Brazil Cardiovascular Devices Market Size, Share, Trends and Forecast by Device Type and Region, 2026-2034

Brazil Cardiovascular Devices Market Size and Share:

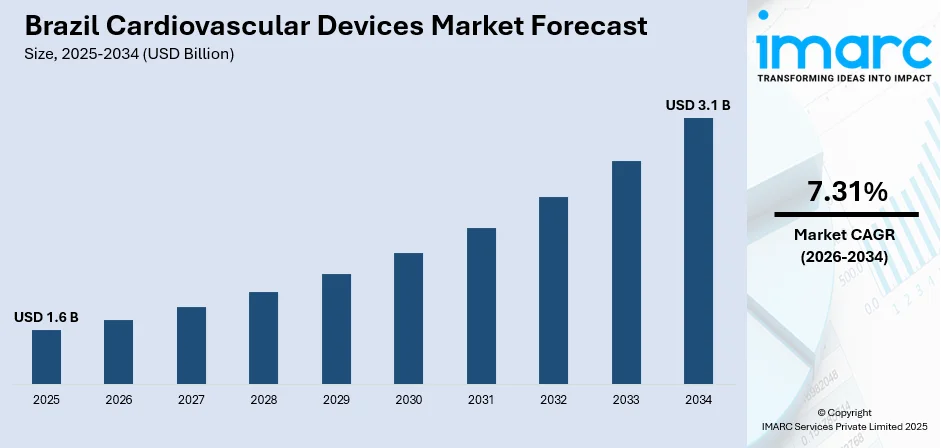

The Brazil cardiovascular devices market size was valued at USD 1.6 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 3.1 Billion by 2034, exhibiting a CAGR of 7.31% from 2026-2034. At present, with a rising number of individuals experiencing conditions like coronary artery disease, arrhythmia, and heart failure, the demand for medical devices, including stents, defibrillators, and diagnostic equipment, is growing. Supportive government initiatives and healthcare reforms are fueling the Brazil cardiovascular devices market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 1.6 Billion |

| Market Forecast in 2034 | USD 3.1 Billion |

| Market Growth Rate 2026-2034 | 7.31% |

At present, the market is expanding due to the growing prevalence of cardiovascular diseases. Unhealthy diets, obesity, smoking, and high stress levels are leading to a greater need for early diagnosis and advanced treatment. Brazil’s aging population is also contributing significantly, as older individuals are more prone to heart conditions, driving the demand for monitoring and interventional devices, such as pacemakers, stents, and heart valves. Improvements in healthcare infrastructure and access, especially in urban areas, are further supporting the adoption of advanced cardiovascular technologies in both public and private hospitals. Moreover, government initiatives aimed at expanding universal healthcare coverage are impelling the Brazil cardiovascular devices market growth.

To get more information on this market, Request Sample

The growing awareness among patients about the importance of preventive cardiac care is leading to increased utilization of diagnostic tools like wearable monitors. Technological innovations also play a role, with new minimally invasive procedures gaining popularity due to faster recovery and fewer complications. Rising medical tourism and the presence of skilled healthcare professionals continue to attract international patients for cardiac care. According to the IMARC Group, the Brazil medical tourism market size reached USD 3.10 Billion in 2024. The availability of skilled cardiologists, investments in medical training, and the entry of international and local device manufacturers are contributing to a competitive and growing landscape. Moreover, increasing partnerships between hospitals and technology providers help in upgrading equipment and offering better treatment outcomes.

Brazil Cardiovascular Devices Market Trends:

Rising prevalence of cardiovascular diseases

Surging prevalence of cardiovascular diseases is stimulating the market growth. According to industry reports, in 2024, atherosclerotic cardiovascular disease (ASCVD) led to more than 600,000 hospital admissions annually in Brazil, with approximately 82% taking place in the public healthcare system, based on recent findings. As more people are suffering from ailments, such as hypertension, coronary artery disease, arrhythmia, and heart failure, the need for medical devices like pacemakers, stents, defibrillators, and diagnostic tools is increasing. Factors like poor diet, physical inactivity, smoking, and high stress levels are contributing to the rising number of cardiovascular cases. This is motivating healthcare providers to invest in modern technologies to improve early detection and intervention. Hospitals and clinics are expanding their cardiac care departments and adopting advanced equipment to manage the growing patient load.

