Brazil Cosmetics Products Market Size, Share, Trends and Forecast by Product Type, Category, Distribution Channel, and Region, 2026-2034

Brazil Cosmetics Products Market Overview:

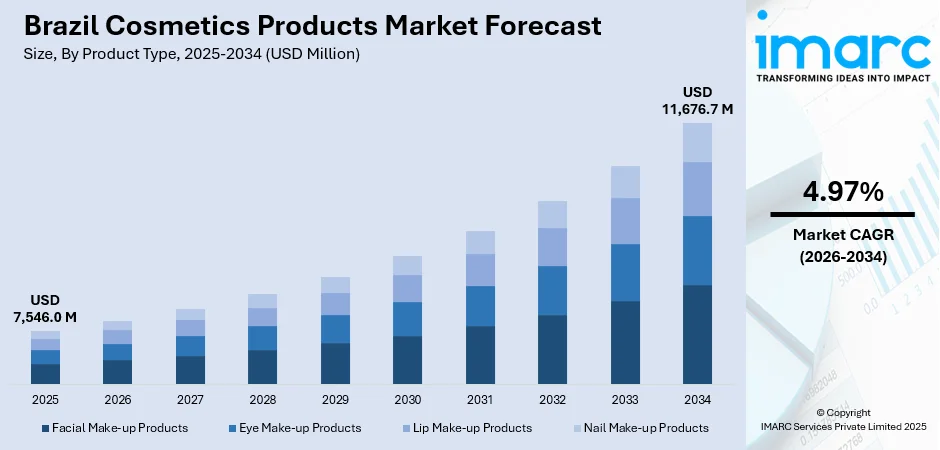

The Brazil cosmetics products market size reached USD 7,546.0 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 11,676.7 Million by 2034, exhibiting a growth rate (CAGR) of 4.97% during 2026-2034. The market is experiencing steady growth, driven by rising disposable incomes, changing beauty standards, and an increasing preference for skincare and organic products. The demand for personal care items, particularly among millennials, growing influence of social media, rapid growth of e-commerce and rising awareness about sustainable beauty are also contributing to the Brazil cosmetics products market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 7,546.0 Million |

| Market Forecast in 2034 | USD 11,676.7 Million |

| Market Growth Rate 2026-2034 | 4.97% |

Brazil Cosmetics Products Market Trends:

Rising Demand for Natural and Organic Products

In Brazil the demand for natural and organic cosmetics is rapidly increasing as consumers become more conscious of the ingredients in their beauty products. For instance, in November 2024, Brazilian cosmetics company Granado announced the acquisition of Care Natural Beauty a clean beauty brand marking its entry into the segment. The acquisition supported by Puig aims to expand Care’s retail presence with kiosks and boutiques while enhancing Granado’s digital capabilities and product offerings in sustainable cosmetics. This shift is driven by concerns about the potential harmful effects of synthetic chemicals on both health and the environment. As a result, consumers are opting for chemical-free and eco-friendly alternatives that are made from natural and sustainably sourced ingredients. Organic products which often contain fewer preservatives and artificial additives are perceived as safer and more beneficial for the skin. This trend is also being fueled by increased awareness about the environmental impact of conventional cosmetics manufacturing prompting a preference for brands that prioritize sustainability. Additionally, Brazilian consumers, especially younger demographics are seeking transparency from beauty brands which has led to a growing market for cruelty-free and eco-conscious cosmetic lines.

To get more information on this market, Request Sample

Growing Focus on Clean Beauty

The demand for clean beauty products in Brazil is rapidly growing with consumers becoming more conscious of what goes into their beauty products. Clean beauty refers to cosmetics that are free from harmful ingredients such as parabens, sulfates and synthetic fragrances. This trend reflects a broader shift toward prioritizing transparency, safety and ethical sourcing in beauty products. Brazilian consumers are increasingly seeking brands that provide clear and honest ingredient lists and commit to using non-toxic, cruelty-free and eco-friendly formulations. For instance, in October 2024, Brazilian clean beauty brand Care Natural Beauty expands to all Sephora stores and plans to open two branded locations in 2025. The company promotes its “Green Friday” campaign focusing on sustainable practices and refillable packaging aiming for R$45 million in revenue this year with a projected 50% growth by 2025. This movement is further fueled by a growing interest in sustainability and a desire for products that promote both personal and environmental health. As a result, many Brazilian beauty brands are adopting cleaner formulations and emphasizing their commitment to safety and transparency. The rise of clean beauty is significantly contributing to Brazil cosmetics products market growth, as more consumers prioritize health-conscious and ethical beauty choices.

