Canada Diaper Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, and Region, 2025-2033

Canada Diaper Market Overview:

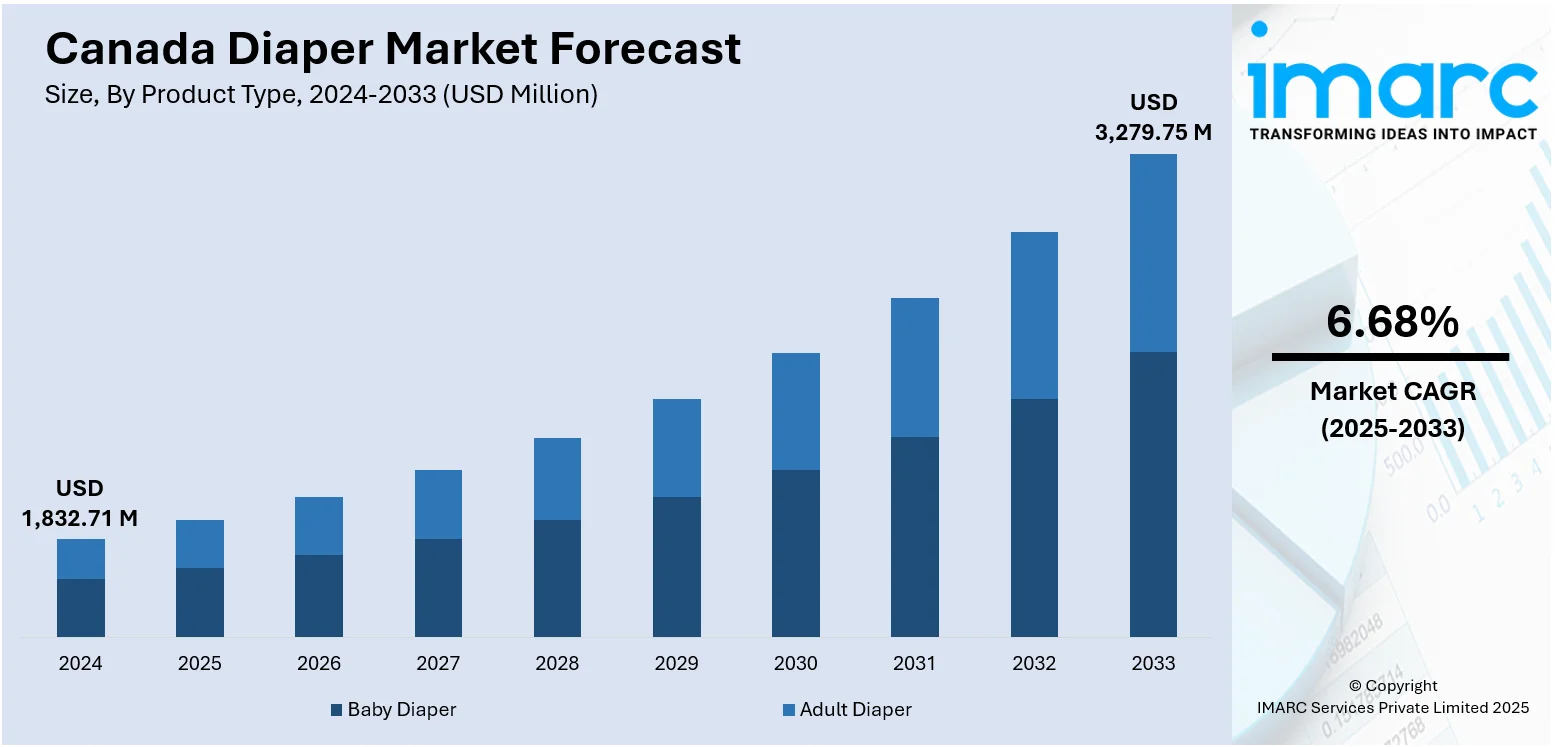

The Canada diaper market size reached USD 1,832.71 Million in 2024. The market is projected to reach USD 3,279.75 Million by 2033, exhibiting a growth rate (CAGR) of 6.68% during 2025-2033. The market continues to expand as parents look for advanced, skin-friendly, and sustainable diaper options. Innovations like plant-based materials and smart features are influencing buying decisions. Increasing environmental awareness is also boosting the demand for biodegradable products. E-commerce and subscription services are becoming more popular, especially in cities, offering greater convenience and reliable delivery. Regions with higher disposable incomes are contributing substantially to this growth, thereby reinforcing Canada’s diaper market share across various product categories.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,832.71 Million |

| Market Forecast in 2033 | USD 3,279.75 Million |

| Market Growth Rate 2025-2033 | 6.68% |

Canada Diaper Market Trends:

Rise of Biodegradable and Eco-Conscious Diapers

Canadian consumers are increasingly drawn to diapers made from biodegradable materials and rise of biodegradable and eco‑conscious diapers. Parents are prioritizing diaper solutions that balance environmental responsibility with high performance. In March 2024, Royale® a trusted Canadian tissue brand debuted its premium homegrown baby diapers offering up to 12 hours of leak protection, breathable materials, wetness indicators, and chlorine-free, hypoallergenic composition at Walmart nationwide. Building on this, manufacturers are introducing plant-based liners, compostable packaging, and clear eco-labels to make green choices more intuitive for consumers. Retailers now dedicate in-store and online sections to eco-friendly diapers, making them easier to find. Though these options usually carry a premium, increasing competition is driving prices down. As urban Canadians become more environmentally conscious and plastic-waste regulations tighten, demand for these products continues to rise. Eco-centric innovation has now become a central driver of Canda diaper market trends, compelling manufacturers to deliver products that are both environmentally responsible and high-performing.

To get more information on this market, Request Sample

Expansion of Adult and Incontinence Products

Canada’s aging population is playing a pivotal role in driving the expansion of the adult incontinence segment, encouraging manufacturers to innovate with discreet, absorbent, and comfortable solutions. In 2021, NorthShore Care Supply announced its expansion into Canada through a partnership with AgeComfort and Healthwick Canada, introducing high-absorbency adult diapers designed for both clinical and everyday use in elder care setting. These products feature slim-fit designs, enhanced odor-control materials, breathable side panels, and user-friendly fasteners, making them suitable for active lifestyles as well as medical needs. Pharmacies, supermarkets, and online retailers are responding by expanding their incontinence product ranges, increasing accessibility. Healthcare providers now frequently recommend these modern undergarments as part of comprehensive elder care protocols, helping normalize use and reducing societal stigma. Additionally, distribution from urban to remote regions has improved thanks to stronger e-commerce networks. As adult hygiene products gain wider social acceptance, this segment has emerged as a key Canada diaper market growth, contributing to a more balanced landscape across infant and adult care categories, while also stimulating continued innovation in product design, comfort, and availability.

Growth of E‑Commerce and Subscription Models

In Canada, e-commerce and subscription models are rapidly transforming how parents purchase diapers. In early 2025, Eco Pea Co., a Vancouver-based bamboo diaper company, introduced a flexible online subscription service. Families can select bundle sizes, adjust delivery schedules, pause shipments, and manage their accounts through a simple, user-friendly portal. This system ensures continuous diaper supply without requiring parents to reorder frequently, providing convenience for busy households. Subscription services additionally enable brands to gather valuable consumer data, facilitating enhanced demand forecasting, optimized inventory management, and more targeted marketing efforts. E-commerce platforms complement these offerings with next-day delivery, eco-friendly packaging, and hassle-free returns, further enhancing convenience. These digital models are particularly beneficial for suburban and rural families who may have limited access to physical stores. As more parents embrace this seamless shopping experience, subscription-based purchasing is becoming a major driver of Canada diaper market, simplifying logistics, improving customer satisfaction, and reshaping how diaper brands engage with modern consumers.

Canada Diaper Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type and distribution channel.

Product Type Insights:

- Baby Diaper

- Disposable Diapers

- Training Diapers

- Cloth Diapers

- Swim Pants

- Biodegradable Diapers

- Adult Diaper

- Pad Type

- Flat Type

- Pant Type

The report has provided adetailed breakup and analysis of the market based on the product type. This includes baby diapers (disposable diaper, training diaper, cloth diaper, swim pants, and biodegradable diaper) and adult diapers (pad type, flat type, and pant type).

