Camel Dairy Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, Packaging Type, and Region, 2026-2034

Camel Dairy Market Size and Share:

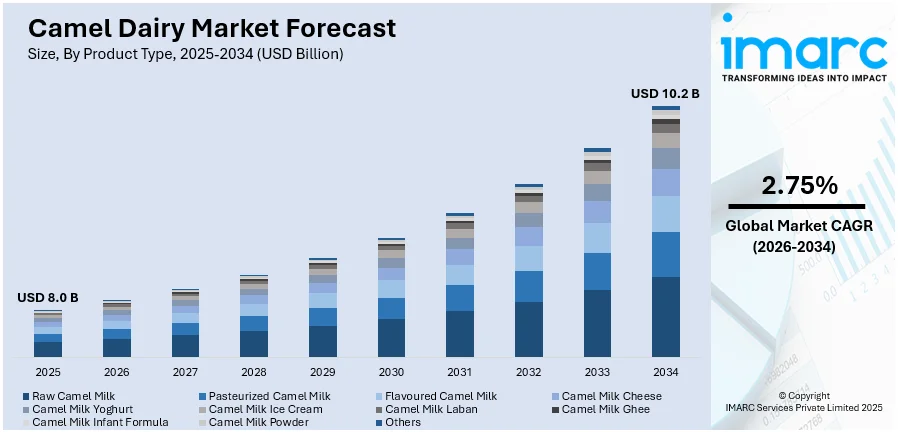

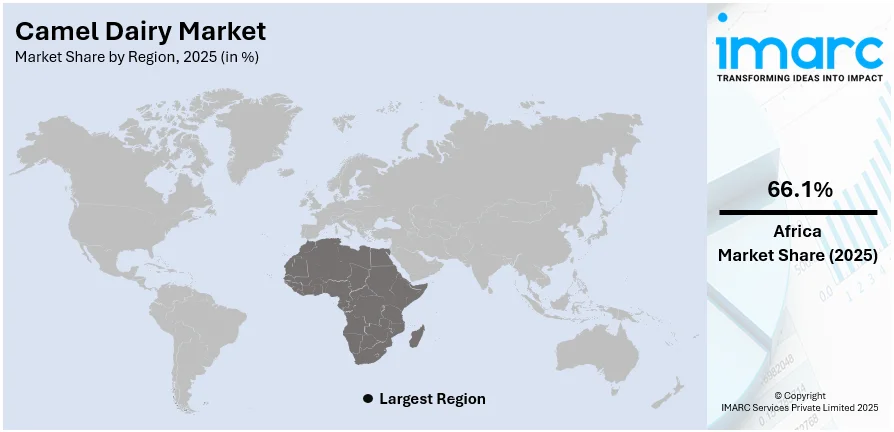

The global camel dairy market size was valued at USD 8.0 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 10.2 Billion by 2034, exhibiting a CAGR of 2.75% during 2026-2034. Africa currently dominates the market, holding a significant market share of over 66.1% in 2025. The market is growing due to rising demand for lactose-free and nutrient-rich dairy alternatives. Increasing awareness of camel milk’s health benefits and expanding availability through organized retail channels are key factors driving this market’s steady development.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 8.0 Billion |

|

Market Forecast in 2034

|

USD 10.2 Billion |

| Market Growth Rate 2026-2034 | 2.75% |

The market is seeing strong growth due to increasing interest in functional and nutrient-rich food options. Consumers are looking for dairy alternatives that support digestion, immunity, and overall well-being. Camel milk fits well into this demand as it contains high levels of vitamins, minerals, and immune-boosting properties. This trend is especially notable in urban centers where health-conscious individuals are open to trying new and exotic dairy options. The rise of lactose intolerance and milk allergies has also pushed people toward camel milk, as it is naturally lower in lactose and less likely to cause allergic reactions. Several camel dairy brands have expanded their presence in online retail spaces, making it easier for consumers to access camel milk products. Additionally, nutritionists and health influencers have started recommending camel milk for its digestive and therapeutic benefits, further encouraging adoption across global markets.

