Canada E-Invoicing Market Size, Share, Trends and Forecast by Channel, Deployment Type, Application, and Region, 2025-2033

Canada E-Invoicing Market Overview:

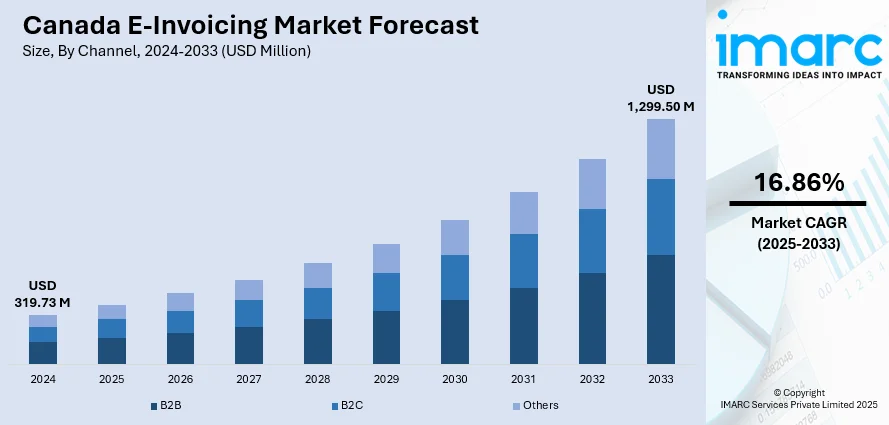

The Canada e-invoicing market size reached USD 319.73 Million in 2024. Looking forward, the market is expected to reach USD 1,299.50 Million by 2033, exhibiting a growth rate (CAGR) of 16.86% during 2025-2033. The market is fueled by escalating digitalization in industries, cost-effectiveness, and government initiatives facilitating electronic procurement. Growth of digital invoicing models, like the federal adoption of e-invoices in government procurement, among the public sector is driving broader market adoption. Expansion of cross-border commerce is also increasing demand for invoice formats that are interoperable. Increased adoption by SMEs, supported by cloud-based technology and standardization initiatives, is further growing Canada e-invoicing market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 319.73 Million |

| Market Forecast in 2033 | USD 1,299.50 Million |

| Market Growth Rate 2025-2033 | 16.86% |

Canada E-Invoicing Market Trends:

Evolution of Regulation and Public Sector Leadership

While Canada has not implemented a federal requirement for e‑invoicing on B2B transactions, it has achieved much on public procurement. Electronic invoices are mandatory from all federal suppliers, using platforms such as SAP Ariba, representing a huge leap towards uniform digital billing for B2G activity. Although private-sector companies—particularly retail, pharma, and finance—continue to stick largely with PDFs and emailed documents, pressure from public agencies is influencing the larger ecosystem. Provinces like Quebec are looking into e-reporting models that could spur pilot programs, and data retention regulations are increasingly becoming a focus. Companies are required to meet CRA regulations calling for the storage of e‑invoices for a minimum of six years, reinforcing requirements for secure archiving and audit-ready systems. This setting places Canada's e‑invoicing strategy in a distinct "hybrid" position—partly regulated for public-sector suppliers, voluntary and market-driven for commercial players.

To get more information on this market, Request Sample

Technological Integration and Interoperability Push

Canadian businesses are increasingly embracing sophisticated technologies like AI, machine learning, RPA, blockchain, and cloud platforms to automate invoice processing. Integration with accounting and ERP systems (e.g. SAP, Oracle Dynamics, Microsoft Dynamics) enables end-to-end automation from invoice capture to payment reconciliation. Cloud-based solutions provide scalability and accessibility that are well received by remote-working organizations throughout Canada, while blockchain is being piloted regarding its ability to provide tamper-proof audit trails. Additionally, Canada is increasingly converging on international standards like UBL and the Peppol network, facilitating cross-border interoperability and allowing Canadian companies to exchange standard e-invoices all over the world. These technological enhancements are improving internal efficiency while preparing organizations for when federal mandates eventually expand into the B2B sphere, which further contributes to the Canada e-invoicing market growth.