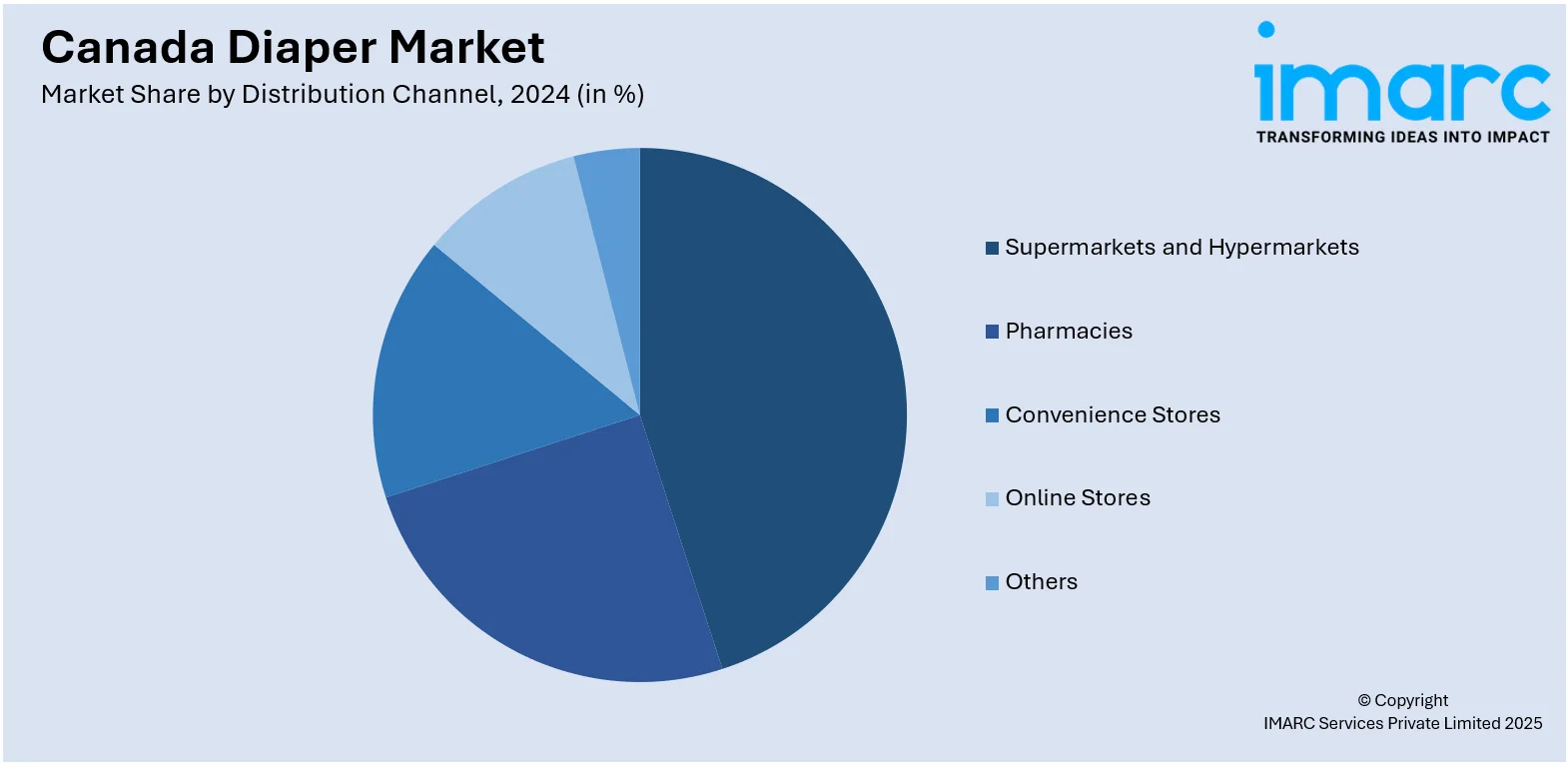

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Pharmacies

- Convenience Stores

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, pharmacies, convenience stores, online stores, and others.

Regional Insights:

- Ontario

- Quebec

- Alberta

- British Columbia

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Ontario, Quebec, Alberta, British Columbia, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Canada Diaper Market News:

- February 2025: GreenCore Solutions Corp. is extending its TreeFree Diaper™ innovation into the feminine care market with the debut of FemCare UltraThin. This new line offers ultra-thin, high‑absorbency, tree‑free pads featuring antibacterial protection and carries the TreeFree PASSPORT™ Supreme certification. Tailored for eco-aware consumers and private‑label partners across Europe, FemCare UltraThin launches bundled with the company’s established TreeFree Diaper™, simplifying multi-category rollouts. By maintaining performance while eliminating pulp, GreenCore strengthens its position as a leader in sustainable hygiene solutions.

- September 2024: Soft N Dry has introduced its latest innovation, the TreeFree Diaper™ featuring the EcoLiite Core™. Designed in Toronto, this eco-friendly diaper eliminates the need for traditional wood pulp, using renewable, sustainable materials instead. The EcoLiite Core™ enhances absorbency while minimizing environmental impact, aligning with global sustainability goals such as the EU Deforestation-Free Regulation (EUDR). Soft N Dry’s commitment to reducing deforestation and promoting responsible sourcing positions the brand as a leader in Canada’s growing green diaper market.

Canada Diaper Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Distribution Channels Covered | Supermarkets and Hypermarkets, Pharmacies, Convenience Stores, Online Stores, Others |

| Regions Covered | Ontario, Quebec, Alberta, British Columbia, and others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Canada Diaper market performed so far and how will it perform in the coming years?

- What is the breakup of the Canada diaper market on the basis of product type?

- What is the breakup of the Canada diaper market on the basis of distribution channel?

- What is the breakup of the Canada diaper market on the basis of region?

- What are the various stages in the value chain of the Canada diaper market?

- What are the key driving factors and challenges in the Canada diaper?

- What is the structure of the Canada diaper market and who are the key players?

- What is the degree of competition in the Canada diaper market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Canada diaper market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Canada diaper market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Canada diaper industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)