Brazil Online Sports Betting Market Size, Share, Trends and Forecast by Sport Type, End-User, and Region, 2026-2034

Brazil Online Sports Betting Market Summary:

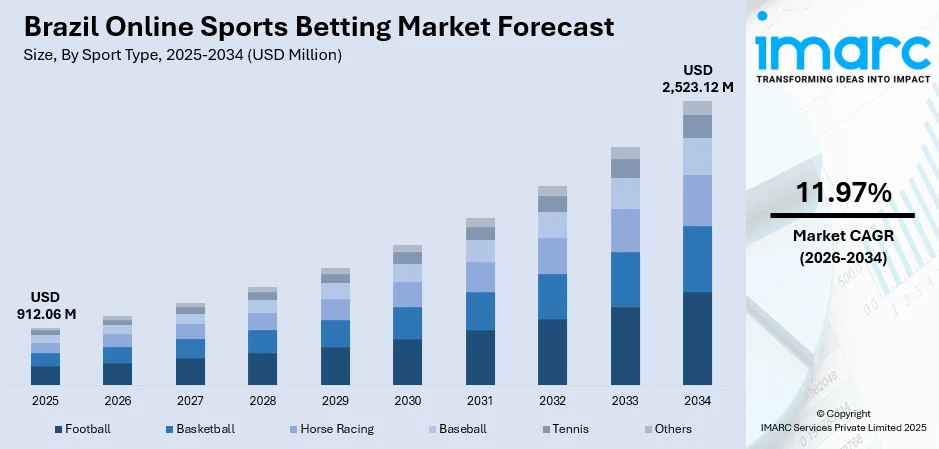

The Brazil online sports betting market size was valued at USD 912.06 Million in 2025 and is projected to reach USD 2,523.12 Million by 2034, growing at a compound annual growth rate of 11.97% from 2026-2034.

The Brazil online sports betting market growth is primarily driven by the implementation of comprehensive regulatory frameworks that have formalized online betting operations, coupled with the country’s deep-rooted passion for football and the widespread adoption of digital payment infrastructure. The convergence of regulatory clarity, mobile technology proliferation, and strategic partnerships between betting operators and major football clubs is fundamentally reshaping the competitive landscape and creating substantial opportunities for market participants.

Key Takeaways and Insights:

- By Sport Type: Football dominates the market with a share of 79.6% in 2025, due to Brazil's unparalleled passion for the sport, extensive media coverage of domestic leagues, and the proliferation of in-play betting options during live matches.

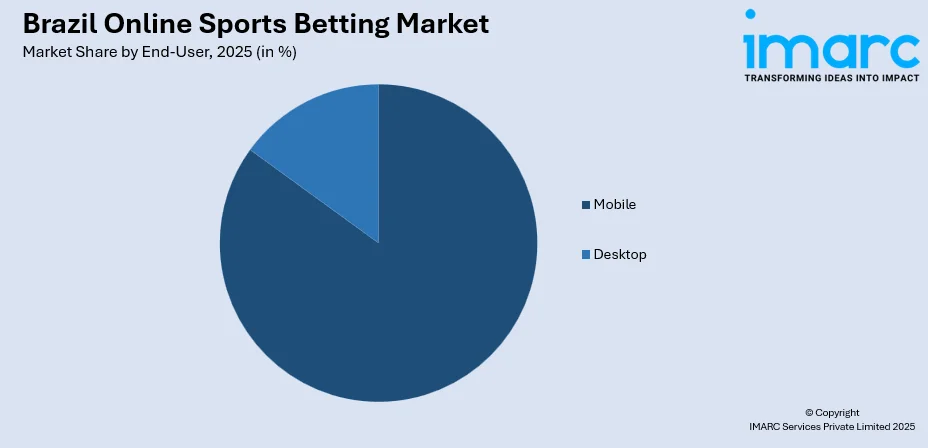

- By End-User: Mobile leads the market with a share of 85.0% in 2025, owing to by high smartphone penetration rates, the convenience of betting applications, and the integration of instant payment systems that enable seamless transactions.

- By Region: Southeast represents the largest segment with a market share of 48.9% in 2025, driven by higher population density in metropolitan areas, greater disposable income levels, and superior digital infrastructure in São Paulo and Rio de Janeiro.

- Key Players: The Brazil online sports betting market is experiencing heightened competitive dynamics, with international gaming operators and domestic platforms vying for market share. They focus on securing sponsorship agreements, investing in technological innovation, and ensuring regulatory compliance to strengthen their market positioning and attract a larger user base.

To get more information on this market Request Sample

The growth of the Brazil online sports betting market is driven by a combination of factors, including maturing regulatory environment, rising user demand for digital entertainment, and increasing national income levels. The recent legalization of online sports betting is creating a secure and structured framework, attracting both domestic and international operators. This regulatory clarity not only encourages competition but also enhances the user experience by offering a diverse range of betting options. In 2025, Betsson AB was granted a full license to offer online sports betting and iGaming in Brazil, marking a pivotal moment in the sector's development. This licensing highlights the market's transition to a regulated environment, ensuring security and high-quality services for local users. Furthermore, the country's deep cultural connection with sports, especially football, along with a tech-savvy younger demographic, further supports the market growth.

