Brazil Toys Market Size, Share, Trends and Forecast by Product Type, Age Group, Sales Channel, and Region, 2026-2034

Brazil Toys Market Summary:

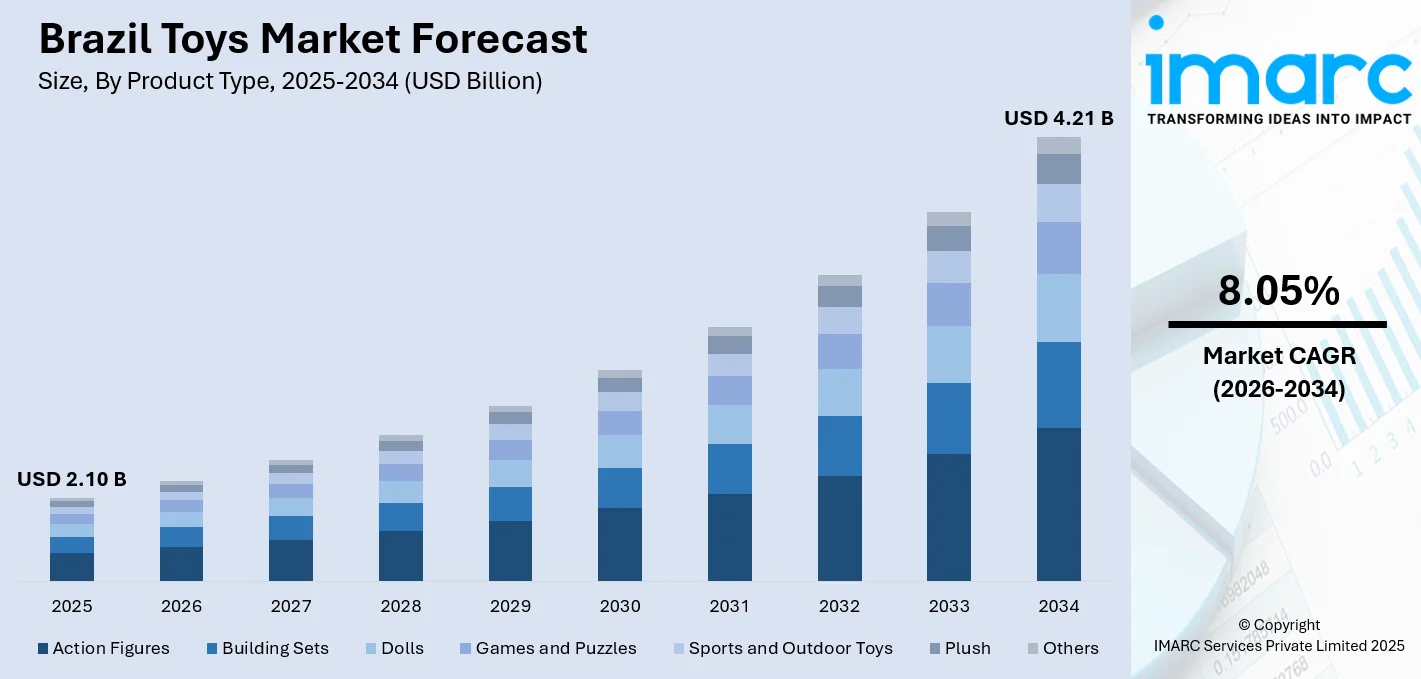

The Brazil toys market size was valued at USD 2.10 Billion in 2025 and is projected to reach USD 4.21 Billion by 2034, growing at a compound annual growth rate of 8.05% from 2026-2034.

The Brazil toys market is experiencing robust expansion, driven by growing parental emphasis on child development through play-based learning and entertainment. Rising disposable incomes across urban centers are enabling families to invest in higher-quality toys that promote cognitive, physical, and social development. The increasing penetration of both traditional retail channels and e-commerce platforms is expanding product accessibility nationwide, while the country's large young population continues to sustain strong demand for diverse toy categories across all price segments.

Key Takeaways and Insights:

- By Product Type: Sports and outdoor toys dominate the market with a share of 20.05% in 2025, owing to Brazil's vibrant outdoor culture and growing parental awareness about physical activity benefits for children. The favorable tropical climate enables year-round outdoor play, driving sustained demand for bicycles, trampolines, and sporting equipment.

- By Age Group: 5 to 10 years lead the market with a share of 42.1% in 2025. This dominance is driven by the peak play engagement during primary school years when children actively participate in structured games, educational activities, and peer-oriented entertainment experiences that require diverse toy selections.

