines. A strong focus on appearance and beauty in American culture is supporting this trend. The market is also expanding because botulinum toxin treats medical conditions, such as migraines, muscle spasms, and excessive sweating, which are highly prevalent. As per industry reports, in the United States, over 30 Million individuals experienced one or more migraine headaches in 2024. Around 75% of individuals who suffered from migraines were female. An aging population is further creating the need for both cosmetic and therapeutic uses.

Botulinum Toxin Market Trends:

Growing incidence of chronic diseases

The increasing incidence of chronic diseases is fueling the market growth. Conditions, such as muscle dystrophy, muscle spasticity, cervical dystonia, and overactive bladder, are becoming more common, driving the demand for botulinum toxin. According to the NIH, as of February 2024, muscular dystrophy included a collection of genetic conditions marked by advancing muscle weakness and degeneration, with an estimated worldwide occurrence of about 1 in 5,000 people. Botulinum toxin offers a non-surgical targeted solution that helps manage symptoms and improve quality of life. As more doctors are recognizing its effectiveness, they are recommending botulinum toxin therapy for different chronic conditions. Patients also prefer treatments that offer relief with fewer side effects compared to long-term medications. Clinical research continues to expand the approved uses of botulinum toxin, leading to wider adoption in healthcare settings, thereby influencing the botulinum toxin market size.

Increasing applications in cosmetics

Rising applications in cosmetics are positively influencing the market. Botulinum toxin is utilized for eyebrow lifting, jawline slimming, treating gummy smiles, and reducing neck bands. As people are seeking non-invasive and quick cosmetic solutions, the demand for botulinum toxin treatments is increasing. Clinics and beauty centers offer new procedures that employ small doses for subtle and natural-looking results, attracting a wider range of customers. Social media and beauty trends are also influencing people to try cosmetic enhancements. As cosmetic technology is advancing, innovative uses continue to emerge. This constant expansion of cosmetic applications keeps the market dynamic. According to the IMARC Group, the global cosmetics market is set to attain USD 629.7 Billion by 2033, showing a CAGR of 4.6% during 2025-2033.

Rising aging population

Increasing aging population is impelling the botulinum toxin market growth. As per the WHO, by the year 2030, 1 in every 6 individuals will be 60 years old or older. As people age, they develop wrinkles, fine lines, and sagging skin, leading many to seek cosmetic solutions. Botulinum toxin offers a simple and non-surgical way to achieve a younger and smoother appearance, making it very popular among older adults. Many individuals also choose botulinum toxin treatments to maintain a youthful and refreshed look for longer periods. In addition, the aging population often faces medical issues like muscle stiffness, chronic migraines, and spasms, which botulinum toxin can effectively treat. As awareness is growing about both cosmetic and therapeutic benefits, older adults are turning to this treatment. Healthcare providers and cosmetic clinics are promoting these solutions, further supporting the market growth.

Botulinum Toxin Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global botulinum toxin market, along with forecast at the global, regional, and country levels from 2026-2034. The market has been categorized based on type, application, and end user.

Analysis by Type:

- Toxin Type A

- Toxin Type B

Toxin type A held 94.7% of the market share in 2025. It is the most widely used and studied segment. It shows strong effectiveness in both cosmetic and medical treatments, making it a preferred choice for doctors and patients. Toxin type A helps reduce wrinkles, fine lines, and facial folds with quick results and minimal side effects. It is also approved for various therapeutic uses, such as treating migraines, muscle stiffness, and eye disorders. Its long-lasting effects minimize the need for frequent treatments, which adds to its popularity. Many well-known brands like Botox employ type A, which increases trust and recognition among users. In addition, the availability of skilled professionals trained in type A injections is supporting the market growth. Regulatory approvals and high success rates in clinical studies also aid in maintaining its leading position. As per the botulinum toxin market forecast, with strong demand in both aesthetics and healthcare, toxin type A continues to dominate the market based on type.

