Canada Co-Working Office Space Market Size, Share, Trends and Forecast by Type, Application, End User, and Region, 2026-2034

Canada Co-Working Office Space Market Overview:

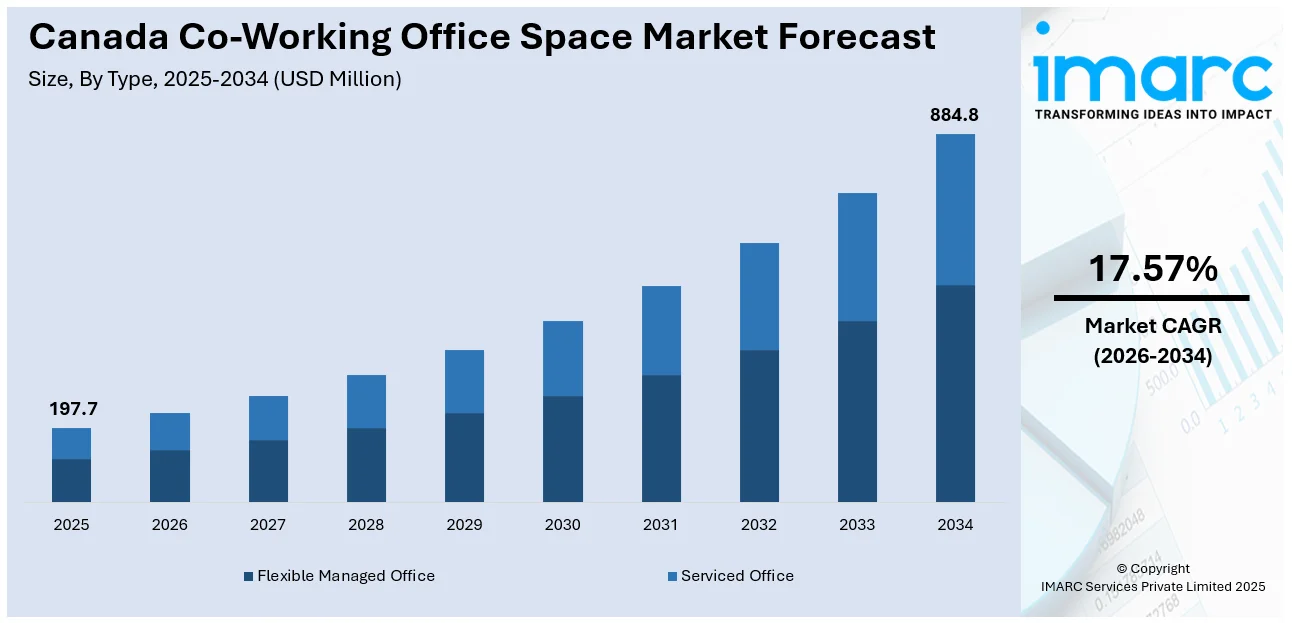

The Canada co-working office space market size reached USD 197.7 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 884.8 Million by 2034, exhibiting a growth rate (CAGR) of 17.57% during 2026-2034. The market is witnessing significant growth mainly driven by the growing adoption of hybrid work models by businesses and seeingk flexible, cost-efficient office solutions. Major cities like Toronto, Vancouver, and Montreal lead demand, while smaller cities are seeing increased interest. Operators are offering tech-enabled, scalable spaces suited for startups, freelancers, and corporate teams. With shifting workplace preferences and rising demand, the Canada co-working office space market share is expected to grow steadily in the coming years.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 197.7 Million |

|

Market Forecast in 2034

|

USD 884.8 Million |

| Market Growth Rate 2026-2034 | 17.57% |

Canada Co-Working Office Space Market Trends:

Hybrid Work Adoption

Hybrid work adoption is playing a major role in shaping the Canada co-working office space market. According to industry reports, 74% of employers in Canada have downsized their office spaces as a result of the shift to hybrid work, resulting in annual savings of over USD 400,000. This financial relief has allowed 38% of these employers to raise salaries, 31% to enhance bonuses, and 70% reported improvements in both productivity and employee satisfaction. As companies shift away from fully remote or full-time office models, they’re adopting flexible in-office schedules that require adaptable workspace solutions. This has led to growing interest in co-working spaces that can accommodate part-time office use without long-term leases. Businesses are providing employees the option to work from nearby co-working centers, reducing commute times while still offering a professional environment. Operators are adjusting by offering part-time desk plans, meeting room rentals, and access to multiple locations. These arrangements support productivity, collaboration, and employee well-being while helping companies’ lower overhead. The hybrid approach appeals across industries and business sizes, from startups to large enterprises. With hybrid models now embedded in workforce strategy, this trend continues to drive demand and contribute to the market growth.

To get more information on this market Request Sample

Flexible Lease Models

Flexible lease models are a key factor contributing to Canada co-working office space market growth. As remote and hybrid work becomes the norm, companies and individuals are moving away from long-term leases in favor of short-term, on-demand access to office space. This shift allows businesses to adjust their workspace usage based on team size, project requirements, or travel needs. Operators are responding with day passes, hourly bookings, and monthly memberships that offer convenience without the burden of traditional contracts. For instance, in August 2024, four Canadian flex office firms ClickSpace, Lauft, Werklab, and CoWork Halifax joined forces to create a network of 11 workspaces in major cities. This collaboration facilitates referrals and day-use passes, helping local independents compete with larger companies while meeting the increasing demand for flexible work environments. These options are especially attractive to startups, freelancers, and mobile professionals who prioritize agility. Even large companies are using flexible leases to support distributed teams and reduce fixed real estate costs. The ability to scale space up or down quickly has become a top priority, and this demand for adaptable leasing is directly fueling the market growth.

