Brazil Beauty and Personal Care Products Market Report by Product (Skincare, Haircare, Oral care, Makeup & Color Cosmetics, Deodorants and Fragrances, and Others), Pricing (Mass, Premium), Ingredient (Natural, Organic, and Others), Distribution Channel (Supermarkets and Hypermarkets, Specialty Stores, Pharmacies, Online, and Others) 2025-2033

Brazil Beauty and Personal Care Products Market Summary:

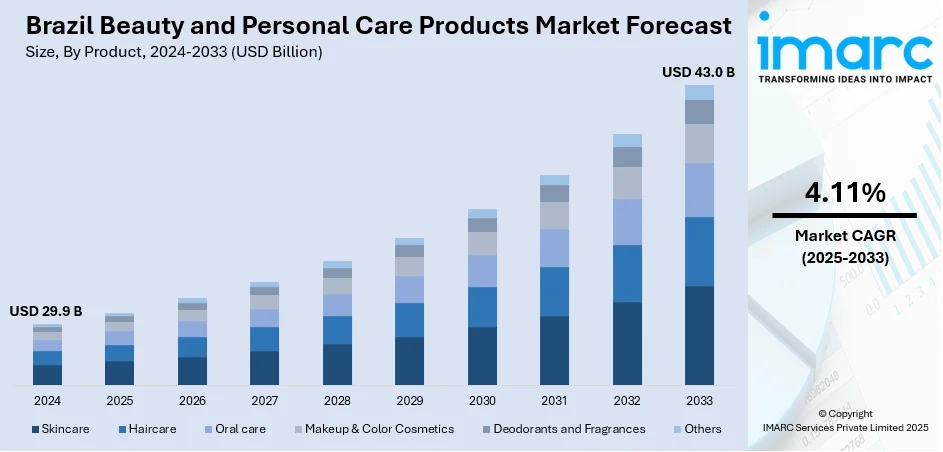

The Brazil beauty and personal care products market size reached USD 29.9 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 43.0 Billion by 2033, exhibiting a growth rate (CAGR) of 4.11% during 2025-2033. The increasing awareness about personal grooming and hygiene, rising consumer preference for natural and organic ingredients in beauty, haircare, and skincare products as well as the rapid growth of e-commerce platforms are among the key factors driving the market growth. According to IQAir, cities like Brasilia, Rio Claro, Osasco, and Sao Jose do Rio Preto face high pollution levels, further driving demand for protective and clean beauty products as consumers become more conscious of skincare and health impacts linked to air quality.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033 |

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 29.9 Billion |

| Market Forecast in 2033 | USD 43.0 Billion |

| Market Growth Rate (2025-2033) | 4.11% |

Beauty and personal care products encompass a variety of products, ranging from skincare and cosmetics to haircare and personal hygiene products. Skincare products, including cleansers, moisturizers, and serums, ensure that the skin remains healthy, while cosmetics products such as foundation, lipstick, and eyeliner improve one's outlook. Haircare products, such as shampoos, conditioners, and styling products, are important for ensuring hair health. Personal care products, ranging from soaps, deodorants, and oral hygiene products, also ensure cleanliness. The market for beauty and personal care products is driven by factors like changing consumer preferences, growing awareness of self-care, skin cycling, and technological advancements that lead to innovative formulations catering to various skin and hair types.

To get more information on this market, Request Sample

In Brazil, growing health consciousness regarding personal cleanliness and grooming has created a surge in demand for such products. As pollution levels are on the rise in all the major cities of Brasilia, Rio Claro, Osasco, and Sao Jose do Rio Preto, there has been an increasing need for protective skincare trends and haircare treatments to beat environmental damage. As listed by IQAir, these cities are some of the most polluted in Brazil, highlighting the importance of products that shield the skin and hair from damaging pollutants. The natural beauty and organic beauty trend is in full swing, spurred by both concerns over skin health and environmental stewardship. The "masstige" segment has arisen, where customers want low-cost products with the premium benefits of high-end products, like anti-aging and moisturizing, without the premium price tag. Also, sustained product innovation in the nation is driving growth as companies address Brazil's multi-faceted consumer requirements.

