Canada Air Freight Market Size, Share, Trends and Forecast by Service, Destination, End-User, and Region, 2025-2033

Canada Air Freight Market Overview:

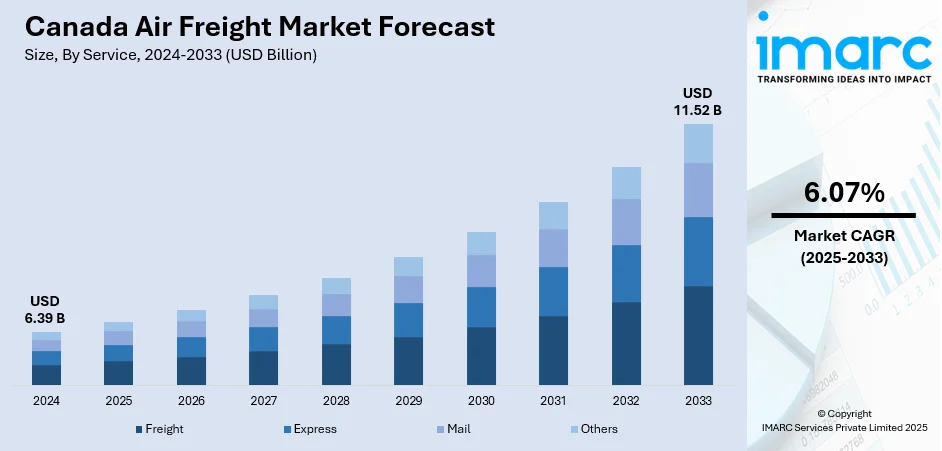

The Canada air freight market size reached USD 6.39 Billion in 2024. The market is projected to reach USD 11.52 Billion by 2033, exhibiting a growth rate (CAGR) of 6.07% during 2025-2033. The market is propelled by growing cross-border e-commerce trade, demand for prompt delivery, and expansion in trade agreements. In addition to this, upgrades in infrastructure at key Canadian airports and technology in cold chain logistics are also facilitating more stable and efficient air freight operations. Moreover, higher demand for speedy pharma and perishable products transportation is also spurring investments in capacity by carriers and logistics operators, thereby augmenting the Canada air freight market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 6.39 Billion |

| Market Forecast in 2033 | USD 11.52 Billion |

| Market Growth Rate 2025-2033 | 6.07% |

Canada Air Freight Market Trends:

Growth of Cross-Border E-Commerce and Express Delivery Demand

The market is increasingly influenced by rising cross-border e-commerce transactions. As Canadian consumers become more accustomed to international online shopping, especially from the United States, China, and the European Union, the demand for rapid parcel movement across borders has intensified. E-commerce players rely heavily on air cargo networks to meet short delivery windows and ensure customer satisfaction. As per industry reports published in 2025, approximately 63% of Canadian consumers have made purchases from international retailers, accounting for 22% of the country's total e-commerce sales. This growing preference for cross-border shopping is driving consistent demand for reliable and fast international shipping services. This has further prompted integrators to expand their air fleets and increase frequency on transpacific and transborder routes. Apart from this, the market benefits from higher shipment volumes of small packages and lightweight goods, which require frequent dispatch cycles and reliable timelines. Moreover, the need for customs pre-clearance, real-time tracking, and last-mile fulfilment integration is reshaping carrier services and airport operations across major hubs like Toronto Pearson, Vancouver International, and Montréal-Trudeau. As e-commerce accelerates, especially during peak seasons, forwarders and third-party logistics providers are adapting their capacity planning, digital interfaces, and airspace allocation strategies to remain competitive in a high-volume, time-sensitive trade environment.

