Cambodia Medical Tourism Market Size, Share, Trends and Forecast by Type, Treatment Type, and Region, 2025-2033

Cambodia Medical Tourism Market Overview:

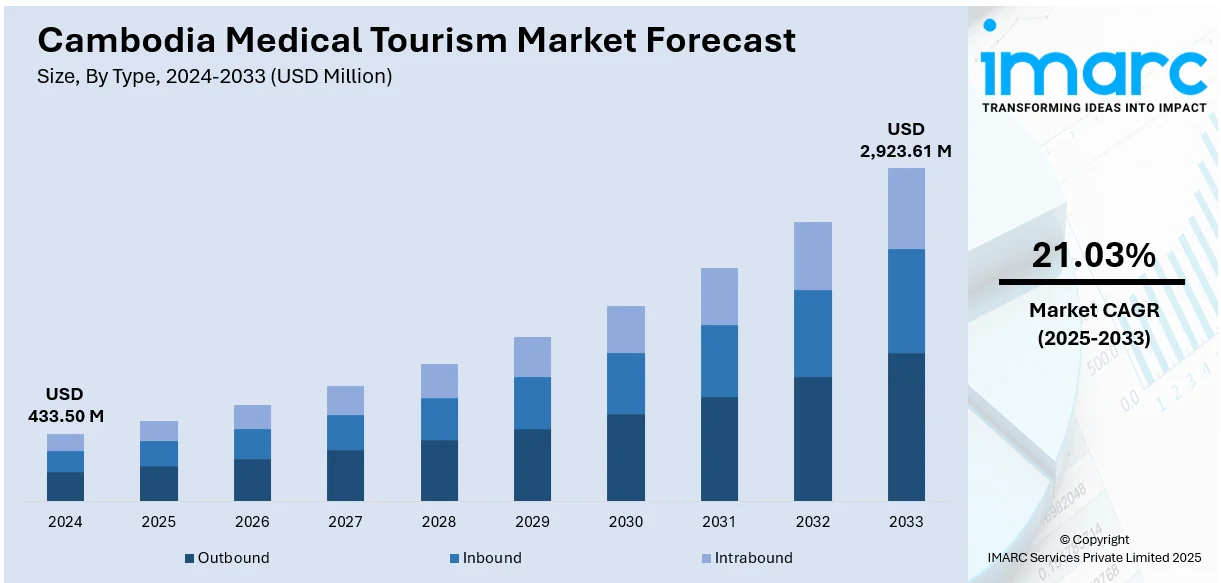

The Cambodia medical tourism market size reached USD 433.50 Million in 2024. Looking forward, the market is projected to reach USD 2,923.61 Million by 2033, exhibiting a growth rate (CAGR) of 21.03% during 2025-2033. The market is driven by Cambodia’s affordability in essential procedures, making it an appealing option for budget-conscious patients across Southeast Asia. Rapid growth in private hospitals and foreign-backed specialty clinics enhances treatment quality and international patient confidence. Strong regional accessibility and cultural familiarity are further augmenting the Cambodia medical tourism market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 433.50 Million |

| Market Forecast in 2033 | USD 2,923.61 Million |

| Market Growth Rate 2025-2033 | 21.03% |

Cambodia Medical Tourism Market Trends:

Cost-Effective Medical Services and Competitive Pricing

Cambodia is gaining visibility as a medical tourism destination due to its substantially lower treatment costs compared to Western countries and regional competitors like Singapore and Thailand. Routine dental work, cosmetic surgery, diagnostics, and fertility treatments are available at a fraction of the price charged in more developed healthcare markets. Patients from neighboring countries, including Laos, Myanmar, and Vietnam, as well as Cambodian expatriates return for affordable care without sacrificing quality in basic procedures. The absence of long waiting times and transparent pricing enhances Cambodia’s attractiveness for budget-conscious international patients. Clinics in Phnom Penh and Siem Reap often cater to foreign clients with multilingual staff and packaged services that include hotel bookings and airport transfers. Government support for medical tourism is gradually increasing, with investments in hospital accreditation, public-private partnerships, and medical training initiatives. Cambodia is home to nearly 16,000 private healthcare providers, complemented by around 1,300 private healthcare facilities. This number continues to rise steadily each year, reflecting the growing demand for healthcare services in the country. Local providers are also seeking international affiliations to improve service standards and boost brand credibility. While Cambodia is still developing in terms of high-end surgical capacity, its ability to deliver affordable, accessible care for common procedures underpins its market appeal. These price-driven advantages remain a foundational force behind Cambodia medical tourism market growth as inbound patient volumes steadily rise.

To get more information on this market, Request Sample

Strategic Regional Location and Cultural Compatibility

Situated in the heart of Southeast Asia, Cambodia benefits from geographical proximity to populous nations with overburdened or high-cost healthcare systems. Direct flights from Thailand, Vietnam, China, and Malaysia make it an accessible option for short-term medical travel. For patients from ASEAN countries, the cultural similarities, shared culinary habits, and comparable linguistic roots lower the psychological barrier to cross-border care. Medical tourists from Laos and Myanmar often view Cambodia as a culturally familiar destination, offering care that feels less foreign than facilities in the West or even in Thailand. Additionally, Cambodia's hospitality sector is already well-established, particularly in tourist centers such as Siem Reap, making the transition from medical treatment to recuperation seamless. The government has implemented several recovery measures to revive the tourism industry, including tax exemptions, cash support, and loans for tourism businesses, vaccination campaigns, employee training, and infrastructure development. For example, a monthly tax exemption policy for hotels and guesthouses in Siem Reap was introduced in February 2020 and extended until March 2023. Tour operators now bundle medical checkups with travel itineraries, integrating wellness into cultural tourism experiences. As more patients seek affordable care that does not require major cultural or logistical adjustments, Cambodia's soft-power appeal becomes increasingly important. The overlap between tourism familiarity and healthcare accessibility positions the country uniquely, especially for middle-income patients seeking non-critical treatments in a comfortable environment. This advantage plays a central role in attracting regional medical travelers and reinforcing Cambodia’s medical tourism potential.