Brazil Beauty and Personal Care Products Market Trends/Drivers:

Growing Consumer Awareness About Personal Grooming and Hygiene

The increasing awareness among Brazilian consumers about trending skin care products along with personal grooming and hygiene is a major driving force behind the growth of the beauty and personal care products market. As the population becomes more conscious of their appearance, health, and overall well-being, there is a rise in demand for a diverse range of products catering to skincare, hair care, makeup, and more. The growing desire to present oneself in the best possible manner has led to the widespread adoption of beauty and personal care products that enhance personal aesthetics and maintain hygiene. This trend is further fueled by changing lifestyles of individuals, rapid urbanization, and rising exposure to global beauty standards through social media and digital platforms. As consumers seek to make positive impressions and invest in self-care routines, the demand continues to escalate, thus supporting the market growth.

Ongoing Shift toward Natural, Organic, and Vegan Products

The Brazilian market for personal care products and beauty is seeing a discernible move towards organic, natural, and vegan products as consumers increasingly prefer sustainable, environmentally friendly, and ethical options. Buyers are becoming more and more picky about ingredients used in their haircare and skincare products, looking for products that reflect their environment-friendly and health-conscious values. Manufacturers are countering with formulations using natural ingredients, eschewing toxic chemicals, and employing sustainable packaging. This is added to by global trend towards conscious consumerism, where consumers are inclined to choose products with the least environmental impact. Another increasing demand is for vegan cosmetics appealing to the ethical consumer who steers clear of products using animals as a source. Clean beauty that emphasizes transparency and non-toxic ingredients is also on the rise in Brazil. As more consumers adopt vegan and clean beauty options, the market transforms with companies highlighting cruelty-free and plant-based products that align with both personal health and environmental stewardship. This is playing a major part in driving the development of Brazil's beauty and personal care market, as a wider movement globally towards more sustainable consumption habits.

Brazil Beauty and Personal Care Products Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Brazil beauty and personal care products market report, along with forecasts for the period 2025-2033. Our report has categorized the market based on product, pricing, ingredient and distribution channel.

Breakup by Product:

- Skincare

- Haircare

- Oral care

- Makeup & Color Cosmetics

- Deodorants and Fragrances

- Others

Skincare represents the most widely used product

The report has provided a detailed breakup and analysis of the market based on the product. This includes skincare, haircare, oral care, makeup & color cosmetics, deodorants and fragrances, and others. According to the report, skincare represented the largest segment.

The main factors that are driving the expansion of this segment include the growing emphasis on self-care, coupled with the rising awareness about the importance of skincare among the masses, which has significantly influenced consumer behavior. Brazilian consumers are increasingly seeking effective skincare solutions to address numerous skin concerns, from anti-aging to hydration and sun protection. Key players are introducing innovative formulations, using novel ingredients like antioxidants, hyaluronic acid, and natural extracts. Furthermore, the integration of dermatologist-backed products and science-driven marketing strategies adds credibility and authenticity, resonating with consumers who prioritize evidence-based solutions. The ability of skincare products to cater to diverse skin types and concerns, aligning with consumers' desire for improved skin health and overall well-being, is contributing to the segment growth.

Breakup by Pricing:

- Mass

- Premium

Mass accounts for the majority of the market share

A detailed breakup and analysis of the market based on the pricing has also been provided in the report. This includes mass and premium. According to the report, mass accounted for the largest market share.

With a diverse consumer base spanning various income level, affordability is a critical factor in shaping purchasing decisions. Mass-priced products, positioned at accessible price points without compromising on quality, cater to a broad spectrum of consumers. This strategy facilitates market penetration and widens the consumer base, particularly in a price-sensitive market like Brazil. Key players leverage economies of scale to offer competitive prices while maintaining effective formulations, creating a balance between quality and affordability. As consumers seek value-for-money products, mass pricing has accelerated the product adoption rate, market growth, and the establishment of brand loyalty, playing a pivotal role in shaping the dynamics of the Brazil beauty and personal care market.

