Canada Cement Market Size, Share, Trends and Forecast by Type, End-Use, and Region, 2025-2033

Canada Cement Market Overview:

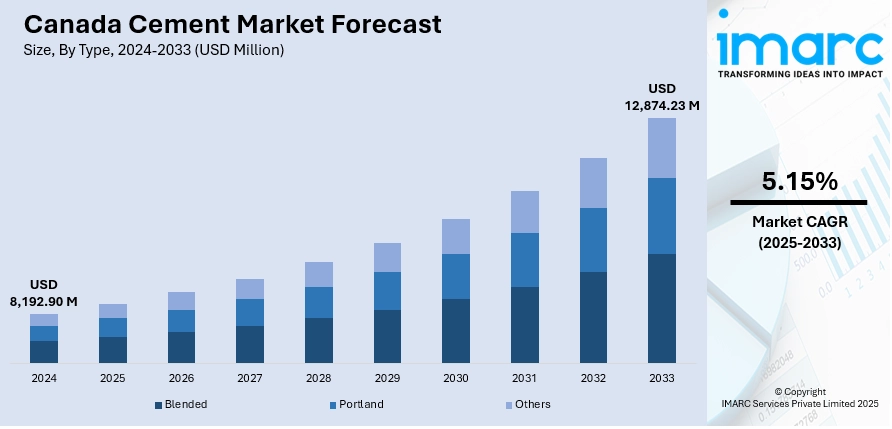

The Canada cement market size reached USD 8,192.90 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 12,874.23 Million by 2033, exhibiting a growth rate (CAGR) of 5.15% during 2025-2033. Rising residential and infrastructure construction, especially in Ontario and British Columbia, replacement demand for aging structures, low-interest rates, and government-backed housing and green infrastructure programs are some of the factors contributing to Canada cement market share. Demand also reflects industrial recovery, population growth, and proximity to US export opportunities.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 8,192.90 Million |

| Market Forecast in 2033 | USD 12,874.23 Million |

| Market Growth Rate 2025-2033 | 5.15% |

Canada Cement Market Trends:

Decarbonization Push Shaping Plant Upgrades

Cement producers in Canada are moving toward cleaner operations by upgrading legacy facilities with more efficient digital systems. Modernization efforts now include integrating advanced automation platforms to cut emissions and optimize output. Plants producing low-carbon cement blends are scaling up, often pairing these shifts with pilot carbon capture initiatives. This signals a deeper shift in production strategy, less about expanding capacity and more about retooling what already exists to align with climate goals. Ontario’s facilities are among those pivoting, showing how older plants can still be part of future-focused infrastructure. The result is increased investment in smart technologies that not only boost performance but also reinforce the push toward sustainable construction materials. These factors are intensifying the Canada cement market growth. For example, in October 2024, Lafarge Canada modernized its Bath Cement Plant in Ontario using ABB's advanced control system, ABB Ability System 800xA. This upgrade would improve process efficiency and support Lafarge’s decarbonization goals. The plant, producing over 1 Million Tons of low-carbon OneCem annually, is also piloting carbon capture technology, strengthening its role in sustainable construction and the Canadian cement market’s shift toward cleaner operations.

To get more information on this market, Request Sample

Low-Carbon Cement Alternatives Gaining Ground

New materials based on magnesium cement are entering the Canadian market as viable substitutes for traditional options. These next-gen products are fire-rated, moisture-resistant, and made with locally sourced components, reducing reliance on gypsum and imported MgO. By using proprietary technology that converts industrial waste into cement, manufacturers are targeting both performance and emissions. With public funding helping scale these efforts, such alternatives are drawing attention in the construction sector. The combination of fire safety, durability, and reduced environmental impact positions these materials as a practical choice for builders looking to meet stricter codes and climate targets without sacrificing quality. For instance, in March 2025, ZS2 Technologies introduced its second-generation magnesium cement materials in Canada, offering fire-rated, low-carbon alternatives to traditional gypsum and MgO imports. The new lineup, TechBoard, TechTile, TechStone, uses domestic inputs and patented waste-to-cement tech. Backed by USD 9.9 Million in grants, the products improve durability and moisture resistance, supporting Canada’s push for greener, high-performance construction solutions in the cement and building materials market.

Canada Cement Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type and end-use.

Type Insights:

- Blended

- Portland

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes blended, portland, and others.

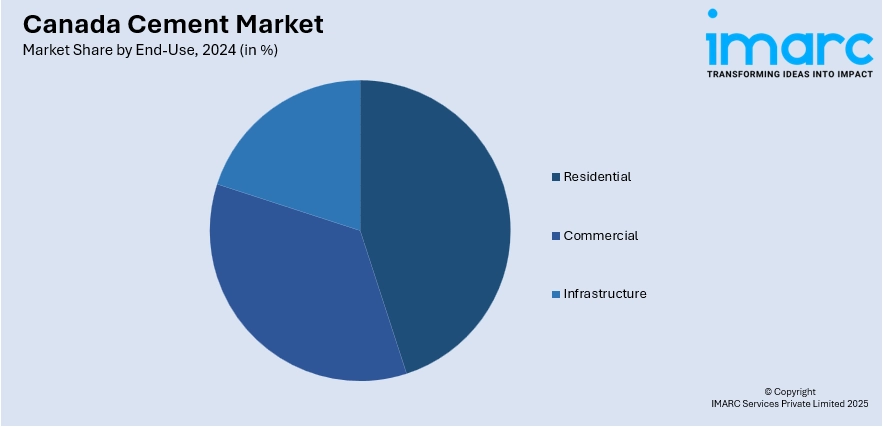

End-Use Insights:

- Residential

- Commercial

- Infrastructure

A detailed breakup and analysis of the market based on the end-use have also been provided in the report. This includes residential, commercial, and infrastructure.

Regional Insights:

- Ontario

- Quebec

- Alberta

- British Columbia

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Ontario, Quebec, Alberta, British Columbia, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Canada Cement Market News:

- In March 2025, Canada advanced emissions reduction in heavy industry by supporting Heidelberg Materials’ carbon capture project in Edmonton. Innovation, Science and Economic Development Canada is negotiating a federal contribution agreement. The government plans to invest up to USD 275 Million, following a 2023 memorandum of understanding. A USD 49 Million agreement has already been signed for the project’s first phase, the first full-scale CCUS plant in North America’s cement sector.

Canada Cement Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Blended, Portland, Others |

| End-Uses Covered | Residential, Commercial, Infrastructure |

| Regions Covered | Ontario, Quebec, Alberta, British Columbia, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Canada cement market performed so far and how will it perform in the coming years?

- What is the breakup of the Canada cement market on the basis of type?

- What is the breakup of the Canada cement market on the basis of end-use?

- What is the breakup of the Canada cement market on the basis of region?

- What are the various stages in the value chain of the Canada cement market?

- What are the key driving factors and challenges in the Canada cement market?

- What is the structure of the Canada cement market and who are the key players?

- What is the degree of competition in the Canada cement market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Canada cement market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Canada cement market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Canada cement industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)