Brazil Blockchain Technology Market Size, Share, Trends and Forecast by Type, Component, Application, Enterprise Size, End Use, and Region, 2026-2034

Brazil Blockchain Technology Market Overview:

The Brazil blockchain technology market size reached USD 1,028.2 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 1,87,968.7 Million by 2034, exhibiting a growth rate (CAGR) of 78.38% during 2026-2034. The market is expanding, majorly driven by beneficial regulatory developments, escalating demand for safe digital transactions, and growing adoption across various sectors. In addition, this technology is improving transparency, lowering fraud, and upgrading operational efficacy for businesses in the country, leading to increased adoption.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 1,028.2 Million |

| Market Forecast in 2034 | USD 1,87,968.7 Million |

| Market Growth Rate (2026-2034) | 78.38% |

Brazil Blockchain Technology Market Trends:

Amplified Adoption in Financial Services

Brazil's financial sector is rapidly adopting blockchain technology to improve transparency, security, and efficacy in transactions which is favoring the Brazil blockchain technology market outlook. Various financial institutions and banks are currently incorporating blockchain into payment frameworks, speeding up payment processing times and minimizing operational costs. Moreover, this inclination is significantly fueled by the requirement to streamline processes and intermediaries, especially in cross-border payments, where blockchain provides substantial benefits. In addition, certain banks’ interest in developing digital currencies and the deployment of blockchain in regulatory adherence further highlight the intensifying dependence on this technology. As per industry reports, the Central Bank of Brazil (Banco Central do Brasil, BCB) intends to introduce its central bank digital currency (CBDC), known as Drex, by the end of 2024. As financial services adopt blockchain technology, it is anticipated to reshape the market, influencing more advancements and enhancing confidence in digital transactions.

Expansion of Blockchain in Supply Chain Management

Blockchain technology is significantly gaining momentum in Brazil’s supply chain industry, especially in enhancing transparency as well as traceability. Numerous enterprises across various sectors such as food, manufacturing, and agriculture are rapidly utilizing blockchain to track products from origin to end user, minimizing inefficiencies, fraud, and errors. Thus, this is positively influencing Brazil blockchain technology market share. According to industry reports, in 2023, Brazil hosted over 1,700 agritech startups focused on developing innovative blockchain solutions to enhance traceability, efficiency, and sustainability within the food supply chain. These startups also supply essential information to customers, regulatory authorities, and other stakeholders, thereby increasing the transparency of ESG initiatives in Brazil's food and agriculture supply chains. The blockchain technology is particularly crucial for Brazil’s export-heavy sectors, where adherence with international regulatory policies and transparency is vital. In addition, blockchain enables data sharing in real-time among supply chain participants, improving both decision-making and coordination. Furthermore, as various companies are currently focusing on upgraded operations and accountability, blockchain’s role in supply chain management continues to proliferate, making it a critical tool for Brazil’s trade and logistics industries.

Increased Blockchain Deployment in Government Services

The government is currently probing blockchain to improve governance and enhance public services which is supporting the Brazil blockchain technology market growth. Blockchain’s capability to guarantee tamper-proof and safe records is expanding its application in segments such as land registry, public procurement, and voting systems. Moreover, governmental bodies are increasingly acknowledging blockchain's potential to optimize bureaucratic processes, mitigate fraud, and enhance transparency. In addition, numerous pilot ventures are currently in progress to deploy blockchain in public administration, highlighting the government’s aim of digital advancement. By adopting blockchain technology, Brazil targets to solidify trust in government services, enhance operational efficacy, and lower corruption, establishing itself as a leading region in blockchain-driven governance in Latin America. For instance, in September 2023, Federal Data Processing Service (Serpro), Brazil's state-owned IT services corporation, announced the development of a blockchain network to enhance data security as the country progresses with the implementation of a new national identity card. This network will support the federal revenue service's shared registry, known as b-Cadastros, and will facilitate the search, issuance, and modification of the new ID cards and tax registration numbers.

Brazil Blockchain Technology Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on type, component, application, enterprise size, and end use.

Type Insights:

- Public

- Private

- Hybrid

The report has provided a detailed breakup and analysis of the market based on the type. This includes public, private, and hybrid.

Component Insights:

- Application and Solution

- Infrastructure and Protocols

- Middleware

A detailed breakup and analysis of the market based on the component have also been provided in the report. This includes application and solution, infrastructure and protocols, and middleware.

Application Insights:

- Digital Identity

- Exchanges

- Payments

- Smart Contracts

- Supply Chain Management

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes digital identity, exchanges, payments, smart contracts, supply chain management, and others.

Enterprise Size Insights:

- Large Enterprise

- Small Enterprise

- Middle Enterprise

A detailed breakup and analysis of the market based on the enterprise size have also been provided in the report. This includes large enterprise, small enterprise, and middle enterprise.

End Use Insights:

- Financial Services

- Government

- Healthcare

- Media and Entertainment

- Retail

- Transportation and Logistics

- Others

The report has provided a detailed breakup and analysis of the market based on the end use. This includes financial services, government, healthcare, media and entertainment, retail, transportation and logistics, and others.

