Brazil Non-Life Insurance Market Size, Share, Trends and Forecast by Insurance Type, Service Provider, Distribution Channel, End User, and Region, 2026-2034

Brazil Non-Life Insurance Market Summary:

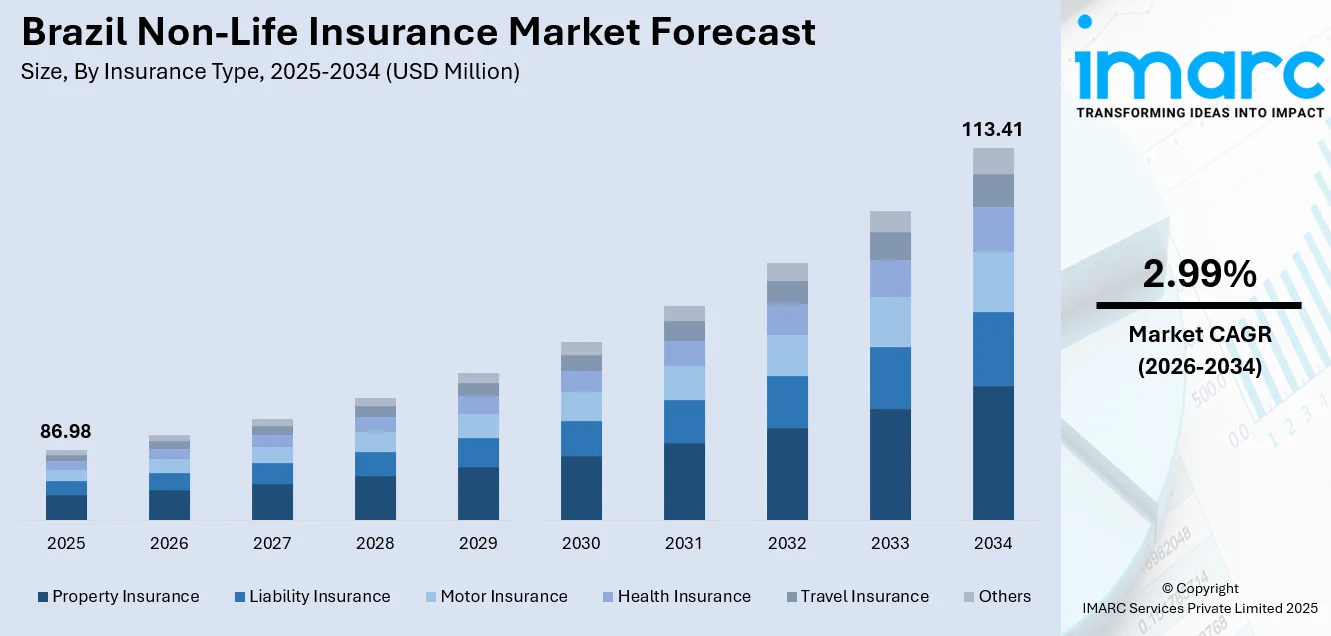

The Brazil non-life insurance market size was valued at USD 86.98 Million in 2025 and is projected to reach USD 113.41 Million by 2034, growing at a compound annual growth rate of 2.99% from 2026-2034.

The Brazil non-life insurance market growth is primarily driven by the expanding middle class, increasing insurance awareness among individuals and businesses, and the ongoing digital transformation of insurance distribution channels. The country's regulatory modernization initiatives are creating a more transparent and competitive environment that encourages market participation. Rising vehicle ownership, infrastructure development investments, and heightened awareness about risk management solutions are substantially contributing to demand expansion. The convergence of technological innovation, regulatory reforms, and economic development creates significant opportunities for stakeholders across the Brazil non-life insurance market.

Key Takeaways and Insights:

- By Insurance Type: Motor insurance dominates the market with a share of 21% in 2025, driven by rising vehicle ownership, mandatory third-party liability requirements, and increasing individual awareness about financial protection against accidents and theft.

- By Service Provider: Private insurance providers lead the market with a share of 90% in 2025, supported by their extensive distribution networks, diverse product portfolios, technological capabilities, and strong brand recognition among consumers and businesses.

