Canada ATM Market Size, Share, Trends and Forecast by Solution, Screen Size, Application, ATM Type, and Region, 2025-2033

Canada ATM Market Overview:

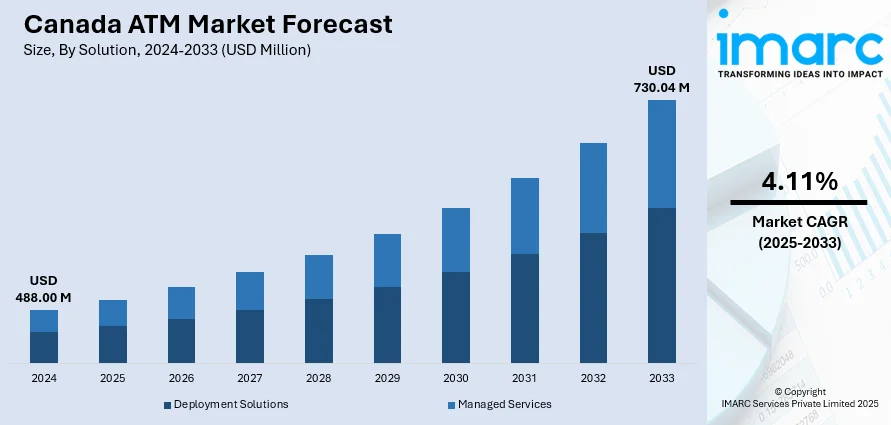

The Canada ATM market size reached USD 488.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 730.04 Million by 2033, exhibiting a growth rate (CAGR) of 4.11% during 2025-2033. The market is fueled by convenience-oriented infrastructure, robust rural banking network, and changing consumer behavior. Despite the growing use of digital payments, cash continues to be a popular choice in communities, particularly in remote and Indigenous areas. Extensive usage of white-label ATMs and technologies reflect the nation's emphasis on inclusive finance. Increasing demand for cryptocurrency has also encouraged the growth of Bitcoin ATMs, further fostering the Canada ATM market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 488.00 Million |

| Market Forecast in 2033 | USD 730.04 Million |

| Market Growth Rate 2025-2033 | 4.11% |

Canada ATM Market Trends:

Emergence of White-Label ATMs

White-label ATMs have exploded in popularity in Canada, making them a major force on the ATM industry. These stand-alone ATMs populate non-traditional locations such as grocery stores, gas stations, and entertainment centers, offering easy access to cash in high-traffic locations. Run by independent deployers, white-label ATMs provide facilities such as cash withdrawals and balance checks, but usually at a more expensive fee than bank-owned machines. The need for easily accessible cash points remains a driving force behind the proliferation of white-label ATMs nationwide, which greatly contributes to the Canada ATM market growth.

To get more information on this market, Request Sample

Integration of Talking ATMs for Accessibility

Canada's dedication to inclusion is seen in the proliferation of talking ATMs, which are meant to cater to visually impaired clients. The ATMs offer voice instructions via a headphone jack, allowing users to conduct transactions independently and safely. Most major banks, such as the Royal Bank of Canada, have integrated talking ATMs in most of their branches, making sure that people with visual disabilities have access to banking facilities on the same grounds as everyone else. The move is in compliance with Canada's accessibility standards and is part of a larger attempt at the financial industry to adapt to the needs of diverse customers. The merger of talking ATMs serves to boost customer experience while raising the bar for other countries that aim toward inclusive banking solutions.

Expansion of Bitcoin ATMs

Canada has become a pioneer in the installation of Bitcoin ATMs, which mirrors Canada's liberal attitude towards the adoption of cryptocurrencies. These devices enable customers to exchange Bitcoin and other digital currencies with cash or debit cards, offering a convenient on-ramp into the cryptocurrency market. Major cities such as Toronto and Vancouver have high concentrations of Bitcoin ATMs, responding to interest in decentralized finance. The growth of these ATMs is fueled by a regulatory framework that protects consumers while encouraging innovation, as trust in cryptocurrency transactions increases. With digital money increasingly being accepted into the mainstream, Canada's Bitcoin ATM machines serve to bridge the enormous gap between the old banking system and new digital economy.

