Brazil Portable Iron Market Size, Share, Trends and Forecast by Iron Type, Soleplate Type, Distribution Channel, and Region, 2026-2034

Brazil Portable Iron Market Summary:

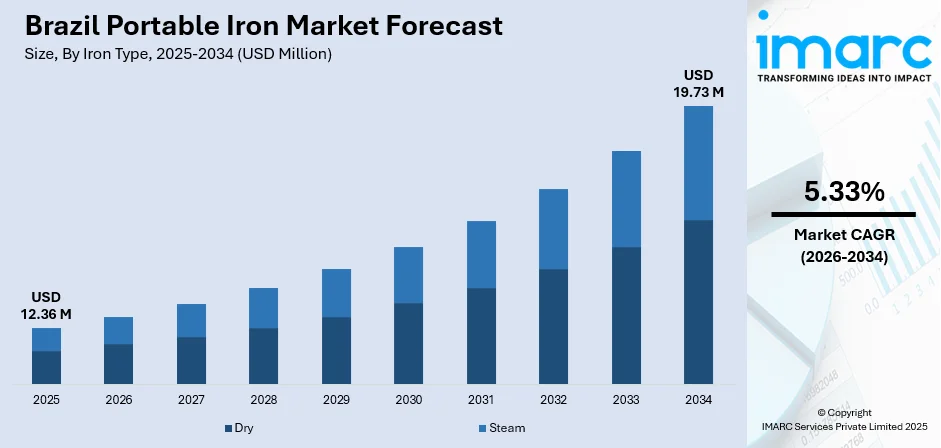

The Brazil portable iron market size was valued at USD 12.36 Million in 2025 and is projected to reach USD 19.73 Million by 2034, growing at a compound annual growth rate of 5.33% from 2026-2034.

The market is driven by the country's expanding middle class with increasing purchasing power, rising urbanization creating demand for convenient household appliances, and growing consumer awareness of garment care solutions. Increasing participation of women in the workforce and busy modern lifestyles elevate the need for efficient ironing solutions. The widespread availability of affordable models through extensive retail networks and the growing emphasis on personal appearance in professional settings continue to strengthen the Brazil portable iron market share.

Key Takeaways and Insights:

-

By Iron Type: Dry dominates the market with a share of 68.9% in 2025, driven by their affordability, lightweight design, ease of use, and widespread preference among budget-conscious consumers seeking reliable basic ironing functionality.

- By Soleplate Type: Stainless steel leads the market with a share of 57.5% in 2025, owing to its excellent durability, superior heat distribution, smooth gliding properties, and resistance to scratches and corrosion.

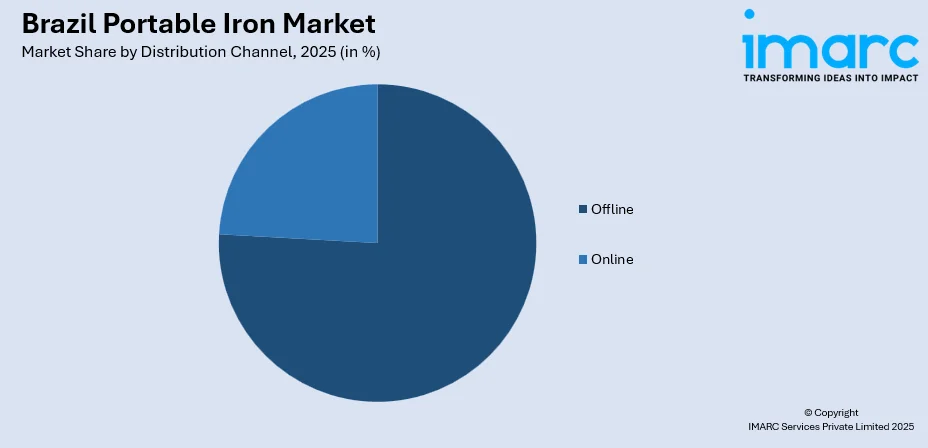

- By Distribution Channel: Offline represents the largest segment with a market share of 75.5% in 2025, driven by consumer preference for physical product inspection, immediate availability, and the extensive presence of electronics retailers and hypermarkets.

- By Region: Southeast dominates the market with a share of 45.7% in 2025, owing to its concentrated population, higher disposable incomes, mature retail infrastructure, and presence of major metropolitan centers including São Paulo and Rio de Janeiro.

