Buy Now Pay Later Market Size, Share, Trends and Forecast by Channel, Enterprise Size, End Use, and Region, 2025-2033

Buy Now Pay Later Market Size and Share:

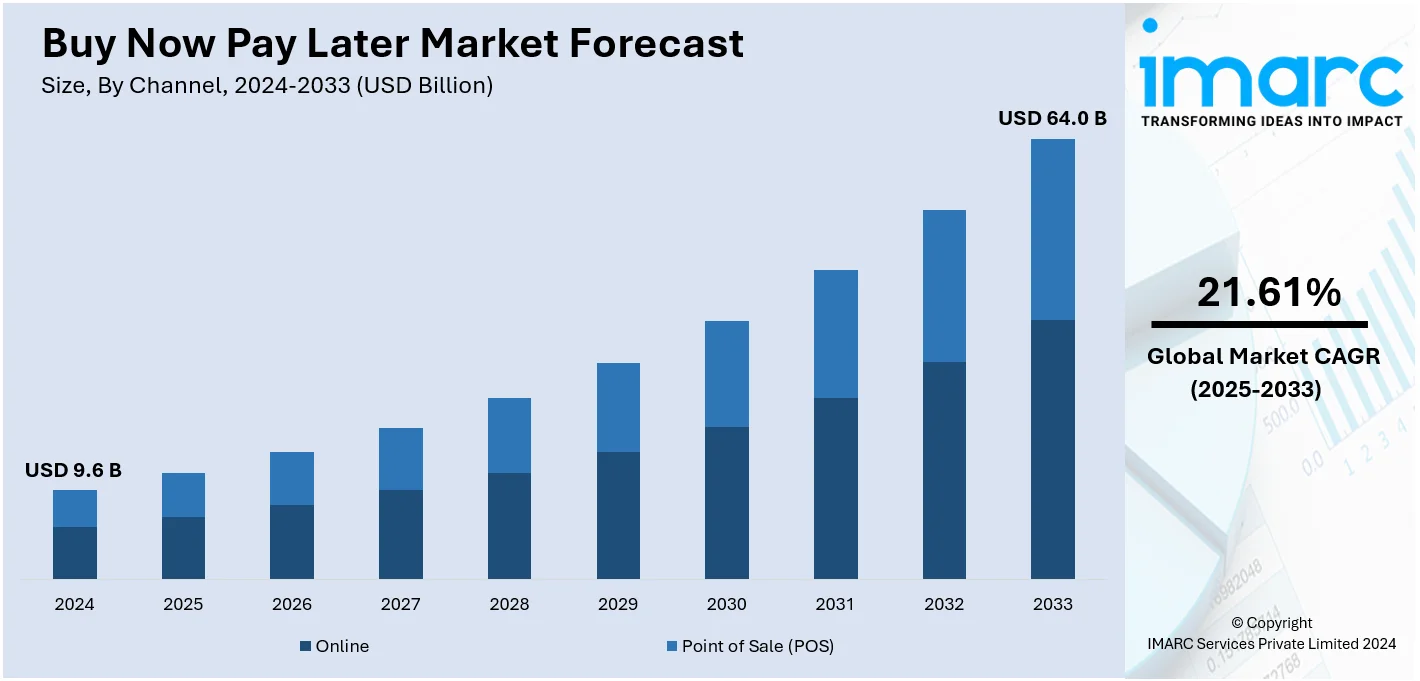

The global buy now pay later market size was valued at USD 9.6 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 64.0 Billion by 2033, exhibiting a CAGR of 21.61% from 2025-2033. North America currently dominates the market, holding a market share of 30.0% in 2024. The market is driven by the increasing demand for flexible, interest-free installment options that make high-value purchases more accessible, particularly during economic uncertainty. Rapid growth in e-commerce and digital payments has enhanced BNPL visibility at checkout, while partnerships between providers and retailers continue to expand the service’s reach. Ongoing innovation, including AI-based credit assessments and blockchain-backed transaction security, is expected to strengthen consumer confidence, further augmenting the buy now pay later market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 9.6 Billion |

| Market Forecast in 2033 | USD 64.0 Billion |

| Market Growth Rate 2025-2033 |

21.61%

|

At present, the rising preference for flexible payment options that allow people to make purchases without paying upfront, especially for high-ticket items, is impelling the market growth. In addition to this, the rising reliance on e-commerce platforms has made BNPL services easily accessible during checkout, enhancing user convenience. Additionally, many BNPL options offer interest-free payment plans, which attract budget-conscious shoppers. Apart from this, BNPL provides an alternative for individuals with limited credit access, promoting financial inclusion. Retailers also partner with BNPL providers, expanding the service's reach. Moreover, the increasing awareness among users about financial education, along with marketing efforts helps to build trust in BNPL. Furthermore, younger people who are more comfortable with digital payments, are supporting the market growth.

