Brazil Car Sharing Market Size, Share, Trends and Forecast by Car Type, Business Model, Application, and Region, 2026-2034

Brazil Car Sharing Market Size and Share:

The Brazil car sharing market size reached USD 170.7 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 380.9 Million by 2034, exhibiting a growth rate (CAGR) of 9.33% during 2026-2034. The market is driven by growing urbanization and traffic congestion in metropolitan cities, heightened environmental concerns and need for green transport options, increasing cost of car ownership and maintenance, and technology improvements in mobiles and easy-to-use apps for car sharing services.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 170.7 Million |

| Market Forecast in 2034 | USD 380.9 Million |

| Market Growth Rate (2026-2034) | 9.33% |

Brazil Car Sharing Market Trends:

Increasing Urbanization and Congestion

Brazil is rapidly urbanizing, with millions of people moving to urban areas in pursuit of improved opportunities and living standards. As per the Observer Research Foundation (ORF) America, 87% of Brazil's population resides in urban areas. The large cities like São Paulo and Rio de Janeiro are witnessing massive population growth, which considerably increases traffic congestion and leads to a lack of parking facilities. These issues are amplifying the demand for alternative transportation means capable of efficiently responding to the needs of urban life. Car sharing has come as a feasible solution to this, enabling dwellers to have access to cars on an as-required basis without the financial weights and hassles of car ownership. With city residents seeking effective means of getting around crowded streets and minimizing their need for personal transportation, car sharing services have become more popular. This is beneficial to ease traffic congestion and promote a better quality of life in urban areas, making car sharing an effective and appealing means of transportation.

Growing Environmental Awareness

There is increasing concern for environmental sustainability in Brazil, especially regarding the negative impact of conventional car ownership on carbon emissions and city air quality. According to the European Commission, Brazil accounted for 1.23% of the world's carbon dioxide emissions in 2023. As a result, consumers are increasingly aware of their environmental impact and acknowledging the value of car sharing as a greener transportation option. By lowering the total number of cars on the road, car sharing lowers greenhouse gas emissions and enhances more productive use of resources. This change in consumer habit is one piece of a broader worldwide movement toward cleaner transportation. It also conforms to the policies of the Brazilian government aimed at promoting environmentally responsible behavior. Additionally, such an emphasis on sustainability has compelled most car share businesses to have electric and hybrid vehicles in their fleets, a move that satisfies environmentally friendly customers and adds up to overall business growth. Therefore, car sharing is addressing urban mobility needs and creating a cleaner future for the nation.

Advancements in Technology and Mobile Applications

Technological advancements at a high speed are fueling tremendous growth in demand for car sharing services across Brazil. Increasing popularity of smartphones and mobile apps has revolutionized how consumers are using car sharing services. Cars can be easily accessed and booked with ease. There are many user-friendly apps offering functions for finding, booking, and unlocking cars. This hugely increases user convenience and satisfaction, driving the uptake of car sharing services. Furthermore, these technology solutions provide smooth payment solutions and real-time tracking of vehicles, making it easy. Customer care is also becoming more effective through technologies, improving user satisfaction with fast problem resolution and various other services. Furthermore, ongoing technology advancements are further improving the operational effectiveness of car sharing platforms and making them more appealing. This involves integrating the strengths of data analytics and artificial intelligence (AI). This enhances fleet management, providing customers with better access to vehicles that are customized to suit their requirements. These technologies are offering a better consumer experience and thus creating a positive market outlook for the Brazil car sharing market.

Brazil Car Sharing Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2026-2034. Our report has categorized the market based on car type, business model and application.

Car Type Insights:

- Economy

- Executive

- Luxury

- Others

The report has provided a detailed breakup and analysis of the market based on the car type. This includes economy, executive, luxury, and others.

Business Model Insights:

- P2P

- Station Based

- Free-Floating

A detailed breakup and analysis of the market based on the business model have also been provided in the report. This includes P2P, station based, and free-floating.

Application Insights:

- Business

- Private

The report has provided a detailed breakup and analysis of the market based on the application. This includes business and private.