Cambodia Medical Tourism Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type and treatment type.

Type Insights:

- Outbound

- Inbound

- Intrabound

The report has provided a detailed breakup and analysis of the market based on the type. This includes outbound, inbound, and intrabound.

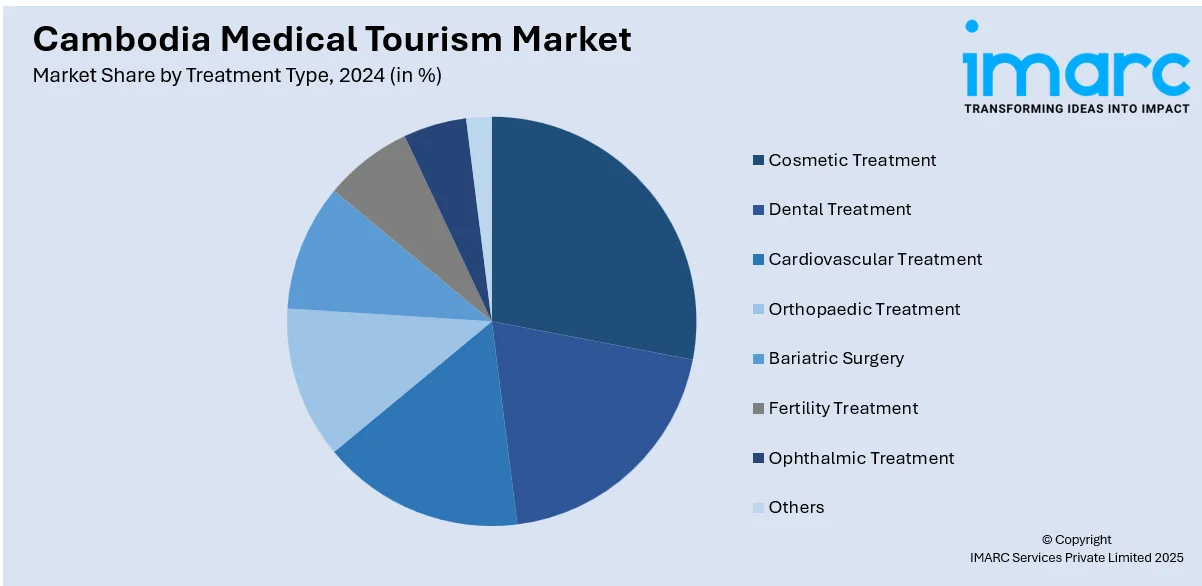

Treatment Type Insights:

- Cosmetic Treatment

- Dental Treatment

- Cardiovascular Treatment

- Orthopaedic Treatment

- Bariatric Surgery

- Fertility Treatment

- Ophthalmic Treatment

- Others

The report has provided a detailed breakup and analysis of the market based on the treatment type. This includes cosmetic treatment, dental treatment, cardiovascular treatment, orthopaedic treatment, bariatric surgery, fertility treatment, ophthalmic treatment, and others.

Regional Insights:

- Northwest

- Southwest

- Northeast

- Center

The report has also provided a comprehensive analysis of all the major regional markets, which include Northwest, Southwest, Northeast, and Center.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Cambodia Medical Tourism Market News:

- On February 11, 2025, the Philippines and Cambodia renewed their tourism cooperation through the signing of an Implementation Program for 2024-2028. This partnership aims to boost mutual tourism growth with initiatives such as professional exchanges, marketing efforts, and joint tourism events. In 2024, the Philippines recorded 4,268 visitors from Cambodia, underlining the importance of this collaboration in enhancing the regional tourism market, which is crucial for the growing medical tourism sector in both countries.

Cambodia Medical Tourism Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Outbound, Inbound, Intrabound |

| Treatment Types Covered | Cosmetic Treatment, Dental Treatment, Cardiovascular Treatment, Orthopaedic Treatment, Bariatric Surgery, Fertility Treatment, Ophthalmic Treatment, Others |

| Regions Covered | Northwest, Southwest, Northeast, Center |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Cambodia medical tourism market performed so far and how will it perform in the coming years?

- What is the breakup of the Cambodia medical tourism market on the basis of type?

- What is the breakup of the Cambodia medical tourism market on the basis of treatment type?

- What is the breakup of the Cambodia medical tourism market on the basis of region?

- What are the various stages in the value chain of the Cambodia medical tourism market?

- What are the key driving factors and challenges in the Cambodia medical tourism market?

- What is the structure of the Cambodia medical tourism market and who are the key players?

- What is the degree of competition in the Cambodia medical tourism market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Cambodia medical tourism market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Cambodia medical tourism market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Cambodia medical tourism industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)