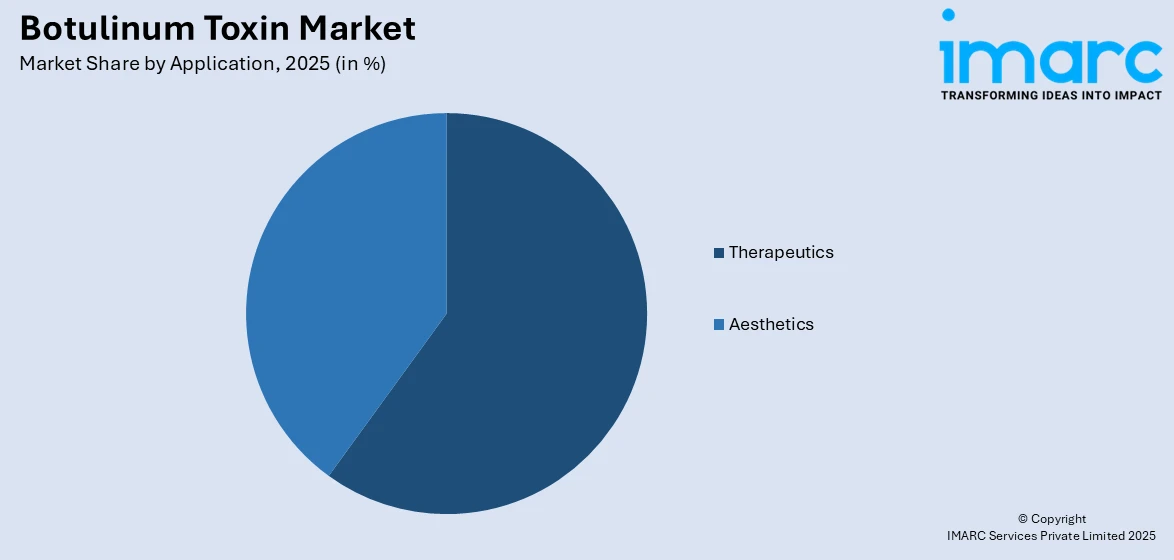

Analysis by Application:

Access the comprehensive market breakdown Request Sample

- Therapeutics

- Aesthetics

Therapeutics account for 43.0% of the market share. It holds dominance because of the wide and growing use of botulinum toxin in treating various medical conditions. Botulinum toxin is approved for several health issues, such as chronic migraines, muscle spasms, cervical dystonia, overactive bladder, and excessive sweating. These conditions affect many people, driving strong demand for effective therapeutic treatment options. Botulinum toxin offers relief with fewer side effects and less invasive procedures compared to surgery and long-term medication. As awareness is increasing, patients and doctors are choosing this treatment for its safety and effectiveness, which is influencing the botulinum toxin market size positively. Ongoing research continues to find new therapeutic uses, further influencing the market positively. The aging population also adds to the demand, as older adults often face muscle and nerve-related conditions. Insurance coverage and support from healthcare systems make therapeutic solutions more accessible.

Analysis by End User:

- Hospitals and Clinics

- Dermatology Clinics

- Spas and Cosmetic Centers

Hospitals and clinics hold 54.9% of the market share. They provide professional, safe, and reliable treatment options for both cosmetic and therapeutic purposes. These healthcare settings have qualified doctors and specialists who are trained to administer botulinum toxin injections properly. Hospitals and clinics offer a controlled environment where patients can receive medical assessments, ensuring the treatments are suitable for their individual needs. With the growing demand for botulinum toxin for conditions like chronic migraines, muscle disorders, and aesthetic treatments, hospitals and clinics are the primary locations where these services are offered. They also have the necessary equipment, technology, and resources to handle potential complications. Additionally, healthcare institutions are often more trusted by patients when it comes to medical procedures. The presence of insurance coverage in hospitals and clinics is making the treatment more accessible to a larger number of people, further strengthening their dominant position in the market.

Regional Analysis:

To get more information on the regional analysis of this market Request Sample

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America, accounting for a share of 66.34%, enjoys the leading position in the market. The region has a strong demand for both cosmetic and therapeutic botulinum toxin treatments, driven by the rising focus on aesthetics and wellness. In North America, people are employing botulinum toxin for anti-aging purposes, such as reducing wrinkles and fine lines. The growing acceptance of non-invasive cosmetic procedures is supporting this trend. Additionally, North America has a large population of patients seeking treatment for medical conditions like chronic migraines, muscle disorders, and excessive sweating, which is driving the demand for botulinum toxin. The presence of advanced healthcare infrastructure, skilled professionals, and well-established clinics is also contributing to the market growth. Regulatory bodies in North America have approved several botulinum toxin products, ensuring safety and quality. High disposable incomes and widespread insurance coverage in the United States and Canada is further propelling the market growth. As per industry reports, in Canada, disposable incomes increased to 7.4% in 2024, up from 5.3% in 2023.