Increasing aging population

Rising aging population is offering a favorable Brazil cardiovascular devices market outlook. As people age, they become more susceptible to chronic diseases, such as hypertension, arrhythmia, and coronary artery disease, which require continuous monitoring and timely intervention. This is leading to greater demand for devices like pacemakers, heart valves, stents, and diagnostic tools. Older adults often need regular check-ups and treatments, encouraging hospitals and clinics to expand their cardiovascular care services and employ advanced medical equipment. The growing elderly population is also creating the need for minimally invasive procedures that offer faster recovery and lower risk. As longevity improves, more people require long-term cardiac management, making cardiovascular devices essential in maintaining their health. This demographic transition is significantly driving the demand for heart-related technologies, supporting the consistent growth of the cardiovascular devices market across Brazil. As per Agência IBGE, by 2070, around 37.8% of Brazil’s population will be aged 60 or over, a demographic shift associated with an increased risk of heart diseases.

Supportive government initiatives and healthcare reforms

Supportive government initiatives and healthcare reforms are among the major Brazil cardiovascular devices market trends. Budget proposals in Brazil indicated a 6.2% increase in funding for the Unified Health System (SUS) in 2025 compared to 2024. Government programs focused on expanding universal healthcare services help more people receive timely diagnosis and treatment for heart conditions. Investments in hospital infrastructure, training of medical professionals, and procurement of modern equipment allow wider adoption of cardiovascular devices, such as pacemakers, stents, and diagnostic tools. Policies aimed at reducing the burden of non-communicable diseases also prioritize cardiovascular health, leading to greater public awareness and preventive care efforts. Additionally, partnerships with private players and funding for local manufacturing aid in minimizing costs and increasing the availability of devices. These efforts improve overall healthcare delivery and support the integration of innovative solutions, making heart treatments more efficient and accessible in the country.

Brazil Cardiovascular Devices Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Brazil cardiovascular devices market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on device type.

Analysis by Device Type:

- Diagnostic and Monitoring Devices

- Electrocardiogram (ECG)

- Remote Cardiac Monitoring

- Others

- Therapeutic and Surgical Devices

- Cardiac Assist Devices

- Cardiac Rhythm Management Device

- Catheter

- Grafts

- Heart Valves

- Stents

- Others

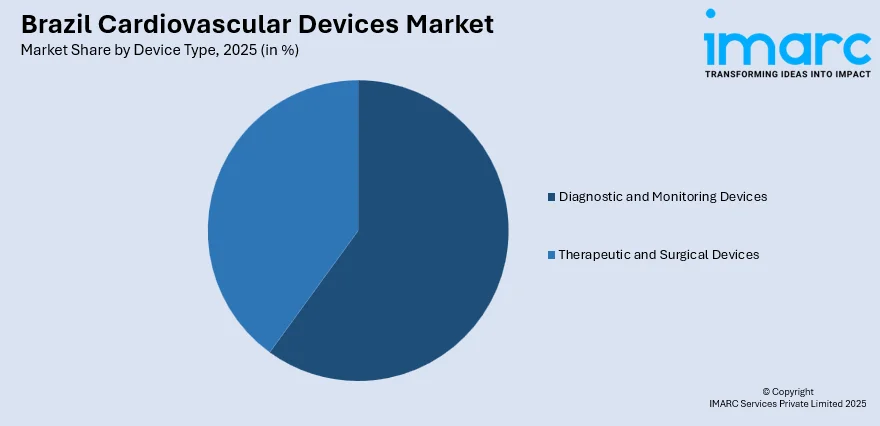

Therapeutic and surgical devices (cardiac assist devices, cardiac rhythm management device, catheter, grafts, heart valves, stents, and others) held 70.8% of the market share in 2025. They play a central role in treating a wide range of heart conditions that require immediate and long-term medical intervention. These devices, including stents, pacemakers, heart valves, and defibrillators, are essential for managing chronic and acute cardiovascular diseases. As the number of patients with heart-related issues is rising, driven by aging, sedentary lifestyles, and unhealthy habits, the demand for effective treatment solutions is increasing. Therapeutic and surgical devices offer precise, reliable, and often minimally invasive options that help restore heart function and improve patient outcomes. Brazil’s healthcare system is equipped to handle complex cardiac procedures, which supports the widespread utilization of such devices. Additionally, continuous innovation makes these tools safer and more efficient, encouraging their adoption by cardiologists and surgeons. As per the Brazil cardiovascular devices market forecast, this category will continue to dominate the market because of the effective addressal of cardiovascular care needs across the country.