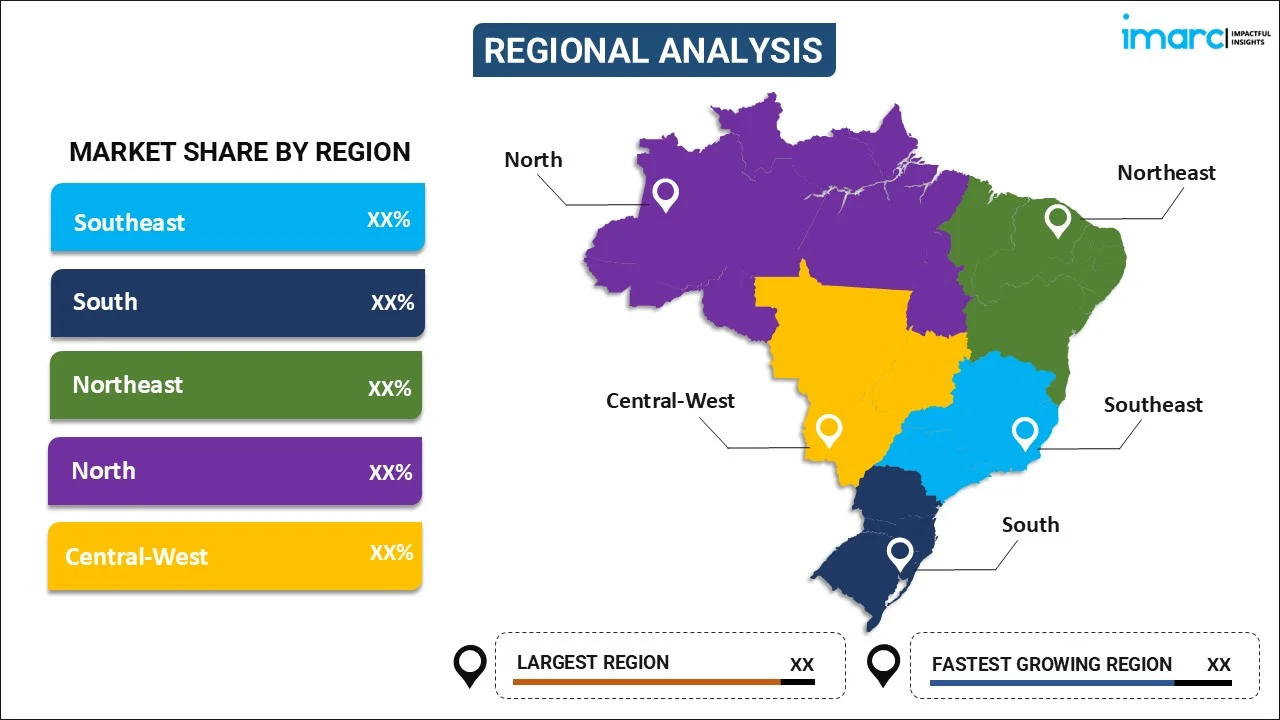

Regional Insights:

- Southeast

- South

- Northeast

- North

- Central-West

The report has also provided a comprehensive analysis of all the major regional markets, which include Southeast, South, Northeast, North, and Central-West.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Brazil Car Sharing Market News:

- 3 April 2025: BlaBlaCar, a Paris-based car-pooling app, has secured €100 million financing to expand its operations globally, notably into Brazil, which emerged as the largest consumer of BlaBlaCar’s services in 2023.

Brazil Car Sharing Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Car Types Covered | Economy, Executive, Luxury, Others |

| Business Models Covered | P2P, Station Based, Free-Floating |

| Applications Covered | Business, Private |

| Regions Covered | Southeast, South, Northeast, North, Central-West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Brazil car sharing market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Brazil car sharing market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Brazil car sharing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The car sharing market in Brazil was valued at USD 170.7 Million in 2025.

The Brazil car sharing market is projected to exhibit a CAGR of 9.33% during 2026-2034, reaching a value of USD 380.9 Million by 2034.

The Brazil car sharing market is driven by increasing urbanization and traffic congestion, rising costs of car ownership, growing environmental awareness promoting sustainable transport, and advancements in mobile technology enabling easy booking and management of services.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)