Bromine Market Size, Share, Trends and Forecast by Derivative, Application, End User, and Region, 2025-2033

Bromine Market Overview:

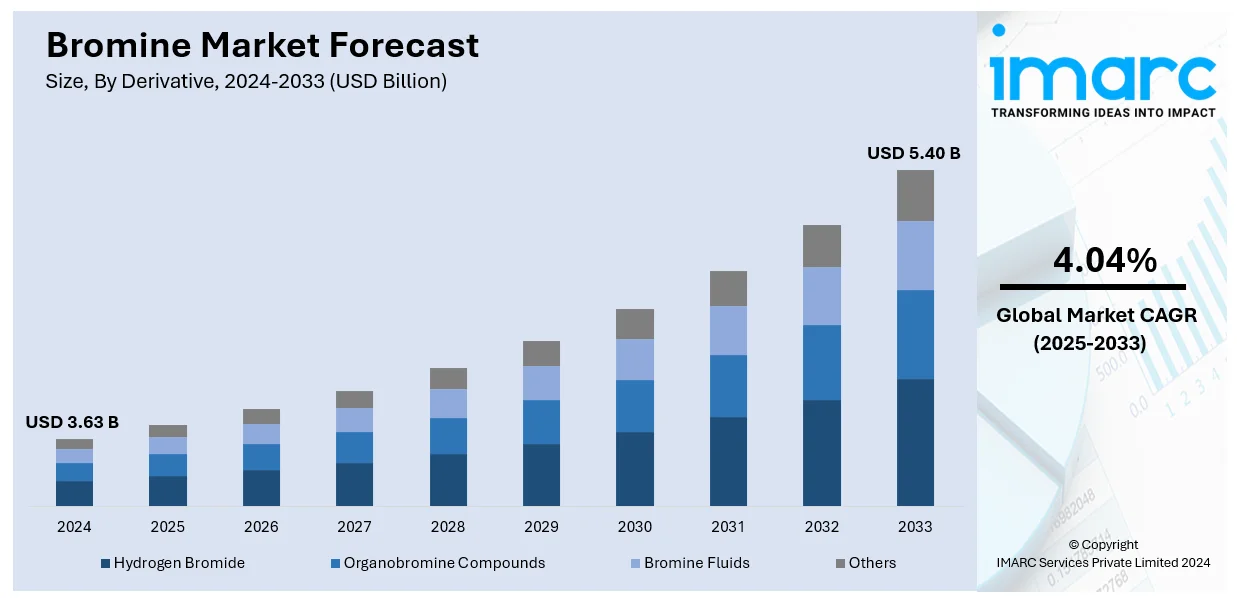

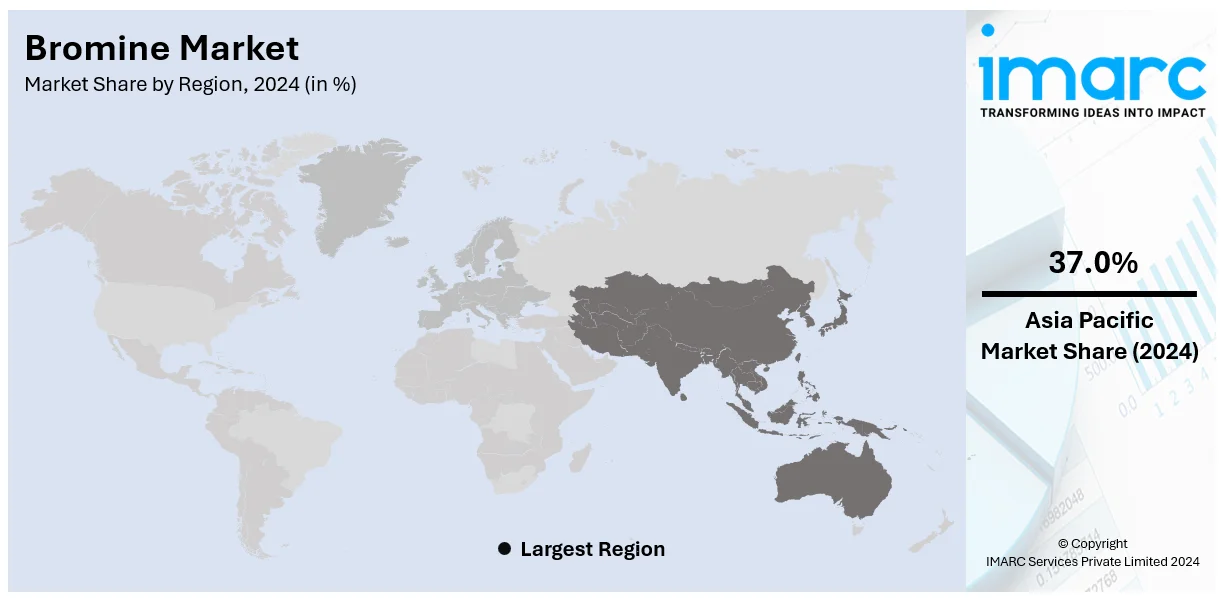

The global bromine market size was valued at USD 3.63 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 5.40 Billion by 2033, exhibiting a CAGR of 4.04% during 2025-2033. Asia-Pacific currently dominates the market, holding a significant market share of over 37% in 2024. This dominance is driven by strong industrial growth and increasing demand for flame retardants, water treatment solutions, and agricultural chemicals in the region.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033 |

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.63 Billion |

| Market Forecast in 2033 | USD 5.40 Billion |

| Market Growth Rate 2025-2033 | 4.04% |

The primary growth driver for the bromine market is the increase in demand for flame retardants from various industries. Bromine compounds, primarily brominated flame retardants, are used abundantly in electronics, textiles, automobiles, and construction sectors in order to decrease flammability and increase safety. For instance, in 2024, Sirmax North America launched its bromine-based flame-retardant polypropylene (PP) compounds with halogen-free compositions. The compounds provide UL Yellow Card certification, V0/5VA ratings, and excellent mechanical and electrical properties for use in electrical applications. Owing to growing stringent fire safety norms globally, the demand for such compounds is highly on the rise. Also, the increasing demand for consumer electronics, which include smartphones and laptops, propels the usage of bromine-based flame retardants. This factor will keep on driving the demand for bromine market growth. Manufacturers would try to keep pace with safety standards and consumers' expectations.

The United States is one of the countries and producers that are majorly exporting bromine and its derivatives to the world. Some of the largest bromine-producing facilities in the United States are located in Arkansas, and they produce large amounts of bromine to industries around the world. Companies of the United States are pioneers in the development of new bromine-based products, such as flame retardants, water treatment chemicals, and pharmaceuticals. For example, in 2024, ICL, a global specialty minerals company addressing sustainability challenges in food, agriculture, and industry through bromine, potash, and phosphate resources, launched VeriQuel R100, a sustainable phosphorus-based flame retardant for rigid polyurethane insulation, with an investment of over $2 million in R&D. Four leading U.S. roofing companies use it, and six more are under development. Moreover, the U.S. government imposes stringent regulations that fuel demand for safer and more sustainable bromine applications, thus driving growth and competitiveness in the domestic bromine market.