To get more information on this market Request Sample

Commercial camel farming is growing rapidly to meet rising demand for camel dairy products worldwide. Producers are scaling operations, investing in better animal care, and introducing modern milking practices. Countries in the Middle East and parts of Africa are leading this transformation, supported by favorable climatic conditions and established camel-rearing traditions. Over the last year, several governments in these regions have launched funding and training programs to help farmers increase camel milk output. Moreover, private companies have started building advanced dairy processing units near camel farms, allowing faster turnaround from production to packaging. This development not only boosts supply but also ensures product quality, shelf stability, and compliance with export standards. The move toward commercialization is also supported by growing interest in camel milk cosmetics and supplements, which is prompting farmers to explore multiple revenue streams. As a result, the camel dairy sector is slowly shifting from niche to mainstream in many regions.

Camel Dairy Market Trends:

Nutritional Benefits

The unique nutritional value of camel milk plays a vital role in driving growth in the global camel dairy market. Camel milk contains lower cholesterol compared to traditional cow milk, making it a preferred choice among health-focused consumers. It is also a natural source of essential vitamins such as vitamin C, B-complex vitamins, and vitamin E, along with minerals like calcium, iron, and potassium. These nutrients support overall wellness, bone health, and immune function. Additionally, camel milk has a higher proportion of certain proteins and bioactive compounds that are believed to aid in digestion and strengthen immunity. This nutritional profile positions camel milk as more than just a dairy product it is increasingly viewed as a functional food. Consumers looking to enhance their diets with natural and nutrient-dense alternatives are turning to camel dairy products, contributing to the sector's rapid expansion across both emerging and established health-conscious markets.

Health and Wellness Trends

The rising global emphasis on health and wellness continues to influence the demand for camel dairy products significantly. As consumers become mindful of what they eat, they are seeking natural and functional foods that align with their wellness goals. Camel milk is seen as a healthier alternative to conventional dairy due to its rich nutrient content and perceived medicinal properties. It has been linked to potential benefits such as improving insulin sensitivity and reducing inflammation, making it appealing for individuals managing diabetes or autoimmune disorders. Furthermore, camel milk is considered hypoallergenic and easier to digest for many, which adds to its appeal in the wellness segment. Its growing use in skincare and natural beauty products also reflects its expanding reach beyond traditional food applications. With more than half of surveyed individuals in the U.S. now prioritizing wellness over previous years, camel dairy products are well-positioned to meet this evolving consumer demand.

Increasing Population of Lactose-Intolerant Individuals

Lactose intolerance is becoming increasingly common worldwide, creating a significant opportunity for growth in the camel dairy market. An estimated 68% of the global population experiences some form of lactose malabsorption, so searching for digestible dairy alternatives is urgent. Camel milk, naturally lower in lactose compared to cow's milk, offers a suitable option for those affected by this condition. Its easy digestibility and gentle impact on the digestive system make it especially popular among people who want to continue consuming dairy without discomfort. In regions such as Asia, the Middle East, and Africa where lactose intolerance rates are particularly high camel milk has long been part of traditional diets and is now gaining renewed attention as a modern solution to a widespread issue. As awareness grows about the challenges of lactose intolerance, and consumers seek dairy-like experiences without negative effects, camel milk stands out as a viable, nutritious alternative.

Camel Dairy Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global camel dairy market, along with forecasts at the global, regional, and country levels from 2026-2034. The market has been categorized based on product type, distribution channel, and packaging type.

Analysis by Product Type:

- Raw Camel Milk

- Pasteurized Camel Milk

- Flavoured Camel Milk

- Camel Milk Cheese

- Camel Milk Yoghurt

- Camel Milk Ice Cream

- Camel Milk Laban

- Camel Milk Ghee

- Camel Milk Infant Formula

- Camel Milk Powder

- Others

In 2025, the raw camel milk led the camel dairy market, holding 73.6% of the market share, largely due to its unprocessed nutritional benefits and growing consumer preference for natural, additive-free products. Rich in iron, vitamin C, and immune-boosting properties, raw camel milk is increasingly being chosen by individuals with lactose intolerance and autoimmune conditions. Its use in traditional medicine across regions like the Middle East and North Africa continues to support demand. Additionally, wellness trends highlighting raw and organic foods have spurred interest among health-conscious urban consumers. Startups and local farms offering farm-to-home delivery models have also fueled access, especially in countries like the UAE and Kenya. As awareness spreads through social media and influencer-led health content, raw camel milk is gaining visibility beyond niche markets. These combined drivers have reinforced its position as a leading product in the camel dairy segment.