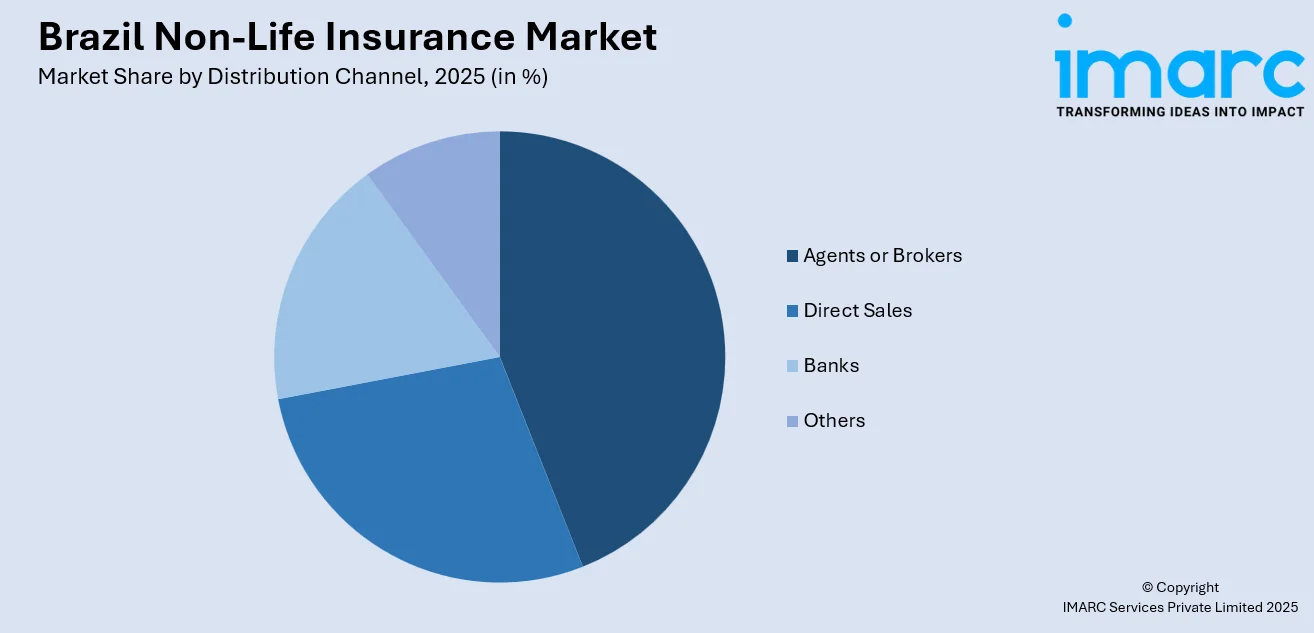

- By Distribution Channel: Agents or brokers represent the largest segment with a market share of 38% in 2025. This dominance is because of personalized advisory services, established client relationships, and the complexity of insurance products requiring professional guidance.

- By End User: Individual dominates the market with a share of 65% in 2025, reflecting the growing middle-class population seeking personal protection for vehicles, property, health, and travel-related risks.

- By Region: Southeast leads the market with a share of 49% in 2025, owing to its high population density, robust economic base, and concentration of commercial and industrial activity. Major urban centers are catalyzing the demand for motor, property, and commercial insurance products, supported by higher asset ownership and income levels.

- Key Players: The Brazil non-life insurance market exhibits moderate competitive intensity, with established domestic insurers and multinational corporations competing across product segments and distribution channels through innovation and service differentiation.

To get more information on this market Request Sample

The Brazil non-life insurance market is driven by multiple factors, including advancements in financial products and regulatory changes. In recent years, Brazil has seen increased interest in innovative insurance solutions, such as insurance-linked securities (ILS), which provide alternative capital to insurers. For instance, Brazil's first ILS deal in 2025 raised $6.2 million, marking a significant step toward integrating capital markets with the insurance sector. This development follows legislation from 2022 that enabled such transactions, helping insurers access additional funding and increasing the market’s resilience. Besides this, the rising awareness among individuals and businesses about the importance of comprehensive risk management is impelling the market growth. As the middle class grows and more people understand the need to protect assets like homes, vehicles, and businesses, the demand for non-life insurance products rises. Additionally, the expansion of digital platforms and the use of data analytics by insurers is making policy management more accessible and efficient, further contributing to the market growth.

Brazil Non-Life Insurance Market Trends:

Economic Growth and Rising Middle-Class Incomes

Brazil’s economic growth and expanding middle class are influencing the non-life insurance market, as increasing incomes and increased financial stability drive the demand for asset protection and risk management solutions. As the country's GDP increases, disposable incomes also rise, leading to higher demand for insurance products. The growing middle class is becoming more aware about the importance of protecting valuable assets, such as homes, automobiles, and businesses. According to the Brazilian Institute of Geography and Statistics (IBGE), in 2025, the per capita household income for Brazil in 2024 was BRL 2,069, ranging from BRL 1,077 in Maranhão to BRL 3,444 in the Federal District. This improved financial stability and increased purchasing power are driving the demand for non-life insurance, as individuals and businesses seek greater financial protection and risk management.

