Brazil Banking Software Market Size, Share, Trends, and Forecast by Component, Deployment Mode, End User, and Region, 2026-2034

Brazil Banking Software Market Overview:

The Brazil banking software market size reached USD 332.4 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 992.3 Million by 2034, exhibiting a growth rate (CAGR) of 12.92% during 2026-2034. The market is primarily driven by the increasing implementation of digital transformation initiatives, higher adoption of open banking, growing mobile banking usage among consumers, regulatory compliance requirements, and the rapid expansion of the fintech ecosystem in the country.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 332.4 Million |

| Market Forecast in 2034 | USD 992.3 Million |

| Market Growth Rate (2026-2034) | 12.92% |

Brazil Banking Software Market Trends:

Expansion of Fintech Ecosystem

Brazil has become a popular center for fintech innovation, resulting in a dynamic change in the traditional banking sector. This growth of the fintech ecosystem is greatly influencing the delivery and consumption of financial services. Traditional financial institutions are acknowledging the importance of partnering with fintech firms to remain competitive and stay relevant in today's continually changing landscape. Traditional banks are inspired to integrate similar technologies as fintech startups introduce creative solutions to meet individual customer requirements. This phenomenon is fueling the need for sophisticated banking software that can connect with different fintech solutions. This software allows banks to expand the services they offer, including payment processing and personal finance management, without having to invest in extensive internal development. This partnership enables banks to improve their range of services and grant clients with smooth access to both conventional and cutting-edge financial products. Moreover, the growth of the fintech industry is encouraging conventional banks to embrace agile approaches in their practices. For instance, as per industry reports, Brazil's fintech landscape is steadily growing, with more than 1500 startups provided fintech services, mainly encompassing online lending, investment platforms, or digital payment services. This allows them to quickly meet market needs and customer choices.

Regulatory Compliance Requirements

The regulatory environment for banks in Brazil is growing more intricate, as the government focuses on adherence to guarantee consumer protection and financial stability. Financial establishments must comply with strict frameworks related to data protection, consumer rights, and anti-money laundering (AML). For instance, as per industry reports, federal agencies across Brazil announced the initiation of 257 Administrative Enforcement Proceedings, with 224 actively ongoing during 2024. Most cases encompassed contract fraud (63), bid fraud (91), and bribery (73). As a result, banks are using specialized banking software to efficiently comply with regulations and overcome these challenges. It is crucial for banks to implement software solutions that aid in regulatory compliance to prevent penalties and damage to their reputation. An example would be strong compliance management systems that can track transactions live, identifying any potentially suspicious behavior for additional review. Banks are making investments in training programs for their employees to guarantee they grasp the significance of compliance and know how to efficiently use the software. This comprehensive method makes sure the organization not only has the correct tools but also fosters a culture of following rules. Banking institutions need software that can adjust to changing regulations to stay compliant and earn customer trust and loyalty.

Brazil Banking Software Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on component, deployment mode, and end user.

Component Insights:

- Solution

- Service

The report has provided a detailed breakup and analysis of the market based on the component. This includes solution and service.

Deployment Mode Insights:

- On-Premises

- Cloud

A detailed breakup and analysis of the market based on the deployment mode have also been provided in the report. This includes on-premises and cloud.

End User Insights:

- Banks

- Financial Institutions

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes banks and financial institutions.