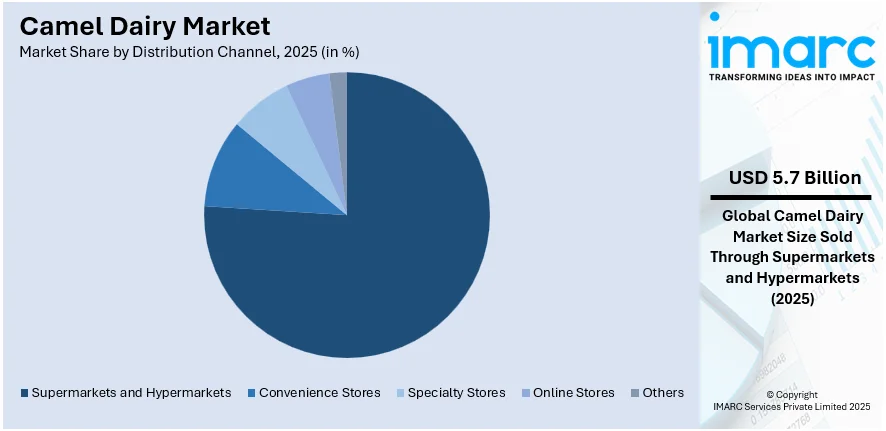

Analysis by Distribution Channel:

Access the comprehensive market breakdown Request Sample

- Supermarkets and Hypermarkets

- Convenience Stores

- Specialty Stores

- Online Stores

- Others

In 2025, the supermarkets and hypermarkets led the camel dairy market, holding 73.8% of the market share, driven by their broad consumer reach and ability to offer a wide variety of camel dairy products under one roof. These retail giants provide consumers with the convenience of accessing camel milk, yogurt, cheese, and even cosmetic products made from camel milk in a single trip. The strategic placement of camel dairy items in health food aisles and the introduction of private-label brands have made these products more visible and affordable. Retail chains in regions like the Middle East and parts of Africa have expanded their product lines to cater to both traditional and modern consumer preferences. For example, Carrefour in the UAE now features camel milk-based drinks and baby formulas. Promotional campaigns, free sampling, and informational signage in stores have further driven consumer trials and repeat purchases, boosting their role as a leading distribution channel.

Analysis by Packaging Type:

- Cartons

- Bottles

- Cans

- Jars

- Others

In 2025, the bottles segment led the camel dairy market, holding 59.1% of the market share, due to its convenience, hygiene, and portability. Bottled camel milk products, especially in single-serve formats, are increasingly popular among urban consumers seeking quick and healthy options for on-the-go consumption. The packaging also ensures extended shelf life while maintaining the milk’s nutritional integrity, an essential factor in markets lacking advanced cold-chain infrastructure. Brands like Camelicious and Al Ain Dairy have introduced flavored camel milk in sleek bottles, appealing to younger demographics and fitness enthusiasts. Bottled packaging supports clear labeling, helping consumers understand the health benefits and origin of the milk, which builds trust and transparency. Additionally, the ability to recycle or repurpose bottles aligns with growing environmental consciousness, giving brands a competitive edge. These factors together position bottled products as a dominant format within the camel dairy industry.

