Brazil Vegetable Oil Market Size, Share, Trends and Forecast by Oil Type, Application, and Region, 2025-2033

Brazil Vegetable Oil Market Overview:

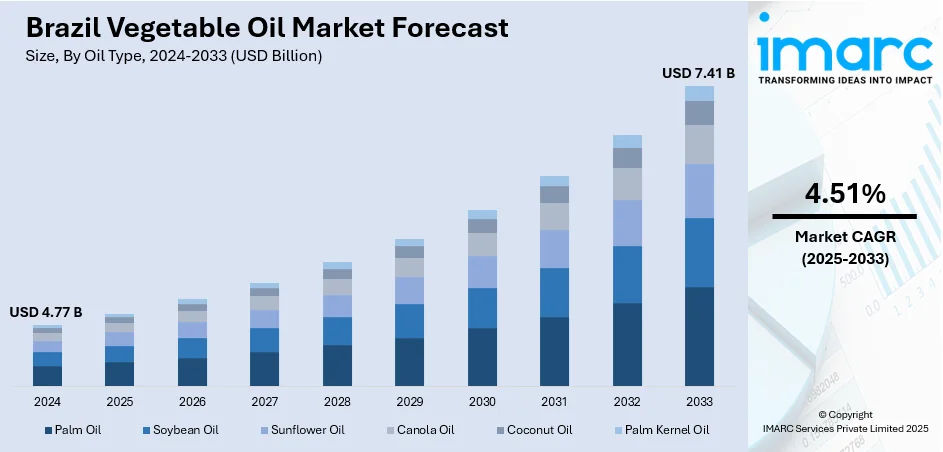

The Brazil vegetable oil market size reached USD 4.77 Billion in 2024. Looking forward, the market is projected to reach USD 7.41 Billion by 2033, exhibiting a growth rate (CAGR) of 4.51% during 2025-2033. The market is driven by Brazil’s dominance in soybean cultivation and integrated oilseed processing infrastructure combined with increasing export demand. Rising demand from processed food industries and urban foodservice channels drive sustained domestic consumption. Growing adherence to sustainability certifications and environmental compliance is further augmenting the Brazil vegetable oil market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 4.77 Billion |

| Market Forecast in 2033 | USD 7.41 Billion |

| Market Growth Rate 2025-2033 | 4.51% |

Brazil Vegetable Oil Market Trends:

Leadership in Oilseed Production and Crushing Capacity

Brazil is one of the world’s largest producers of soybeans, making it a cornerstone of the global vegetable oil industry. The country’s advanced agribusiness sector ensures abundant availability of soybean oil, which dominates both domestic consumption and export revenues. With expansive arable land in states like Mato Grosso, Paraná, and Goiás, Brazil produces oilseeds at scale, supported by mechanized farming and favorable climatic conditions. Major agribusinesses operate integrated supply chains, managing everything from crop cultivation and oilseed crushing to refining and packaging. Over the past decade, Brazil’s industrial soybean oil consumption has more than doubled due to rising biodiesel mandates. This drove a 52% increase in production and expanded crush capacity. For 2024-25 (October-September), production is projected at a record 12 Million MT, but exports are expected to remain nearly flat at 1.3 Million MT as domestic demand continues to outpace output growth. These vertically aligned operations reduce production costs, maintain consistent oil quality, and ensure reliable supply for both domestic and international markets. In addition to soy, Brazil is expanding cultivation of other oil-rich crops like sunflower and cottonseed to diversify its edible oil portfolio. Domestic refining capacity is robust, with plants strategically located near ports and growing consumption hubs. This supply strength makes Brazil not only self-sufficient in vegetable oil but also a competitive exporter, particularly to countries in Latin America, Europe, and Asia. The high-volume production and processing capabilities, paired with logistical efficiency, remain foundational to Brazil vegetable oil market growth, which benefits from scale, stability, and consistent demand.