Canada ATM Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on solution, screen size, application, and ATM type.

Solution Insights:

- Deployment Solutions

- Onsite ATMs

- Offsite ATMs

- Work Site ATMs

- Mobile ATMs

- Managed Services

The report has provided a detailed breakup and analysis of the market based on the solution. This includes deployment solutions (onsite ATMs, offsite ATMs, work site ATMs, and mobile ATMs) and managed services.

Screen Size:

- 15" and Below

- Above 15"

A detailed breakup and analysis of the market based on the screen size has also been provided in the report. This includes 15” and below and above 15”.

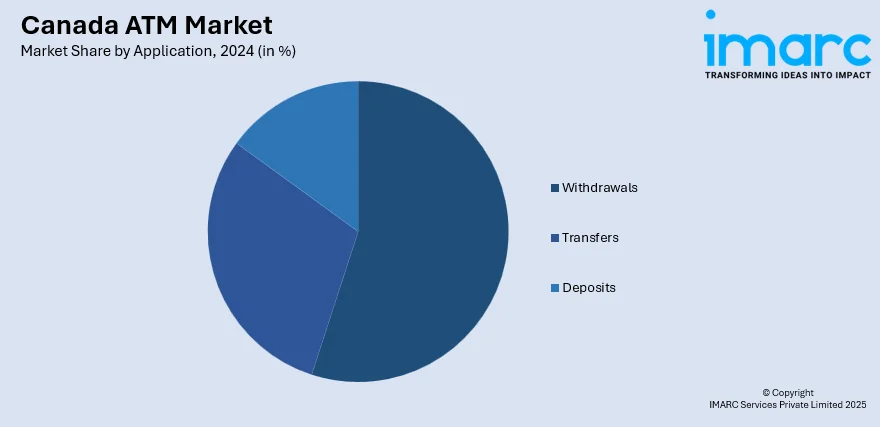

Application Insights:

- Withdrawals

- Transfers

- Deposits

A detailed breakup and analysis of the market based on the application has also been provided in the report. This includes withdrawals, transfers, and deposits.

ATM Type Insights:

- Conventional/Bank ATMs

- Brown Label ATMs

- White Label ATMs

- Smart ATMs

- Cash Dispensers

The report has provided a detailed breakup and analysis of the market based on the ATM type. This includes conventional/bank ATMs, brown label ATMs, white label ATMs, smart ATMs, and cash dispensers.

Regional Insights:

- Ontario

- Quebec

- Alberta

- British Columbia

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Ontario, Quebec, Alberta, British Columbia, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Canada ATM Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Solutions Covered |

|

| Screen Sizes Covered | 15" and Below, Above 15" |

| Applications Covered | Withdrawals, Transfers, Deposits |

| ATM Types Covered | Conventional/Bank ATMs, Brown Label ATMs, White Label ATMs, Smart ATMs, Cash Dispensers |

| Regions Covered | Ontario, Quebec, Alberta, British Columbia, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Canada ATM market performed so far and how will it perform in the coming years?

- What is the breakup of the Canada ATM market on the basis of solution?

- What is the breakup of the Canada ATM market on the basis of screen size?

- What is the breakup of the Canada ATM market on the basis of application?

- What is the breakup of the Canada ATM market on the basis of ATM type?

- What is the breakup of the Canada ATM market on the basis of region?

- What are the various stages in the value chain of the Canada ATM market?

- What are the key driving factors and challenges in the Canada ATM market?

- What is the structure of the Canada ATM market and who are the key players?

- What is the degree of competition in the Canada ATM market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Canada ATM market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Canada ATM market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Canada ATM industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)