Canada Community Cloud Market Size, Share, Trends and Forecast by Component, Application, Industry Vertical, and Region, 2025-2033

Canada Community Cloud Market Overview:

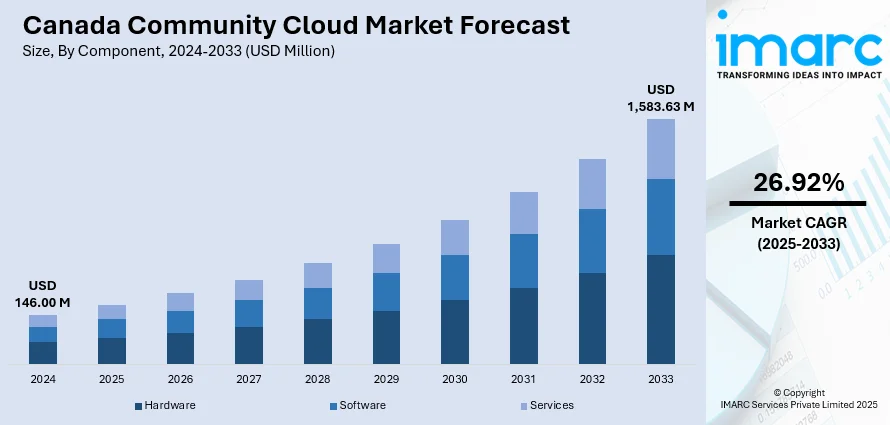

The Canada community cloud market size reached USD 146.00 Million in 2024. The market is projected to reach USD 1,583.63 Million by 2033, exhibiting a growth rate (CAGR) of 26.92% during 2025-2033. The market is transforming swiftly as a result of increased need for secure, compliant, and collaborative cloud solutions. Regulated industries and public institutions are embracing community clouds in order to address data sovereignty needs while enjoying shared infrastructure and governance. The model facilitates digital transformation, operational efficiency, and industry-specific tailoring. Higher dependence on cloud-based collaboration within healthcare, education, and government is driving adoption, powering the overall Canada community cloud market share for the national digital economy.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 146.00 Million |

| Market Forecast in 2033 | USD 1,583.63 Million |

| Market Growth Rate 2025-2033 | 26.92% |

Canada Community Cloud Market Trends:

Growing Public Sector Uptake Promoting Data Sovereignty

One of the major trends in forging Canada's community cloud market is the public sector uptake that is growing by leaps and bounds with institutions looking to gain greater data sovereignty. Government ministries, healthcare networks, and educational institutions are increasingly turning to community cloud infrastructure to maintain data control while benefiting from the scalability and flexibility of cloud-based solutions. The capability of aligning cloud architecture with national data privacy regulations and regional compliance standards makes community cloud perfect for public service management. With increasing institutions opting to digitize their operations, there is an increased call for cost-sharing modes, shared stewardship, and centralized resource administration. This method facilitates secured inter-agency collaboration without defeating regulatory mandates. In addition, geographical data sovereignty options are forcing the adoption of new models of IT away from conventional models towards community-oriented cloud environments. According to sources, in December 2023, AWS launched the Canada West (Calgary) Region, enhancing the country’s cloud infrastructure with localized data storage, reduced latency, and improved availability. This development is indirectly supporting the Canada community cloud market growth by providing sovereign-capable infrastructure. Moreover, ongoing digital transformation is a key driver of this market, as public sector authorities increasingly seek platforms that offer operational flexibility while ensuring full compliance with federal and provincial data protection regulations.

To get more information on this market, Request Sample

Sector-Specific Cloud Customization Driving Usage

Growing demand for industry-specific cloud solutions is a key driver of community cloud model adoption in Canada. Organizations in industries like healthcare, finance, and education are seeking more than standard cloud providers and are finding sector-specific operation, security, and compliance needs addressed through community cloud architectures that share best practices and frameworks among similar organizations. For example, educational consortia will enjoy common learning management platforms and common access protocols, whereas healthcare groups can consolidate patient data storage in accordance with Canadian health legislation. This is a process that enables institutions to enhance cost effectiveness while they ensure sectoral consistency. With the increasing need for tailored solutions, it is driving Canada community cloud market trends among organizations that require shared governance frameworks and co-operative digital ecosystems without the need to create separate private clouds from scratch.

