Brazil Biorational Products Market Size, Share, Trends and Forecast by Product, Application, Method of Propagation, and Region, 2026-2034

Brazil Biorational Products Market Summary:

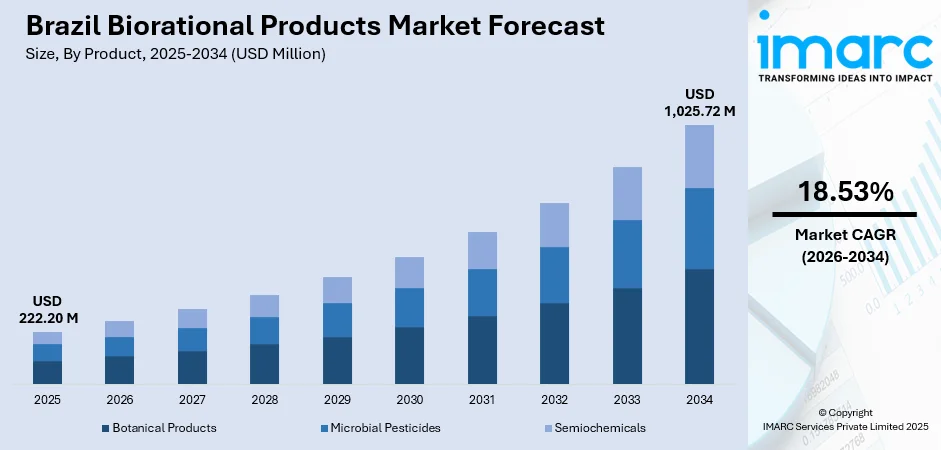

The Brazil biorational products market size was valued at USD 222.20 Million in 2025 and is projected to reach USD 1,025.72 Million by 2034, growing at a compound annual growth rate of 18.53% from 2026-2034.

The market is expanding rapidly due to increasing adoption of sustainable agricultural practices and the growing awareness among farmers about the environmental benefits of eco-friendly pest management solutions. Rising demand for residue-free agricultural produce for both domestic consumption and export markets is driving farmers to transition from conventional chemical pesticides to biorational alternatives. Government initiatives promoting low-carbon agriculture and the implementation of favorable regulatory frameworks are accelerating the commercialization and adoption of these products across the country's diverse agricultural regions.

Key Takeaways and Insights:

-

By Product: Microbial pesticides dominate the market with a share of 45.2% in 2025, driven by the proven effectiveness of bacterial and fungal agents in controlling agricultural pests while maintaining environmental sustainability and compatibility with integrated pest management programs.

-

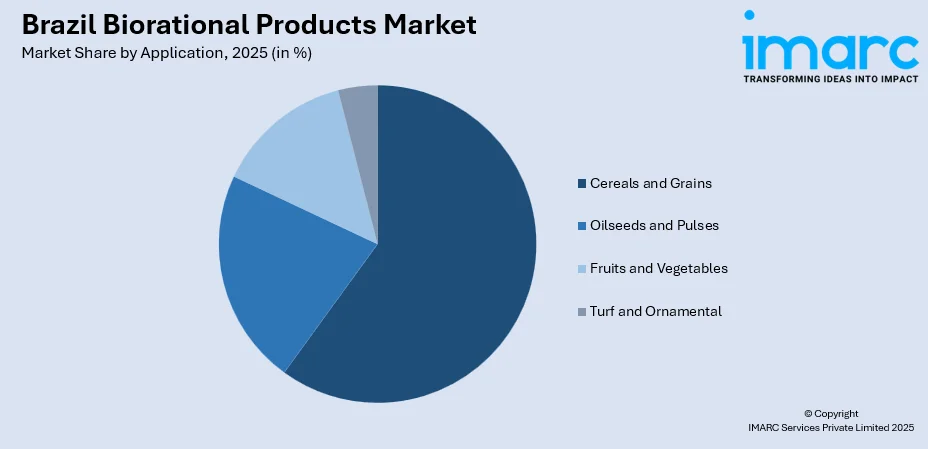

By Application: Cereals and grains lead the market with a share of 59.7% in 2025, owing to Brazil's position as one of the world's largest producers and exporters of soybeans and corn, which collectively account for the majority of planted agricultural area.

-

By Method of Propagation: Foliar spray represents the largest segment with a market share of 48.6% in 2025. This dominance is driven by the method's precision and effectiveness in delivering biorational products directly onto plant leaves, ensuring rapid absorption and immediate action against pests.

-

By Region: Central West prevails the market with a share of 33.2% in 2025, due to its vast commercial farming areas, high pest pressure from warm climate, and strong focus on export-oriented crops. Large farms adopt sustainable solutions faster, driving higher demand for biological and eco-friendly crop protection products.