Regional Analysis:

To get more information on the regional analysis of this market Request Sample

- Africa

- Middle East

- Asia

- Oceania

- Rest of the World

In 2025, Africa led the camel dairy market, holding 66.1% of the market share, supported by a combination of tradition, livestock abundance, and increasing commercialization. Countries like Kenya, Somalia, and Ethiopia have long-standing practices of camel milk consumption, making it a culturally embedded and daily dietary staple. As urban populations grow, so does the formalization of camel milk supply chains, allowing local producers to scale operations and reach new consumer segments. Initiatives by governments and NGOs to support camel herders, improve veterinary services, and develop processing infrastructure have significantly enhanced product quality and availability. For instance, Kenyan cooperatives have started exporting powdered camel milk and yogurts to Europe and the Middle East. Moreover, camel milk’s resilience in arid climates aligns with Africa’s changing climate conditions, making it a sustainable livestock option. These social, economic, and environmental drivers continue to strengthen Africa’s leadership in the global camel dairy market.

Key Regional Takeaways:

Africa Camel Dairy Market Analysis

Africa presents a substantial market for camel dairy products, driven by widespread camel pastoralism across arid and semi-arid regions. Camels thrive in these harsh climates, making them a reliable source of milk where other livestock may struggle. Traditional consumption of camel milk is deeply rooted in many African communities, where it is often used for nourishment and ceremonial purposes. For instance, about 80% of the camel milk produced among Kenyan pastoralist communities is consumed raw and/or for making tea. Its cultural significance enhances consumer trust and acceptance. Camel milk’s nutritional benefits, including high vitamin C, iron, and antimicrobial properties, along with its use in managing diabetes and boosting immunity, have increased its appeal. Camel dairy products like fermented milk, butter, and cheese are gaining popularity across urban and rural markets in Africa.

Middle East Camel Dairy Market Analysis

The Middle East represents a key market for camel dairy, deeply rooted in the region’s cultural heritage and historical reliance on camels. Camel milk has been consumed for centuries, often considered a staple in nomadic communities due to its resilience in arid environments. For instance, it is estimated that the Dom population in Middle Eastern countries is around 5 Million. It holds religious and cultural significance, frequently referenced in traditional medicine and local customs. In many households, camel milk is still used for daily consumption, believed to support immunity and digestion. Its high vitamin C, iron, and insulin-like proteins are increasingly recognized in modern health discussions. This blend of tradition and growing awareness of nutritional benefits is driving market demand across both urban and rural areas in the region.

Asia Camel Dairy Market Analysis

Asia represents a significant market for camel dairy, deeply rooted in its historical and cultural connections with camels. Regions with arid and semi-arid climates have traditionally relied on camels for transport, food, and sustenance. For instance, India ranks tenth in the world with 0.38 Million camel population. Countries such as India, Pakistan, and Mongolia have centuries-old practices of camel rearing, where camel milk is consumed not only as a daily staple but also as part of traditional remedies. Its perceived health benefits, particularly for individuals with digestive issues, make it a preferred alternative to cow’s milk. In Rajasthan, camel milk is used in sweets like kulfi and kheer, while in Balochistan, it’s commonly consumed raw or fermented, reflecting its cultural and nutritional relevance across Asia.

Oceania Camel Dairy Market Analysis

Oceania, particularly Australia, has emerged as a significant market for camel dairy, supported by its large feral camel population and expanding camel farming operations. Camel milk production in Australia has seen steady growth, with farms such as those in the outback regions focusing on supplying fresh and powdered milk, cheeses, and skincare products. For instance, production of camel milk in Australia grew from 50,000 litres (11,000 imp gal) of camel milk in 2016 to 180,000 litres (40,000 imp gal) per annum in 2019. The country’s multicultural population has contributed to the demand, especially among communities with traditional ties to camel milk consumption. Health-conscious consumers are also drawn to its digestibility and potential anti-inflammatory properties. Products like camel milk kefir and probiotic drinks are gaining popularity in health food stores, while specialty cafés and wellness shops increasingly stock camel dairy offerings.

Competitive Landscape:

The competitive landscape of the camel dairy market is driven by rising demand for functional and alternative dairy products. Producers are focusing on innovation in product forms like powders, flavored milk, and supplements to attract health-conscious consumers. Expansion into retail chains and online platforms has intensified market competition, while advancements in processing technologies and quality certifications are helping players differentiate their offerings and build trust in both domestic and international markets.

