Brazil Specialty Fertilizer Market Report by Speciality Type (CRF, Liquid Fertilizer, SRF, Water Soluble), Application Mode (Fertigation, Foliar, Soil), Crop Type (Field Crops, Horticultural Crops, Turf and Ornamental), and Region 2026-2034

Brazil Specialty Fertilizer Market Overview:

Brazil specialty fertilizer market size reached USD 989.2 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 1,823.1 Million by 2034, exhibiting a growth rate (CAGR) of 7.03% during 2026-2034. The market is growing due to expanding agriculture, crop diversity, and government support. High-demand crops like soybean and sugarcane drive the need for advanced fertilizers to boost yields and protect soil. Precision agriculture—using GPS, sensors, and data tools—is helping farmers apply fertilizers more efficiently, cutting waste and improving sustainability. This tech-driven shift supports environmental goals and strengthens Brazil’s role in global agri-exports, especially as producers seek smarter, targeted nutrient solutions tailored to key crops and local soil conditions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 989.2 Million |

|

Market Forecast in 2034

|

USD 1,823.1 Million |

| Market Growth Rate 2026-2034 | 7.03% |

Specialty fertilizers are specifically formulated to meet the unique nutritional needs of particular crops or to address specific soil deficiencies. Unlike standard fertilizers, which provide a broad spectrum of nutrients, specialty fertilizers are tailored to optimize the growth and yield of specific plants. These products are a growing segment within the chemical industries, reflecting a shift toward more precise and sustainable solutions in agriculture. They can come in various forms, including granular, liquid, controlled release fertilizers, and water soluble fertilizers, all designed to deliver essential nutrients like nitrogen (N), phosphorus (P), potassium (K), and micronutrients such as iron, zinc, and magnesium in accurate proportions. This targeted delivery improves nutrient use efficiency, enhances crop quality, and reduces environmental harm. The integration of agrochemicals in balanced amounts, when paired with specialty fertilizers, supports higher yields while minimizing runoff and soil degradation.

Brazil Specialty Fertilizer Market Trends:

Growth in Bio-Based Fertilizers

The rising use of bio-based products is transforming the specialty fertilizer landscape in Brazil. Derived from natural materials like compost, plant extracts, and microbes, these inputs reduce reliance on synthetic agrochemicals and align with the sustainability goals of modern chemical industries. They're especially popular in high-value crops like soybean and sugarcane, where sustainable practices and certification are critical for export. Government programs and private investment are advancing production of bio-based inputs, while local manufacturers are expanding capacity to reduce imports. Demand for alternatives to conventional fertilizers is creating space for controlled release fertilizers and water soluble fertilizers that improve nutrient efficiency and environmental outcomes.

Rise of Organic Farming

Organic farming is on the rise in Brazil, fueled by global demand for residue-free produce and tighter import standards. This trend is driving the use of specialty fertilizers that comply with organic regulations—avoiding synthetic agrochemicals and focusing on naturally sourced nutrients. Farmers are increasingly adopting water soluble fertilizers and controlled release fertilizers suited for organic systems, helping manage fertility precisely without over-application. The growing shift also reflects the broader transformation of Brazil’s chemical industries, which are investing in cleaner, crop-specific solutions. With soybean and sugarcane growers exploring organic methods, the need for efficient and certified specialty fertilizers continues to rise, supported by both market forces and targeted agronomic training.

Brazil Specialty Fertilizer Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on speciality type, application mode, and crop type.

Speciality Type Insights:

- CRF

- Polymer Coated

- Polymer-Sulfur Coated

- Others

- Liquid Fertilizer

- SRF

- Water Soluble

The report has provided a detailed breakup and analysis of the market based on the speciality type. This includes CRF (polymer coated, polymer-sulfur coated, and others), liquid fertilizer, SRF, and water soluble.

Application Mode Insights:

- Fertigation

- Foliar

- Soil

A detailed breakup and analysis of the market based on the application mode have also been provided in the report. This includes fertigation, foliar, and soil.

Crop Type Insights:

- Field Crops

- Horticultural Crops

- Turf and Ornamental

The report has provided a detailed breakup and analysis of the market based on the crop type. This includes field crops, horticultural crops, and turf and ornamental.