-

Key Players: The Brazil biorational products market exhibits competitive intensity, with multinational agricultural science corporations competing alongside regional manufacturers and emerging biotechnology firms across various product categories and price segments. They introduce eco-friendly crop protection solutions, ensure regulatory compliance, and promote sustainable farming practices

To get more information on this market Request Sample

The market is experiencing robust expansion fueled by the country's rich biodiversity, which provides a competitive edge in developing location-specific biological solutions tailored to tropical agricultural conditions. By the end of 2024, Brazil's Ministry of Agriculture, Livestock, and Supply (MAPA) recorded 309 products as bioinsecticides, 119 as biofungicides, and 96 as bionematicides, demonstrating the regulatory backing for adopting biological control. Research institutions and public universities have developed specialized training programs for farmers, ensuring quality production standards and broader adoption of biorational solutions across diverse crop systems. Climate variability and pest resistance issues are also pushing growers towards innovative, targeted pest control methods. Government support for sustainable agriculture is strengthening the market growth. Expanding organic farming and integrated pest management practices further drive demand for biorational solutions.

Brazil Biorational Products Market Trends:

Rising need for regulatory approvals

Regulatory approvals are supporting the biorational products market growth in Brazil by creating a clearer pathway for product commercialization and farmer adoption. As authorities increasingly recognize biological and low-toxicity inputs, confidence in these products grows among growers and distributors. Faster approvals encourage companies to invest in innovation and launch new formulations. In May 2024, Bioceres Crop Solutions Corp. revealed that Brazil’s Ministry of Agriculture and Livestock approved three new bio-insecticidal/bio-nematicidal solutions made from inactivated cells of the company’s unique Burkholderia platform. The authorization signified a notable regulatory achievement in the Brazilian market, highlighting the initial approval of biological products made from completely inactivated microorganisms. Regulations promoting safer agriculture also push farmers away from high-risk chemicals toward approved biorational solutions.

Increasing focus on sustainability

Rising focus on sustainability is driving the market expansion in Brazil, as farmers seek environmentally safe alternatives to conventional chemicals. In January 2024, UPL introduced Tackler, a liquid bioinsecticide with Beauveria bassiana, in Brazil to manage pests in crops like coffee, maize, and sugarcane. The product does not leave harmful remnants and can be kept at room temperature for long durations, supporting traditional pesticides and promoting sustainability in Brazilian farming. Growers increasingly adopt biological and low-toxicity solutions to protect soil health, biodiversity, and water quality. Sustainable farming practices are becoming important for export competitiveness and brand image, pushing demand for residue-free crop protection.

Growing Export Compliance Driving Adoption

Stringent international regulations on pesticide residues are compelling Brazilian farmers to adopt biorational products, particularly for export-oriented crops. European Union standards have become increasingly restrictive, pushing cooperatives to expand biological procurement significantly for export lots. In November 2024, Brazil and China finalized agreements allowing the export of Brazilian sorghum, grapes, and sesame to the Chinese market, further incentivizing residue-free production methods to maintain access to premium international markets.

Market Outlook 2026-2034:

The market expansion is driven by the increasing integration of biotechnological innovations, favorable government policies, and the growing need to reduce dependence on chemical pesticides. The market generated a revenue of USD 222.20 Million in 2025 and is projected to reach a revenue of USD 1,025.72 Million by 2034, growing at a compound annual growth rate of 18.53% from 2026-2034. The sector is expected to benefit significantly from the implementation of Law 15.070/2024 in December 2024, which established a comprehensive regulatory framework for bioinputs, promoting sustainable agriculture and stimulating innovation across the market.

Brazil Biorational Products Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product | Microbial Pesticides | 45.2% |

| Application | Cereals and Grains | 59.7% |

| Method of Propagation | Foliar Spray | 48.6% |

| Region | Central-West | 33.2% |

Product Insights:

- Botanical Products

- Microbial Pesticides

- Semiochemicals

Microbial pesticides dominate with a market share of 45.2% of the total Brazil biorational products market in 2025.

Microbial pesticides have emerged as the cornerstone of biological pest control in Brazilian agriculture, utilizing bacteria, fungi, viruses, and entomopathogenic nematodes to effectively manage pests and diseases. These products play a critical role in integrated pest and disease management strategies, acting through multiple biocontrol mechanisms, including toxin production, enzyme secretion, and direct pathogen colonization.

