Brazil Probiotics Market Size, Share, Trends and Forecast by Type, Distribution Channel, and Region, 2026-2034

Brazil Probiotics Market Size and Share:

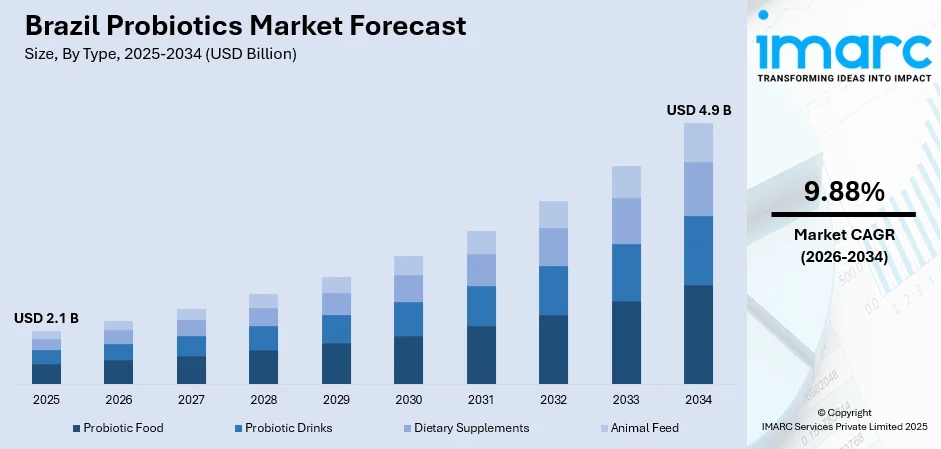

The Brazil probiotics market size was valued at USD 2.1 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 4.9 Billion by 2034, exhibiting a CAGR of 9.88% from 2026-2034. The market is experiencing steady growth driven by increasing health consciousness and consumer awareness about gut health's impact on overall well-being. Additionally, endorsements by healthcare professionals, government initiatives, and the expansion of e-commerce and retail channels make probiotics more accessible to a broad audience, further propelling market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 2.1 Billion |

|

Market Forecast in 2034

|

USD 4.9 Billion |

| Market Growth Rate 2026-2034 | 9.88% |

The Brazil probiotics market is witnessing significant growth, which is primarily due to the increasing consumer awareness about gut health and the need for maintaining overall wellness. Rising health consciousness among Brazil's population, as well as a demand for natural and preventive healthcare solutions, is majorly driving the demand for probiotics in dietary supplements, functional foods, and beverages. Along with this, the growing consumer awareness of the role of probiotics in enhancing immunity, improving digestion, and mitigating lifestyle-related disorders such as obesity and diabetes is also favoring the market. A new research published at 2024 International Congress on Obesity (ICO 2024, São Paulo, Brazil, 26 - 29 June) has shown that if the trend continues, nearly half of adult Brazilians (48%) will be living with obesity by 2044 while another 27% will be estimated to live with overweight - in other words, it is estimated that by 20 years from now, three-quarters of Brazilian adults will live with obesity and/or overweight. This stands at 56% with obesity or overweight today (34% with obesity and 22% with overweight). Moreover, with rising disposable income and urbanization in Brazil, premium probiotic products have access and are common in health-conscious households which is providing an impetus to the market.

To get more information on this market Request Sample

Another key driver is the proactive role of healthcare professionals and government initiatives towards probiotics consumption. Medical practitioners increasingly recommending probiotics as a complementary treatment alongside conventional treatments for gastrointestinal disorders and other health issues is another major factor that is positively influencing the market. Moreover, innovations in product formulations and the diversification of probiotic strains tailored for specific health needs are fueling market growth. Considerable growth in e-commerce platforms and retail channels is providing a greater section of the population the access to probiotics, further stimulating market growth. Furthermore, regulatory approvals and guidelines to ensure product quality and safety are also contributing to increased consumer trust, with more Brazilians incorporating probiotics as part of their daily lives.