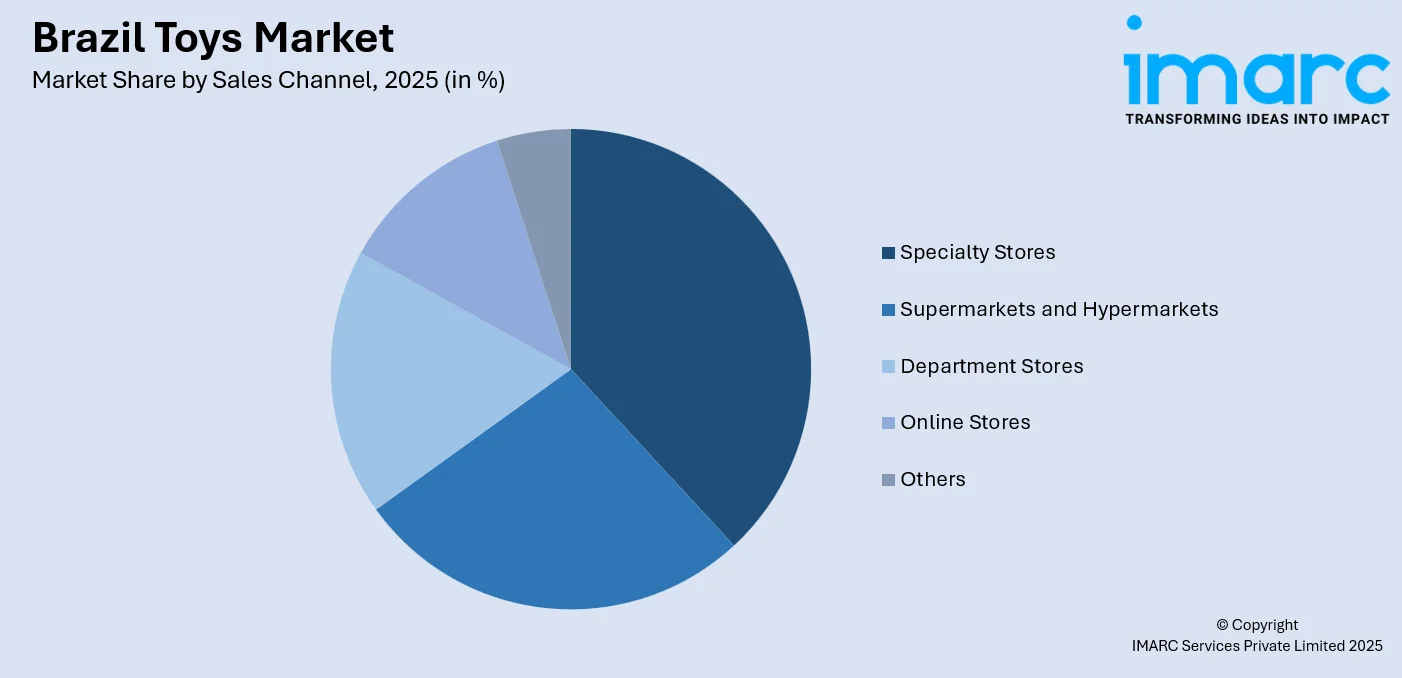

- By Sales Channel: Specialty stores represent the largest segment with a market share of 38.02% in 2025, reflecting consumer preference for dedicated toy retailers offering expert guidance, extensive product demonstrations, and curated selections that enhance the shopping experience for discerning parents.

- By Region: Southeast comprises the largest region with 40% share in 2025, driven by the concentration of Brazil's major metropolitan areas, including São Paulo and Rio de Janeiro, higher disposable incomes, and well-developed retail infrastructure supporting premium toy purchases.

- Key Players: Key players drive the Brazil toys market by expanding product portfolios across traditional and innovative categories, strengthening omnichannel distribution networks, and securing licensing agreements with popular entertainment franchises. Their investments in educational toy development, sustainability initiatives, and digital marketing strategies boost brand awareness and market penetration across diverse consumer demographics.

To get more information on this market Request Sample

The Brazil toys market demonstrates remarkable resilience and growth potential, underpinned by favorable demographic factors and evolving consumer preferences. Brazil's substantial young population, with children aged zero to fourteen representing 20% of the total population in 2024, creates sustained baseline demand for age-appropriate toys across developmental stages. The market benefits from a sophisticated retail ecosystem, combining specialty toy stores, mass-market retailers, and rapidly expanding e-commerce platforms that collectively enhance product accessibility. Parents increasingly prioritize toys offering educational value, promoting science, technology, engineering, and mathematics (STEM) skills, creativity, and physical development. The strong influence of international entertainment franchises drives demand for licensed merchandise, while growing environmental consciousness encourages sustainable toy alternatives. Regional disparities in economic development create diverse market dynamics, with urban centers in the Southeast demonstrating premium purchasing patterns.