The report provides a comprehensive analysis of the competitive landscape in the camel dairy market with detailed profiles of all major companies, including:

- Camelicious

- Al Ain Dairy

- Desert Farms

- Vital Camel Milk

- Tiviski Dairy

- Camilk Dairy

- Camel Dairy Farm Smits

- Camel Milk Co Australia

- Camel Milk South Africa

Latest News and Developments:

- May 2025: Oman announced plans to establish a camel milk cheese production facility in the Dhofar region, with operations expected to commence in the first quarter of 2026. Initially, the plant will handle between 500 liters and two tons of camel milk daily. Plans are already underway to scale up its processing capacity to five tons by the end of its inaugural year, eventually surpassing 15 tons in subsequent phases.

- April 2025: Pakistan began exporting camel milk powder to China, marking a significant milestone in its dairy sector. This export initiative is being supported by two leading Chinese enterprises, One HK Holding Ltd and Xi’an TUO ZHONG TUO Biotechnology Limited Company, reflecting growing global trust in Pakistan's agricultural production and processing standards. The development is anticipated to enhance trade relations between the two nations, create new income opportunities for domestic camel herders, and set the stage for broader diversification in the country’s dairy exports.

- October 2024: Mongolia prepared to enter the global market with camel milk exports. A processing plant was planned for launch in Umnugov aimag to support the initiative. The “Mongol temee” project, started in 2021, aimed to modernize camel farming. By 2023, modern milking methods boosted daily camel milk yield to 3 liters.

- September 2024: A Kazakh entrepreneur from Akshi village established camel milk exports to China and the Middle East. His farm in the Ili district produced five tons of milk daily and 15 tons of powdered shubat monthly. Half of the output was exported, with the rest sold domestically. He began the venture in the 1990s after moving from Karakalpakstan with his family.

- August 2024: Bahula Naturals partnered with the Rajasthan Cooperative Dairy Federation to sell fresh camel milk through Saras. The company operated from Bikaner and shipped across all Indian states. While focusing on B2B, they also sold D2C through their website. This collaboration expanded access to fresh camel milk nationwide.

Camel Dairy Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Product Types Covered | Raw Camel Milk, Pasteurized Camel Milk, Flavored Camel Milk, Camel Milk Cheese, Camel Milk Yoghurt, Camel Milk Ice Cream, Camel Milk Laban, Camel Milk Ghee, Camel Milk Infant Formula, Camel Milk Powder, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Specialty Stores, Online Stores, Others |

| Packaging Types Covered | Cartons, Bottles, Cans, Jars, Others |

| Regions Covered | Africa, Middle East, Asia, Oceania, Rest of the World |

| Companies Covered | Camelicious, Al Ain Dairy, Desert Farms, Vital Camel Milk, Tiviski Dairy, Camilk Dairy, Camel Dairy Farm Smits, Camel Milk Co Australia, Camel Milk South Africa |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the camel dairy market from 2020-2034.

- The camel dairy market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the camel dairy industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The camel dairy market was valued at USD 8.0 Billion in 2025.

The camel dairy market is projected to exhibit a CAGR of 2.75% during 2026-2034, reaching a value of USD 10.2 Billion by 2034.

Rising awareness of camel milk’s health benefits, including its low allergenicity and high nutrient content, is driving demand. Expanding availability through organized retail and e-commerce, growing lactose-intolerant populations, and increased investment in camel farming, especially in Gulf countries, further support market growth.

In 2025, Africa dominated the camel dairy market, accounting for the largest market share of 66.1%. The growth is driven by a large camel population, traditional consumption habits, and rising awareness of camel milk’s nutritional value.

Some of the major players in the camel dairy market include Camelicious, Al Ain Dairy, Desert Farms, Vital Camel Milk, Tiviski Dairy, Camilk Dairy, Camel Dairy Farm Smits, Camel Milk Co Australia, and Camel Milk South Africa.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)