Rising Natural Disaster Risks

Increasingly frequent and intense natural disasters in Brazil, including floods, hurricanes, and wildfires, are driving the demand for non-life insurance products. As climate change exacerbates weather-related risks, both individuals and businesses are becoming more inclined to purchase property, crop, and disaster-related coverage. Insurers are also expanding their offerings to include more comprehensive coverage for natural events. For instance, in 2025, Aon structured Brazil's first parametric forest fire insurance policy for Faber-Castell, designed to address the financial risks from wildfires. This innovative solution offered quick payouts based on satellite data, ensuring operational continuity within 30 days. It marked a significant milestone in climate risk management in Brazil, enhancing coverage for industries vulnerable to forest fires.

Development of Digital and Insurtech Solutions

With advancements in technology, insurers are offering digital solutions that streamline the purchasing process, simplify claims management, and improve client experiences. The rise of online distribution channels, mobile apps, and automated underwriting systems is making it easier for people to access and purchase non-life insurance products. In line with trend, in 2024, InsureMO and Noorden Group announced a strategic partnership aimed at accelerating digital transformation in Brazil’s insurance industry. The collaboration combined InsureMO’s advanced digital infrastructure with Noorden Group's local market expertise, offering enhanced support, faster product launches, and improved operational efficiency for Brazilian insurers. These innovations are particularly appealing to tech-savvy individuals who seek convenience and efficiency.

Market Outlook 2026-2034:

The Brazil non-life insurance market demonstrates robust growth potential over the forecast period, supported by favorable demographic trends, regulatory modernization, and accelerating digital transformation across the insurance sector. Rising awareness about risk protection, expansion of vehicle ownership, and growth in property and commercial activities are catalyzing the demand for non-life insurance products. Continued innovation and improved distribution channels are expected to sustain steady market growth. The market generated a revenue of USD 86.98 Million in 2025 and is projected to reach a revenue of USD 113.41 Million by 2034, growing at a compound annual growth rate of 2.99% from 2026-2034.

Brazil Non-Life Insurance Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Insurance Type | Motor Insurance | 21% |

| Service Provider | Private Insurance Providers | 90% |

| Distribution Channel | Agents or Brokers | 38% |

| End User | Individual | 65% |

| Region | Southeast | 49% |

Insurance Type Insights:

- Property Insurance

- Liability Insurance

- Motor Insurance

- Health Insurance

- Travel Insurance

- Others

Motor insurance dominates with a market share of 21% of the total Brazil non-life insurance market in 2025.

Motor insurance leads the market due to widespread vehicle ownership, high urban mobility, and a steady demand for financial protection against road-related risks. As personal and commercial vehicle fleets expand, motor insurance continues to play a vital role in safeguarding assets and promoting responsible driving. In 2024, Brazil’s commercial vehicle production saw a strong recovery, reaching 169,001 units, according to the Association of Automotive Vehicle Manufacturers of Brazil (ANFAVEA). This growth further strengthens the motor insurance sector, contributing to stable premium inflows and long-term portfolio growth.

The dominance of motor insurance is reinforced by ongoing product innovation and the expansion of distribution channels. Digital platforms, usage-based policies, and customizable coverage options enhance customer engagement and make insurance more accessible to a wider audience. Additionally, partnerships with auto dealers, banks, and digital aggregators improve market penetration, ensuring a larger user base. Strong claims management systems and improved underwriting capabilities contribute to building trust among users, solidifying motor insurance as the leading segment within the market.

Service Provider Insights:

- Public Insurance Providers

- Private Insurance Providers

Private insurance providers lead with a market share of 90% of the total Brazil non-life insurance market in 2025.

Private insurance providers dominate the market owing to their strong distribution networks, broad product portfolios, and ability to tailor coverage solutions to diverse user needs. These providers offer flexible policy structures, competitive pricing, and value-added services that appeal to individual and commercial clients. Their focus on client experience, supported by digital platforms and efficient claims processing, enhances policy adoption and retention across multiple non-life insurance segments.

The dominance of this segment is further strengthened by continuous innovation and strategic partnerships. Investment in data analytics, risk assessment tools, and digital underwriting improves operational efficiency and pricing accuracy. Collaboration with banks, auto dealers, and online platforms expands market reach. Strong brand presence, financial stability, and responsive service models enable private insurance providers to maintain leadership in the market.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Direct Sales

- Agents or Brokers

- Banks

- Others

Agents or brokers exhibit a clear dominance with a 38% share of the total Brazil non-life insurance market in 2025.