The United States has emerged as a major region in the buy now pay later market owing to many factors. The market is driven by the rising focus on financial inclusion, as BNPL allows users access to purchase goods, without traditional credit. Besides this, people seek flexible payment options, particularly for high-ticket items or during periods of economic uncertainty. Additionally, BNPL enables shoppers to split payments into installments, which makes purchases relatively more manageable. The rising number of e-commerce portals and digital payment platforms is further making BNPL services easily accessible at checkout. Moreover, many BNPL providers give interest-free payment plans, which entice budget-conscious buyers Further, major companies are teaming up with digital platforms to work on providing efficient BNPL services. In December 2024, Synergent, a financial services provider, collaborated with equipifi®, a well-known fintech company to broaden credit union access to BNPL systems in the United States. Credit unions partnering with Synergent can initiate their own BNPL programs via their digital banking applications, assisting members in dividing substantial purchases into manageable installment loans. This approach seeks to address users' buying habits while fostering revenue and interaction.

COVID-19 Impact:

The COVID‑19 pandemic significantly accelerated the adoption of Buy Now Pay Later (BNPL) services as consumers shifted to online shopping and became more cautious with spending. Economic uncertainty and reduced disposable incomes drove demand for flexible payment solutions, allowing users to manage their budgets without relying on traditional credit. Retailers, aiming to maintain sales amid lockdowns and store closures, integrated BNPL options to encourage purchases and reduce cart abandonment. This trend was especially evident in sectors like electronics, fashion, and home essentials. The convenience and interest-free nature of BNPL attracted first-time users, many of whom continued using the service post-pandemic, contributing to lasting market growth. Financial institutions and fintechs responded by accelerating digital offerings and expanding BNPL access through apps and embedded payment platforms. As a result, the pandemic served as a catalyst for BNPL adoption, reinforcing its role as a mainstream consumer financing tool and reshaping payment behavior across multiple demographics.

Buy Now Pay Later Market Trends:

Growing Consumer Demand for Flexible, Interest-Free Payments

The BNPL market is experiencing sustained momentum due to a shift in consumer behavior toward flexible, interest-free installment options. Shoppers are increasingly seeking alternatives to traditional credit cards, driven by a preference for transparency and control over spending. BNPL services provide an accessible way to manage larger purchases without upfront costs or long approval processes, appealing to younger demographics and budget-conscious buyers. The ability to split payments into manageable chunks not only helps with cash flow but also enhances purchasing power, especially for discretionary items. As per the buy now pay later market forecast, the trust in BNPL services is growing, repeat usage is climbing, making it a preferred method of payment in various retail segments. This rising demand is encouraging more brands to offer BNPL options, reinforcing the cycle of consumer reliance and market expansion.

Integration of BNPL Services into E-Commerce Platforms and Retail Checkout

The expansion of e-commerce has been a major catalyst for BNPL growth, with platforms integrating these payment solutions directly into online checkout experiences. Retailers view BNPL as a tool to boost conversion rates, increase average order values, and reduce cart abandonment. When offered at the point of sale, BNPL provides customers with a sense of affordability and immediacy, driving more frequent purchases. Retailers can also tailor promotional campaigns around installment plans, especially during peak seasons or product launches. As BNPL becomes embedded across online and mobile commerce channels, it is increasingly being adopted by large marketplaces and small businesses alike. This deep integration into digital storefronts has shifted BNPL from a novel feature to a standard offering, shaping consumer expectations and further accelerating market penetration.