Collaborative Ecosystems Driving Innovation

Another prominent Canada community cloud market trend is the development of co-operative digital ecosystems that enable innovation and interoperability. Community clouds are facilitating collections of organizations with common objectives to share resources, network infrastructure, and develop technology jointly. These communities are most applicable in urban development programs, smart city initiatives, and university networks for research, where coordination and information sharing are essential. According to the reports, in March 2024, the Digital Research Alliance of Canada initiated a National Cloud Strategy to accelerate academic research by providing increased access to hybrid, commercial, and community cloud infrastructure and services. Moreover, the communal aspect of community cloud platforms fosters collaborative problem-solving and innovation between jurisdictions or institutions, driving rapid delivery of services and enhanced citizen participation. Through the establishment of shared innovation platforms, the community cloud model is improving digital inclusiveness and resilience. With an increasing number of stakeholders engaging in this collaborative system, the noted impact is increased public-private technology deployment patterns. The trend is poised to further promote Canada community cloud market growth, reinforcing the influence of cloud-based collaboration on the country's digital landscape.

Canada Community Cloud Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on component, application, and industry vertical.

Component Insights:

- Hardware

- Server

- Networking

- Storage

- Others

- Software

- Enterprise Application Software

- Collaboration Tools Software

- Dashboards Business Intelligence Software

- Services

- Training Services

- Maintenance and Support

- Regulation and Compliance

- Consulting

The report has provided a detailed breakup and analysis of the market based on the component. This includes hardware (server, networking, storage, and others), software (enterprise application software, collaboration tools software, and dashboards business intelligence software), and services (training services, maintenance and support, regulation and compliance, and consulting).

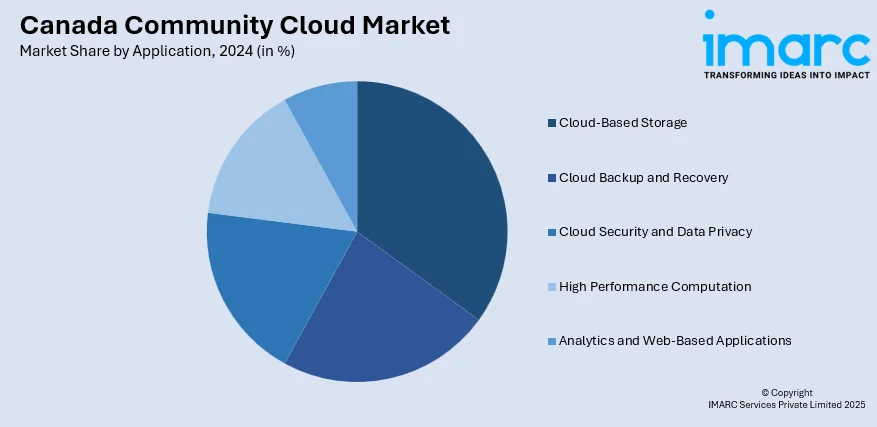

Application Insights:

- Cloud-Based Storage

- Cloud Backup and Recovery

- Cloud Security and Data Privacy

- High Performance Computation

- Analytics and Web-Based Applications

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes cloud-based storage, cloud backup and recovery, cloud security and data privacy, high performance computation, and analytics and web-based applications.

Industry Vertical Insights:

- BFSI

- Gaming

- Government

- Healthcare

- Education

- Others

The report has provided a detailed breakup and analysis of the market based on the industrial vertical. This includes BFSI, gaming, government, healthcare, education, and others.

Regional Insights:

- Ontario

- Quebec

- Alberta

- British Columbia

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Ontario, Quebec, Alberta, British Columbia, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Canada Community Cloud Market News:

- In February 2025, Backblaze opened its Canada East data center in Toronto to meet Canadian businesses' data sovereignty and compliance requirements. The center enables faster, more affordable cloud storage. In collaboration with Opti9 Technologies, Backblaze seeks to widen its coverage and enhance its presence in the Canadian cloud services market.

- In June 2025, HIVE Digital Technologies purchased a 7.2 MW Toronto data center to strengthen sovereign AI and high-performance computing capacity. While privately operated, the facility boosts data residency and regulatory compliance, thus indirectly enabling the growth of Canada's community cloud market through secure, localized infrastructure for public sector use.

Canada Community Cloud Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered |

|

| Applications Covered | Cloud-Based Storage, Cloud Backup and Recovery, Cloud Security and Data Privacy, High Performance Computation, Analytics and Web-Based Applications |

| Industry Verticals Covered | BFSI, Gaming, Government, Healthcare, Education, Others |

| Regions Covered | Ontario, Quebec, Alberta, British Columbia, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Canada community cloud market performed so far and how will it perform in the coming years?

- What is the breakup of the Canada community cloud market on the basis of component?

- What is the breakup of the Canada community cloud market on the basis of application?

- What is the breakup of the Canada community cloud market on the basis of industrial vertical?

- What is the breakup of the Canada community cloud market on the basis of region?

- What are the various stages in the value chain of the Canada community cloud market?

- What are the key driving factors and challenges in the Canada community cloud?

- What is the structure of the Canada community cloud market and who are the key players?

- What is the degree of competition in the Canada community cloud market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Canada community cloud market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Canada community cloud market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Canada community cloud industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)