Bunker Fuel Market Size, Share, Trends and Forecast by Fuel Type, Vessel Type, Seller, and Region, 2026-2034

Bunker Fuel Market Size and Share:

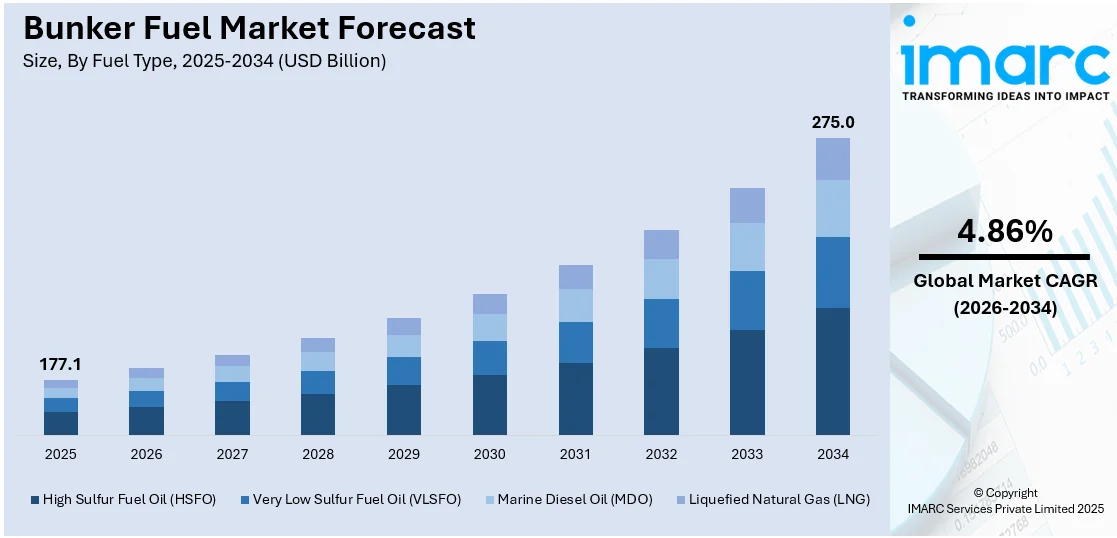

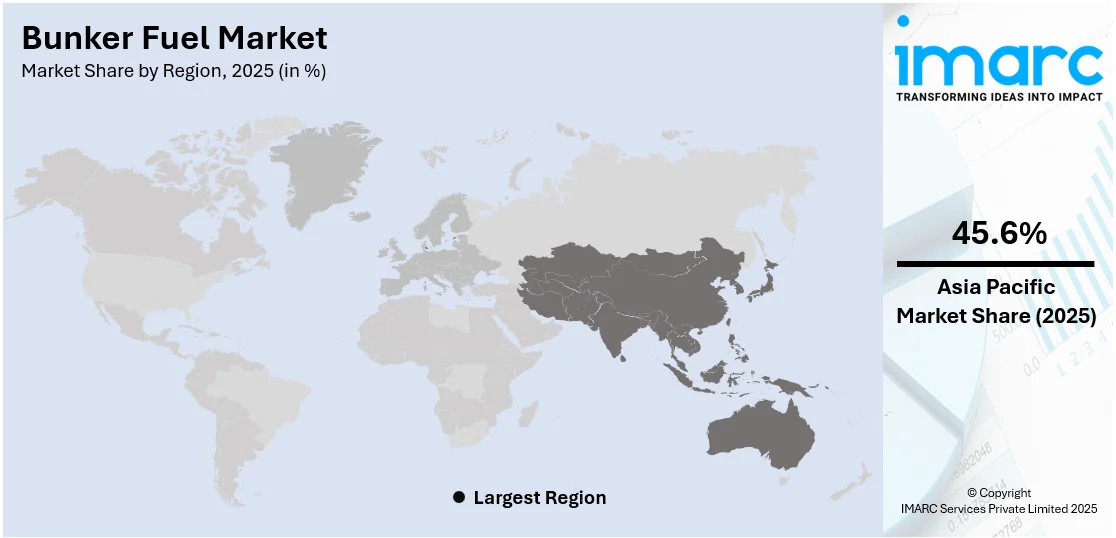

The global bunker fuel market size was valued at USD 177.1 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 275.0 Billion by 2034, exhibiting a CAGR of 4.86% during 2026-2034. Growing environmental awareness and stringent regulations are driving the adoption of cleaner fuels like LNG, gasoil, and LPG as alternatives to traditional bunker fuels. These changes, prompted by air pollution concerns and greenhouse gas emissions, are pushing the maritime industry toward sustainable fuel options, boosting market growth. Asia-Pacific currently dominates the industry, holding 45.6% of the total bunker fuel market share in 2025.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 177.1 Billion |