To get more information on this market, Request Sample

Sustainability Practices and Certified Palm Oil Adoption

Brazil’s vegetable oil sector is increasingly shaped by environmental considerations, both for domestic regulatory compliance and export competitiveness. Overall vegetable oil sales in Brazil are projected to reach 2,358.3 Million KG by 2025. Multinational food manufacturers and local companies operating in Brazil are shifting toward sustainably sourced, certified oils to meet global Environmental, Social, and Governance (ESG) standards. Although palm oil production is limited compared to soybean oil, its use in processed foods and cosmetics is growing—driven by certified imports and domestic cultivation efforts in the North and Northeast regions. Sustainable palm oil adoption is supported by entities such as the Roundtable on Sustainable Palm Oil (RSPO) and national guidelines under Brazil’s Forest Code, which mandates responsible land use. The soy industry also engages in zero-deforestation commitments and traceability systems, especially in sensitive biomes like the Amazon and Cerrado. Moreover, used cooking oil (UCO) collection is being scaled up in urban areas to support biodiesel production and circular economy goals. From April 2023, Brazil increased its mandated biodiesel blend rate in diesel fuel from 10% to 15%, driving higher soybean oil demand. These initiatives reflect Brazil’s dual objective: maintaining competitiveness in food exports while aligning with global sustainability benchmarks. The vegetable oil market is therefore underpinned not just by supply and demand, but also by its responsiveness to climate and sustainability imperatives.

Brazil Vegetable Oil Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on oil type and application.

Oil Type Insights:

- Palm Oil

- Soybean Oil

- Sunflower Oil

- Canola Oil

- Coconut Oil

- Palm Kernel Oil

The report has provided a detailed breakup and analysis of the market based on the oil type. This includes palm oil, soybean oil, sunflower oil, canola oil, coconut oil, and palm kernel oil.

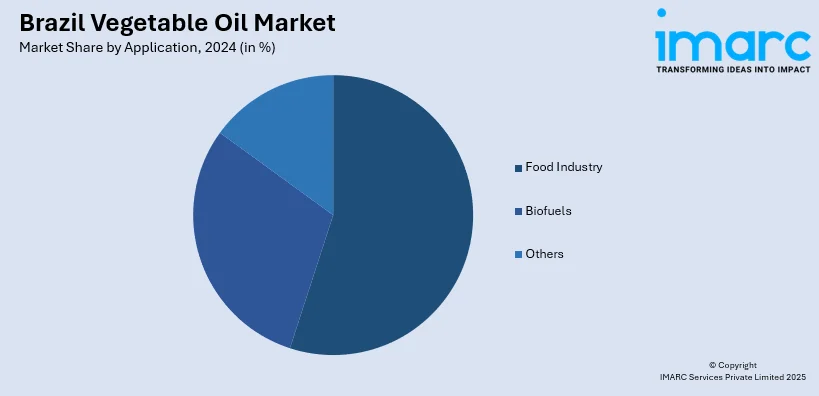

Application Insights:

- Food Industry

- Biofuels

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes food industry, biofuels, and others.

Regional Insights:

- Southeast

- South

- Northeast

- North

- Central-West

The report has also provided a comprehensive analysis of all major regional markets. This includes Southeast, South, Northeast, North, and Central-West.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Brazil Vegetable Oil Market News:

- On November 21, 2024, Bunge became the first global exporter to achieve 100% traceability of direct and indirect soy purchases in Brazil’s priority regions. This covers 2,000 properties spanning over 2 million hectares, with participation from more than 90 grain resellers. The milestone enhances sustainability and transparency in Brazil’s vegetable oil supply chain.

Brazil Vegetable Oil Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Oil Types Covered | Palm Oil, Soybean Oil, Sunflower Oil, Canola Oil, Coconut Oil, Palm Kernel Oil |

| Applications Covered | Food Industry, Biofuels, Others |

| Regions Covered | Southeast, South, Northeast, North, Central-West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Brazil vegetable oil market performed so far and how will it perform in the coming years?

- What is the breakup of the Brazil vegetable oil market on the basis of oil type?

- What is the breakup of the Brazil vegetable oil market on the basis of application?

- What is the breakup of the Brazil vegetable oil market on the basis of region?

- What are the various stages in the value chain of the Brazil vegetable oil market?

- What are the key driving factors and challenges in the Brazil vegetable oil market?

- What is the structure of the Brazil vegetable oil market and who are the key players?

- What is the degree of competition in the Brazil vegetable oil market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Brazil vegetable oil market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Brazil vegetable oil market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Brazil vegetable oil industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)