Brazil Toys Market Trends:

Rising Demand for Educational and STEM-Based Toys

Brazilian parents are increasingly prioritizing toys that combine entertainment with educational value, driving significant demand for products promoting STEM learning. This shift reflects heightened awareness about early childhood cognitive development importance and the competitive educational environment. Construction sets, coding games, and interactive learning kits are gaining substantial traction, as parents seek to prepare children for future academic and professional success through play-based learning experiences. Additionally, rising influence of digital learning trends and school-led recommendations is encouraging manufacturers to integrate technology, creativity, and problem-solving elements into toy designs.

Expansion of E-commerce and Digital Retail Channels

The rapid digitalization of Brazil's retail landscape is transforming toy purchasing behavior, with e-commerce platforms offering unprecedented product variety and competitive pricing. Consumers increasingly leverage digital channels for price comparison, product reviews, and convenient home delivery options. As per IMARC Group, the Brazil e-commerce market size reached USD 513.3 Billion in 2025. This trend is particularly pronounced among urban millennials and tech-savvy parents who value seamless shopping experiences, expanding market access beyond traditional brick-and-mortar limitations to reach consumers nationwide.

Growing Preferences for Sustainable and Eco-Friendly Toys

Environmental consciousness among Brazilian consumers is driving increased demand for toys manufactured from sustainable materials, including recycled plastics, bamboo, and organic cotton. Parents are actively seeking products with reduced environmental footprints, encouraging manufacturers to adopt eco-friendly production processes and packaging solutions. This sustainability trend extends to durability expectations, with consumers preferring quality toys designed for extended use and intergenerational sharing rather than disposable alternatives. As a result, brands emphasizing ethical sourcing, safety certifications, and transparent sustainability messaging are gaining stronger trust and preference among environmentally aware Brazilian households.

Market Outlook 2026-2034:

The Brazil toys market outlook remains decidedly positive, supported by fundamental demographic strengths and evolving consumption patterns. Continued urbanization and rising middle-class incomes are expected to sustain premium toy segment growth, while digital transformation reshapes distribution dynamics. The market generated a revenue of USD 2.10 Billion in 2025 and is projected to reach a revenue of USD 4.21 Billion by 2034, growing at a compound annual growth rate of 8.05% from 2026-2034. Innovations in product development, particularly technology-integrated and educational toys, will drive market differentiation. Licensing partnerships with global entertainment franchises are anticipated to strengthen character-based toy sales, while sustainability initiatives attract environmentally conscious consumers.

Brazil Toys Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Product Type |

Sports and Outdoor Toys |

20.05% |

|

Age Group |

5 to 10 Years |

42.1% |

|

Sales Channel |

Specialty Stores |

38.02% |

|

Region |

Southeast |

40% |

Product Type Insights:

- Action Figures

- Building Sets

- Dolls

- Games and Puzzles

- Sports and Outdoor Toys

- Plush

- Others

Sports and outdoor toys dominate with a market share of 20.05% of the total Brazil toys market in 2025.

The prominence of sports and outdoor toys in Brazil reflects the nation's deeply ingrained culture of physical activity and outdoor recreation. Brazil's favorable tropical climate enables year-round outdoor play, creating consistent demand for products, including bicycles, trampolines, soccer equipment, and water toys. Additionally, urban parks, residential complexes, and school playgrounds are increasingly incorporating dedicated play zones, further supporting demand for outdoor toys. E-commerce and organized retail channels are also improving product accessibility, enabling wider adoption across both urban and semi-urban regions.

The outdoor toys segment benefits significantly from Brazil's passionate soccer culture, with sports-related toys maintaining evergreen demand across demographic groups. Holiday periods and international sporting events generate substantial sales spikes for outdoor equipment. Growing health consciousness among parents drives preference for toys promoting gross motor development, cardiovascular fitness, and social interaction through group play activities. The segment continues to expand through product innovations, incorporating safety features and durable materials suited to intensive outdoor use.

Age Group Insights:

- Up to 5 Years

- 5 to 10 Years

- Above 10 Years

5 to 10 years lead with a share of 42.1% of the total Brazil toys market in 2025.