Breakup by Ingredient:

- Natural

- Organic

- Others

Natural holds the largest share in the market

A detailed breakup and analysis of the market has been provided based on ingredient. This includes natural, organic, and others. According to the report, natural accounted for the largest market share.

Consumers in Brazil are increasingly seeking products that align with their health-conscious and environmentally aware values. The integration of natural ingredients, such as botanical extracts, essential oils, and plant-based formulations, resonates with this demand. Natural ingredients are perceived as gentler on the skin and hair, minimizing the risk of allergies and irritations. Key players are responding to these evolving preferences by developing innovative formulations that harness the benefits of these ingredients, catering to the growing segment of consumers seeking clean and sustainable options. This trend reflects a shift toward healthier self-care routines and contributes to the market growth by attracting eco-conscious consumers who prioritize products that are both effective and environmentally responsible.

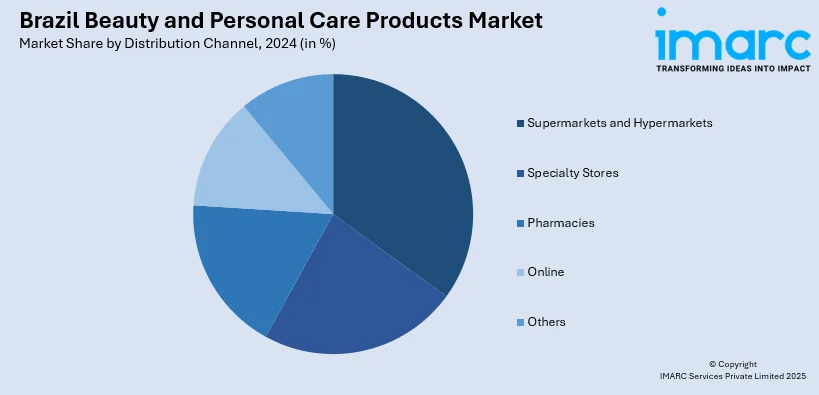

Breakup by Distribution Channel:

- Supermarkets and Hypermarkets

- Specialty Stores

- Pharmacies

- Online

- Others

Beauty and personal care products are majorly distributed through supermarkets and hypermarkets in Brazil

A detailed breakup and analysis of the market has been provided based on distribution channel. This includes supermarkets and hypermarkets, specialty stores, pharmacies, online, and others. According to the report, supermarkets and hypermarkets accounted for the largest market share.

Supermarkets and hypermarkets are retail channels that provide widespread accessibility and improved convenience for consumers seeking a diverse range of beauty and personal care products at a single place. With an extensive network of outlets across the country, supermarkets and hypermarkets offer a platform for both established and emerging brands to showcase their products to a vast and diverse customer base. The physical presence of these products on shelves enhances consumer exposure and encourages impulse purchases.

Additionally, the availability of promotions, discounts, and bundled offers in these retail environments further incentivizes consumers, fostering sales growth. By offering a seamless shopping experience and catering to the preferences of price-conscious consumers, supermarkets and hypermarkets contribute significantly to the market expansion.

Competitive Landscape:

The market is experiencing steady growth as key players in the industry are introducing a variety of advancements to cater to evolving consumer preferences and demands. These innovations range from the incorporation of new skincare ingredients to the development of eco-friendly packaging solutions. Moreover, the leading manufacturers are launching personalized beauty solutions, leveraging advanced technology to offer skincare and makeup products tailored to individual consumers. Additionally, the development of multifunctional products that combine skincare and makeup benefits caters to time-conscious consumers seeking efficient routines. The integration of augmented reality (AR) and virtual try-on features for makeup Brazil products has enhanced the online shopping experience, further bridging the gap between virtual and physical try-ons. Such innovations collectively highlight the industry's commitment to delivering effective, sustainable beauty and personal care market size.

The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the key players included:

- Beiersdorf AG

- Cargill, Incorporated

- Coty Inc.

- Grupo Boticario

- L’Oréal SA

- Natura & Co.