Brazil Online Sports Betting Market Trends:

Legalization and Regulatory Framework

The introduction of a formalized regulatory framework is the key actor impelling the market by providing legal clarity for operators, ensuring user protection, and generating tax revenue. This regulatory structure is attracting both domestic and international investment, enhancing competition and improving customer experiences. A significant milestone was reached in January 2025 when Brazil officially launched online sports betting and iGaming under the oversight of the Prizes and Betting Secretariat (SPA). The issuance of 67 licenses to major brands underscores the rapid shift to a competitive, regulated environment, fostering industry growth and boosting market confidence.

Platform Innovation and User Experience Enhancement

Operators are increasingly focusing on creating user-friendly, dynamic, and engaging experiences to attract and retain users. By offering intuitive interfaces, diverse betting options, and seamless mobile integration, platforms can better meet the evolving demands of bettors. This enhanced user experience, combined with adherence to Brazil’s regulatory framework, fosters user confidence and supports the market growth. In 2025, BIG Brazil launched its sports betting brand, BigBet, expanding its presence in Brazil’s regulated betting market. The platform emphasizes a user-friendly and dynamic experience while ensuring compliance with the new regulatory framework, providing secure services for bettors.

Improved Payment Solutions and Security

People are increasingly selecting platforms that provide secure, fast, and convenient payment methods, such as credit cards, digital wallets, and bank transfers. The integration of robust encryption and anti-fraud systems further builds user trust. As payment security improves and options become more user-friendly, more people in the country are encouraged to engage in online betting. For instance, in 2025, Paysafe announced its expansion into Brazil's regulated online sports-betting market after receiving a payment institution license from the Central Bank of Brazil. This move will allow Paysafe to enhance its partnerships with iGaming operators and provide Brazilians with diverse payment options, including Skrill, NETELLER, and Pix.

Market Outlook 2026-2034:

The Brazil online sports betting market is set for strong growth during the forecast period, driven by regulatory advancements and changing consumer engagement trends. The market generated a revenue of USD 912.06 Million in 2025 and is projected to reach a revenue of USD 2,523.12 Million by 2034, growing at a compound annual growth rate of 11.97% from 2026-2034. This growth is driven by increasing adoption of online betting platforms and evolving legal frameworks that promote a more regulated and accessible market.

Brazil Online Sports Betting Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Sport Type | Football | 79.6% |

| End-User | Mobile | 85.0% |

| Regional | Southeast | 48.9% |

Sport Type Insights:

- Football

- Basketball

- Horse Racing

- Baseball

- Tennis

- Others

Football exhibits a clear dominance with a 79.6% share of the total Brazil online sports betting market in 2025.

Football dominates the market due to the country’s deep-rooted passion for the sport. As the most popular sport, football attracts the highest volume of bettors, with numerous leagues and international tournaments providing continuous opportunities for wagering.

The extensive cultural significance of football and the resulting high fan engagement, which makes it the primary driver of online sports betting activity, is further validated by the market entry of new platforms, such as BandBet, which officially launched in 2025, offering betting options on over 30 sports, including football.

End-User Insights:

Access the comprehensive market breakdown Request Sample

- Desktop

- Mobile

Mobile leads with a share of 85.0% of the total Brazil online sports betting market in 2025.

Mobile holds the biggest market share owing to the widespread use of smartphones and the convenience they offer. Bettors can place bets anytime, anywhere, providing greater accessibility and driving higher participation in sports betting across the country.

Additionally, mobile technology enhances user experience with features like live updates, real-time odds, and seamless transaction capabilities. This accessibility is underscored by Aposta Ganha becoming the first Brazilian sports betting company to launch a dedicated mobile app for Android users in 2025.This move aims to enhance user experience with a fast, intuitive, and secure platform, offering easy access to a wide range of sports events and betting markets.

Regional Insights:

- Southeast

- South

- Northeast

- North

- Central-West

Southeast dominates with a share of 48.9% of the total Brazil online sports betting market in 2025.

Southeast represents the largest segment, driven by its high population density and economic significance. The region benefits from advanced infrastructure, widespread internet access, and higher disposable incomes.

The substantial demand generated by major cities like São Paulo and Rio de Janeiro, which establishes the region's market leadership in online sports betting, is a key factor attracting global operators, as evidenced by bet365's official launch of its online sports betting and casino operations in Brazil, in 2025, with its headquarters strategically located in Barueri, São Paulo.

Market Dynamics:

Growth Drivers:

Why is the Brazil Online Sports Betting Market Growing?

Enhanced User Protection and Responsible Gambling Practices

The increasing emphasis on user protection and responsible gambling practices is a key factor bolstering the Brazil online sports betting market growth. Platforms that allow users to self-exclude from betting sites contribute to creating a safer gambling environment by reducing risks associated with excessive betting. This fosters user trust and encourages wider participation in the market. In 2025, Brazil launched a centralized self-exclusion platform, developed by the Federal Data Processing Service, enabling players to voluntarily block access to licensed betting sites. This platform enhances consumer protection by ensuring self-excluded individuals are blocked within 72 hours, promoting long-term market expansion.

