Brazil Real Time Payments Market Report by Type of Payments (P2P, P2B), and Region 2026-2034

Brazil Real Time Payments Market Summary:

The Brazil real time payments market size reached 5.93 Billion Payments in 2025. Looking forward, IMARC Group expects the market to reach 18.50 Billion Payments by 2034, exhibiting a growth rate (CAGR) of 13.47% during 2026-2034. The growing small and medium-sized enterprises (SMEs), the significant expansion in hospitals and clinics, and the widespread adoption of real-time payments in fintech, online retailers, and e-commerce businesses are some of the key factors propelling the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

5.93 Billion Payments |

|

Market Forecast in 2034

|

18.50 Billion Payments |

| Market Growth Rate 2026-2034 | 13.47% |

Real-time payments, also known as instant payments, refer to a financial transaction system that enables the instantaneous transfer of funds between two parties or accounts. The transfer of money occurs within seconds, offering unparalleled speed and convenience compared to traditional payment methods, such as checks or electronic funds transfers (EFTs), which can take several business days to complete. The speed is made possible through advanced technological infrastructure and interoperability between financial institutions. Additionally, they enhance financial inclusivity by providing a faster and more accessible means of sending and receiving money. This is particularly impactful in Brazil payments, where innovations like Pix have transformed how consumers interact with financial services. It eliminates the waiting time associated with older payment methods—whether it's splitting a restaurant bill with friends, paying bills, or sending funds to family members in numerous parts of the world. Moreover, real-time payments streamline cash flow management, reducing the need for businesses to wait for payments and improving liquidity, which has a positive impact on a company's overall financial health. They also stimulate economic growth and facilitate commerce by enabling seamless online and mobile transactions through platforms such as digital wallet, making it easier for consumers to shop and businesses to sell their products and services.

Brazil Real Time Payments Market Trends:

AI-Driven Payment Security Enhancing Trust

As real-time payments gain widespread adoption, the demand for robust fraud prevention solutions is growing rapidly. Artificial Intelligence (AI) plays a crucial role in enhancing payment security by enabling real-time fraud detection and dynamic risk assessment. AI algorithms monitor transaction patterns, flag anomalies instantly, and reduce false positives, creating a smoother and safer user experience. With increasing cyber threats and rising transaction volumes, especially through platforms like Pix and wallet payments, banks and fintechs are investing in AI-powered tools to secure digital payments. This not only strengthens consumer trust but also encourages broader adoption of instant payment methods, contributing to the long-term growth of the real-time payments ecosystem.

Mobile Wallet Adoption Accelerating Instant Transactions

There is a surge in mobile wallet use, driven by smartphone penetration, fintech innovation, and the convenience of cashless transactions. Wallets integrated with real-time payment systems like Pix empower users to send and receive money instantly, pay bills, and make purchases seamlessly. Platforms such as Mercado Pago, PicPay, and Nubank are at the forefront of this trend, significantly increasing Brazil digital wallet payments. With the continued rise of e-commerce and investments in financial technology, mobile wallets are becoming essential tools for modern transactions—enhancing speed, convenience, and user control while reducing dependence on legacy banking systems.

Financial Inclusion via Pix Driving Market Expansion

Pix, the real-time payment system developed by Brazil’s central bank, is transforming access to formal financial services. By enabling fast, secure, and free transactions 24/7, Pix allows millions of unbanked and underbanked individuals to participate in the digital economy. Its adoption by individuals, merchants, and public agencies illustrates its broad utility. Pix also inspires innovation across fintech and banking, leading to the development of tailored services for underserved populations. As features like Pix Automático and cross-border capabilities evolve, Pix remains central to democratizing finance and advancing Brazil digital wallet payments in a digitally connected economy.

Brazil Real Time Payments Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on type of payments.

Type of Payments Insights:

To get more information on this market, Request Sample

- P2P

- P2B

The report has provided a detailed breakup and analysis of the market based on the type of payments. This includes P2P and P2B.