To get more information on this market, Request Sample

Airport Infrastructure Modernization and Digital Cargo Initiatives

The large-scale airport infrastructure modernization and the adoption of digital cargo handling systems are positively impacting the Canada air freight market growth. Major gateway airports, including Vancouver, Calgary, and Toronto, are investing in expanded cargo terminals, dedicated freighter aprons, and airside connectivity to improve cargo throughput and reduce handling time. A significant announcement was made on March 10, 2025. Canada's Minister of Innovation, Science and Industry issued a policy statement authorizing private investment—including via subleases, subcontracts, and subsidiary ventures—into the National Airports System to modernize infrastructure and attract capital such as pension funds. This move signals a shift toward greater private-sector participation in enhancing airport efficiency and capacity. By opening the door to institutional capital, the government aims to accelerate the development of cargo terminals, freighter aprons, and digital logistics facilities, which are critical for meeting the growing demands of the air freight sector. In parallel, there is increasing adoption of digital freight platforms, electronic airway bills (e-AWBs), and cargo community systems (CCS) that enable greater transparency, coordination, and speed across stakeholders. These platforms streamline processes between freight forwarders, carriers, customs, and ground handlers. AI-based shipment visibility, predictive arrival estimates, and integrated slot-booking systems are helping to optimize resource planning and reduce delays.

Canada Air Freight Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels 2025-2033. Our report has categorized the market based on service, destination, and end-user.

Service Insights:

- Freight

- Express

- Others

The report has provided a detailed breakup and analysis of the market based on the service. This includes freight, express, mail, and others.

Destination Insights:

- Domestic

- International

A detailed breakup and analysis of the market based on the destination have also been provided in the report. This includes domestic and international.

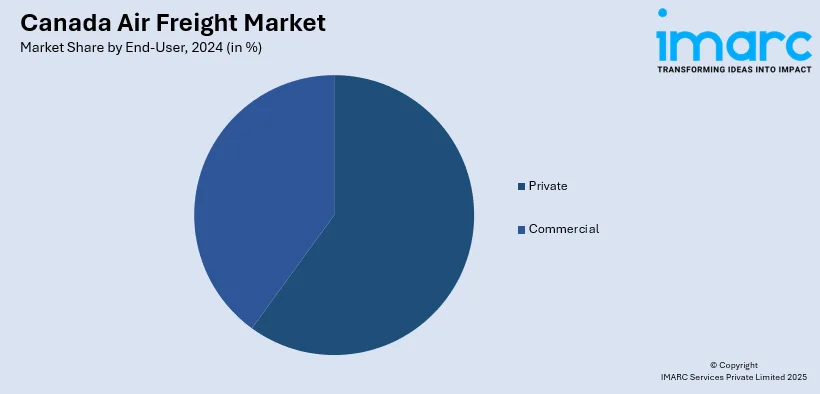

End-User Insights:

- Private

- Commercial

The report has provided a detailed breakup and analysis of the market based on the end-user. This includes private and commercial.

Regional Insights:

- Ontario

- Quebec

- Alberta

- British Columbia

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Ontario, Quebec, Alberta, British Columbia, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Canada Air Freight Market News:

- On March 27, 2025, Freightos (Nasdaq: CRGO) expanded its WebCargo Pay air‑cargo payment platform into Canada through a strategic partnership with Qatar Airways Cargo. The launch grants Canadian freight forwarders, especially those based in Toronto and Montreal, seamless access to Qatar Airways Cargo rates and booking capabilities without requiring existing accreditation, bank guarantees, or upfront payment. It also offers local payment options and deferred payment—up to 48 hours before departure, enhancing financial flexibility and competitive access for forwarders of all sizes.

Canada Air Freight Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Services Covered | Freight, Express, Mail, Others |

| Destinations Covered | Domestic, International |

| End-Users Covered | Private, Commercial |

| Regions Covered | Ontario, Quebec, Alberta, British Columbia, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Canada air freight market performed so far and how will it perform in the coming years?

- What is the breakup of the Canada air freight market on the basis of service?

- What is the breakup of the Canada air freight market on the basis of destination?

- What is the breakup of the Canada air freight market on the basis of end-user?

- What is the breakup of the Canada air freight market on the basis of region?

- What are the various stages in the value chain of the Canada air freight market?

- What are the key driving factors and challenges in the Canada air freight market?

- What is the structure of the Canada air freight market and who are the key players?

- What is the degree of competition in the Canada air freight market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Canada air freight market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Canada air freight market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Canada air freight industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)