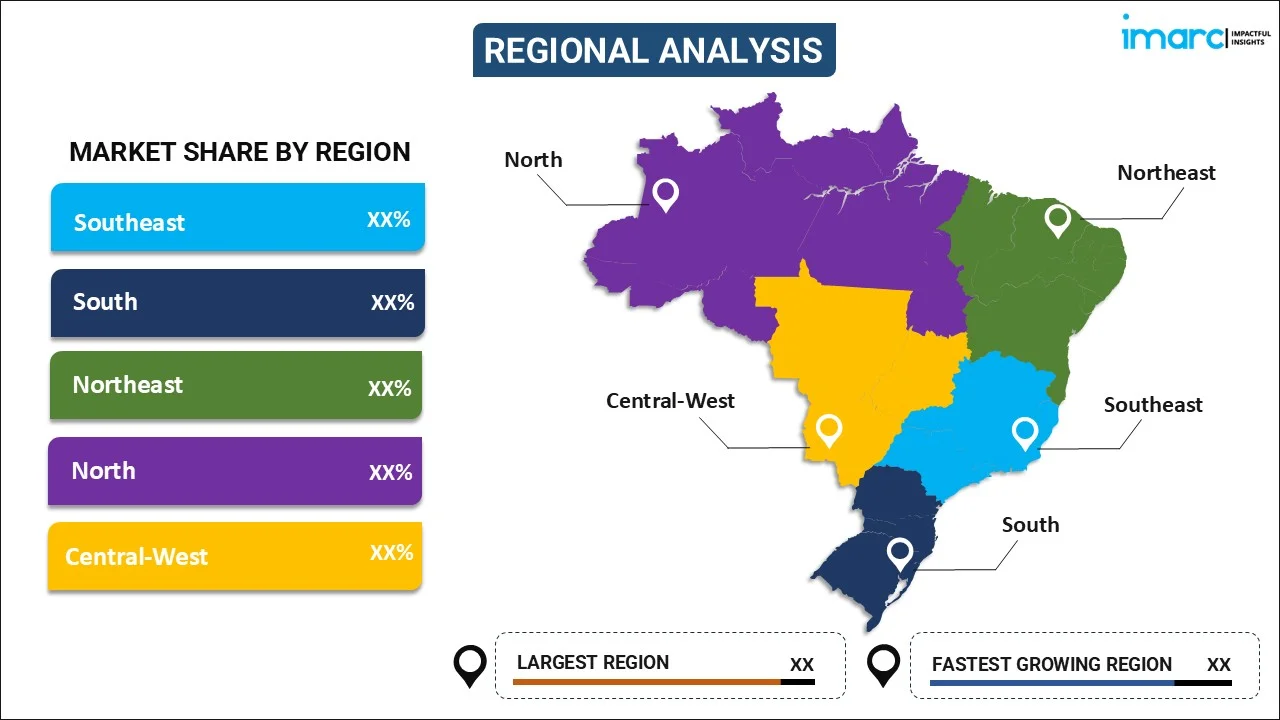

Regional Insights:

- Southeast

- South

- Northeast

- North

- Central-West

The report has also provided a comprehensive analysis of all the major regional markets, which include Southeast, South, Northeast, North, and Central-West.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Brazil Banking Software Market News:

- On July 17, 2024, Matera, a noted Brazilian financial software company, secured a $100 million investment from Warburg Pincus to fuel its expansion into North America and develop new banking software solutions. The company's expertise with Brazil’s Pix system, which accounts for over 40% of the country’s electronic transactions, positions it as a key player in Brazil's digital banking sector. This investment underscores Brazil’s prominence in payment infrastructure and Matera’s plan to bring this innovation to the North American market.

- On May 7, 2024, Brazilian payment company Ebanx announced its expansion into India through a partnership with Yes Bank. Ebanx aims to provide cross-border payment infrastructure for global brands, allowing Indian consumers to make payments using local methods such as UPI and RuPay. Ebanx, known for its success with Brazil's Pix system, plans to replicate its achievements in India, leveraging its experience in developing markets.

Brazil Banking Software Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Solution, Service |

| Deployment Modes Covered | On-Premises, Cloud |

| End Users Covered | Banks, Financial Institutions |

| Regions Covered | Southeast, South, Northeast, North, Central-West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Brazil banking software market performed so far and how will it perform in the coming years?

- What is the breakup of the Brazil banking software market on the basis of component?

- What is the breakup of the Brazil banking software market on the basis of deployment mode?

- What is the breakup of the Brazil banking software market on the basis of end user?

- What is the breakup of the Brazil banking software market on the basis of region?

- What are the various stages in the value chain of the Brazil banking software market?

- What are the key driving factors and challenges in the Brazil banking software market?

- What is the structure of the Brazil banking software market and who are the key players?

- What is the degree of competition in the Brazil banking software market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Brazil banking software market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Brazil banking software market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Brazil banking software industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)