- Key Players: The Brazil portable iron market exhibits a moderately fragmented competitive structure, with established international brands and domestic manufacturers competing across price segments. Market participants emphasize product innovation, energy efficiency features, and extensive distribution partnerships to strengthen market positioning.

To get more information on this market Request Sample

The Brazil portable iron market continues to expand as household formation rises and consumer preferences shift toward convenient, space-saving garment care solutions. Improving disposable incomes across urban and suburban regions support higher spending on reliable household appliances that simplify daily routines. A sustained focus on professional appearance across offices, services, and informal employment reinforces steady demand for effective ironing products among diverse consumer groups. Manufacturers are addressing evolving expectations by launching models with enhanced safety mechanisms, improved energy efficiency, faster heating performance, and ergonomic designs suited to frequent use. As per sources, Electrolux Group announced an investment of over R$700 million to build a 100% sustainable manufacturing plant in São José dos Pinhais, Paraná, reinforcing long-term commitment to Brazil’s appliance sector. Furthermore, the steady expansion of organized retail formats, combined with deeper penetration of e-commerce platforms, is strengthening product availability, price transparency, and brand visibility across metropolitan and tier-2 markets throughout Brazil.

Brazil Portable Iron Market Trends:

Growing Demand for Energy-Efficient Appliances

Brazilian consumers are increasingly prioritizing energy-efficient household appliances as electricity costs continue rising and environmental awareness grows. Government-led initiatives such as the Brazilian National Energy Conservation Label program influence purchasing decisions by highlighting products that consume less power during operation. As per sources, in 2025, INMETRO implemented updated mandatory energy-efficiency labeling regulations for household appliances in Brazil, improving transparency on electricity consumption and guiding consumers toward more energy-efficient products. Moreover, manufacturers are developing irons with automatic shut-off features, temperature regulation systems, and improved heating elements that reduce energy consumption while maintaining performance standards. This trend aligns with broader sustainability preferences shaping consumer behavior across the household appliances sector.

Expansion of Online Retail Channels

The e-commerce sector is experiencing rapid growth as digital infrastructure improves and consumers become more comfortable with online purchasing. Major retail platforms are expanding their home appliances categories, offering competitive pricing and convenient delivery options that attract tech-savvy shoppers. According to sources, Mercado Livre announced expansion of Brazil logistics operations, increasing fulfillment centers from 10 to 21 by 2025, improving same-day delivery coverage and strengthening e-commerce distribution for home appliances. While offline channels currently dominate, online sales are gaining momentum particularly in urban centers where internet penetration and smartphone adoption are highest. Retailers are implementing omnichannel strategies that integrate physical stores with digital platforms to capture evolving consumer shopping preferences.

Product Innovation and Enhanced Safety Features

Manufacturers are investing in product development to differentiate their offerings through advanced features and improved user experience. Modern portable irons incorporate safety mechanisms including automatic temperature control, anti-drip systems, and heat-resistant handles that prevent accidents during use. Lightweight designs with ergonomic grips reduce user fatigue during extended ironing sessions. Premium models feature advanced soleplate coatings that enhance gliding performance across different fabric types while minimizing the risk of damage to delicate garments.

Market Outlook 2026-2034:

The Brazil portable iron market demonstrates stable growth prospects as urbanization continues and household appliance penetration expands across emerging consumer segments. Rising income levels in secondary cities and regional markets present opportunities for market expansion beyond traditional metropolitan strongholds. The ongoing shift toward energy-efficient products will influence product development priorities and consumer preferences throughout the forecast period. E-commerce growth is expected to accelerate distribution efficiency while enhancing price competitiveness across market segments. The market is projected to generate sustained revenue growth as manufacturers introduce innovative products addressing evolving consumer expectations. The market generated a revenue of USD 12.36 Million in 2025 and is projected to reach a revenue of USD 19.73 Million by 2034, growing at a compound annual growth rate of 5.33% from 2026-2034.

Brazil Portable Iron Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Iron Type | Dry | 68.9% |

| Soleplate Type | Stainless Steel | 57.5% |

| Distribution Channel | Offline | 75.5% |

| Region | Southeast | 45.7% |

Iron Type Insights:

- Dry

- Steam

Dry dominates with a market share of 68.9% of the total Brazil portable iron market in 2025.