Bromine Market Trends:

Innovation in Bromine Derivatives

The bromine derivatives have recently developed very fast innovation, particularly concerning more efficient and environmentally friendly products. They mainly deal with creating more sophisticated flame retardants, with greater fire resistance, less harmful, and better recyclable materials. The sector for water treatment includes newly designed bromine-based chemicals with enhanced environmental features, ensuring superior performance in biological contaminants' control, and thus maintaining compliance with new stringent standards. Such innovations are driven by the increasing regulatory pressures and the growing global emphasis on sustainability, pushing companies to invest in R&D for cost-effective solutions that align with environmental goals. For instance, in March 2024, Archean Chemical's subsidiary, Acume Chemicals initiated the first phase of a production facility for bromine derivative products in Gujarat. The firm reported net sales of INR 412.63 Crore (USD 49.3 Million) for the December quarter of the 2023–24 fiscal year, with a net profit of INR 101.53 Crore (USD 12.1 Million). The company is poised to benefit from the conflict in West Asia, which is anticipated to drive up bromine prices due to a projected slowdown in production in the Dead Sea region.

Increasing Demand for Flame Retardant

The demand for bromine-based flame retardants is increasing at a very rapid pace. This is primarily due to its application in areas such as electronics, automotive, and construction where fire safety becomes the prime consideration. These flame retardants significantly reduce flammability and hinder the spread of fire. Such applications include circuit boards, automotive components, and building materials. A global increase in stringent fire safety regulations and fire hazard awareness have fueled this demand. Moreover, consumer electronics, vehicles, and infrastructure require the hardiness of bromine-based flame retardants, thus establishing the critical role of these compounds in providing safety compliance. For instance, in October 2023, Clariant inaugurated a new state-of-the-art production facility for halogen-free flame retardants in Daya Bay, Huizhou, representing a CHF 60 Million (USD 66.8 Million) investment. This plant will address the growing demands from China- and Asian-based component manufacturers, particularly in the E-mobility and electrical & electronic segments. The new facility strengthens Clariant's position in providing innovative and sustainable fire safety solutions.

Growth in Pharmaceutical and Agrochemical Applications

Bromine-based compounds are integral in the development of pharmaceutical and agrochemical products, especially as active ingredients for biocides and pesticides. Growth in the pharmaceutical and agrochemical sectors, including new markets and countries, also contributes to growing demand for such bromine compounds. As such sectors expand, the demand for good quality, consistent chemical intermediate continues to grow. For this purpose, bromine is an integral intermediate in many of the active pharmaceutical and agrochemical ingredients used today. The increasing focus on food security and healthcare in developing regions further fuels this demand, making bromine an indispensable element in supporting global agricultural and pharmaceutical advancements. According to industry reports, India's pharmaceutical industry is growing rapidly, set to reach USD 65 Billion by 2024 and USD 130 Billion by 2030. Currently valued at USD 50 Billion, it serves over 200 countries, supplying over 50% of Africa's generics, 40% of the US market, and 25% of the UK's medicine. India also meets 60% of global vaccine demand, supplying 70% of WHO's essential vaccines. Among the critical growth factors in the bromine market, its increased usage in pharmaceutical and agrochemical applications finds significant value, attributed to its inevitable role in active ingredient synthesis, thus increasing product efficacy. These factors are, however more vibrant in the developing markets where growing demand for biocides and pesticides with efficacies is fuelling this business expansion.

Bromine Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global bromine market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on derivative, application, and end user.

Analysis by Derivative:

- Hydrogen Bromide

- Organobromine Compounds

- Bromine Fluids

- Others

As per bromine market outlook, organobromine compounds stand as the largest derivative in 2024. Organobromine compounds dominate the bromine market, as they account for the majority of its share, mainly because of their extensive use in flame retardants, which are crucial for enhancing fire safety in various materials. These compounds are widely used in electronics, textiles, and construction materials, where fire resistance is essential. In line with this, organobromine compounds are key components in pharmaceuticals, agrochemicals, and water treatment processes. Their versatility, efficiency, and acceptance in safety applications make them dominate the market highly. With the continuing focus of different industries on more safety and more performance, this demand for organobromine compounds will have a robust basis. This development is generating abundant business opportunities within the bromine market, especially in the manufacturing and marketing of new-generation flame retardants, advanced water treatment chemicals, and intermediate pharmaceuticals as the need and usage of those are on constant increase within these sectors of economies around the globe.

