Canada Electric Bus Market Size, Share, Trends and Forecast by Propulsion Type, Battery Type, Length, Range, Battery Capacity, and Region, 2026-2034

Canada Electric Bus Market Summary:

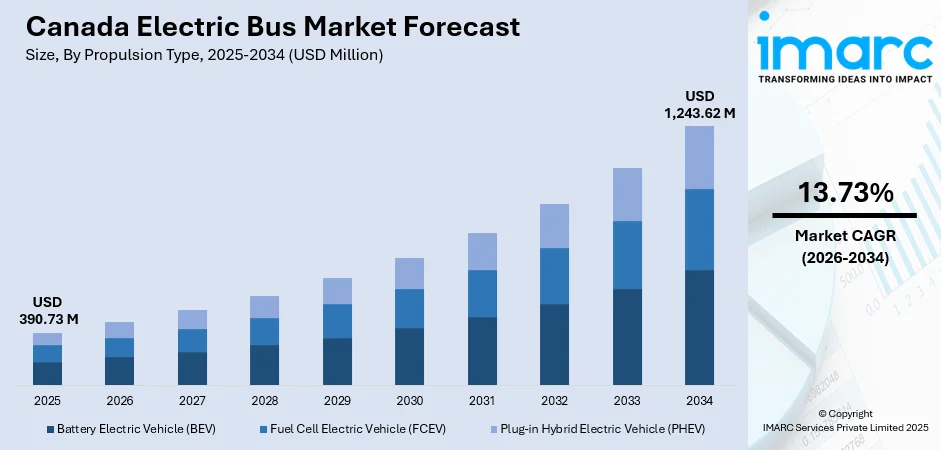

The Canada electric bus market size was valued at USD 390.73 Million in 2025 and is projected to reach USD 1,243.62 Million by 2034, growing at a compound annual growth rate of 13.73% from 2026-2034.

The market is driven by stringent government environmental policies and emissions reduction targets, rising urban population densities necessitating efficient public transit systems, continuous advancements in battery technology enabling extended operational ranges, and substantial federal and provincial funding programs accelerating fleet electrification. The declining total cost of ownership for zero-emission transit vehicles and growing public awareness regarding air quality improvements are collectively strengthening the Canada electric bus market share.

Key Takeaways and Insights:

- By Propulsion Type: Battery electric vehicle (BEV) dominates the market with a share of 65% in 2025, driven by economical, maintainable, and environment-friendly features that make them applicable for urban transport services.

