Canada Cheese Market Size, Share, Trends and Forecast by Source, Type, Product, Format, Distribution Channel, and Region, 2025-2033

Canada Cheese Market Overview:

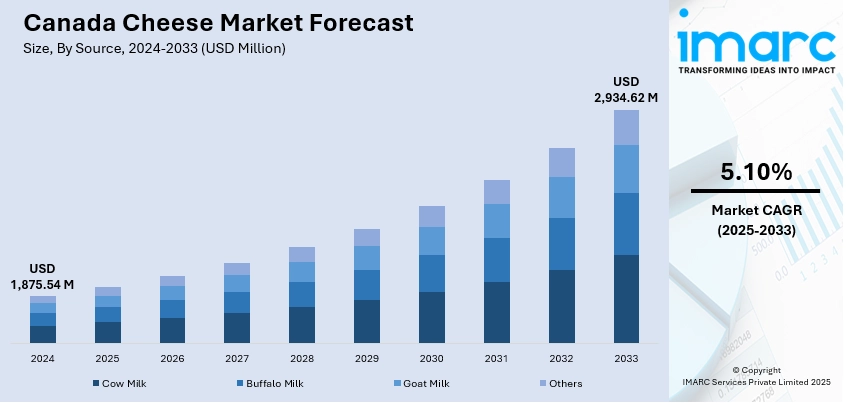

The Canada cheese market size reached USD 1,875.54 Million in 2024. The market is projected to reach USD 2,934.62 Million by 2033, exhibiting a growth rate (CAGR) of 5.10% during 2025-2033. The market is driven by an accelerating demand for premium, health-oriented, and conveniently packaged cheese, backed by changing dietary patterns and heightened consumer sensitivity to quality and origin. Amplified demand for artisanal and functionally innovative cheeses continues to fuel diversification of products and category growth. Retailers are reacting with wider assortments and focused merchandising efforts as well. As cheese becomes more entrenched in daily snacking and consumption habits, competition increases by format and price point, eventually dictating the changing Canada cheese market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,875.54 Million |

| Market Forecast in 2033 | USD 2,934.62 Million |

| Market Growth Rate 2025-2033 | 5.10% |

Canada Cheese Market Trends:

Growing Demand for Artisan and Specialty Cheese

In Canada, consumer demand is increasingly trending toward artisan and specialty cheeses, reflecting a broader movement of appreciation for craftsmanship, local sourcing, and varied taste profiles. Canadian buyers are seeking out non-traditional types like blue cheese, washed-rind options, and soft-ripened varieties instead of the classic cheddar or mozzarella. Such a change is mostly due to heightened culinary interest and exposure to food-oriented media that raise awareness of regional and artisanal cheese. Farmers' markets, specialty retailers, and upscale grocery stores are increasing their selection to accommodate this expanding demand. In addition, Canadian manufacturers are getting creative in order to address standards of quality and originality, sustaining local morale and enthusiasm for Canadian cheese artisanship. For instance, in January 2024 – Lactalis Canada Foodservice introduced Galbani Professionale Premio Pizza Mozzarella, a 26% mozzarella in 2.3kg block packaging, providing chefs with enhanced melting, blister coverage, and creamy texture to Canada's foodservice market. Moreover, not only does this diversification support market resilience, but it also delivers Canada cheese market growth through the introduction of premium pricing practices and brand loyalty among refined cheese connoisseurs, particularly in urban areas with greater disposable incomes.

To get more information on this market, Request Sample

Health-Focused Cheese Innovations

A solid wellness trend is redefining shopper expectations within the Canadian cheese marketplace. Consumers increasingly look for cheese that enables healthier living, such as lower fat and sodium or those enhanced with functional benefits like probiotics or soy proteins. Such products are gaining acceptance not only among people with dietary requirements but also with the overall population in pursuit of well-being without sacrificing taste. The increase in flexitarian and health-oriented diets drives this trend, with some Canadians willing to pay a premium for organic, lactose-free, or nutrient-dense labeled cheeses. Stores are responding to this demand through designated sections that showcase health-oriented cheese offerings. The trend is consistent with Canada cheese market trends as health-conscious consumption emerges as a strong driver of innovation and consumer purchase behavior. Consequently, manufacturers are spending more on R&D to cater to these preferences while maintaining traditional taste standards.