Entry of International Operators and Platform Expansion

As international companies secure local licenses and offer tailored gaming experiences, including a variety of betting and casino options, they play a pivotal role in market diversification and fostering increased competition. This not only enhances user choice but also raises industry standards, promoting responsible gaming and accelerating market adoption. In 2025, DigiPlus Interactive Corp. launched its GamePlus platform in Brazil, securing a federal license to operate both online sports betting and casino games. With over 150 local game titles, including sports-themed offerings, GamePlus aims to meet Brazil’s growing demand for regulated sports betting while setting new standards for responsible gaming.

Growing Disposable Income

As Brazil's economy expands and disposable incomes rise, more individuals are allocating funds to leisure activities, including online sports betting. According to the Brazilian Institute of Geography and Statistics (IBGE), in 2025, the per capita household income for Brazil in 2024 was BRL 2,069, ranging from BRL 1,077 in Maranhão to BRL 3,444 in the Federal District. This increase in income levels across various regions is fostering a growing inclination to spend on leisure. Combined with the availability of diverse betting options, this shift toward digital entertainment continues to drive the demand for online sports betting in Brazil.

Market Restraints:

What Challenges the Brazil Online Sports Betting Market is Facing?

Competition from Illegal Offshore Operators Undermining Market Development

Illegal offshore betting platforms remain a major challenge to the legitimate market, offering unregulated services that bypass local laws and protections. These platforms undermine industry standards by avoiding taxes and skipping responsible gambling practices, creating an uneven playing field. Despite regulatory actions, many unauthorized websites persist, competing unfairly with licensed operators who bear the costs of compliance and consumer protection.

High Regulatory Compliance and Licensing Costs Constraining Market Entry

The high cost of market entry, including licensing fees and mandatory financial reserves, creates significant barriers for new entrants. Smaller domestic operators struggle to compete with international companies that have established infrastructure and deep financial resources. These steep costs limit competition and consolidate power among well-capitalized firms, restricting innovation and diversity in the market, and hindering the growth of local businesses.

User Protection Concerns

Increased awareness about problem gambling and user indebtedness is leading to heightened regulatory scrutiny. Concerns over user protection are leading to potential restrictions on advertising, promotions, and payment methods in the betting industry. The governing body is starting monitoring consumer spending patterns through platforms like PIX, and this growing oversight is likely to lead to tighter regulations and additional controls on the industry.

Competitive Landscape:

The Brazil online sports betting market exhibits intensifying competitive dynamics characterized by the presence of major international gaming operators alongside emerging domestic platforms competing across multiple dimensions, including brand recognition, technological capabilities, and promotional offerings. Market dynamics reflect strategic positioning, ranging from premium, technology-driven experiences emphasizing advanced features and superior user interfaces to value-oriented approaches targeting price-sensitive individuals through competitive odds and promotional incentives. The competitive landscape is increasingly shaped by football sponsorship agreements that create brand visibility and individual engagement opportunities, with operators investing substantially in marketing activities to establish market positioning during the formative regulatory period. Regulatory compliance capabilities, responsible gambling credentials, and payment processing efficiency are emerging as critical competitive differentiators.

Recent Developments:

- In February 2025, MGM Resorts launched its online betting platform, BetMGM Brasil, in partnership with Grupo Globo. The platform, featuring over a thousand games, is now accessible nationwide, focusing on sports betting, casino games, and live-streaming casinos. With a five-year operating license granted by Brazil’s Ministry of Finance, MGM aims to provide a responsible and enjoyable betting experience, incorporating tools for user protection and responsible gaming.

- In December 2024, Brazil's Ministry of Finance began issuing authorisations for the first 71 online gambling applications, ahead of the market's official launch on January 1, 2025. As part of the regulatory process, companies must meet a four-stage review process covering security, anti-money laundering measures, and responsible gambling protocols.

Brazil Online Sports Betting Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sport Types Covered | Football, Basketball, Horse Racing, Baseball, Tennis, Others |

| End-Users Covered | Desktop, Mobile |

| Regions Covered | Southeast, South, Northeast, North, and Central-West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Brazil online sports betting market size was valued at USD 912.06 Million in 2025.

The Brazil online sports betting market is expected to grow at a compound annual growth rate of 11.97% from 2026-2034 to reach USD 2,523.12 Million by 2034.

Football dominates the Brazil online sports betting market with 79.6% revenue share in 2025, driven by the sport's cultural significance, extensive media coverage, and substantial operator investments in football club sponsorships.

Key factors driving the Brazil online sports betting market include improved payment security, fast and convenient payment methods like credit cards, digital wallets, and bank transfers, and enhanced user trust through robust encryption and anti-fraud systems. For instance, in 2025, Paysafe expanded into Brazil’s regulated market after receiving a payment institution license, offering diverse payment options such as Skrill, NETELLER, and Pix.

Major challenges include competition from illegal offshore operators circumventing regulatory requirements, high licensing and compliance costs constraining market entry, growing regulatory scrutiny regarding consumer protection and problem gambling, and evolving tax policies that may impact operator profitability.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)