Brazil Cosmetics Products Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on product type, category, and distribution channel.

Product Type Insights:

- Facial Make-up Products

- Eye Make-up Products

- Lip Make-up Products

- Nail Make-up Products

The report has provided a detailed breakup and analysis of the market based on the product type. This includes facial make-up products, eye make-up products, lip make-up products, and nail make-up products.

Category Insights:

- Mass

- Premium

A detailed breakup and analysis of the market based on the category have also been provided in the report. This includes mass and premium.

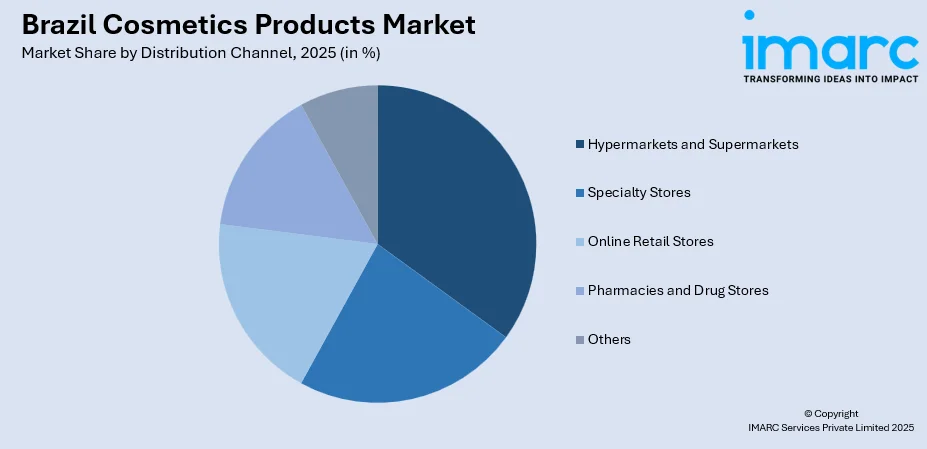

Distribution Channel Insights:

- Hypermarkets and Supermarkets

- Specialty Stores

- Online Retail Stores

- Pharmacies and Drug Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes hypermarkets and supermarkets, specialty stores, online retail stores, pharmacies and drug stores, and others.

Regional Insights:

- Southeast

- South

- Northeast

- North

- Central-West

The report has also provided a comprehensive analysis of all the major regional markets, which include Southeast, South, Northeast, North, and Central-West.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Brazil Cosmetics Products Market News:

- In April 2025, Dove launched its first facial care line Dove Regenerative in Brazil aimed at making dermocosmetics accessible. Featuring premium ingredients like niacinamide and retinyl propionate the range reflects Brazil's diverse population. It comes as the dermocosmetics market is projected to grow significantly.

- In June 2024, Natura & Co launched Natura Ventures a corporate venture capital fund with R$50m ($9.2m) to invest in Brazilian beauty startups. The fund aims to support up to 15 seed-stage companies focused on circular economy and customer service technology over the next three years enhancing Natura's innovation strategies.

Brazil Cosmetics Products Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Facial Make-up Products, Eye Make-up Products, Lip Make-up Products, Nail Make-up Products |

| Categories Covered | Mass, Premium |

| Distribution Channels Covered | Hypermarkets and Supermarkets, Specialty Stores, Online Retail Stores, Pharmacies and Drug Stores, Others |

| Regions Covered | Southeast, South, Northeast, North, Central-West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Brazil cosmetics products market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Brazil cosmetics products market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Brazil cosmetics products industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The cosmetics products market in Brazil was valued at USD 7,546.0 Million in 2025.

The Brazil cosmetics products market is projected to exhibit a CAGR of 4.97% during 2026-2034, reaching a value of USD 11,676.7 Million by 2034.

The Brazil cosmetics products market is driven by a strong cultural emphasis on personal appearance, increasing disposable incomes, and the growing influence of social media. Consumers' rising awareness about natural/sustainable ingredients and a need for inclusive products catering to diverse skin tones and hair types are also some major factors contributing to market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)