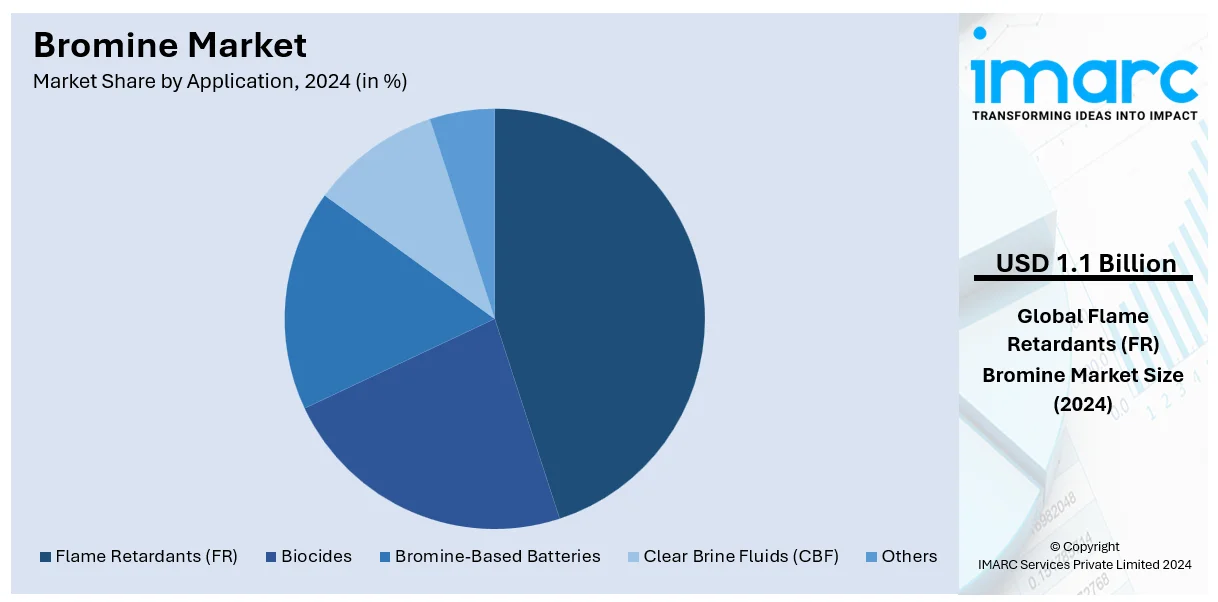

Analysis by Application:

- Biocides

- Flame Retardants (FR)

- Bromine-Based Batteries

- Clear Brine Fluids (CBF)

- Others

Flame retardants lead the market with around 30% of the market share in 2024. Flame retardants (FR) have the largest market share because of their critical role in reducing the flammability of materials across a wide range of industries. Bromine-based flame retardants are highly effective in slowing the spread of fire and are extensively used in electronics, automotive components, construction materials, textiles, and furniture. The growing attention towards fire safety regulations and compliance with strict safety standards have led to the demand for bromine-based flame retardants. Their performance in improving fire resistance without impairing material properties makes them critical in several manufacturing processes. Growing safety concerns around the world will continue to raise the demand for bromine-based flame retardants, thus enhancing the positive outlook of the bromine market.

Analysis by End User:

- Chemicals

- Oil and Gas

- Pharmaceuticals

- Agriculture

- Textiles

- Electronics

- Others

Chemicals leads the market share in 2024. The chemicals segment is dominating the bromine market, largely because of the high usage of bromine in chemical compound production. Bromine acts as a core ingredient in producing flame retardants, biocides, and many intermediates used in the pharmaceutical, and agrochemical industries, and so on. They thus contribute effectively to product improvement on bromine-based chemicals mainly attributed to its enhancement of applications mainly for fire resistances and microbiological controls in product usages. Secondly, bromine demand in producing specialties used for purposes of water and oil treatment including drilling within major industries further intensifies demand around different economies globally. This widespread application in various industries guarantees that the chemicals segment remains one of the strong growth drivers of the bromine market. For instance, in June 2024, SBI Mutual Fund and White Oak Group jointly acquired approximately 5.67% stake in Neogen Chemicals, a leading manufacturer of Bromine-based and Lithium-based specialty chemicals in India. The transaction will support the promoter's long-term financial plans. The company reported improved consolidated revenue of INR 691 Crores (USD 82.6 Million) for FY24, emphasizing its expansion into the Battery Materials sector.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia-Pacific accounted for the largest market share of over 37%. Asia Pacific dominates the market, as it has the highest share in this market. The reason is the extensive industrial base and a rapidly expanding chemical manufacturing sector and bromine market price in this region. This is also due to high demand for bromine-based flame retardants in electronics, automotive, and construction industries, particularly in countries like China, India, and Japan. For example, Asia-Potash International Investment (Guangzhou) Co., Ltd completed a bromine production project in Laos in June 2023, with an annual output of 10,000 tons of bromine. The project is located in Khammuan province and will help Laos in its industrialization and urbanization process. Moreover, the region's massive production of bromine, with the support of natural resources and low-cost production, further strengthens its position. Another reason for the growing use of bromine compounds is the increased focus on fire safety regulations and environmental standards in the region. Industrialization and urbanization continue to surge in Asia Pacific, so the demand for bromine will remain robust and ensure market dominance. The Asia Pacific region is expected to continue its strong growth trajectory based on ongoing industrial developments and increasing demand for bromine-based products, according to the bromine market forecast.

Key Regional Takeaways:

United States Bromine Market Analysis

US accounts for 85% share of the market in North America. The United States bromine market is poised for steady growth, driven by increasing demand in key industries such as flame retardants, drilling fluids, and water treatment. The growing demand for flame retardants in electronics, automotive, and construction sectors, fueled by stringent fire safety regulations, is a significant driver. Additionally, the oil and gas industry’s reliance on bromine-based compounds for drilling fluids enhances extraction efficiency and addresses environmental concerns, supporting the market's expansion. The U.S. also benefits from a focus on sustainability, with eco-friendly alternatives and innovative applications of bromine in battery technologies and renewable energy solutions gaining traction. Moreover, the rising need for water treatment solutions due to water scarcity further stimulates market growth. In parallel, the U.S. plastic additives market is projected to exhibit a compound annual growth rate (CAGR) of 3.70% from 2024 to 2032, reflecting the broader industrial demand for specialty chemicals like bromine. With increasing R&D investments and advancements in industrial applications, the U.S. bromine market is expected to maintain its dominant position globally throughout the forecast period.

North America Bromine Market Analysis

North America is also one of the highly growing markets in bromine due to its varied usage in many applications in industries like flame retardants, pharmaceuticals, agriculture, and water treatment. In particular, the demand for bromine-based compounds as flame retardants is also gaining momentum as electronic devices and construction materials require better fire safety compliance. For instance, in 2024, TETRA expects a $200-$250 million revenue increase and $90-$115 million EBITDA growth from vertically integrating its bromine production, boosting sales in offshore oil, gas, and energy storage sectors. The region’s extensive chemical manufacturing base further supports the demand for bromine in specialty chemicals. The market is also benefitting from innovations in biocides and pharmaceutical applications, where bromine compounds play a crucial role. Key players, such as Albemarle Corporation and ICL Group, are focusing on expanding production capacity and enhancing product offerings to meet the evolving needs of industries. The market is expected to witness steady growth, driven by both regulatory pressures and technological advancements.