The 5 to 10 years age group represents the peak period of active toy engagement, characterized by diverse play preferences spanning educational games, construction sets, action figures, and outdoor equipment. Children in this developmental stage demonstrate sophisticated play patterns requiring more complex and varied toy selections. The segment shows high responsiveness to new product launches, licensed characters, and interactive features that sustain long-term engagement. Rapid cognitive and social development during these years increases demand for toys that encourage creativity, problem-solving, and collaborative play.

This segment benefits from strong influence of entertainment franchises, peer recommendations, and emerging digital literacy that shapes product preferences. Parents demonstrate heightened willingness to invest in educational toys supporting academic preparation during formative school years. The transition from preschool to structured education creates demand for toys balancing entertainment with developmental benefits. Birthday celebrations, academic achievement rewards, and holiday gifting traditions concentrate purchasing activity within this age demographic throughout the calendar year.

Sales Channel Insights:

Access the comprehensive market breakdown Request Sample

- Supermarkets and Hypermarkets

- Specialty Stores

- Department Stores

- Online Stores

- Others

Specialty stores exhibit a clear dominance with a 38.02% share of the total Brazil toys market in 2025.

Specialty stores maintain market leadership through superior product expertise, comprehensive selections, and immersive shopping experiences that mass retailers cannot replicate. Dedicated toy retailers offer personalized customer service, product demonstrations, and curated assortments across premium and value segments. The tactile shopping experience enables parents and children to interact with products before purchase, building confidence in quality and age-appropriateness. Specialty stores often host promotional events, character appearances, and loyalty programs that strengthen customer relationships and drive repeat purchases.

The channel's prominence reflects Brazilian consumer preference for expert guidance when selecting children's gifts and educational products. Specialty retailers benefit from prime locations within shopping malls and commercial centers, capturing high foot traffic during peak shopping periods. The Abrin International Toy Fair held in March 2024 in São Paulo attracted thousands of visitors, showcasing the industry's commitment to innovation and retail partnership development. Strategic positioning and exclusive product launches reinforce specialty store competitive advantages against expanding online alternatives.

Regional Insights:

- Southeast

- South

- Northeast

- North

- Central-West

Southeast represents the leading region with a 40% share of the total Brazil toys market in 2025.

Southeast’s market dominance stems from concentrated economic activities and population density within Brazil's most developed metropolitan areas. São Paulo and Rio de Janeiro function as primary distribution hubs with extensive retail infrastructure supporting diverse toy categories, ranging from premium international brands to accessible domestic alternatives. Higher regional disposable incomes enable consumers to invest in educational, technology-integrated, and branded toys at premium price points. Strong exposure to global trends, media influence, and marketing campaigns further accelerates toy adoption and shapes consumer preferences.

The region benefits from sophisticated logistics networks enabling efficient product distribution and reduced lead times for inventory replenishment. Major toy manufacturers maintain headquarters and production facilities in São Paulo, supporting localized supply chain optimization. The Southeast's extensive shopping mall presence concentrates specialty toy retail within high-traffic commercial environments. E-commerce penetration reaches highest levels nationally within this region, creating multichannel purchasing options that enhance consumer convenience and market accessibility for domestic and international toy brands.

Market Dynamics:

Growth Drivers:

Why is the Brazil Toys Market Growing?

Rising Disposable Incomes and Middle-Class Expansion

The sustained expansion of Brazil's middle class and corresponding increases in household discretionary spending are fundamentally reshaping toy consumption patterns. Economic stabilization has restored consumer confidence, enabling families to allocate greater budgets towards children's entertainment and developmental products. Urban households demonstrate particular propensity for premium toy purchases, viewing quality play products as investments in child development rather than mere entertainment expenditures. As per macrotrends, the urban population of Brazil in 2023 was 185,356,223. This economic strengthening creates cascading effects throughout the value chain, encouraging manufacturers to expand product portfolios addressing diverse price points and consumer preferences. Rising purchasing power enables parents to respond to children's evolving interests with more frequent toy acquisitions, supporting both volume growth and category diversification across educational, outdoor, and entertainment segments. The premiumization trend benefits international brands while creating opportunities for domestic manufacturers offering competitive value propositions.

Increasing Parental Focus on Educational Development

Contemporary Brazilian parents demonstrate heightened awareness about play-based learning's importance for cognitive, social, and physical development. This educational consciousness drives demand for toys incorporating STEM concepts, problem-solving challenges, and creative expression opportunities. The competitive academic environment motivates parents to seek products providing developmental advantages while maintaining entertainment value. Educational toys spanning construction sets, coding kits, science experiments, and language learning systems command premium pricing based on perceived developmental benefits. This trend reflects broader societal emphasis on preparing children for knowledge-based economy participation through early skill development. Manufacturers respond by expanding educational product lines and emphasizing developmental benefits in marketing communications. The intersection of entertainment and education creates sustainable demand growth as parents increasingly evaluate toy purchases against developmental criteria rather than pure entertainment value alone.