|

Market Forecast in 2034

|

USD 275.0 Billion |

| Market Growth Rate 2026-2034 | 4.86% |

One major driver of the bunker fuel market growth is the steady expansion of the global maritime trade. As international shipping volumes continue to rise due to an increased demand for consumer goods, raw materials, and industrial products, the need for reliable marine fuel solutions grows accordingly. Bunker fuel remains a primary energy source for commercial vessels, including container ships, bulk carriers, and tankers. Expanding port infrastructure and fleet modernization are further contributing to sustained fuel consumption. In addition to this, the government is also imposing regulations for cleaner fuel adoption. For instance, in January 2025, The U.S. Treasury and IRS released guidance on Section 45Z, offering 2025 tax credits for producing transportation fuels, including SAF and non-SAF, with reduced lifecycle greenhouse gas emissions. Additionally, regulatory measures, such as the International Maritime Organization's (IMO) 2020 sulfur cap, are reshaping fuel preferences, accelerating the demand for compliant low-sulfur fuel alternatives in key shipping routes. This, in turn, is facilitating the bunker fuel market demand across the globe.

To get more information on this market Request Sample

The United States plays a significant role in the global bunker fuel market through its well-established port infrastructure, extensive refining capacity, and regulatory alignment with international maritime standards. For instance, in October 2024, ABS announced granting of AiP to VARD’s ammonia bunkering barge, developed by the RADIUS consortium, compatible with vessels like Höegh’s Aurora Class and MMMCZCS’s 15,000 TEU container ship, targeting 2030 East Coast operations. Major ports, such as Houston, Los Angeles, and New York, serve as key bunkering hubs, supplying a range of marine fuels, including very low sulfur fuel oil (VLSFO) and marine gas oil (MGO). The U.S. refiners are actively producing compliant fuels to meet IMO 2020 regulations, while also investing in cleaner alternatives like LNG and biofuels. This also represents one of the key bunker fuel market trends across the country. Strategic geographical positioning and robust trade activity further enable the U.S. to support global maritime fuel demands efficiently.

Bunker Fuel Market Trends:

Stringent environmental regulations

Stringent environmental regulations implemented by governing agencies of several countries are propelling the bunker fuel market growth. According to the World Meteorological Organization, global carbon dioxide (CO₂) emissions was reported to reach 41.6 Billion tons in 2024, up from 40.6 Billion tonnes in 2023, with rising temperatures causing increasingly severe environmental impacts. In response to concerns about air pollution and greenhouse gas (GHG) emissions, international organizations, such as the International Maritime Organization (IMO), are implementing various regulations. These regulations mandate the use of cleaner, low-sulfur bunker fuels, encouraging the industry to invest in cleaner technologies and fuels. Ship operators must comply with these rules, driving the demand for compliant fuels and catalyzing innovation in the sector. This shift towards cleaner fuels not only benefits the environment but also opens new market opportunities for suppliers of low-sulfur and alternative bunker fuels, positioning them for long-term growth and profitability in the evolving maritime industry.

Global trade expansion

As economies are expanding and international commerce is flourishing, the demand for maritime transport is increasing. Bunker fuel is prominent in the shipping industry, powering cargo vessels that transport goods across the oceans worldwide. This increasing need for shipping services results in higher bunker fuel market demand. Developing economies are witnessing a rise in trade activities, further impelling the growth of the market. According to UN Trade & Development, global trade is projected to reach nearly USD 33 Trillion in 2024, reflecting a 3.3% annual growth, driven primarily by a 7% increase in trade in services. Moreover, the diversification of trade routes and the rising number of new shipping hubs are contributing to a more dynamic and robust bunker fuel market. The growing trend of global trade, making bunker fuel an essential component of the international supply chain is offering a favorable market outlook.