Agents and brokers represent the largest segment, attributed to their strong advisory role, personalized service, and in-depth understanding of client risk profiles. Their ability to effectively explain coverage options, tailor policies to specific needs, and offer ongoing support fosters trust and builds long-term relationships with clients. This consultative approach is especially valued in complex non-life insurance products, such as motor, property, and commercial insurance, where the need for clear communication and guidance is critical.

The dominance of agents and brokers in the market is reinforced by their deep regional presence and close relationships with local communities and businesses. Their ability to provide efficient claims assistance, renewal management, and risk assessments significantly enhances the client experience. In 2025, Arthur J. Gallagher & Co. strengthened its capabilities in Brazil by acquiring São Paulo-based Case Group, an employee and health benefits brokerage. This acquisition demonstrates how the integration of digital tools with personal engagement improves reach, responsiveness, and overall service delivery in the non-life insurance sector.

End User Insights:

- Individual

- Corporates

Individual dominates with a market share of 65% of the total Brazil non-life insurance market in 2025.

Individual holds the biggest market share because of the rising personal asset ownership and the growing awareness about financial protection. Increased ownership of vehicles, homes, and personal valuables drives the demand for motor and property insurance products. Insurers offer a wide range of customizable policies designed to meet individual needs, making non-life insurance accessible and relevant for personal risk management. High renewal rates and long-term policy relationships further strengthen the individual segment’s contribution to overall market growth.

The dominance of the segment is further bolstered by the growth of digital distribution and client engagement initiatives. Online platforms, mobile apps, and streamlined policy issuance processes enhance accessibility and convenience, allowing individuals to easily manage their insurance needs. Personalized pricing, flexible payment options, and quicker, more efficient claims handling also contribute to greater satisfaction among individual clients. In addition, educational campaigns and a focus on improved transparency are encouraging more people to engage with the insurance market, broadening participation and increasing policy adoption.

Regional Insights:

- Southeast

- South

- Northeast

- North

- Central-West

Southeast dominates with a market share of 49% of the total Brazil non-life insurance market in 2025.

Southeast leads the market, largely driven by its robust economic foundation, high population density, and concentration of both commercial and industrial activities. This region’s major urban centers, such as São Paulo and Rio de Janeiro, are key drivers of demand for motor, property, and commercial insurance products. Higher asset ownership, coupled with elevated income levels, drive the need for comprehensive insurance coverage. The presence of both large corporate clients and small businesses also ensures steady demand for diverse non-life insurance solutions, solidifying the Southeast’s position as the dominant market force.

In addition to its economic strength, the Southeast enjoys a well-established insurance ecosystem and advanced financial infrastructure. A strong presence of insurers, brokers, and digital platforms enhances product availability and service delivery. High levels of insurance awareness and adoption further support premium growth and renewals. Continuous urban development, infrastructure projects, and a dynamic business environment guarantee long-term demand, making the Southeast the most influential region in Brazil’s non-life insurance landscape.

Market Dynamics:

Growth Drivers:

Why is the Brazil Non-Life Insurance Market Growing?

Increasing Awareness and Demand for Travel Protection

The growth of Brazil’s travel insurance market is largely driven by increasing individual awareness and the rising demand for travel protection. As more travelers seek to safeguard their trips against unforeseen events, such as medical emergencies, cancellations, or trip delays, the need for reliable travel insurance is growing. For instance, as per the IMARC Group, in 2024, the Brazil travel insurance market reached USD 477.82 million, reflecting the increasing recognition of the importance of coverage while traveling. This rise in demand is further driven by the growing number of international and domestic trips, alongside an increasing focus on securing peace of mind for travelers.

Growing Healthcare Costs and Medical Insurance Demand

The rising cost of healthcare in Brazil is driving the demand for non-life insurance coverage, as individuals and families seek protection against escalating medical expenses. Health insurance providers are responding by expanding their offerings to include broader coverage options, such as critical illness insurance and emergency medical services. In line with this trend, Porto Seguro, a prominent Brazilian insurance group, revealed in 2025 that it is in talks with private equity firms, including Summit Partners, to sell a minority stake in its health insurance division. This potential deal, involving a 5% stake, aims to accelerate the expansion of Porto Seguro's health business, underscoring the growing importance of comprehensive medical insurance in the country.