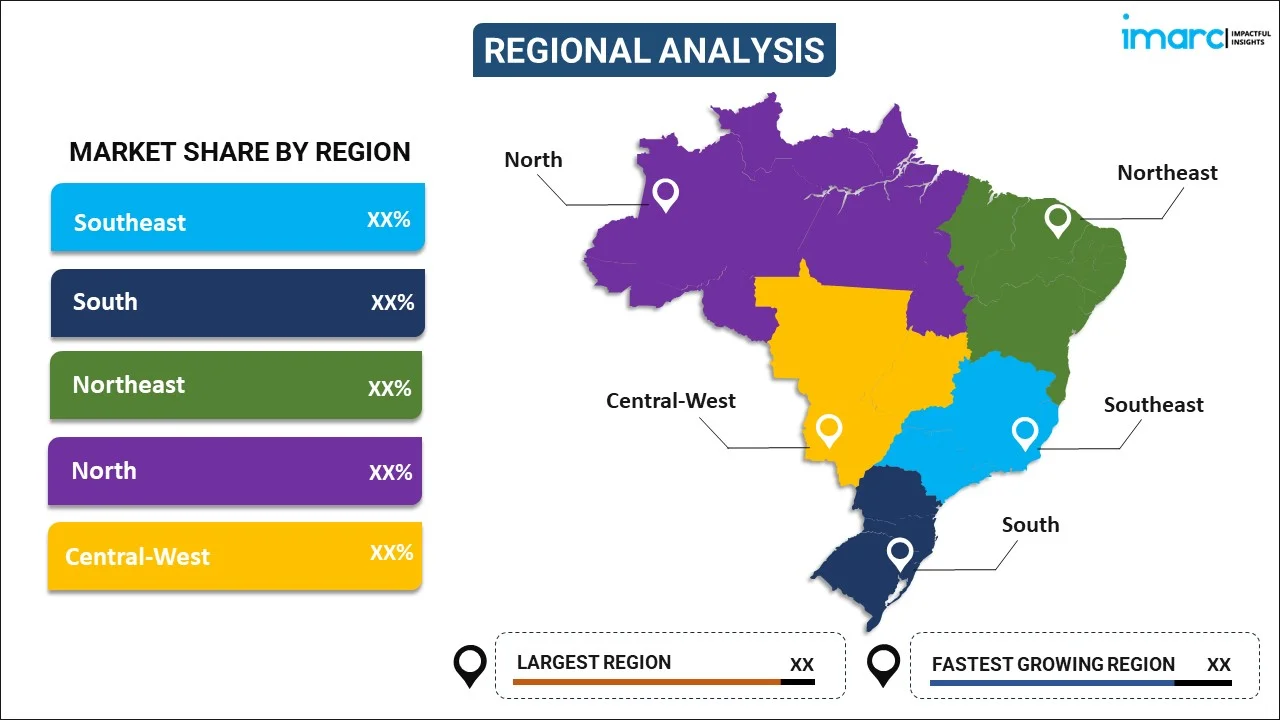

Regional Insights:

- Southeast

- South

- Northeast

- North

- Central-West

The report has also provided a comprehensive analysis of all the major regional markets, which include Southeast, South, Northeast, North, and Central-West.

Brazilian Specialty Fertilizer Companies:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Brazil Specialty Fertilizer Market News:

- In April 2025, Brazilian fertilizer producer Rifertil filed for bankruptcy protection, citing R647.9mn ($112.7mn) in debt. Key pressures included falling fertilizer prices, prolonged droughts in Goiás (its main market), increased customer defaults, and exchange rate losses from a stronger US dollar.

- In February 2025, Haifa Group launched a new blending facility in Uberlândia, Minas Gerais, to produce its Multicote controlled-release fertilizer. The plant will offer around 5,000–7,000 tonnes per year, with a focus on custom formulations tailored to specific crop and soil needs. This move strengthens Haifa’s role in Brazil as a precision nutrition provider. With over 20 years in the country, the company sees the facility as a key step in expanding its specialty fertilizer footprint.

- In February 2024, ICL acquired Brazilian biologicals firm Nitro 1000 for $30 million to boost its specialty plant nutrition portfolio. The move strengthens ICL’s presence in Brazil’s agri-input market, targeting crops like soybean, corn, and sugarcane with sustainable alternatives to traditional fertilizers. The acquisition supports ICL’s expansion strategy and builds on previous deals with Compass Minerals and Fertiláqua. Nitro 1000’s expertise will enhance ICL’s R&D, product innovation, and market share in Brazil’s growing biologicals segment.

Brazil Specialty Fertilizer Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Speciality Types Covered |

|

| Application Modes Covered | Fertigation, Foliar, Soil |

| Crop Types Covered | Field Crops, Horticultural Crops, Turf and Ornamental |

| Regions Covered | Southeast, South, Northeast, North, Central-West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 9-11 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Brazil specialty fertilizer market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Brazil specialty fertilizer market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Brazil specialty fertilizer industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Brazil specialty fertilizer market reached USD 989.2 Million in 2025.

The Brazil specialty fertilizer market is projected to grow at a CAGR of 7.03% during 2026-2034, reaching USD 1,823.1 Million by 2034.

Growth is fueled by expanding soybean and sugarcane cultivation, increasing adoption of precision agriculture, rising demand for high-efficiency and customized nutrient solutions, environmental concerns around conventional inputs, and ongoing R&D investments in sustainable crop nutrition technologies.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)