Technological advancements in maritime industry

Ongoing technological advancements in the maritime industry are strengthening the growth of the market. Modern vessels are designed to be more fuel-efficient and environment friendly. Innovations like advanced engine designs, hull optimization, and route planning software help ships consume less fuel per voyage. This not only reduces operating costs for shipping companies but also lowers their environmental footprint. According to the 2024 Review of Maritime Transport by UNCTAD, maritime trade volume is projected to expand by 2% in 2024, with containerized trade volumes forecasted to grow by 3.5%. Additionally, between 2025 and 2029, total seaborne trade is expected to increase at an average rate of 2.4%, driving higher fuel consumption. As shipowners and operators increasingly prioritize fuel efficiency and emissions reductions, they are more likely to adopt eco-friendly bunker fuels, such as liquefied natural gas (LNG) and hydrogen-based alternatives. This shift towards cleaner technologies and fuels is presenting growth opportunities for suppliers of bunker fuels, aligning with the sustainability goals.

Emerging markets and industrialization

Rapid industrialization in emerging markets is strengthening the growth of the market. Several countries are experiencing substantial economic growth, leading to increased production and trade activities. These nations rely heavily on maritime transport to import raw materials and export finished goods. Consequently, there is a growing need for bunker fuels to power the vessels involved in these trade routes. For instance, in March 2025, Hafnia, in partnership with Studio 30 50, is launching FuelSure, a digital platform integrating real-time data to enhance transparency, accountability, and cost efficiency in the maritime bunker fuel market. As industrialization is driving economic development in these regions, the demand for bunker fuels is rising. Moreover, emerging markets are witnessing an increase in cruise tourism, further catalyzing the demand for bunker fuels.

Bunker Fuel Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global bunker fuel market, along with forecast at the global, regional, and country levels from 2026-2034. The market has been categorized based on fuel type, vessel type, and seller.

Analysis by Fuel Type:

- High Sulfur Fuel Oil (HSFO)

- Very Low Sulfur Fuel Oil (VLSFO)

- Marine Diesel Oil (MDO)

- Liquefied Natural Gas (LNG)

Very low sulfur fuel oil stand as the largest fuel type in 2025, holding around 43.2% of the market. This dominance is primarily attributed to the International Maritime Organization's (IMO) 2020 sulfur cap regulation, which mandates a maximum sulfur content of 0.5% in marine fuels. VLSFO quickly became the preferred option for compliance, offering a cleaner and more environmentally acceptable alternative to high sulfur fuel oil (HSFO). Its compatibility with existing marine engines, without the need for scrubbers, further strengthened its adoption. Shipping companies worldwide have increasingly transitioned to VLSFO to meet emissions requirements while minimizing capital expenditure on retrofitting vessels. As a result, the VLSFO segment continues to gain momentum, reinforcing its position as the industry standard.

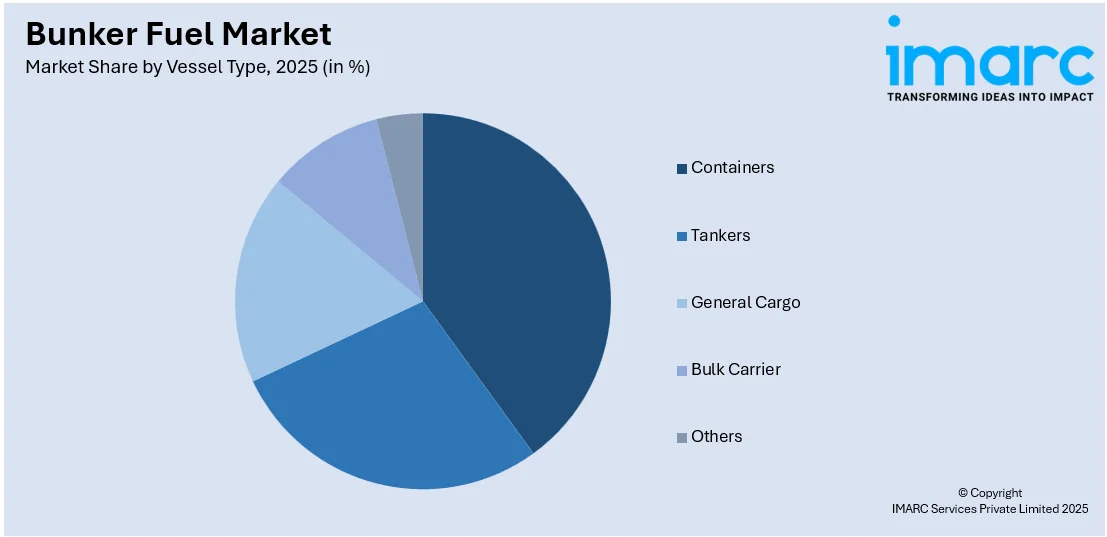

Analysis by Vessel Type:

Access the comprehensive market breakdown Request Sample

- Containers

- Tankers

- General Cargo

- Bulk Carrier

- Others

Containers leads the market with around 40.0% of the bunker fuel market share in 2025. This dominance is largely driven by the extensive global movement of consumer goods, electronics, and manufactured products, which are primarily transported via container vessels. The rise in e-commerce, global trade, and supply chain expansion has increased the frequency and volume of container shipping operations. These vessels, often operating on fixed schedules and long international routes, require substantial and consistent fuel supplies. Additionally, the ongoing investments in fleet expansion and modernization, including the deployment of larger and more fuel-efficient container ships, are contributing to sustained bunker fuel demand. The container shipping segment remains a key driver of growth across major international ports and maritime trade routes.

Analysis by Seller:

- Major Oil Companies

- Leading Independent Sellers

- Small Independent Sellers

Major oil companies lead the market with around 55.6% of the market share in 2025. Their leadership stems from well-established global supply networks, vertically integrated operations, and strong refining capabilities. These companies, including ExxonMobil, Shell, BP, and Chevron, have the resources to produce and distribute compliant fuels such as very low sulfur fuel oil (VLSFO) and marine gas oil (MGO), ensuring reliable supply to international shipping fleets. Additionally, their investments in infrastructure—such as bunker barges, storage terminals, and digital fueling platforms—enhance operational efficiency and customer reach. Their ability to adapt to evolving IMO regulations and offer a wide range of marine fuel solutions further reinforces their market dominance and long-term strategic relevance.

Regional Analysis:

To get more information on the regional analysis of this market Request Sample

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2025, Asia-Pacific accounted for the largest market share of over 45.6%. This leadership is supported by the region’s strategic ports, including Singapore, Shanghai, Hong Kong, and Busan, which serve as key global maritime hubs. High shipping traffic through major trade routes such as the Strait of Malacca significantly contributes to fuel demand. The region also benefits from advanced port infrastructure, competitive fuel pricing, and strong government support for maritime activities. In addition, rapid economic growth, export-driven industries, and expanding seaborne trade across China, Japan, South Korea, and Southeast Asia further increase bunker fuel consumption. With ongoing investments in port upgrades and fuel compliance solutions, Asia-Pacific continues to be the center of global marine fuel activity.

Key Regional Takeaways:

United States Bunker Fuel Market Analysis

The United States bunker fuel market is experiencing steady growth, driven by the rising demand for marine transportation and increasing trade activities. The country's extensive coastline and strategic ports play a crucial role in facilitating bunker fuel consumption across the shipping sector. The growing adoption of low-sulfur fuel oils (LSFO), in line with IMO 2020 regulations, is significantly influencing market trends as shipping companies seek to comply with stringent emission norms. Moreover, the rising emphasis on eco-friendly fuel alternatives, such as liquefied natural gas (LNG) and biofuels, is reshaping the market landscape. Advancements in fuel storage infrastructure and the expansion of shipping routes are further supporting market growth. The market is also benefitting from increased trade volumes, with the United States goods and services deficit rising by 17.0% in 2024, alongside a 3.9% increase in exports and a 6.6% rise in imports, according to the Bureau of Economic Analysis. With ongoing regulatory developments, rising maritime trade, and the adoption of sustainable fuels, the United States bunker fuel market is poised for consistent expansion in the coming years.

North America Bunker Fuel Market Analysis

The North America bunker fuel market is supported by a strong maritime infrastructure, advanced refining capacity, and strategic coastal locations. Major ports such as Houston, Los Angeles, Vancouver, and New York serve as key bunkering hubs for international and domestic shipping routes. The implementation of the IMO 2020 sulfur cap has prompted a shift toward very low sulfur fuel oil (VLSFO) and marine gas oil (MGO), driving refiners and suppliers in the region to adapt product offerings. Growing emphasis on cleaner marine fuels, including liquefied natural gas (LNG) and biofuels, is encouraging investments in alternative fuel infrastructure. For instance, in response to a 2024 trade probe, the U.S. may imposed up to $1 million port fees or $1,000 per net ton on vessels owned by Chinese maritime transport operators. Regulatory alignment, stable demand from cargo and cruise operations, and technological innovation position North America as a competitive and compliant bunker fuel market.