Dry represents the foundational product category within Brazil's portable iron market, offering straightforward functionality at accessible price points. These appliances appeal to budget-conscious consumers who prioritize simplicity and reliability over advanced features. The segment benefits from strong demand across lower and middle-income households where cost considerations significantly influence purchasing decisions. Lightweight construction and uncomplicated operation make dry irons suitable for consumers seeking basic garment care solutions without the complexity of water tanks and steam mechanisms.

The widespread availability of dry irons through diverse retail channels ensures consistent market penetration across urban and rural areas. Manufacturers continue offering a range of models with varying temperature settings and soleplate materials to address different consumer preferences and fabric care requirements. The durability and lower maintenance needs of dry irons compared to steam alternatives contribute to their sustained popularity among practical-minded consumers. Entry-level pricing enables first-time buyers and replacement purchasers to access quality ironing solutions within modest budgets.

Soleplate Type Insights:

- Stainless Steel

- Ceramic

- Others

Stainless steel leads with a share of 57.5% of the total Brazil portable iron market in 2025.

Stainless steel has established as the preferred choice among Brazilian consumers due to their excellent balance of performance, durability, and affordability. The material provides consistent heat distribution across the ironing surface, ensuring efficient wrinkle removal across various fabric types. Superior scratch resistance and corrosion protection extend product lifespan, offering consumers reliable long-term value. The smooth surface facilitates easy gliding during use while maintaining effectiveness through extended operational periods.

Manufacturers favor stainless-steel construction for its cost-effectiveness in production while delivering quality performance that meets consumer expectations. The material's robustness makes it suitable for frequent use in household environments where durability is essential. Stainless-steel soleplates require minimal maintenance compared to alternative materials, adding practical convenience for users. The segment's established market position reflects consumer confidence in proven technology that delivers consistent ironing results across diverse garment categories.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Offline

- Online

Offline exhibits a clear dominance with a 75.5% share of the total Brazil portable iron market in 2025.

Offline maintains a strong market leadership through extensive physical presence across Brazil's diverse geographic regions. Electronics stores, hypermarkets, and specialty retailers provide consumers with opportunities to examine products directly before purchase, an important consideration for appliance buying decisions. Major retail chains such as Casas Bahia and Magazine Luiza offer flexible payment plans and financing options that make purchases accessible to consumers across income levels. As per sources, in October 2025, Magazine Luiza is set to inaugurate a 4,000-square-meter Galeria Magalu megastore on Paulista Avenue, featuring the YouTube Theater through a Google naming rights partnership, integrating digital and physical retail experiences. Moreover, the ability to receive immediate product delivery and access after-sales support at physical locations reinforces consumer preference for traditional retail formats.

This channel benefits from established distribution networks that ensure product availability across metropolitan centers and secondary cities throughout Brazil. Retailers provide hands-on product demonstrations and personalized recommendations that assist consumers in selecting appropriate models for their specific needs. The integration of omnichannel strategies is enhancing offline retail competitiveness by combining in-store experiences with digital convenience features. Physical retail presence remains particularly important in regions where e-commerce infrastructure and delivery logistics are still developing.

Regional Insights:

- Southeast

- South

- Northeast

- North

- Central-West

Southeast dominates with a market share of 45.7% of the total Brazil portable iron market in 2025.

The Southeast dominates the Brazil portable iron market due to its high population density, advanced urbanization, and relatively higher disposable incomes. Major states such as São Paulo, Rio de Janeiro, and Minas Gerais generate consistent demand supported by a large working population and strong emphasis on professional appearance. Reliable electricity access and higher penetration of modern household appliances further support both first-time purchases and replacement demand.

Additionally, the Southeast benefits from well-developed retail and logistics infrastructure that ensures broad product availability. Organized retail chains, appliance specialty stores, and expanding e-commerce platforms enhance consumer access and price transparency. Proximity to manufacturing hubs and major ports lowers supply chain costs, enabling competitive pricing, efficient inventory management, and faster product introductions across the region.

Market Dynamics:

Growth Drivers:

Why is the Brazil Portable Iron Market Growing?

Rising Urbanization and Household Formation

Brazil's ongoing urbanization trend is creating sustained demand for household appliances as families establish new homes in metropolitan and suburban areas. The migration to urban centers drives household formation rates, with each new residence representing potential demand for essential appliances including portable irons. According to sources, in 2025, Eletros projected a 5% to 10% growth in appliance sales in Brazil, reflecting strong consumer demand and expanding household appliance adoption across urban and suburban regions. Moreover, cities offer greater employment opportunities and higher incomes that enable consumers to invest in products that enhance daily living standards. Urban lifestyles characterized by professional employment and social activities increase the importance of well-maintained clothing and personal presentation, directly supporting iron market growth.