Impact of Economic Uncertainty on Consumer Payment Preferences

Economic instability has heightened demand for alternative financing tools like BNPL, as consumers look for ways to maintain purchasing habits without increasing credit card debt. Inflation, interest rate fluctuations, and job market volatility have made many consumers cautious, prompting a turn toward short-term, no-interest payment plans. During the COVID-19 pandemic, BNPL usage surged as people sought financial flexibility for essential and discretionary spending alike. This trend has continued, with BNPL serving as a buffer against economic stress by allowing consumers to manage unexpected costs or delay full payments. It has become especially relevant for individuals with limited or no access to traditional credit. As uncertainty persists, BNPL is increasingly positioned not just as a convenience, but as a financial coping mechanism embedded in everyday transactions.

Advancement of Digital Infrastructure and Financial Technology in BNPL

Technological innovation is enabling BNPL services to scale rapidly and offer enhanced user experiences. Advanced data analytics and AI-driven credit scoring allow providers to assess creditworthiness in real time with minimal friction. Digital wallets and virtual cards are also reducing payment friction, allowing consumers to use BNPL at both online and offline points of sale. Blockchain and other encryption technologies are being adopted to increase data security and transaction transparency, helping build user trust. The API-first approach of many BNPL providers enables seamless integration with merchant systems, while mobile apps make it easy for users to track purchases and manage repayments. These developments are transforming BNPL into a robust digital financial service rather than just a checkout feature, positioning it as a long-term component of digital commerce infrastructure.

Emerging Market Risks and Operational Challenges for BNPL Providers

While BNPL growth has been strong, the sector faces rising scrutiny from regulators and financial watchdogs over consumer protection. Concerns about irresponsible lending, lack of transparency, and the risk of debt accumulation have led to calls for stricter compliance requirements. Some users take on multiple BNPL obligations across platforms, leading to overextension and missed payments. At the same time, providers must absorb operational costs, manage default risks, and maintain merchant relationships while keeping fees competitive. As regulatory frameworks evolve across markets, BNPL firms may face added pressure to conduct credit checks, provide clearer disclosures, and improve customer support systems. These factors could impact profitability and market entry barriers, requiring providers to balance innovation with risk management in order to sustain growth.

Buy Now Pay Later Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global buy now pay later market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on channel, enterprise size, and end use.

Analysis by Channel:

- Online

- Point of Sale (POS)

Online leads the market with 67.8% of market share in 2024. Online channels are being employed, as they offer convenience and easy access. Shopping online allows people to browse products at their own pace and select BNPL options at checkout, without any pressure. With a few clicks, users can split payments into installments for creating bigger purchases better managed. The process is fast and seamless, especially with the integration of BNPL services into popular e-commerce websites and apps. Individuals are used to shopping online and prefer it for its comfort, especially when BNPL options are available to make payments more flexible. In addition, online shopping often provides access to exclusive deals, and BNPL services allow users to take advantage of those offers without worrying about upfront costs. Since a lot of BNPL providers focus on partnering with online retailers, the digital shopping experience remains the leading channel. This convenience, combined with the rise of mobile shopping is offering a favorable buy now pay later market outlook.

Analysis by Enterprise Size:

- Large Enterprises

- Small and Medium Enterprises

Large enterprises dominate the market with 63.8% of market share in 2024 as they have the resources to invest in and scale BNPL services. These businesses often have a bigger customer base, which means they can offer BNPL options to more shoppers. They also have more financial flexibility to partner with BNPL providers, integrating these services into their websites and apps smoothly. Large enterprises benefit from the data they collect, allowing them to better understand user behavior and provide personalized BNPL solutions. They can manage risk more effectively due to their financial strength, which makes offering installment payments less risky for them. Additionally, big companies have brand recognition and trust that attract customers to use BNPL services, as people are more likely to use flexible payment options from well-established businesses.