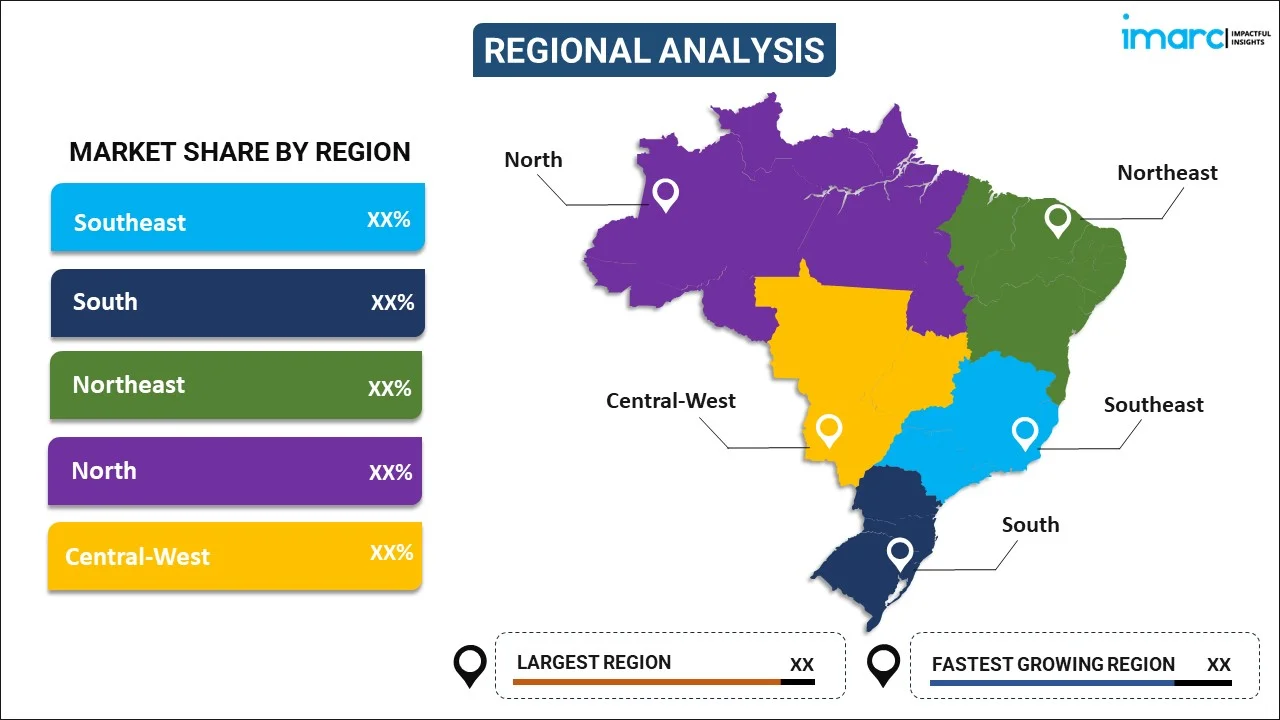

Regional Insights:

- Southeast

- South

- Northeast

- North

- Central-West

The report has also provided a comprehensive analysis of all the major regional markets, which include Southeast, South, Northeast, North, and Central-West.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Brazil Real Time Payments Market News:

- In June 2025, PPRO integrated Pix Automático, Brazil’s new recurring payment feature within the Pix instant payment system, on the day of its official rollout. Developed by the Central Bank, Pix Automático allows users to authorize repeat payments (e.g., subscriptions, utilities) with a single consent, enhancing convenience and financial inclusion—especially for 60 million unbanked Brazilians. This move supports PPRO’s aim to simplify payment flows and boost retention for merchants. It reflects Brazil’s growing digital payments sector and rising global competition to localize payment solutions.

- In May 2025, Juspay, a leading Indian FinTech, opened a Brazil office to offer advanced Pix 2.0 solutions, including Pix Biometrico, Pix Automático, and Pix by Proximity. This expansion marks its entry into Latin America amid Brazil’s booming digital payments sector. Juspay aims to enhance Pix infrastructure with secure, seamless real-time payments and provide its Hyperswitch orchestration platform.

Brazil Real Time Payments Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion Payments |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Type of Payments Covered | P2P, P2B |

| Regions Covered | Southeast, South, Northeast, North, Central-West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 9-11 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Brazil real time payments market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Brazil real time payments market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Brazil real time payments industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The real time payments market in Brazil reached 5.93 Billion Payments in 2025.

The Brazil real time payments market is projected to exhibit a CAGR of 13.47% during 2026-2034, reaching 18.50 Billion Payments by 2034.

The real-time payments market in Brazil is growing because of widespread smartphone adoption, regulatory support for digital payment infrastructure, and user demand for faster, low-cost transactions. Financial inclusion efforts and competition among fintech and traditional banks are accelerating innovation. Businesses are also adopting real-time solutions to improve cash flow and user experience, further contributing to the market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)