Key Regional Takeaways:

United States Botulinum Toxin Market Analysis

The United States holds 90.60% of the market share in North America. The country is witnessing increasing botulinum toxin adoption due to the growing number of dermatology clinics that offer treatments for various dermatological conditions. For instance, in 2024, there were around 4,965 dermatology businesses in the United States, equating to a rise of 0.8% from 2023. The demand is significantly driven by the effectiveness of botulinum toxin in managing excessive smooth muscle activity, irregular gland function, and hyperhidrosis. Dermatology clinics are integrating botulinum toxin into their treatment protocols to address these conditions, contributing to broader clinical acceptance. Patients seek non-invasive therapeutic options, making dermatology clinics a central point for cosmetic and medical applications. Moreover, advancements in dermatological procedures and increasing awareness among people about minimally invasive options are further supporting botulinum toxin utilization. As dermatological conditions continue to be widely diagnosed, dermatology clinics serve as an essential channel for treatment, enhancing the growth trajectory of botulinum toxin employment across clinical and cosmetic domains in the region.

Europe Botulinum Toxin Market Analysis

Europe is experiencing market expansion, driven by rising elderly population and their wish to maintain youthful and healthy skin. According to the WHO, the number of individuals aged 60 and above were rapidly increasing in the WHO European Region. In 2021, the count was 215 Million. By 2030, it is expected to reach 247 Million, and by 2050, it will surpass 300 Million. Aging demographics are turning to aesthetic procedures to maintain a youthful appearance, with botulinum toxin serving as a prominent choice for wrinkle reduction and facial rejuvenation. The demand for non-invasive cosmetic treatments is on the rise, aligning with the expectations of older adults seeking long-lasting skincare solutions. With the prevalence of age-related skin changes, the cosmetic industry is tailoring offerings to meet geriatric needs. Botulinum toxin procedures offer efficient and low-downtime outcomes, making them highly attractive for this age group. The desire for healthy skin remains a primary motivator, leading to ongoing interest in botulinum toxin applications across European aesthetic markets, particularly in age-focused cosmetic care.

Asia-Pacific Botulinum Toxin Market Analysis

The Asia-Pacific region is witnessing increasing botulinum toxin usage due to the rapid expansion of spas and cosmetic centers that offer aesthetic enhancement services. For instance, there were around 993 spas in Delhi, as of January 2025. Spas and cosmetic centers are leveraging botulinum toxin treatments to address fine lines, wrinkles, and facial contouring demands among the growing beauty-conscious population. The popularity of non-surgical cosmetic interventions is broadening across urban and semi-urban zones, with spas and cosmetic centers becoming key destinations for routine aesthetic procedures. With rising disposable incomes and increasing influence of beauty standards, the role of spas and cosmetic centers has intensified in enhancing botulinum toxin penetration. These centers provide accessible and repeatable treatments, aligning with the population’s evolving preferences for rejuvenation therapies.

Latin America Botulinum Toxin Market Analysis

Latin America is demonstrating high employment of botulinum toxin, owing to the rise in the occurrence and identification of long-term and short-term illnesses. Healthcare providers are integrating botulinum toxin into broader treatment plans to manage conditions associated with muscular disorders, pain, and neurological symptoms. As awareness and accessibility to healthcare are improving, chronic and acute disease management is evolving with the inclusion of supportive therapies like botulinum toxin. The prevalence of such diseases is driving the demand for alternative therapeutic modalities, strengthening the role of botulinum toxin across diverse clinical settings. Moreover, the rising trend of influencer marketing is encouraging people to employ non-invasive cosmetic options. As per industry reports, influencer marketing in Latin America increased by 12.6% in 2024.

Middle East and Africa Botulinum Toxin Market Analysis

The Middle East and Africa region is advancing in botulinum toxin application due to the rise of the real estate sector, which is supporting the establishment of hospitals and clinics. According to the Dubai Healthcare City Authority report, Dubai's healthcare sector saw rapid growth, with 55,208 licensed professionals and 4,482 private medical facilities in 2022. The development of modern healthcare infrastructure, particularly hospitals and clinics, has increased access to cosmetic and therapeutic treatments. With broadening healthcare offerings, botulinum toxin is becoming more available across various clinical services. The real estate sector’s contribution to medical facility expansion plays a critical role in strengthening regional treatment capabilities and promoting wider adoption of botulinum toxin.