Expanding Middle Class and Disposable Income Growth

The growth of Brazil's middle class is expanding the consumer base for household appliances across income segments. Rising disposable incomes enable greater spending on products that provide convenience and improve quality of life. According to economic indicators, Brazilian household disposable income has demonstrated consistent growth, reaching substantial levels that support consumer spending on durable goods. In 2025, Brazil’s household disposable income accumulated over 12 months was reported at 9,029,009,000,000.000 BRL in Oct increasing from 8,973,737,000,000.000 BRL for Sep 2025. This economic improvement allows consumers to upgrade from basic products to premium models with enhanced features and better performance characteristics.

Workforce Participation and Professional Appearance Requirements

Increasing workforce participation, particularly among women, generates sustained demand for efficient garment care solutions that support professional appearance requirements. As per sources, in September 2025, women represented 35.4% of Brazil’s capital markets workforce, reflecting increasing female labor participation and professional engagement across the financial sector. Moreover, modern workplaces maintain dress codes and presentation standards that necessitate well-pressed clothing for employees across various industries. The time constraints faced by working professionals create preference for efficient ironing solutions that deliver quality results quickly. Dual-income households have greater purchasing power while simultaneously experiencing time pressures that make effective home appliances essential for managing daily responsibilities.

Market Restraints:

What Challenges the Brazil Portable Iron Market is Facing?

Economic Volatility and Consumer Spending Fluctuations

Brazil’s economic environment experiences periodic volatility that influences consumer confidence and discretionary spending. Elevated interest rates and persistent inflationary pressures can constrain household budgets, prompting consumers to postpone non-essential appliance purchases. Additionally, currency fluctuations affect the cost of imported components and finished products, creating pricing uncertainty and potentially limiting affordability and overall market accessibility.

Competition from Alternative Garment Care Solutions

The portable iron market faces growing competition from alternative garment care options such as garment steamers, wrinkle-release sprays, and professional laundry services. Convenience-oriented consumers may prefer solutions requiring less time and effort. Moreover, the increasing adoption of wrinkle-resistant fabrics reduces the perceived need for frequent ironing among select consumer segments.

Infrastructure Limitations in Remote Regions

Infrastructure constraints in Brazil’s remote and rural regions restrict market penetration beyond major urban centers. High logistics and distribution costs raise retail prices and limit product availability. In addition, inconsistent electricity supply in certain areas can discourage appliance adoption, influencing purchasing decisions for portable irons and other electrical household products.

Competitive Landscape:

The Brazil portable iron market exhibits a competitive landscape shaped by established international brands alongside domestic manufacturers catering to varied consumer segments. International players capitalize on strong brand equity, advanced technology, and innovation to target premium consumers, while local companies emphasize cost competitiveness and efficient distribution to reach price-sensitive buyers. Competition is driven by product features, pricing strategies, distribution coverage, and after-sales service reliability. Market participants increasingly differentiate through higher energy efficiency ratings, improved soleplate materials, ergonomic designs, and enhanced safety certifications. Strategic retail partnerships, digital marketing, and promotional campaigns play a critical role in strengthening brand visibility and influencing consumer purchase decisions.

Brazil Portable Iron Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Iron Types Covered | Dry, Steam |

| Soleplate Types Covered | Stainless Steel, Ceramic, Others |

| Distribution Channels Covered | Offline, Online |

| Regions Covered | Southeast, South, Northeast, North, Central-West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Brazil portable iron market size was valued at USD 12.36 Million in 2025.

The Brazil portable iron market is expected to grow at a compound annual growth rate of 5.33% from 2026-2034 to reach USD 19.73 Million by 2034.

Dry dominated the Brazil portable iron market, driven by low cost, lightweight design, ease of operation, minimal maintenance needs, and widespread preference among budget-conscious households for basic, dependable ironing solutions.

Key factors driving the Brazil portable iron market include rising urbanization and household formation rates, expanding middle-class consumer base, increasing workforce participation requiring professional appearance, growing retail network coverage, and rising consumer preference for energy-efficient appliances.

Major challenges include economic volatility affecting consumer spending, competition from alternative garment care solutions, distribution limitations in remote regions, currency fluctuations impacting import costs, and price sensitivity among budget-conscious consumer segments.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)