Asia Pacific Bromine Market Analysis

The Asia-Pacific bromine market is experiencing strong growth, driven by industrial expansion in key countries such as China, India, and Southeast Asia. The demand for flame retardants in electronics, textiles, and automotive sectors, as well as increased construction activities, is contributing to higher bromine consumption. In the oil and gas sector, bromine-based compounds are widely used in drilling fluids to enhance extraction processes. According to industry reports, China employed 3.4 Million people in the oil and gas industry, India had 0.7 Million, and the rest of Asia-Pacific employed 1.1 Million in 2019, reflecting the sector’s significant role in driving bromine demand. Additionally, growing concerns over water scarcity are boosting the need for bromine in water treatment applications. The region’s expanding manufacturing base and investments in sustainable technologies also support market growth. As industrialization progresses across the region, the demand for bromine is expected to continue rising, particularly with a growing focus on eco-friendly solutions. These factors collectively contribute to the dynamic growth of the bromine market in Asia-Pacific.

Europe Bromine Market Analysis

Europe's bromine market is poised for continued growth, fueled by industrial safety regulations, sustainability initiatives, and advancements in technology. Flame retardants, which are crucial for the construction, automotive, and electronics industries, are a major driver of demand, particularly as regulations around fire safety become more stringent. The rise of electric vehicles (EVs) further contributes to this trend, as they require flame retardants for battery safety and insulation. According to the International Energy Agency (IEA), new electric car registrations in Europe reached nearly 3.2 Million in 2023, marking an increase of almost 20% compared to 2022. Within the European Union, sales amounted to 2.4 Million, reflecting similar growth rates. This surge in EV adoption directly supports the need for bromine-based solutions in the automotive sector. Additionally, bromine compounds are widely used in the chemical industry for applications in pharmaceuticals, agrochemicals, and water treatment. Europe’s growing emphasis on environmental sustainability is driving the development of greener bromine-based products. With investments in R&D and the expansion of eco-friendly applications, the region is set to maintain its leadership in the global bromine market, benefiting from a well-established chemical infrastructure and increasing demand across various industries.

Latin America Bromine Market Analysis

The bromine market in Latin America is driven by expanding industrial activities, particularly in the oil and gas sector, where bromine-based drilling fluids are crucial for enhancing extraction processes. According to industry reports, agriculture remains a vital sector in Latin America, representing approximately 14% of the region’s workforce. This reliance on agriculture drives demand for bromine-based solutions, especially in pest control and crop protection. As the agricultural sector grows and modernizes, the need for efficient and sustainable solutions, including those involving bromine, is expected to rise. These factors collectively contribute to the ongoing growth of the bromine market in the region.

Middle East and Africa Bromine Market Analysis

The Middle East bromine market is significantly influenced by the oil and gas industry, where bromine-based drilling fluids are essential for enhancing extraction processes. The UAE oil and gas market, in particular, is projected to exhibit a growth rate of 6.30% CAGR from 2025 to 2033, further driving the demand for bromine in the region. Additionally, rapid infrastructure development in sectors like construction and automotive is fueling the need for bromine-based flame retardants. Growing concerns over water scarcity are also contributing to the increasing use of bromine in water treatment. These factors position the Middle East as a key market for bromine.

Competitive Landscape:

Several major players dominate the competitive landscape of the bromine market. Global chemical giants control the bromine market by developing extensive production capabilities, robust research and development efforts, and a diversified bromine-based product portfolio. Strategic partnerships, mergers, and acquisitions further consolidate their market share and expand their geographic reach. Innovations also come as an aspect for firms to ensure the meeting of growing demand for environmentally friendly and safer bromine products, particularly flame retardants, water treatment, and agricultural chemicals. Competition is further enhanced through the aspects of cost efficiency and regulation compliance. For instance, in October 2024, Albemarle Corporation announced that its Energy Storage and Specialties units would merge to improve agility, reduce costs, and enhance long-term competitiveness, including bromine operations in the U.S. and Jordan.

The report provides a comprehensive analysis of the competitive landscape in the bromine market with detailed profiles of all major companies, including:

- Albemarle Corporation

- Chemada Industries Ltd.