Canada Co-Working Office Space Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on type, application, and end user.

Type Insights:

- Flexible Managed Office

- Serviced Office

The report has provided a detailed breakup and analysis of the market based on the type. This includes flexible managed office and serviced office.

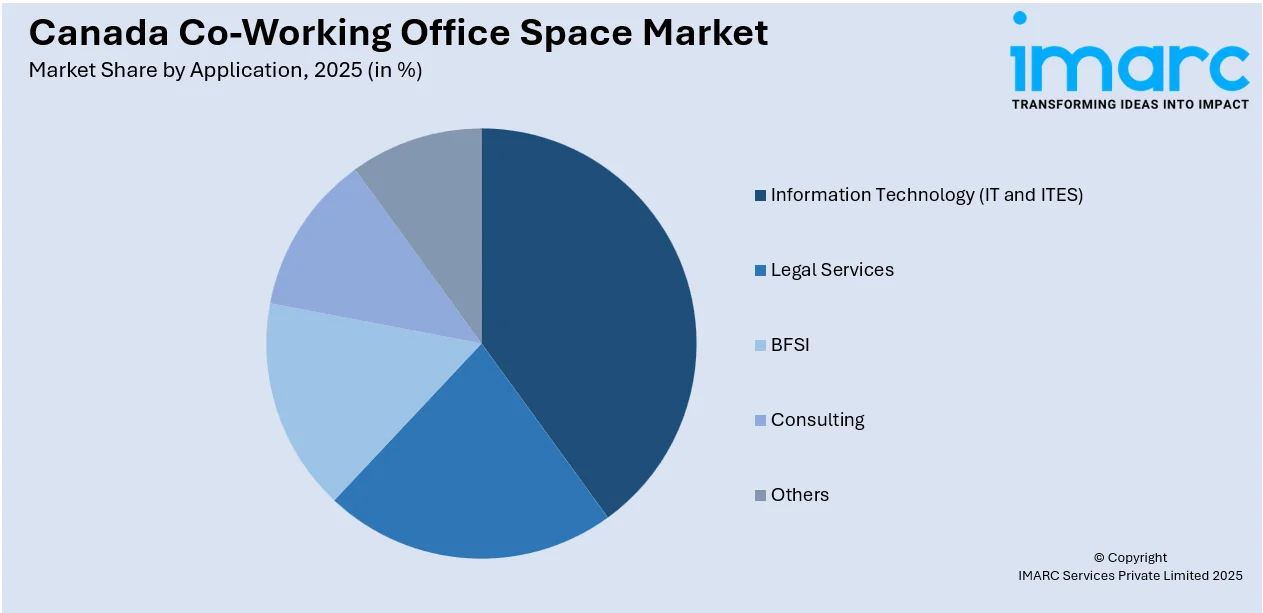

Application Insights:

Access the comprehensive market breakdown Request Sample

- Information Technology (IT and ITES)

- Legal Services

- BFSI

- Consulting

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes information technology (IT and ITES), legal services, BFSI, consulting, and others.

End User Insights:

- Personal User

- Small Scale Company

- Large Scale Company

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes personal user, small scale company, large scale company, and others.

Regional Insights:

- Ontario

- Quebec

- Alberta

- British Columbia

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Ontario, Quebec, Alberta, British Columbia, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Canada Co-Working Office Space Market News:

- In May 2024, iQ Offices announced its plans to unveil a premium flexible workspace in Toronto's historic 302 Bay Street this fall. The renovation will feature modern amenities, including a rooftop terrace, wellness rooms, and versatile meeting spaces while preserving the building's architectural heritage.

- In February 2024, the Government of Canada opened its first GCcoworking site on Fort William First Nation, promoting collaboration between federal employees and Indigenous communities. The site reflects traditional Indigenous designs and provides workspaces to advance Indigenous-focused programming. It features 18 workstations and supports reconciliation efforts with local populations.

Canada Co-Working Office Space Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Flexible Managed Office, Serviced Office |

| Applications Covered | Information Technology (IT and ITES), Legal Services, BFSI, Consulting, Others |

| End Users Covered | Personal User, Small Scale Company, Large Scale Company, Others |

| Regions Covered | Ontario, Quebec, Alberta, British Columbia, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Canada co-working office space market performed so far and how will it perform in the coming years?

- What is the breakup of the Canada co-working office space market on the basis of type?

- What is the breakup of the Canada co-working office space market on the basis of application?

- What is the breakup of the Canada co-working office space market on the basis of end user?

- What is the breakup of the Canada co-working office space market on the basis of region?

- What are the various stages in the value chain of the Canada co-working office space market?

- What are the key driving factors and challenges in the Canada co-working office space market?

- What is the structure of the Canada co-working office space market and who are the key players?

- What is the degree of competition in the Canada co-working office space market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Canada co-working office space market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Canada co-working office space market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Canada co-working office space industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)