Europe Bunker Fuel Market Analysis

The Europe bunker fuel market is growing steadily, driven by the region’s expanding maritime trade and stringent environmental regulations. The implementation of the IMO 2020 sulfur cap has accelerated the shift toward low-sulfur fuel oils (LSFO) and alternative fuels. Major ports in countries play a crucial role in driving bunker fuel demand across the region. The rising adoption of liquefied natural gas (LNG) and biofuels as cleaner alternatives is further supporting market growth. Further forcing shipping companies towards greener fuel options is the implementation of the EU Emissions Trading System (EU ETS) from January 2024. It captures all CO₂ emissions from every large vessel (5,000 gross tonnage and above) entering the EU ports, irrespective of their flag. This regulatory expansion is expected to accelerate the transition to sustainable bunker fuels. The region’s ongoing investments in green shipping initiatives and emission reduction technologies are creating new growth opportunities.

Asia Pacific Bunker Fuel Market Analysis

The Asia Pacific bunker fuel market is witnessing robust growth, driven by the region’s position as a global trade hub and increasing maritime activities. The presence of major ports is fueling the demand for bunker fuel. The widespread adoption of low-sulfur fuel oils (LSFO) following the IMO 2020 regulations is reshaping the market landscape. Additionally, rising investments in LNG bunkering infrastructure and the growing preference for eco-friendly fuel alternatives are supporting market expansion. The region's inflating trade activities further contribute to market growth, with the Press Information Bureau reporting that FY 2023-24 closed with the highest monthly merchandise exports of the current fiscal year in March 2024, reaching USD 41.68 Billion. This surge in exports is driving greater demand for marine transportation, consequently boosting bunker fuel consumption.

Latin America Bunker Fuel Market Analysis

The Latin America bunker fuel market is expanding steadily, supported by the region’s growing maritime trade and shipping activities. Countries like Brazil, Mexico, and Panama serve as key bunkering hubs, driving fuel demand across the region. The shift toward low-sulfur fuel oils (LSFO) in line with international regulations is reshaping market preferences. Furthermore, increasing investments in port infrastructure and fuel storage facilities are contributing to market expansion. According to The Maritime Executive, Brazil's privatization plan targets over 50 projects, including port leases and concessions slated for the next two years, with expected investments worth over USD 3 Billion in the Brazilian port sector. These infrastructure developments are expected to enhance the region's bunkering capacity and fuel storage facilities.

Middle East and Africa Bunker Fuel Market Analysis

The Middle East and Africa bunker fuel market is growing due to strategic location and increasing maritime trade. Major ports in Saudi Arabia, UAE, and South Africa support fuel demand. Low-sulfur fuel oils and LNG are reshaping the market while rising port infrastructure investments and regulatory compliance support market expansion. The region’s maritime sector is witnessing notable progress, with reports stating that Saudi Arabia recorded a 6.4% increase in gross tonnage of its maritime fleet in 2024 compared to 2023, strengthening its position in the Arab and regional maritime transport sectors. The region’s strategic importance in global shipping routes and the rising focus on environmental sustainability, is projected to positively influence the bunker fuel market forecast.

Competitive Landscape:

The bunker fuel market features a competitive landscape marked by the presence of major oil companies, regional suppliers, and independent bunker traders. Key players maintain a strong market position through extensive global networks, advanced refining capabilities, and diversified fuel offerings. For instance, in March 2024, Chevron’s first hybrid electric bunker tanker, launched in Singapore, announced its plans to supply regional maritime customers with fuel while using 20% less energy than conventional tankers, helping lower emissions, and operational costs. These companies are increasingly investing in low-sulfur and alternative fuels to comply with evolving environmental regulations. Additionally, independent suppliers and local distributors compete by offering flexible pricing and localized services in high-traffic ports. Strategic partnerships, mergers, and technological innovations in fuel quality and delivery systems continue to shape competition and drive market differentiation.

The report provides a comprehensive analysis of the competitive landscape in the bunker fuel market with detailed profiles of all major companies, including:

- Bomin Bunker Holding GmbH & Co. KG (Marquard & Bahls AG)

- BP Plc

- Chevron Corporation

- Exxon Mobil Corporation

- Gazprom Neft PJSC (Gazprom)

- LUKOIL

- Neste Oyj

- Petroliam Nasional Berhad (PETRONAS)

- Royal Dutch Shell Plc

- TOTAL S.A.

Latest News and Developments:

- May 2025: Cargill and Hafnia launched Seascale Energy, a marine fuels joint venture. The company aims to handle combined volumes of approximately 7.5 million metric tons per year. The joint venture focuses on delivering efficiency and transparency in bunker fuel procurement.