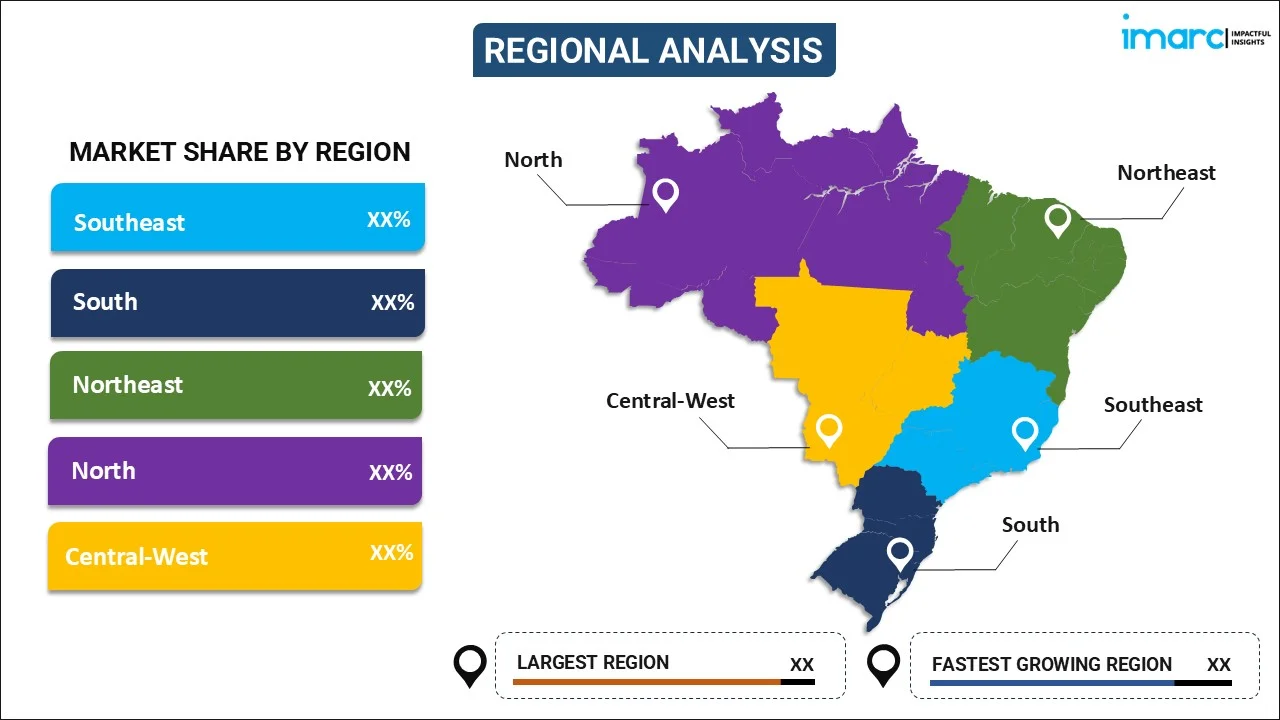

Regional Insights:

- Southeast

- South

- Northeast

- North

- Central-West

The report has also provided a comprehensive analysis of all the major regional markets, which include Southeast, South, Northeast, North, and Central-West.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Brazil Blockchain Technology Market News:

- In June 2024, Parfin, a financial technology firm, developed Rayls, an innovative blockchain system designed as a privacy solution for Brazil's central bank digital currency (CBDC), Drex. This new blockchain system enables permissioned operations and facilitates connections to other public blockchains through Rayls Public Chain, a native Ethereum Layer 2 (L2) solution.

- In September 2024, Bunge Global SA and Bangkok Produce Merchandising Public Co. Ltd. (BKP), collaboratively tested a traceability platform utilizing blockchain technology. This initiative involved the loading of three shipments, totaling 185,000 tons of deforestation-free soybean meal in Brazil, for export purposes.

Brazil Blockchain Technology Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Public, Private, Hybrid |

| Components Covered | Application and Solution, Infrastructure and Protocols, Middleware |

| Applications Covered | Digital Identity, Exchanges, Payments, Smart Contracts, Supply Chain Management, Others |

| Enterprise Sizes Covered | Large Enterprise, Small Enterprise, Middle Enterprise |

| End Uses Covered | Financial Services, Government, Healthcare, Media and Entertainment, Retail, Transportation and Logistics, Others |

| Regions Covered | Southeast, South, Northeast, North, Central-West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Brazil blockchain technology market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Brazil blockchain technology market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Brazil blockchain technology industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The blockchain technology market in Brazil was valued at USD 1,028.2 Million in 2025.

The Brazil blockchain technology market is projected to exhibit a CAGR of 78.38% during 2026-2034, reaching a value of USD 1,87,968.7 Million by 2034.

The market is driven by the rise in digital financial services, growing interest in decentralized applications, increased government focus on secure data infrastructure, and expanding fintech activity. Adoption across banking, supply chain, and healthcare sectors, along with supportive regulatory initiatives and investment in innovation hubs, are key contributors to the growing use of blockchain solutions in Brazil.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)