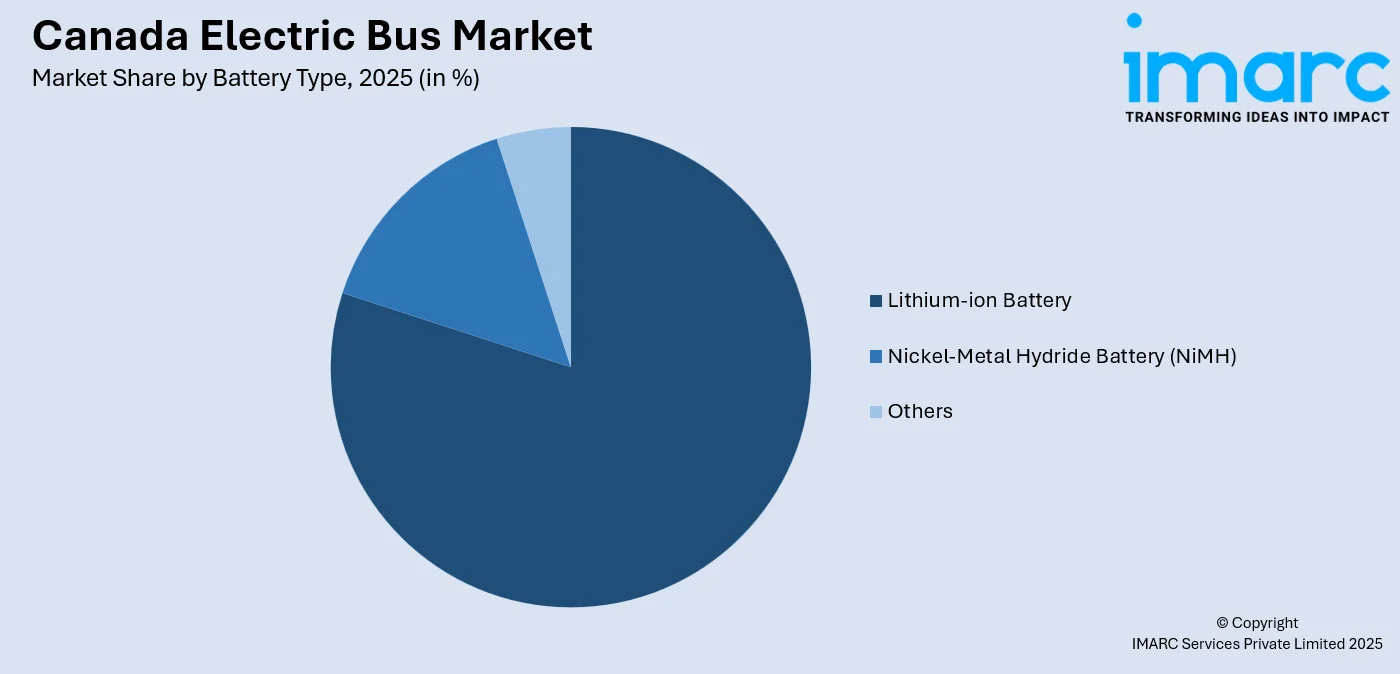

- By Battery Type: Lithium-ion battery leads the market with a share of 80% in 2025, owing to added benefits such as higher energy density and long cycle life. The price for lithium-ion battery will further decline due to technological advancement.

- By Length: 9-14 meters represents the largest segment with a market share of 69% in 2025, driven by optimal passenger capacity balancing appropriate urban maneuverability with network efficiency for regular transportation routes.

- By Range: More than 200 miles dominates the market with a share of 57% in 2025, owing to full-day operational requirements without mid-route charging, enhancing fleet scheduling flexibility and service reliability.

- By Battery Capacity: Up to 400 kWh represents the largest segment with a market share of 55% in 2025, driven by its ability to power a medium-sized bus to transport passengers without increasing its weight, thus increasing its passenger-carrying capacity to a greater extent.

- By Region: Ontario leads the market with a share of 33% in 2025, driven by concentrated urban populations in metropolitan areas, robust provincial incentives, and major transit agency electrification commitments.

- Key Players: The Canada electric bus market exhibits a moderately consolidated competitive structure, with established North American transit vehicle manufacturers leveraging domestic manufacturing capabilities alongside global electric mobility specialists entering through strategic partnerships.

To get more information on this market Request Sample

The Canada electric bus market is experiencing substantial momentum as transit agencies nationwide accelerate fleet electrification initiatives aligned with federal net-zero emissions commitments. In June 2025, the Toronto Transit Commission (TTC) announced that it now has over 100 battery-electric buses in service, marking a major electrification milestone funded jointly by the federal government and the City of Toronto and underscoring progress toward its 2040 net-zero goal. Moreover, the transition is supported by comprehensive government funding mechanisms that provide capital assistance for vehicle procurement and charging infrastructure development. Transit authorities across provinces are implementing phased electrification strategies, incorporating advanced battery management systems and intelligent charging solutions to optimize operational efficiency. Municipal governments recognize that zero-emission buses contribute to improved urban air quality while reducing noise pollution in residential neighbourhoods. The collaborative partnerships between government entities, transit operators, and technology providers are fostering innovation and knowledge exchange essential for successful large-scale fleet transitions.

Canada Electric Bus Market Trends:

Integration of Smart Charging and Energy Management Systems

Canadian transit agencies are increasingly deploying sophisticated smart charging management platforms to optimize electric bus fleet operations and energy consumption patterns. In November 2024, Toronto Transit Commission implemented a smart charging management system, supported by Natural Resources Canada, to enable coordinated depot charging, load balancing, and peak-demand control for electric. Further, these advanced systems coordinate charging schedules based on vehicle duty cycles, grid demand periods, and electricity pricing structures to minimize operational costs while ensuring service reliability. Transit operators are implementing dynamic load management technologies that balance power distribution across depot chargers, preventing grid strain during peak demand windows.

Expansion of Hydrogen Fuel Cell Electric Bus Deployments

The Canada electric bus market is witnessing growing interest in hydrogen fuel cell technology as transit agencies evaluate propulsion alternatives suited to diverse operational requirements and climatic conditions. As per sources, in September 2025, Canada-based Ballard Power Systems unveiled its FCmove-SC hydrogen fuel cell module for city buses, designed to improve cold-weather performance, extend operating range, and reduce lifecycle costs for public transit fleets. Furthermore, fuel cell buses offer extended operational ranges without mid-route charging requirements, making them particularly attractive for longer transit routes and harsh winter environments where battery performance may diminish. Transit authorities are investing in hydrogen production and refueling infrastructure, leveraging provincial clean electricity resources to produce green hydrogen domestically.