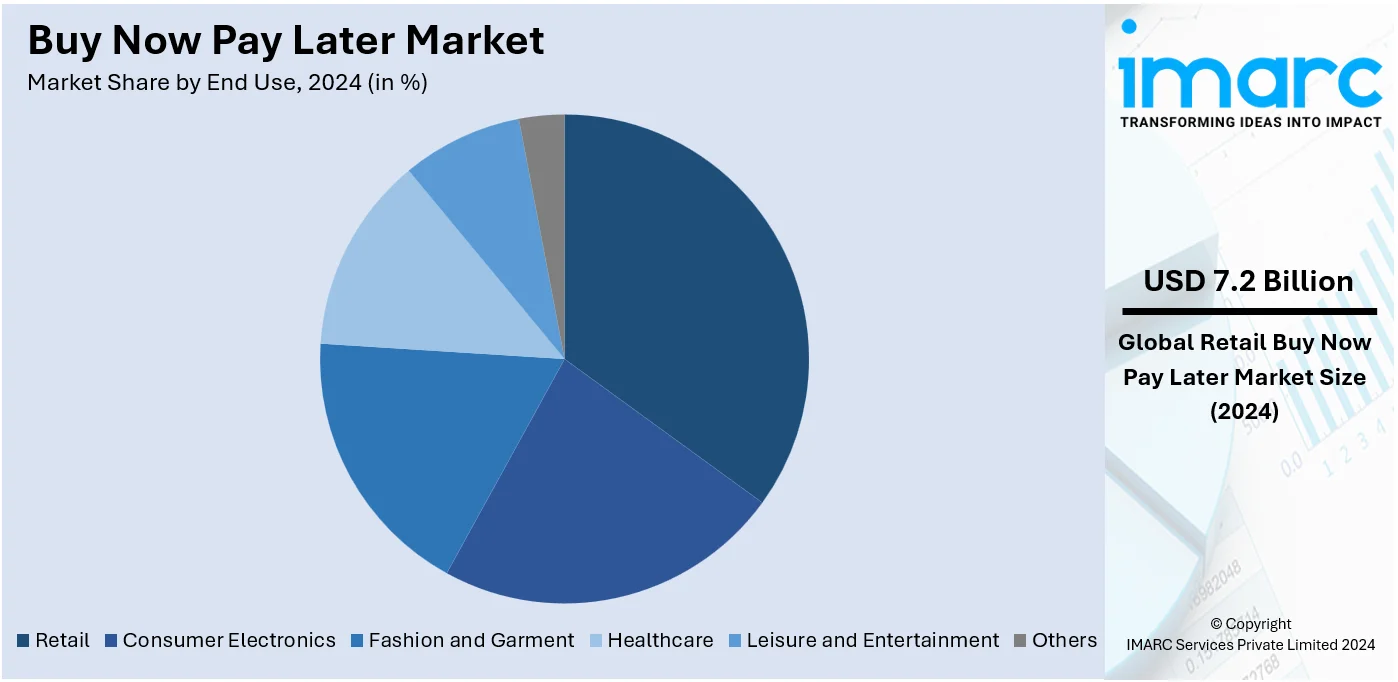

Analysis by End Use:

- Consumer Electronics

- Fashion and Garment

- Healthcare

- Leisure and Entertainment

- Retail

- Others

Retail leads the market with 75.0% of market share in 2024 because it is the channel where individuals often make larger and frequent purchases, and BNPL makes them more affordable. Whether it is clothing, electronics, or home goods, shoppers in retail are more likely to spend more money upfront, and BNPL gives them the flexibility to pay in installments. Retailers also benefit from offering BNPL as it encourages customers to buy more or opt for higher-priced items without worrying about the full cost at checkout. Consequently, individuals get the flexibility that they want, and retailers increase sales. Additionally, retail is one of the fastest-growing sectors in e-commerce, with many brands already partnering with BNPL providers to integrate these services into their websites and apps. This growing popularity of online shopping, combined with the easy access to BNPL options, makes retail the dominant end-use sector.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America held the largest market share, accounting 30.0% because of a combination of technological, economic, and user behavior factors. The region has a highly developed e-commerce infrastructure where BNPL services are seamlessly integrated into online shopping platforms, making it easy for people to use flexible payment options at checkout. In addition, the growing usage of digital payments and mobile wallets further drives the buy now pay later market demand. The region’s high user spending power, coupled with the rising need for flexible financing options, further fuels the market growth. BNPL services in North America often come with attractive features, such as interest-free installments, which appeal to budget-conscious shoppers. Furthermore, North Americans are more willing to adopt alternative financing methods, particularly due to economic uncertainties or during major shopping events. In the United States, retailers, including large chains and online marketplaces, partner with BNPL providers to offer convenient payment solutions. In April 2024, One, a financial technology company supported by Walmart, introduced its new BNPL service. The firm started providing BNPL loans for high-value products in over 4,600 stores across the United States.