- Gulf Resources Inc.

- Hindustan Salts Limited

- Honeywell International Inc.

- ICL Group Ltd.

- Jordan Bromine Company Limited

- Lanxess AG

- Solaris Chemtech Industries Limited (Agrocel Industries Pvt. Ltd.)

- Tata Chemicals Limited

- TETRA Technologies Inc.

- Tosoh Corporation

Bromine Market News:

- October 2024: Archean Chemical is set to launch its bromine derivative products, including Clear Brine Fluids, PTA Synthesis, and other specialty chemicals, in the second half of FY25. These products are part of the company’s strategic expansion into the bromine derivatives market, aimed at strengthening its position in the specialty chemicals sector.

- August 2024: TETRA Technologies, Inc. completed a definitive feasibility study for its Arkansas bromine project, upgrading previously announced bromine resources to reserves. The study indicates a 40-year projected operating life with a 62% internal rate of return for the project. Upon final investment decision, the company expects higher sales volumes and an increase in adjusted EBITDA. The estimated payback for capital expenditures post-FID is 5.7 years.

- July 2024: Neogen Chemicals Limited, an Indian manufacturer with expertise in bromine-based chemicals, has expanded into Lithium-Ion Battery materials via its subsidiary, Neogen Ionics Limited. The company sold 5.67% of its equity to institutional investors SBI Mutual Fund and White Oak Group, while retaining majority ownership.

- May 2024: GHCL Limited announced expansion plans with a capital budget of approximately INR 224 Crores (USD 27 Million) for the financial year 2024-25, including a INR 117 Crore (USD 14 Million) Bromine project. Additionally, the board approved a greenfield project for a soda ash annual production capacity of 5.5 Million Tons in Kutch, Gujarat, with an investment of INR 4,000 Crores (USD 478 Million).

- September 2022: De Nora launched the MIOX® Bromine Oxidant Solution System (BOSS) to improve water treatment in systems with high pH or ammonia levels, such as cooling towers. Available as new equipment or an upgrade, the system provided flexibility in adjusting oxidizing solutions to meet disinfection needs, improving efficiency and reducing operating costs.

Bromine Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Derivatives Covered | Hydrogen Bromide, Organobromine Compounds, Bromine Fluids, Others |

| Applications Covered | Biocides, Flame Retardants (FR), Bromine-Based Batteries, Clear Brine Fluids (CBF), Others |

| End Users Covered | Chemicals, Oil and Gas, Pharmaceuticals, Agriculture, Textiles, Electronics, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Albemarle Corporation, Chemada Industries Ltd., Gulf Resources Inc., Hindustan Salts Limited, Honeywell International Inc., ICL Group Ltd., Jordan Bromine Company Limited, Lanxess AG, Solaris Chemtech Industries Limited (Agrocel Industries Pvt. Ltd.), Tata Chemicals Limited, TETRA Technologies Inc., Tosoh Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the bromine market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global bromine market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the bromine industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global Bromine market was valued at USD 3.63 Billion in 2024.

The market is estimated to reach USD 5.40 Billion by 2033, exhibiting a CAGR of 4.04% during 2025-2033.

The main drivers for the global bromine market include increasing demand for flame retardants in electronics and construction, water treatment and agriculture growth, developments in energy storage technologies, pressure from regulations regarding fire safety, and the growing scope of pharmaceutical applications, thus contributing to a long-term increase in the market with innovation.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Asia Pacific currently dominates the global market and is the largest producer of bromine.

Some of the major players in the global Bromine market include Albemarle Corporation, Chemada Industries Ltd., Gulf Resources Inc., Hindustan Salts Limited, Honeywell International Inc., ICL Group Ltd., Jordan Bromine Company Limited, Lanxess AG, Solaris Chemtech Industries Limited (Agrocel Industries Pvt. Ltd.), Tata Chemicals Limited, TETRA Technologies Inc., Tosoh Corporation, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)