Government Regulations and Policy Mandates

Government regulations and policy mandates are crucial factors shaping the Brazil non-life insurance market, as these regulatory frameworks ensure the stability and growth of the sector by defining operational standards and protecting consumers. In 2025, the Brazilian Private Insurance Authority (SUSEP) initiated a public consultation on a new draft resolution aimed at modernizing reinsurance regulations. The proposed changes align with the New Brazilian Insurance Law and address key areas such as contract deadlines, retrocession limits, and jurisdictional provisions. The feedback on these changes, due by December 29, 2025, is expected to further streamline and enhance the reinsurance market, influencing the broader non-life insurance landscape.

Market Restraints:

What Challenges the Brazil Non-Life Insurance Market is Facing?

Economic Volatility and Interest Rate Fluctuations

Macroeconomic instability marked by inflation, currency volatility, and fluctuating interest rates challenges insurance market development by reducing individual purchasing power and increasing operating uncertainty. Rising financing costs affect premium affordability, while unstable economic conditions complicate investment planning, claims reserving, and pricing strategies. These pressures require insurers to carefully manage risk, maintain financial discipline, and adapt product structures to sustain market stability.

Limited Insurance Penetration in Underserved Segments

Significant insurance coverage gaps remain across Brazil, particularly among rural populations and lower-income segments. Limited awareness about insurance benefits, affordability concerns, and uneven distribution networks restrict broader market penetration. These gaps constrain near-term market growth while highlighting the need for expanded outreach, simplified products, and inclusive distribution models to extend coverage and strengthen long-term development of the non-life insurance sector.

Complex Regulatory Environment and Compliance Requirements

Brazil’s evolving regulatory environment requires insurers and intermediaries to continuously adapt to new compliance standards. Implementation of the Insurance Contract Law and Open Insurance initiatives introduces transition complexities, while detailed tax structures and reporting requirements increase operational workloads. These regulatory demands raise compliance costs and require ongoing investment in systems, governance, and expertise, influencing operational efficiency across the non-life insurance market.

Competitive Landscape:

The Brazil non-life insurance market exhibits moderate competitive intensity characterized by the presence of established domestic insurers and multinational corporations competing across product segments and distribution channels. Market dynamics reflect strategic positioning, ranging from premium, innovation-driven offerings emphasizing advanced technology and client experience to value-oriented products targeting cost-conscious individuals. The competitive landscape is increasingly shaped by digital transformation initiatives, merger and acquisition (M&A) activity, and strategic partnerships between traditional insurers and insurtech companies. Market leaders are differentiating through distribution network expansion, product innovation, and service quality enhancements while new entrants leverage technology platforms to challenge established business models.

Recent Developments:

- January 2026: Now Seguros, a Brazilian digital insurer, received full authorization from the Superintendence of Private Insurance (Susep) to operate nationwide. This approval ends its participation in the Regulatory Sandbox and enables the company to expand its property, casualty, and personal coverage offerings. Now Seguros aims to simplify insurance through its digital-first approach and strategic partnerships.

- August 2025: FM Seguros, a subsidiary of FM Global, received a license to operate as an insurer in Brazil. This strategic move capitalized on FM’s 40-year presence in the country, allowing it to offer property insurance based on engineering and scientific research for loss prevention. The company planned to start operations in 2026, enhancing its partnerships with Brazilian businesses.

Brazil Non-Life Insurance Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Insurance Types Covered | Property Insurance, Liability Insurance, Motor Insurance, Health Insurance, Travel Insurance, Others |

| Service Providers Covered | Public Insurance Providers, Private Insurance Providers |

| Distribution Channels Covered | Direct Sales, Agents or Brokers, Banks, Others |

| End Users Covered | Individual, Corporates |

| Regions Covered | Southeast, South, Northeast, North, Central-West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Brazil non-life insurance market size was valued at USD 86.98 Million in 2025.

The Brazil non-life insurance market is expected to grow at a compound annual growth rate of 2.99% from 2026-2034 to reach USD 113.41 Million by 2034.

Motor insurance dominates the market with 21% revenue share in 2025, driven by rising vehicle ownership, mandatory liability requirements, and increasing individual awareness about financial protection.

Key factors driving the Brazil non-life insurance market include the country’s economic growth and the expanding middle class. As household incomes rise, with an average of BRL 2,069 in 2024, financial stability increases, leading individuals and businesses to seek greater asset protection and risk management solutions.

Major challenges include economic volatility and interest rate fluctuations affecting consumer purchasing power, limited insurance penetration in underserved segments and rural areas, complex regulatory compliance requirements, and intense competition pressuring profit margins across product categories.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)