Key Regional Takeaways:

United States Buy Now Pay Later Market Analysis

In North America, the market share for the United States was 90.0%. The increasing reliance on flexible payment methods is reshaping user spending in healthcare. Patients now seek seamless ways to manage medical expenses, aligning with the rising costs of treatments and wellness programs. The Centers for Medicare and Medicaid Services report that the national healthcare spending in the US hit USD 4.5 Trillion in 2022 and is projected to rise to USD 6.2 Trillion by 2028. Offering immediate relief from upfront payments, this payment method encourages users to access necessary medical care without financial stress. In response, healthcare providers integrate these options into billing systems to amplify patient satisfaction. Hospitals and clinics that cater to both elective and essential services frequently feature instalment-based solutions, reflecting the high demand for affordability. Furthermore, the appeal extends to specialized care, such as dental, vision, and physical therapy where patients often face high out-of-pocket costs. Coupled with evolving financial tools, the expanding healthcare sector supports the rising preference for this payment flexibility, ensuring accessibility and improved patient care across diverse service categories.

Asia-Pacific Buy Now Pay Later Market Analysis

The adoption of alternative payment methods is gaining traction among enterprises that emphasize adaptability and customer-centric solutions. Enterprises employ these methods to attract customers seeking manageable payment schedules. The trend is most pronounced among smaller businesses, which often use such payment options to gain a competitive edge in crowded markets. As per the India Brand Equity Foundation, the count of micro, small and medium enterprises (MSMEs) in the nation is anticipated to increase from USD 0.76 Million to about USD 0.9 Million in the near future, expanding at an expected CAGR of 2.5%. Merchants offering extended payment plans report higher customer retention rates, with flexible terms fostering loyalty and repeat purchases. The development of user-friendly platforms has simplified the integration process, enabling resource-limited enterprises to adopt these solutions. Additionally, partnerships with payment service providers enhance these enterprises' ability to offer personalized financing terms, catering to a wide array of needs.

Europe Buy Now Pay Later Market Analysis

E-commerce platforms have adopted innovative financing solutions to enhance customer experiences. According to reports, In EU businesses, the e-commerce revenue generated through their own websites or apps in 2022 exceeded that from marketplaces by over 6 times. The rise of digital shopping has created the need for flexibility, with instalment-based payment options becoming standard in many online stores. These solutions appeal to buyers by removing barriers to high-value purchases and simplifying checkout processes. Additionally, merchants benefit from increased conversion rates and larger transaction sizes, as customers feel empowered to spend without immediate financial strain. The adoption of such payment methods is further improved by advancements in secure transaction technologies, reassuring both buyers and sellers. Retailers specializing in fast-moving user goods and luxury items alike have integrated these options to cater to diverse demographics.

Latin America Buy Now Pay Later Market Analysis

The rise in disposable income among households has increased the demand for high-tech gadgets, fueling the appeal of payment flexibility. For instance, the overall disposable income in Latin America is projected to increase by almost 60% in real value from 2021 to 2040. Customers prioritize affordability when upgrading to premium electronics, favoring options that ease financial commitments. Payment plans frequently accompany electronics purchases, enabling wider access to smartphones, laptops, and other devices. Retailers highlight these solutions as essential features, aligning with customers' preferences for manageable installments. Additionally, the availability of tailored financing has enhanced increased spending on home entertainment systems and personal devices, thereby catalyzing the demand for BNPL plans. This approach reflects changing financial behaviors where affordability and convenience impact user choices.

Middle East and Africa Buy Now Pay Later Market Analysis

Growing investments have strengthened retail landscapes, enabling the use of instalment-based payment solutions. As per the Dubai Chamber of Commerce and Industry, retail sales in the UAE are forecasted to hit USD 70.5 Billion by 2025. Retailers leverage these methods to entice customers, especially for big-ticket items like furniture and apparel. Shoppers demand affordable alternatives to lump-sum payments, promoting merchants to diversify their financing options. These payment methods simplify purchase decisions, encouraging higher spending and enhancing customer satisfaction. Retailers also partner with financial service providers to offer streamlined approval processes, broadening the appeal of these solutions.