Competitive Landscape:

Key players are creating enhanced formulations to meet the high demand. They are wagering on research and development (R&D) activities to refine product safety, effectiveness, and new uses. These companies are launching updated versions of products and expanding their item lines to cater to the evolving preferences. They also focus on strong marketing strategies to raise awareness among users and healthcare providers. Training programs for professionals help ensure safe and proper utilization of the products. Key players work on gaining approvals from regulatory bodies, which allows them to enter new markets and reach more customers. Strategic partnerships, mergers, and global expansion efforts are also supporting the market growth. By maintaining high quality, spending on innovations, and educating users, major companies aid in shaping the market and keeping it competitive. For instance, in January 2025, Hugel Inc., a well-known medical aesthetics firm from South Korea, obtained authorization from the UAE Ministry of Health and Prevention for its botulinum toxin product, Botulax. Offered in 50IU, 100IU, and 200IU doses, Botulax was authorized for five uses, encompassing aesthetic procedures like crow's feet and glabellar lines, along with therapeutic applications, such as eyelid spasms and muscle spasticity, following a stroke.

The report provides a comprehensive analysis of the competitive landscape in the botulinum toxin market with detailed profiles of all major companies, including:

- AbbVie Inc.

- Eisai Co. Ltd

- Evolus Inc

- Galderma SA

- HUGEL Inc.

- Ipsen Group

- Medytox Inc.

- Merz Pharma GmbH & Co. KGaA

- Metabiologics Inc.

- Revance Therapeutics Inc.

Latest News and Developments:

- April 2025: CKD BiO introduced its botulinum toxin product, TM-Bus, following approval from South Korea's Ministry of Food and Drug Safety. The product, designed to enhance moderate to severe glabellar lines, was created by CKD BiO and Chong Kun Dang Holdings. Botulinum toxin, a protein sourced from the Clostridium botulinum bacteria, was recognized for its ability to smooth wrinkles.

- March 2025: Hugel Inc. and Benev Company Inc. revealed the complete US commercialization of Letybo (letibotulinumtoxinA-wlbg), an FDA-approved botulinum toxin type A item for addressing moderate-to-severe glabellar (frown) lines in adults.

- February 2025: Daewoong Pharmaceutical unveiled its high-purity botulinum toxin product, NABOTA, in Saudi Arabia, following approval from the Saudi Food and Drug Authority. NABOTA, produced with HI-PURE™ Technology, was likewise acknowledged by the FDA, EMA, and Health Canada.

Botulinum Toxin Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Toxin Type A, Toxin Type B |

| Applications Covered | Therapeutics, Aesthetics |

| End Users Covered | Hospitals and Clinics, Dermatology Clinics, Spas and Cosmetic Centers |

| Regions Covered | North America, Asia-Pacific, Europe, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, China, Japan, India, South Korea, Australia, Indonesia, Germany, France, United Kingdom, Italy, Spain, Russia, Brazil, Mexico |

| Companies Covered | AbbVie Inc., Eisai Co. Ltd, Evolus Inc, Galderma SA, HUGEL Inc., Ipsen Group, Medytox Inc., Merz Pharma GmbH & Co. KGaA, Metabiologics Inc., Revance Therapeutics Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the botulinum toxin market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global botulinum toxin market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the botulinum toxin industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The botulinum toxin market was valued at USD 6.6 Billion in 2025.

The botulinum toxin market is projected to exhibit a CAGR of 6.26% during 2026-2034, reaching a value of USD 11.4 Billion by 2034.

The growing awareness and acceptance of aesthetic enhancements across different age groups and regions is fueling the market growth. Additionally, the expanding applications of botulinum toxin in therapeutic areas, such as treating chronic migraines, muscle spasms, overactive bladder, and excessive sweating, are positively influencing the market. Technological advancements, improved product formulations, and increasing approvals by regulatory authorities are also supporting the market growth.

North America currently dominates the botulinum toxin market, accounting for a share of 66.34% in 2025, driven by the high demand for cosmetic and therapeutic treatments, advanced healthcare infrastructure, presence of skilled professionals, and strong regulatory support. The region also has high disposable incomes and widespread acceptance of non-invasive procedures.

Some of the major players in the botulinum toxin market include AbbVie Inc., Eisai Co. Ltd, Evolus Inc, Galderma SA, HUGEL Inc., Ipsen Group, Medytox Inc., Merz Pharma GmbH & Co. KGaA, Metabiologics Inc. Revance Therapeutics Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)