Canada Craft Beer Market Report by Product Type (Ales, Lagers, and Others), Age Group (21-35 Years Old, 40-54 Years Old, 55 Years Above), Distribution Channel (On-Trade, Off-Trade), and Region 2025-2033

Canada Craft Beer Market Overview:

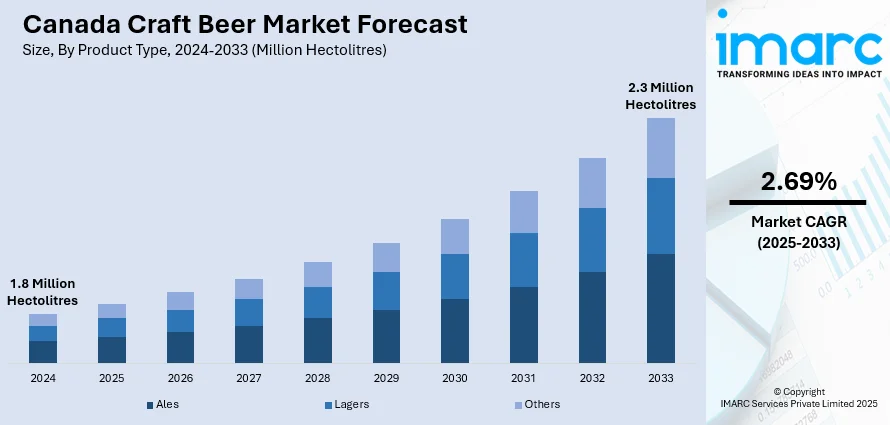

The Canada craft beer market size reached 1.8 Million Hectolitres in 2024. Looking forward, IMARC Group expects the market to reach 2.3 Million Hectolitres by 2033, exhibiting a growth rate (CAGR) of 2.69% during 2025-2033. The market is propelled by increasing craft beer tourism, growing consumer preference for locally produced and artisanal beers, collaborations between breweries and local farmers, and escalating demand for low-alcohol and healthier beer options.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | 1.8 Million Hectolitres |

| Market Forecast in 2033 | 2.3 Million Hectolitres |

| Market Growth Rate 2025-2033 | 2.69% |

Canada Craft Beer Market Trends:

Growing Craft Beer Tourism

The increasing craft beer tourism has become a primary driver of the marketplace in Canada, with both domestic and international tourists expressing interest in visiting local breweries and taking part in beer festivals. As per Canadian Craft Brewers Association, a recent study by MNP revealed the significant economic impact of craft beer tourism, creating $1,475 Million in total output and sustaining up to 8,800 jobs. As beer enthusiasts travel across various provinces, experiencing the thrill of brewery tours, beer tastings, and festivals, the local economy is a beneficiary of this. Tourism operators have teamed up with the craft beer industry to offer travel packages based on craft beer. Meanwhile, the proliferation of "beer trails" across regions such as Ontario and British Columbia offers pre-programmed opportunities for tourists to access a number of breweries in one visit. This kind of experiential tourism promotes individual craft brands and contributes to cultural and economic development in the participating regions and further cements craft beer as part of Canada's tourism story.

To get more information of this market, Request Sample

Rising Preference for Local Products

The Canadian craft beer market is highly fueled due to the consumer interest that has shifted to locally brewed, artisanal beers. Consumers are increasingly opting for products reflecting unique local flavors, brewing techniques, and ingredients. According to a report by Beer Canada, the number of breweries increased from 1120 in 2019 to 1210 in 2020, with an 8.0% growth rate in Canada. Also, a majority of the breweries in Canada are small and local businesses, since 94% of them produce less than 15,000 hectolitres of beer. Besides, in 2020, 85% of beer consumed in Canada was brewed in Canada. Craft beer resonates with a search for authenticity and personalized experiences, as well as sustainability and transparency in sourcing. It has also been diversified by different flavor profiles, from mass-produced beers to crafts. Thus, microbreweries and craft beer manufacturers exploit this trend by brewing specialty products for regional taste that, in turn, foster the regional economy. This is part of the international trend-the "buy local" movements-and sustains the rapid growth of the craft beer industry at large in Canada.

Canada Craft Beer Market News:

- In September 2024, Saskatchewan's 9 Mile Legacy Brewing has established the LGCY Innovation Hub to help emerging brewers navigate industry challenges. The initiative, which helps both homebrewers and farmers, seeks to bring more brewers into the craft business. According to Cassy Appelt, LGCY's program coordinator, the new project may encourage additional brewers to enter the market.

- In September 2024, Vancouver Island Brewing (VIB) inked a co-packing deal with Phillips Brewing & Malting Company (Phillips) to create and package craft beers. The deal, which takes effect on November 1st, 2024, ensures that VIB's high-quality, all-natural beers, such as Islander Lager, Mystic Haze, and Broken Islands Hazy IPA, will continue to be produced locally.

Canada Craft Beer Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on product type, age group, and distribution channel.

Product Type Insights:

- Ales

- Lagers

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes ales, lagers, and others.

Age Group Insights:

- 21-35 Years Old

- 40-54 Years Old

- 55 Years and Above

A detailed breakup and analysis of the market based on the age group have also been provided in the report. This includes 21-35 years old, 40-54 years old, and 55 years and above.

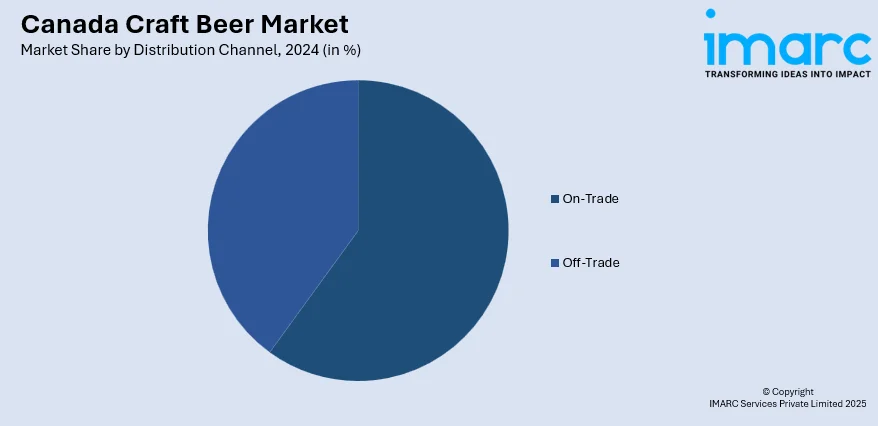

Distribution Channel Insights:

- On-Trade

- Off-Trade

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes on-trade and off-trade.

Regional Insights:

- Ontario

- Quebec

- Alberta

- British Columbia

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Ontario, Quebec, Alberta, British Columbia, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Canada Craft Beer Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million Hectolitres |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Ales, Lagers, Others |

| Age Groups Covered | 21-35 Years Old, 40-54 Years Old, 55 Years Above |

| Distribution Channels Covered | On-Trade, Off-Trade |

| Regions Covered | Ontario, Quebec, Alberta, British Columbia, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Canada craft beer market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the Canada craft beer market?

- What is the breakup of the Canada craft beer market on the basis of product type?

- What is the breakup of the Canada craft beer market on the basis of age group?

- What is the breakup of the Canada craft beer market on the basis of distribution channel?

- What are the various stages in the value chain of the Canada craft beer market?

- What are the key driving factors and challenges in the Canada craft beer?

- What is the structure of the Canada craft beer market and who are the key players?

- What is the degree of competition in the Canada craft beer market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Canada craft beer market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Canada craft beer market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Canada craft beer industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)