Regional Analysis:

- Southeast

- South

- Northeast

- North

- Central-West

Southeast is enjoying the leading position in the market. It has the most developed healthcare infrastructure and the highest population density in the country. Cities, including São Paulo and Rio de Janeiro, are located in this region, offering advanced hospitals, specialized cardiac centers, and skilled healthcare professionals. In February 2024, Hapvida, the largest operator of vertical healthcare plans in Brazil, allocated R$1.5 Billion to construct three new hospitals in São Paulo, Rio de Janeiro, and Recife. The investments additionally comprised the reopening of another facility in São Paulo’s capital. Each of the three new hospitals would feature 200 beds. These cities attract a large number of patients seeking diagnosis and treatment for cardiovascular conditions. The region also benefits from higher awareness about heart health, better access to medical services, and a greater presence of private healthcare providers. Besides this, the Southeast has a stronger economy compared to other regions, allowing both public and private institutions to wager on modern cardiovascular technologies and devices. Medical institutions in the area often collaborate with international device manufacturers, ensuring faster adoption of innovative products.

Competitive Landscape:

Key players are introducing advanced technologies, expanding product portfolios, and enhancing accessibility to quality cardiac care. These companies are spending on research and development (R&D) activities to manufacture innovative equipment, such as minimally invasive (MI) stents, pacemakers, and diagnostic tools that enhance treatment outcomes and reduce recovery time. They are collaborating with hospitals and healthcare providers to train professionals and support the use of new equipment. Key players are also working on improving the affordability and availability of cardiovascular devices across public and private healthcare sectors. Through marketing strategies, awareness campaigns, and local partnerships, they help increase knowledge about heart health and the importance of early diagnosis. Their continuous efforts to modernize cardiac care are stimulating the growth of the cardiovascular devices market in Brazil. For instance, in April 2025, Brazil's Braile Biomedica teamed up with Zydus MedTech to market its cutting-edge TAVI technology in India, Europe, and other selected markets. Braile persisted in producing the device, utilizing Dr. Domingo Braile’s advancements, while the partnership sought to promote worldwide growth and introduce new cardiovascular innovations over a three-year period.

The report provides a comprehensive analysis of the competitive landscape in the Brazil cardiovascular devices market with detailed profiles of all major companies.

Latest News and Developments:

- May 2025: Cordis initiated the SELUTION Global Coronary Registry, enrolling as many as 10,000 patients globally to assess the outcomes of the SELUTION SLR™ Drug-Eluting Balloon. Brazilian Professor Alexandre Abizaid became part of the International Steering Committee, highlighting the country's commitment to promoting drug-eluting balloon technology and enhancing real-world cardiovascular care data.

Brazil Cardiovascular Devices Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Device Types Covered |

|

| Regions Covered | Southeast, South, Northeast, North, Central-West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Brazil cardiovascular devices market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Brazil cardiovascular devices market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Brazil cardiovascular devices industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Brazil cardiovascular devices market was valued at USD 1.6 Billion in 2025.

The Brazil cardiovascular devices market is projected to exhibit a CAGR of 7.31% during 2026-2034, reaching a value of USD 3.1 Billion by 2034.

Rising incidence of cardiovascular diseases is contributing significantly to the growing demand for medical devices. Brazil’s aging population also plays a major role, as older individuals are more likely to suffer from heart-related conditions, requiring diagnostic and therapeutic support. Improved access to healthcare services and expanding hospital infrastructure further allow better diagnosis and treatment employing advanced cardiovascular technologies.

Therapeutic and surgical devices (cardiac assist devices, cardiac rhythm management device, catheter, grafts, heart valves, stents, and others) account for the largest Brazil cardiovascular devices device type market share as they are essential for treating heart conditions, offer effective and immediate solutions, support minimally invasive procedures, and meet the high demand for reliable cardiac care across hospitals and clinics.

Southeast accounts for the largest Brazil cardiovascular devices market share due to its advanced healthcare infrastructure, large urban population, higher medical awareness, and strong presence of specialized hospitals and skilled professionals. This is resulting in greater access to and demand for cardiovascular treatments and technologies.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)