The Rise of Convenience and Snacking Cheese Formats

Canada's hectic lifestyle and shifting meal habits are propelling demand for convenient cheese formats for snacking on the move. Shoppers, especially in urban centers, are gravitating towards single-serving packs of cheese, pre-sliced cheeses, and combining cheese with nuts or fruit as a healthy snack. These formats are especially appealing to working adults, busy parents, and students who appreciate portability and convenience of consumption. The demand for healthy, quick foods also is changing merchandising programs in supermarkets and convenience stores, which now offer wider ranges of ready-to-eat (RTE) cheese items. Additionally, creative packaging solutions that enhance shelf life and product integrity are facilitating this trend. These changing consumption patterns suggest a key opportunity for Canada cheese market trens, especially in appealing to weekday lunchboxes and nighttime snacking occasions. Growth in convenience-oriented formats also supports Canada cheese market growth by increasing cheese consumption beyond meals to varied lifestyle-driven situations.

Canada Cheese Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on source, type, product, format, and distribution channel.

Source Insights:

- Cow Milk

- Buffalo Milk

- Goat Milk

- Others

The report has provided a detailed breakup and analysis of the market based on the source. This includes cow milk, buffalo milk, goat milk, and others.

Type Insights:

- Natural

- Processed

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes natural and processed.

Product Insights:

- Mozzarella

- Cheddar

- Feta

- Parmesan

- Roquefort

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes mozzarella, cheddar, feta, parmesan, roquefort, and others.

Format Insights:

- Slices

- Diced/Cubes

- Shredded

- Blocks

- Spreads

- Liquid

- Others

A detailed breakup and analysis of the market based on the format have also been provided in the report. This includes slices, diced/cubes, shredded, blocks, spreads, liquid, and others.

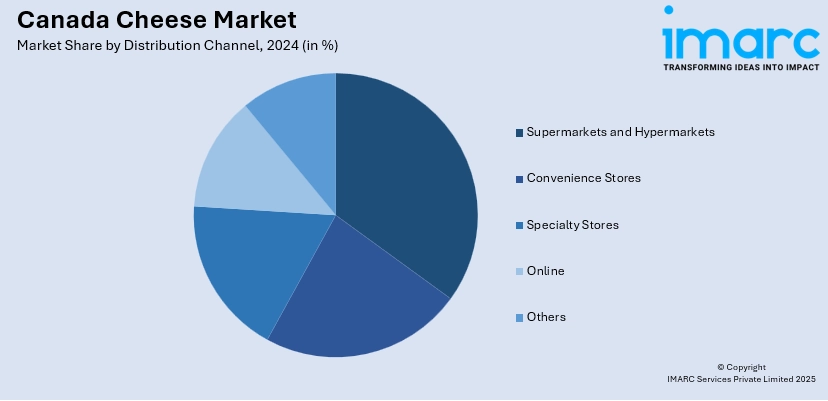

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Convenience Stores

- Specialty Stores

- Online

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes supermarkets and hypermarkets, convenience stores, specialty stores, online, and others.

Regional Insights:

- Ontario

- Quebec

- Alberta

- British Columbia

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Ontario, Quebec, Alberta, British Columbia, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Canada Cheese Market News:

- July 2024: Violife unveiled Canada's first-ever 100% dairy-free Creamy Block cream cheese, now in stores at leading retailers. Whipping-friendly, bake-and-spread, and ready to devour, the innovation provides Canadians with a plant-based alternative that is versatile in nature. Launch festivities involve parties at street festivals across the country to highlight the versatility of the product in Canadian cuisine.

- May 2024: Bel Group Canada introduced The Laughing Cow® Plant-Based, a rich, almond-based variety in its iconic triangle shape. This product is part of Bel's ambition to have 50% of its product portfolio plant-based by 2030 and responds to shifting Canadian consumer desires for more delicious, sustainable, and convenient plant-based cheese alternatives.

Canada Cheese Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sources Covered | Cow Milk, Buffalo Milk, Goat Milk, Others |

| Types Covered | Natural, Processed |

| Products Covered | Mozzarella, Cheddar, Feta, Parmesan, Roquefort, Others |

| Formats Covered | Slices, Diced/Cubes, Shredded, Blocks, Spreads, Liquid, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Specialty Stores, Online, Others |

| Regions Covered | Ontario, Quebec, Alberta, British Columbia, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Canada cheese market performed so far and how will it perform in the coming years?

- What is the breakup of the Canada cheese market on the basis of source?

- What is the breakup of the Canada cheese market on the basis of type?

- What is the breakup of the Canada cheese market on the basis of product?

- What is the breakup of the Canada cheese market on the basis of format?

- What is the breakup of the Canada cheese market on the basis of distribution channel?

- What is the breakup of the Canada cheese market on the basis of regions?

- What are the various stages in the value chain of the Canada cheese market?

- What are the key driving factors and challenges in the Canada cheese?

- What is the structure of the Canada cheese market and who are the key players?

- What is the degree of competition in the Canada cheese market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Canada cheese market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Canada cheese market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Canada cheese industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)