Bacillus thuringiensis has become one of the most extensively used bioinsecticides, particularly following widespread pest outbreaks that caused severe damage to multiple crops, including soybeans, corn, and cotton. The segment's dominance is further strengthened by advancements in formulation technologies that enhance efficacy under Brazil's diverse climatic conditions. In addition, growing demand for sustainable farming and export-quality produce makes microbial pesticides an attractive choice. Their ability to improve soil biology while providing consistent protection further strengthens their appeal.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Cereals and Grains

- Oilseeds and Pulses

- Fruits and Vegetables

- Turf and Ornamental

Cereals and grains lead with a share of 59.7% of the total Brazil biorational products market in 2025.

The cereals and grains segment's leadership position reflects Brazil's status as a global agricultural powerhouse and one of the world's largest producers and exporters of soybeans and corn. The development of pest resistance to chemical pesticides has accelerated the adoption of biorational products, particularly in managing critical pests like lepidopterans and stink bugs in soybean crops.

Brazilian farmers are increasingly incorporating biorational products into their integrated pest management programs as preventative measures and to meet export compliance requirements. For the 2024/2025 harvest season, total grain production was estimated at over 322 Million Tons in Brazil, as per the third survey by the National Supply Company (Conab), underscoring the massive scale of application for biorational products in this segment and the ongoing need for sustainable crop protection strategies.

Method of Propagation Insights:

- Foliar Spray

- Seed Treatment

- Soil Treatment

Foliar spray exhibits a clear dominance with a 48.6% share of the total Brazil biorational products market in 2025.

Foliar spray leads the market because it offers fast, visible, and effective results across a wide range of crops. Farmers prefer foliar application since it directly targets affected plant parts, allowing quicker pest and disease control compared to soil or seed treatments. This method ensures better absorption of biological agents, nutrients, and growth stimulants, improving overall crop health.

Foliar sprays also allow precise application, reducing product waste and environmental exposure. In Brazil’s diverse climate conditions, growers benefit from flexible spraying schedules that can be adjusted to weather changes and pest cycles. It is easily integrated into existing spraying equipment, making adoption easier and cost-effective. Additionally, foliar application supports integrated pest management strategies by enabling targeted use of biorational products without disturbing beneficial organisms in the soil. Its reliability, ease of use, and immediate impact make foliar spray the dominant application method.

Regional Insights:

- Southeast

- South

- Northeast

- North

- Central-West

Central-West represents the leading segment with a 33.2% share of the total Brazil biorational products market in 2025.

Central-West leads the biorational products market in Brazil because the region is the country’s largest agricultural hub, with extensive cultivation of soybeans, corn, cotton, and sugarcane. These crops are highly exposed to pests and diseases, creating strong demand for effective and sustainable crop protection solutions.

Large commercial farms in the region are more open to adopting modern and environment-friendly technologies to protect yields and meet market standards. Climate conditions, such as heat and humidity, increase pest pressure, making frequent and safe applications necessary. Farmers in Central-West also focus on export-oriented production, where residue limits and sustainability practices are important. This pushes growers towards biorational inputs over conventional chemicals. In addition, well-developed agribusiness networks and access to input suppliers support faster adoption. Together, high crop volume, pest pressure, and sustainability awareness position Central-West as the dominant region in the market.

Market Dynamics:

Growth Drivers:

Why is the Brazil Biorational Products Market Growing?

Rising Demand for Sustainable Agriculture

Sustainability has become a central focus in Brazil’s agricultural sector, driving strong demand for biorational products. Farmers are under increasing pressure to reduce chemical usage and adopt eco-friendly inputs that protect soil health, water sources, and beneficial organisms. Biorational products offer targeted action with minimal environmental impact, making them ideal for modern farming systems. As awareness is growing about long-term soil fertility and ecological balance, farmers view biological solutions as an investment rather than a cost. Exposure to international agricultural practices further encourages change. In addition, government programs and agricultural bodies promote sustainable methods to ensure long-term productivity. Farmers increasingly realize that overuse of chemical pesticides harms crop health and raises resistance issues. Biorational products reduce pest resistance development while maintaining effectiveness. This growing shift towards environmentally responsible farming continues to reinforce demand and ensures long-term market expansion.

Growth of Organic and Export-Oriented Farming

Brazil’s expanding organic farming sector is a major growth driver for the biorational products market. Export crops require strict compliance with residue standards, pushing farmers towards low-toxicity inputs. Biorationals help meet international quality requirements while ensuring pest and disease control. High-value crops, such as fruits, vegetables, and specialty commodities, increasingly depend on biological solutions for market access. Exporters also promote certification programs that favor biological inputs. Organic farming premiums provide financial incentives, encouraging adoption despite higher upfront costs. Furthermore, international buyers prioritize sustainability, making biorational products essential for market competitiveness. The link between biorationals and export success continues to strengthen adoption rates. As demand for certified crops increases globally, Brazilian farmers investing in biological inputs gain easier access to premium markets. This trend makes biorational products a strategic necessity rather than a niche choice in export-driven agriculture.