Competitive Landscape:

Key players are placing bets on offering innovative solutions and building trust among users and merchants. Leading BNPL providers work to enhance their platforms with user-friendly interfaces, along with flexible payment choices. They partner with a wide range of retailers to integrate BNPL seamlessly into online and offline shopping experiences. These players also invest in marketing campaigns to educate people about the benefits of BNPL, increasing adoption rates. Additionally, by leveraging data analytics, they come up with personalized offers to improve credit assessment and reduce default risks. Moreover, they team up with financial institutions and tech firms to expand their reach and capabilities. Their efforts make BNPL a convenient, transparent, and trusted payment option. In December 2024, eBay partnered with Klarna to offer BNPL options to users in important European regions, such as the UK, France, and Italy. Customers have the option of flexible payment methods, such as Pay in 3 or monthly installments for bigger purchases. This solution addresses the high adoption of BNPL, particularly among Millennials and Gen Z. eBay purchasers gain from the Authenticity Guarantee, providing safe and adaptable shopping experiences.

The report provides a comprehensive analysis of the competitive landscape in the buy now pay later market with detailed profiles of all major companies, including:

- Affirm Inc.

- Afterpay Pty Ltd (Block Inc.)

- Billie GmbH

- Klarna Bank AB

- LatitudePay Australia Pty Ltd

- Laybuy Holdings Limited

- LazyPay Private Limited (PayU)

- Openpay Group

- Payl8r

- Paypal Holdings Inc.

- Splitit Payments Ltd.

- Zip Co Limited

Latest News and Developments:

- January 2025: Data on online sales shows that holiday shoppers in 2024 depended significantly on "buy now, pay later" options, such as Klarna, Affirm, and Afterpay. These choices, favored by lower-income buyers, emphasize economic pressure when contrasted with higher-income families, as stated by Moody's. Retail analyst Mickey Chadha observed that the trend mirrors the overall condition of user expenditure.

- January 2025: MakeMyTrip launched a "Buy Now, Pay Later" feature for international flight bookings, extending this trend beyond fintech into travel services. Other platforms, such as Myntra and Snapdeal also provide pay-later services through fintech partners like Simpl and LazyPay. The trend underscores an increasing user appetite for adaptable payment options.

- December 2024: PayPal intends to increase charges for US merchants utilizing its services, which include well-liked BNPL features. BNPL enables customers to make payments in installments, frequently without any fees for on-time payments. Rivals, such as Klarna, Affirm, and Afterpay have also risen to prominence in the BNPL market.

- October 2024: Marqeta launched Marqeta Flex, an innovative solution integrating BNPL services seamlessly into payment apps and wallets. Developed with Klarna, Affirm, and Branch, it enhances BNPL accessibility during payment processes. The branch plans to implement Flex for W-2 and 1099 workers, offering tailored loan options. This collaboration aims to expand BNPL's reach to a broader audience.

Buy Now Pay Later Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Channels Covered | Online, Point of Sale (POS) |

| Enterprise Sizes Covered | Large Enterprises, Small and Medium Enterprises |

| End Uses Covered | Consumer Electronics, Fashion and Garment, Healthcare, Leisure and Entertainment, Retail, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Affirm Inc., Afterpay Pty Ltd (Block Inc.), Billie GmbH, Klarna Bank AB, LatitudePay Australia Pty Ltd, Laybuy Holdings Limited, LazyPay Private Limited (PayU), Openpay Group, Payl8r, Paypal Holdings Inc., Splitit Payments Ltd., Zip Co Limited, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the buy now pay later market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global buy now pay later market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the buy now pay later industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The buy now pay later market was valued at USD 9.6 Billion in 2024.

IMARC estimates the buy now pay later market to exhibit a CAGR of 21.61% during 2025-2033.

The growing adoption of digital payments and e-commerce platforms represents one of the key factors positively influencing the market. Besides this, the rising shift towards flexible payment options that allow people to purchase products and pay over time, especially for high-ticket items, is impelling the market growth. Moreover, the increasing marketing efforts and user education by BNPL platforms are leading to better understanding and trust in these services.

On a regional level, the market has been classified into North America, Europe, Asia-Pacific, Latin America, Middle East and Africa, wherein North America currently dominates the market.

Some of the major players in the buy now pay later market include Affirm Inc., Afterpay Pty Ltd (Block Inc.), Billie GmbH, Klarna Bank AB, LatitudePay Australia Pty Ltd, Laybuy Holdings Limited, LazyPay Private Limited (PayU), Openpay Group, Payl8r, Paypal Holdings Inc., Splitit Payments Ltd., Zip Co Limited, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)