Market Adoption Patterns and SME Inclusion

Adoption of e‑invoicing in Canada’s private sector follows a “leader‑follower” pattern: large enterprises and public suppliers are early adopters, while small and medium‑sized businesses (SMBs) engage more cautiously. As Payments Canada reports, almost half of companies now issue electronic invoices, although complete automation remains less prevalent among SMEs, which still tend to stick with paper or hybrid invoice types. Large commercial companies, on the other hand, are beginning to adopt ISO 20022 payment message standards to optimize reconciliation and maximize straight‑through processing rates. As regulatory priorities and cost‑efficiency pressures increase—particularly after the pandemic's digital push—SMBs are being incentivized to embrace e‑invoicing through incentives, technical alliances, and easier onboarding by coalitions such as the Business Payments Coalition. The result is a multi‑tiered adoption landscape: early adopters as the drivers of innovation, followed by smaller firms as solutions become less expensive, more standardized, and underpinned by both public and private sectors.

Canada E-Invoicing Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on channel, deployment type, and application.

Channel Insights:

- B2B

- B2C

- Others

The report has provided a detailed breakup and analysis of the market based on the channel. This includes B2B, B2C, and others.

Deployment Type Insights:

- Cloud-based

- On-premises

The report has provided a detailed breakup and analysis of the market based on the deployment type. This includes cloud-based and on-premises.

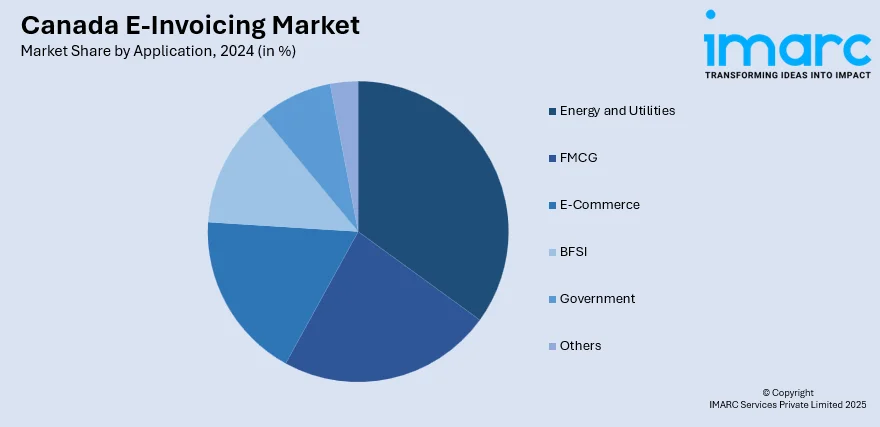

Application Insights:

- Energy and Utilities

- FMCG

- E-Commerce

- BFSI

- Government

- Others

A detailed breakup and analysis of the market based on the application has also been provided in the report. This includes energy and utilities, FMCG, e-commerce, BFSI, government, and others.

Regional Insights:

- Ontario

- Quebec

- Alberta

- British Columbia

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Ontario, Quebec, Alberta, British Columbia, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Canada E-Invoicing Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Channels Covered | B2B, B2C, Others |

| Deployment Types Covered | Cloud-based, On-premises |

| Applications Covered | Energy and Utilities, FMCG, E-Commerce, BFSI, Government, Others |

| Regions Covered | Ontario, Quebec, Alberta, British Columbia, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Canada e-invoicing market performed so far and how will it perform in the coming years?

- What is the breakup of the Canada e-invoicing market on the basis of channel?

- What is the breakup of the Canada e-invoicing market on the basis of deployment type?

- What is the breakup of the Canada e-invoicing market on the basis of application?

- What is the breakup of the Canada e-invoicing market on the basis of region?

- What are the various stages in the value chain of the Canada e-invoicing market?

- What are the key driving factors and challenges in the Canada e-invoicing market?

- What is the structure of the Canada e-invoicing market and who are the key players?

- What is the degree of competition in the Canada e-invoicing market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Canada e-invoicing market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Canada e-invoicing market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Canada e-invoicing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)