- April 2025: Vitol launched a FuelEU Maritime-compliant co-processed Very Low Sulfur Fuel Oil (VLSFO) produced at its Fujairah refinery. This bunkering fuel matches conventional RMG380 VLSFO quality, requiring no special charter party clauses. Co-processing incorporates diverse sustainable feedstocks, reducing reliance on crop-based inputs and cutting greenhouse gas intensity by over 70% compared to fossil fuels. Certified under ISCC-EU, the fuel’s emissions compliance is verified via DNV’s Emissions Connect platform.

- March 2025: Bunker One USA acquired Element Alpha’s New York Harbor (NYH) operation, marking a strategic expansion beyond its established U.S. Gulf Coast presence. This acquisition enables Bunker One to offer comprehensive bunker fuel supply, focusing on HSFO, with dedicated storage and barge facilities at IMTT, enhancing delivery efficiency. The move strengthens Bunker One’s U.S. and global network, connecting East Coast bunkering routes from Brazil and the Caribbean to New York.

- February 2025: Wallenius Wilhelmsen completed its first biofuel bunkering trial in Japan at the Port of Yokohama, using 400 metric tons of Bio Bunker B24 supplied by Mitsubishi Corporation Energy. This milestone advances the company’s global decarbonization strategy, aiming for net-zero emissions by 2040 and a 40% reduction in greenhouse gases by 2030. Expanding biofuel supply locations, including Japan, Belgium, Korea, and Singapore, supports efficient, sustainable operations.

- January 2025: Oman Oil Marketing Company (OOMCO) and TFG Marine established a joint venture, TFG-OOMCO LLC, to supply bunker fuel to vessels visiting Omani ports. This partnership combines OOMCO's local knowledge with TFG Marine's global reach and infrastructure. It aims to meet the increasing demand for compliant, high-quality marine fuels while adhering to international standards. TFG Marine also deployed a bunker vessel with Mass Flow Meter technology to enhance transparency and efficiency in fuel bunkering at Sohar Port.

- January 2025: KPI OceanConnect, Neste, and Global Energy Trading finalized a biofuel bunkering operation in Singapore, delivering HVO100 (100% hydrotreated vegetable oil) to a cruise vessel. The biofuel obtained from Vopak Penjuru Terminal provided 90% reduced emissions compared to diesel, aiding in the decarbonization of the marine fuel sector.

Bunker Fuel Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Bunker Fuel Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Fuel Types Covered | High Sulfur Fuel Oil (HSFO), Very Low Sulfur Fuel Oil (VLSFO), Marine Diesel Oil (MDO), Liquefied Natural Gas (LNG) |

| Vessel Types Covered | Containers, Tankers, General Cargo, Bulk Carrier, Others |

| Sellers Covered | Major Oil Companies, Leading Independent Sellers, Small Independent Sellers |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Bomin Bunker Holding GmbH & Co. KG (Marquard & Bahls AG), BP Plc, Chevron Corporation, Exxon Mobil Corporation, Gazprom Neft PJSC (Gazprom), LUKOIL, Neste Oyj, Petroliam Nasional Berhad (PETRONAS), Royal Dutch Shell Plc, TOTAL S.A., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the bunker fuel market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global bunker fuel market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the bunker fuel industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The bunker fuel market was valued at USD 177.1 Billion in 2025.

IMARC estimates the bunker fuel market to reach USD 275.0 Billion by 2034, exhibiting a CAGR of 4.86% during 2026-2034.

Key factors driving the bunker fuel market include rising global maritime trade, increasing demand for low-sulfur and alternative fuels due to IMO regulations, expansion of port infrastructure, and fleet modernization. Additionally, growing seaborne transportation of consumer goods and industrial materials continues to support sustained fuel consumption across major shipping routes.

Asia Pacific currently dominates the market with 45.6% share, supported by major shipping hubs like Singapore and Shanghai, extensive maritime trade routes, and strong regional demand for marine fuel. Ongoing port expansions, competitive pricing, and a high concentration of commercial shipping traffic further reinforce the region’s leading position in global bunker fuel consumption while creating a positive bunker fuel market outlook.

Some of the major players in the bunker fuel market include Bomin Bunker Holding GmbH & Co. KG (Marquard & Bahls AG), BP Plc, Chevron Corporation, Exxon Mobil Corporation, Gazprom Neft PJSC (Gazprom), LUKOIL, Neste Oyj, Petroliam Nasional Berhad (PETRONAS), Royal Dutch Shell Plc, TOTAL S.A., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)