E-commerce Expansion and Digital Retail Transformation

The rapid acceleration of e-commerce adoption across Brazil is fundamentally transforming toy distribution dynamics and market accessibility. Digital platforms enable consumers in geographically remote areas to access comprehensive toy selections previously available only in major urban centers. Online retail offers compelling advantages, including price transparency, product reviews, and home delivery convenience that resonate with time-constrained parents. The proliferation of marketplace platforms and direct-to-consumer (D2C) channels creates opportunities for both established brands and emerging manufacturers to reach expanded customer bases. Mobile commerce growth enables spontaneous purchase decisions through social media discovery and influencer recommendations. Digital marketing capabilities allow targeted advertising reaching specific demographic segments with personalized product suggestions. This channel transformation democratizes market access while intensifying competition based on customer experience, delivery performance, and value proposition differentiation across the expanding digital retail ecosystem.

Market Restraints:

What Challenges the Brazil Toys Market is Facing?

Economic Volatility and Consumer Price Sensitivity

Brazil's susceptibility to economic fluctuations creates uncertainty in discretionary spending patterns, with toy purchases often deferred during periods of reduced consumer confidence. Currency volatility impacts import costs for international brands, potentially constraining product availability or increasing retail prices. Inflationary pressures compress household budgets, forcing prioritization of essential expenditures over entertainment purchases. Economic uncertainty particularly affects mid-market consumers who may downgrade product selections or reduce purchasing frequency during challenging periods.

Counterfeit Products and Quality Concerns

The prevalence of counterfeit and substandard toys within informal distribution channels presents significant market challenges. Unauthorized products undermine brand value, potentially compromise child safety, and erode consumer trust in legitimate manufacturers. Enforcement of quality standards remains inconsistent, particularly in less regulated retail environments. Counterfeit competition compresses margins for authorized distributors while exposing consumers to products lacking required safety certifications and quality assurances mandated by Brazilian regulatory frameworks.

Digital Entertainment Competition

Increasing screen time among Brazilian children creates competitive pressure from digital entertainment alternatives, including video games, streaming content, and mobile applications. Children's engagement with digital platforms reduces time available for traditional toy play, particularly affecting categories requiring extended physical interaction. Parents navigating screen time limitations must balance educational benefits of certain digital content against developmental advantages of hands-on play experiences. This competition necessitates toy industry innovation incorporating digital elements that complement rather than compete with electronic entertainment options.

Competitive Landscape:

The Brazil toys market exhibits moderate to high concentration with established multinational corporations competing alongside influential domestic manufacturers and emerging regional brands. International players leverage strong brand recognition, extensive distribution networks, and licensing partnerships with global entertainment franchises to maintain premium market positioning. Domestic manufacturers compete through localized product development, competitive pricing strategies, and established relationships with traditional retail channels. The competitive landscape features continuous innovations in product development, with manufacturers investing in educational content, sustainability initiatives, and technology integration to differentiate offerings. Omnichannel distribution strategies, combining physical retail presence with e-commerce capabilities, have become essential for competitive success.

Brazil Toys Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Action Figures, Building Sets, Dolls, Games and Puzzles, Sports and Outdoor Toys, Plush, Others |

| Age Groups Covered | Up to 5 Years, 5 to 10 Years, Above 10 Years |

| Sales Channels Covered | Supermarkets and Hypermarkets, Specialty Stores, Department Stores, Online Stores, Others |

| Regions Covered | Southeast, South, Northeast, North, Central-West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Brazil toys market size was valued at USD 2.10 Billion in 2025.

The Brazil toys market is expected to grow at a compound annual growth rate of 8.05% from 2026-2034 to reach USD 4.21 Billion by 2034.

Sports and outdoor toys dominated the market with a share of 20.05%, driven by Brazil's vibrant outdoor culture, favorable tropical climate enabling year-round outdoor activities, and growing parental awareness about physical activity benefits for child development.

Key factors driving the Brazil toys market include rising disposable incomes and middle-class expansion, increasing parental focus on educational development through play-based learning, and rapid e-commerce expansion enhancing product accessibility nationwide.

Major challenges include economic volatility affecting consumer spending patterns, prevalence of counterfeit products undermining brand value and safety standards, digital entertainment competition reducing traditional toy engagement time, regulatory compliance costs, and supply chain disruptions impacting product availability and pricing.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)