- Procter & Gamble

- Surya Brasil

- Unilever Brazil (Unilever)

- The Estée Lauder Companies Inc.

Brazil Beauty and Personal Care Products Market Recent News:

- April 2025: Dove launched its first facial care range in Brazil, targeting the rapidly growing Brazil cosmetics and personal care sector. The Dove Regenerative line, featuring premium ingredients like niacinamide and retinyl propionate, aimed to democratize access to skincare for Brazil's diverse population, impacting the beauty and personal care sector's expansion.

- March 2025: Lubrizol, in partnership with Suzano, pre-launched Carbopol BioSense in Brazil, the first biodegradable ingredient in the Carbopol line. This innovation, combining performance with sustainability, marked a milestone for the beauty and personal care sector, offering eco-friendly alternatives for cosmetic formulations.

- October 2024: ISDIN aimed to double its sales in Brazil by 2028, focusing on its strong presence in the sun protection and acne treatment sectors. With innovations like Transparent Spray sunscreen and Acniben products, ISDIN capitalized on Brazil's growing market, driving significant growth.

- September 2024: Givaudan Active Beauty launched the [N.A.S.] Vibrant Collection in Brazil, featuring vegan botanical extracts for hybrid make-up. This innovative collection, offering skin benefits like anti-ageing and antioxidant properties, advanced the beauty sector by combining skincare and make-up, enhancing product performance and sustainability.

Brazil Beauty and Personal Care Products Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Products Covered | Skincare, Haircare, Oral care, Makeup & Color Cosmetics, Deodorants and Fragrances, Others |

| Pricings Covered | Mass, Premium |

| Ingredients Covered | Natural, Organic, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Specialty Stores, Pharmacies, Online, Others |

| Companies Covered | Beiersdorf AG, Cargill, Incorporated., Coty Inc., Grupo Boticario, L’Oréal, Natura & Co., Procter & Gamble, Surya Brasil, Unilever Brazil (Unilever), The Estée Lauder Companies Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Brazil beauty and personal care products market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Brazil beauty and personal care products market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Brazil beauty and personal care products industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Brazil beauty and personal care products market is projected to grow at a CAGR of 4.11% 2025-2033.

Key factors driving Brazil’s beauty and personal care products market include the increasing awareness among Brazilian consumers about personal grooming and hygiene and growing consumer preference for sustainable and environmentally friendly options.

COVID-19 led to shifts in Brazil's beauty market, with increased demand for hygiene products and a rise in e-commerce. Consumers leaned towards natural and wellness-oriented products, while brands focused on digital sales channels and adapting offerings to home use.

Popular beauty products in Brazil include skincare items like moisturizers, sunscreens, and anti-aging creams. Haircare products, such as shampoos and conditioners, especially those designed for curly hair, are also highly sought after. Additionally, fragrances and body lotions are frequently used.

Skincare products, particularly those for hydration and sun protection, are the most popular. Haircare products, especially for curly or textured hair, also lead in demand. Fragrances and personal care items, such as deodorants and body lotions, are consistently favored nationwide.

The cosmetics market in Brazil is experiencing growth due to rising demand for self-care products, an expanding middle class, and a robust beauty culture. Additionally, the influence of social media, along with a focus on wellness and natural ingredients, is boosting market expansion.

Based on the product, the Brazil beauty and personal care products market has been segmented into skincare, haircare, oral care, makeup & color cosmetics, deodorants and fragrances, and others.

Based on the pricing, the Brazil beauty and personal care products market has been segmented into mass and premium.

Based on the ingredient, the Brazil beauty and personal care products market has been segmented into natural, organic, and others.

Based on the distribution channel, the Brazil beauty and personal care products market has been segmented into supermarkets and hypermarkets, specialty stores, pharmacies, online, and others.

Some of the major players in the Brazil beauty and personal care products market include Beiersdorf AG, Cargill, Incorporated., Coty Inc., Grupo Boticario, L’Oréal, Natura & Co., Procter & Gamble, Surya Brasil, Unilever Brazil (Unilever), The Estée Lauder Companies Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)