Increasing Pest Resistance to Chemical Pesticides

The rising resistance of pests and diseases to conventional chemicals is leading farmers towards biorational alternatives. A study by Embrapa anticipates that by 2100, 46% of agricultural diseases in Brazil will intensify, directly impacting essential crops, such as rice, corn, soybeans, coffee, sugar cane, vegetables, and fruits. Repeated chemical use has reduced effectiveness and increased application frequency, raising costs and environmental risks. Biorational products offer different modes of action, helping break resistance cycles. Farmers increasingly use biological solutions in rotation or in combination with chemical products to maintain effectiveness. This approach improves long-term crop protection and reduces the risk of total crop failure. Resistance problems are particularly severe in large-scale farming systems where chemicals have been heavily applied. Biorationals help maintain control while protecting natural enemies of pests. Over time, farmers adopt these products as part of resistance management strategies. As pest pressure increases due to climate change, sustainable pest control methods become more essential. This continuous resistance challenge ensures growing use of biorational products across Brazil’s agricultural landscape.

Market Restraints:

What Challenges the Brazil Biorational Products Market is Facing?

Limited Shelf Life and Product Stability Concerns

Biorational products, particularly those containing live microorganisms, face significant challenges related to shelf life and stability under varying environmental conditions. Live microbial products can lose substantial efficacy when exposed to high temperatures, yet transportation conditions on Brazil's main agricultural routes often exceed optimal storage parameters. This limitation increases distribution costs and necessitates refrigerated logistics or rapid delivery systems, particularly in the hottest agricultural corridors.

Infrastructure and Cold-Chain Logistics Constraints

Infrastructure limitations, particularly cold-chain constraints outside the core agricultural regions, hinder the efficient distribution of temperature-sensitive biorational products. Most transportation carriers operate non-refrigerated fleets, requiring suppliers to lease chilled trucks at significant cost premiums or rush deliveries within narrow temperature windows. Farmers in remote regions report discarding incoming biological shipments due to expired viability thresholds upon arrival.

Knowledge Gaps and Farmer Education Requirements

Many farmers, particularly traditional producers, lack confidence in biorational products due to limited understanding of proper application methods and expected efficacy timelines. Unlike chemical pesticides that often show immediate visible effects, biorational products may require longer timeframes to demonstrate results, creating perception challenges. Insufficient extension services and demonstration programs in some regions slow adoption rates despite the proven benefits of biological alternatives.

Competitive Landscape:

The Brazil biorational products market is characterized by the presence of global agricultural science corporations competing alongside regional manufacturers and emerging biotechnology firms. Companies are concentrating on developing products tailored to specific crops and expanding distribution networks to improve accessibility for farmers across diverse regions. Strategic partnerships between research institutions and biopesticide manufacturers are fostering the development of crop-specific solutions tailored to Brazil's unique agricultural landscape. Investments in research and development (R&D) activities focused on improving product efficacy, extending shelf life, and enhancing stability under tropical conditions remain a key competitive differentiator. Market players are also building relationships with agricultural cooperatives and local distributors to strengthen market penetration and support farmer education programs that build confidence in biological solutions.

Brazil Biorational Products Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Botanical Products, Microbial Pesticides, Semiochemicals |

| Applications Covered | Cereals and Grains, Oilseeds and Pulses, Fruits and Vegetables, Turf and Ornamental |

| Methods of Propagation Covered | Foliar Spray, Seed Treatment, Soil Treatment |

| Regions Covered | Southeast, South, Northeast, North, Central-West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Brazil biorational products market size was valued at USD 222.20 Million in 2025.

The Brazil biorational products market is expected to grow at a compound annual growth rate of 18.53% from 2026-2034 to reach USD 1,025.72 Million by 2034.

Microbial pesticides dominate the market with 45.2% share, driven by proven effectiveness of bacterial and fungal agents in sustainable pest management and strong compatibility with integrated pest management programs.

Key factors driving the Brazil biorational products market include favorable government policies and regulatory support for bioinputs, increasing pest resistance to chemical pesticides, growing demand for organic and residue-free agricultural products, and rising export compliance requirements for international markets.

Major challenges include limited shelf life and product stability under tropical conditions, infrastructure and cold-chain logistics constraints across remote agricultural regions, knowledge gaps among traditional farmers, variable efficacy under diverse climatic conditions, and competition from established chemical pesticide alternatives.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)