Brazil Probiotics Market Trends:

Shift Toward Plant-Based and Vegan Probiotics

The popularity of plant-based diets in Brazil is increasing the demand for vegan and dairy-free probiotics. This can be attributed to the rising consumer demand for probiotics obtained from plant-based materials such as fermented soy, almond milk, and other non-dairy alternatives to dairy. The trend coincides with the current rise of interest in sustainable, allergen-free, and eco-friendly products. On 19th September 2024, Researchers from the University of São Paulo's Medical School conducted a study involving 774 Brazilian vegans and found that while participants generally consumed recommended levels of proteins and essential amino acids, their diets depended heavily on ultra-processed products such as textured soy protein (TSP) and plant-based supplements. These products, accounting for 13.2% of their energy intake compared to 23.7% of the general population, played a critical role in meeting protein requirements. Unprocessed and minimally processed foods formed 66.5% of the participants’ energy intake, significantly higher than the 44.9% observed in the general population. The study highlights concern about health risks associated with ultra-processed foods and calls for improved nutritional education and regulatory policies to promote access to healthier plant-based options. In addition to this, manufacturers are innovating as they seek to fulfill all these demands with a range of vegan-friendly probiotics, which capitalize on an emerging market segment that appeals to the health-conscious and ethical consumer.

Growing Focus on Targeted Probiotic Products

Personalized and condition-specific probiotics are trending in Brazil's market. More recent developments in microbiome are enabling companies to tailor their products to stress management, skin wellness, and women's health conditions, among others. This resonates well with consumers seeking tailored solutions to their problems, thus increasing their confidence in the effectiveness of probiotics. On 17th June 2024, Scientists in Brazil have designed bread that could be used to prevent asthma, a respiratory disease that causes more than 350,000 hospitalizations annually in the SUS, Brazil's public healthcare system. The formulation, on which a patent application has been submitted to the Brazilian Patent and Trademark Office (BR1020210266465), features in an article published in the Journal Current Developments in Nutrition. It has Saccharomyces cerevisiae UFMG A-905, which is a probiotic brewer's yeast strain with the ability to attenuate asthma symptoms in mice. Moreover, the market is further augmented by a focused marketing campaign and partnerships with healthcare professionals articulating the functional benefits of such specialty products.

Increasing Integration of Probiotics in Pet Care

As probiotics gain more significant attention in Brazil, the pet care sector witnesses a rise in applications, reflecting the increasingly raised awareness regarding pet health and nutrition. According to a research report by IMARC Group, Brazil's pet food market size is anticipated to exhibit a growth rate (CAGR) of 6.97% during 2024-2032. Moreover, pet owners are opting for probiotics to treat digestive problems, enhance immunity, and improve the overall well-being of their pets. It is due to this trend that companies are launching probiotic supplements, treats, and functional pet foods. It's a niche but rapidly expanding market that reflects the increasingly developed knowledge of probiotics' benefits. Thus, this growing population of health-conscious pet owners in Brazil is creating a positive market outlook.

Brazil Probiotics Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Brazil probiotics market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on type and distribution channel.

Analysis by Type:

- Probiotic Food

- Probiotic Drinks

- Dietary Supplements

- Animal Feed

Probiotic food is gaining prominence as it largely includes products, such as yogurt and fermented food. Its increasing consumption in daily meals to support digestion and immunity is positively influencing demand, particularly in the urban population seeking convenience with health-oriented diets.

On the other hand, probiotic drinks are becoming increasingly popular among the masses, including products such as kombucha, kefir, and enhanced juices. These consumer-friendly beverages combine a refreshing drink with a health booster, providing an immediate solution for busy, urban consumers looking to support gut health and general well-being.

Moreover, dietary supplements are also on the rise as consumers pursue preventive health management. Probiotics, sold in capsules, powders, and chewable forms cater to individual and general interest in having improved digestive health, enhanced immunity, and lowered lifestyle-related health risks.

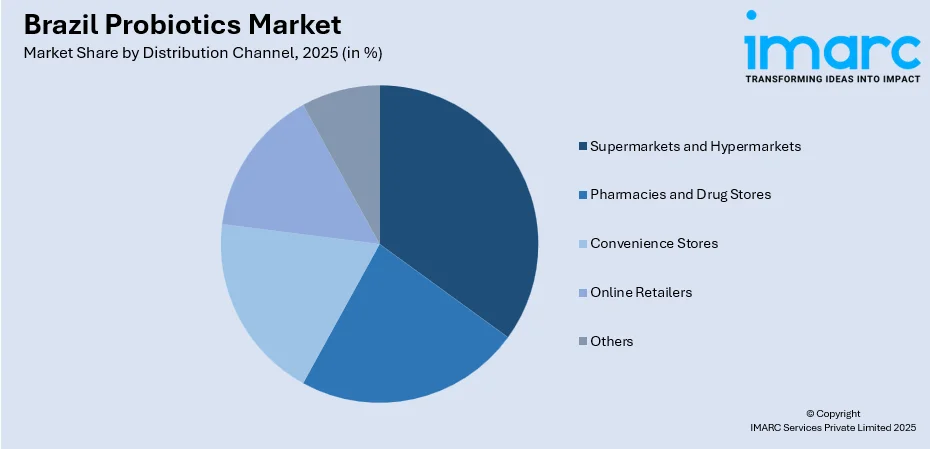

Analysis by Distribution Channel:

Access the comprehensive market breakdown Request Sample

- Supermarkets and Hypermarkets

- Pharmacies and Drug Stores

- Convenience Stores

- Online Retailers

- Others

One of the major distribution channels for probiotics in Brazil is supermarkets and hypermarkets, where a vast array of products is combined under one roof. These stores attract customers through their convenience, low prices, and frequent promotion activities, resulting in the high consumption of probiotic food and beverages.

On the contrary, pharmacies and drug stores are among the most important vendors of probiotic dietary supplements and health-oriented products. Their reputability, combined with access to professional advice from pharmacists, makes them the most reliable points of purchase for consumers looking for targeted, health-specific probiotics.

Furthermore, convenience stores are addressed to those consumers who want probiotic drinks and ready-to-eat foods in a hurry. The urban and overpopulated areas for such stores are impulse purchase hotspots while their businesses continue to thrive based on the increasing demand for functional foods due to busy life trends.

Regional Analysis:

- Southeast

- South

- Northeast

- North

- Central-West

The Southeast region market is driven by its urbanized population, higher income levels, and advanced retail infrastructure.

On the other hand, the South region leverages its health-conscious population and strong dairy consumption, driving demand for probiotic-rich products.

In addition, growing awareness and improved accessibility are fueling probiotics adoption in the Northeast, despite its lower urbanization.

The North region is gradually expanding its probiotics market as infrastructure develops and health-focused products gain traction.

The Central-West region benefits from its growing urban centers and rising health awareness, driving moderate growth in probiotics consumption.

Competitive Landscape:

The market in Brazil is highly competitive, with key players innovating constantly to cater to the varied needs of their consumers, capitalizing on the growth of health awareness. Several new product formulations, including vegan and plant-based probiotics, are being introduced in response to trends dominating the market due to their sustainability and allergen-free profiles. Moreover, numerous players are offering personalized probiotics focused on digestive health, immunity, and women's health, due to the extension of microbiome research. Apart from this, the strategic partnerships with healthcare professionals and retail channels are improving the credibility and accessibility of the products. In addition, the use of digital marketing and different e-commerce platforms is also serving as an avenue for key players in reaching a wider audience, particularly younger, tech-friendly consumers. Regulatory compliance and quality assurance continue to be at the forefront, with brands having to earn credibility in a competitive marketplace to deliver safe, effective, and scientifically grounded probiotic products.

The report provides a comprehensive analysis of the competitive landscape in the Brazil probiotics market with detailed profiles of all major companies.

Latest News and Developments:

-

May 15, 2024: NOVA Easy Kombucha, the sister company of Novo Brazil Brewing, launched a five-year co-branding partnership, gaining exclusive rights to partner with the San Diego Padres with kombucha. Sunset Slam Mango Lime is a part of the collaborations in this five-year partnership, which will be sold throughout Petco Park and at retail locations throughout San Diiego County. The drink will be served at multiple draft stations within the ballpark and in 16-oz cans with the colors of the Padres City Connect uniform.

Brazil Probiotics Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Probiotic Food, Probiotic Drinks, Dietary Supplements, Animal Feed |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Pharmacies and Drug Stores, Convenience Stores, Online Retailers, Others |

| Regions Covered | Southeast, South, Northeast, North, Central-West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Brazil probiotics market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Brazil probiotics market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Brazil probiotics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Probiotics are live microorganisms that, when consumed in adequate amounts, confer health benefits to the host. They are widely used in dietary supplements, functional foods, beverages, and animal feed to enhance digestion, boost immunity, and address lifestyle-related health conditions such as obesity and diabetes.

The Brazil probiotics market was valued at USD 2.1 Billion in 2025.

IMARC estimates the Brazil probiotics market to exhibit a CAGR of 9.88% during 2026-2034.

The growing consumer awareness about gut health and immunity, increasing health consciousness, rising demand for natural and preventive healthcare solutions, endorsements by healthcare professionals, and greater accessibility through e-commerce and retail channels are acting as significant factors driving the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)