Development of Vehicle-to-Grid Integration Capabilities

Canadian utilities and transit operators are pioneering vehicle-to-grid integration initiatives that transform electric bus fleets into distributed energy resources capable of supporting electrical grid stability. In September 2025, BC Hydro launched Canada’s first real-world V2G pilot using electric school buses, enabling them to discharge stored energy back to the grid during peak demand periods, demonstrating potential revenue generation and grid support. These bidirectional charging technologies enable parked buses to discharge stored energy back to the grid during peak demand periods, creating potential revenue streams while enhancing grid resilience. Transit depot facilities are being designed with advanced power management infrastructure to accommodate bidirectional energy flows, incorporating renewable generation assets and stationary storage systems.

Market Outlook 2026-2034:

The Canada electric bus market is positioned for substantial revenue expansion throughout the forecast period as transit agencies nationwide transition conventional diesel fleets toward zero-emission alternatives. Government funding commitments through federal infrastructure programs continue driving procurement activities, with major metropolitan areas targeting complete fleet electrification within the coming decade. Technological advancements in battery energy density and charging infrastructure efficiency are reducing total cost of ownership barriers, enabling broader adoption across diverse transit system configurations. The market generated a revenue of USD 390.73 Million in 2025 and is projected to reach a revenue of USD 1,243.62 Million by 2034, growing at a compound annual growth rate of 13.73% from 2026-2034.

Canada Electric Bus Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Propulsion Type |

Battery Electric Vehicle (BEV) |

65% |

|

Battery Type |

Lithium-ion Battery |

80% |

|

Length |

9-14 Meters |

69% |

|

Range |

More than 200 Miles |

57% |

|

Battery Capacity |

Up to 400 kWh |

55% |

|

Region |

Ontario |

33% |

Propulsion Type Insights:

- Battery Electric Vehicle (BEV)

- Fuel Cell Electric Vehicle (FCEV)

- Plug-in Hybrid Electric Vehicle (PHEV)

Battery electric vehicle (BEV) dominates with a market share of 65% of the total Canada electric bus market in 2025.

Battery electric vehicles (BEVs) lead the Canada electric bus market, offering lower total ownership costs and zero tailpipe emissions crucial for urban air quality. Falling lithium-ion battery prices allow cost parity with diesel alternatives, while Canadian manufacturers provide cold-weather optimized thermal management systems to maintain reliable performance in harsh winters, supporting transit agencies in sustainable and efficient fleet electrification initiatives. According to reports, Nova Bus secured an order for 339 LFSe+ long-range electric buses for the Société de transport de Montréal (STM), with options for 890 units, supporting nine Quebec transit authorities in their fleet electrification initiatives.

Transit operators across major metropolitan areas are prioritizing BEV for fleet replacement programs due to lower maintenance requirements and reduced fuel expenses compared to conventional diesel buses. The overnight depot charging model aligns effectively with transit operational schedules, enabling complete battery replenishment during non-service hours without disrupting daily route assignments. Advanced regenerative braking systems further enhance energy efficiency while extending brake component lifespan, contributing to improved lifecycle economics for transit agencies pursuing sustainable transportation objectives.

Battery Type Insights:

Access the comprehensive market breakdown Request Sample

- Lithium-ion Battery

- Nickel-Metal Hydride Battery (NiMH)

- Others

Lithium-ion battery leads with a share of 80% of the total Canada electric bus market in 2025.

Lithium-ion batteries dominate the Canada electric bus market, providing full-day operational ranges on single overnight charges. Ongoing global research and scale economies enhance cycle life performance, while advanced thermal management maintains efficiency across extreme temperatures. Canadian transit operators report lower-than-expected battery degradation, extending vehicle service life and improving long-term procurement economics, supporting the nationwide transition to reliable, zero-emission bus fleets. In October 2025, Canada invested over $22 Million across eight projects to accelerate battery innovation and domestic production, supporting EVs, energy storage, and a skilled workforce nationwide.

Federal investments in domestic battery research and innovation centers are advancing technology development while building skilled workforce capabilities supporting the broader electric vehicle supply chain. Advanced thermal management systems integrated within lithium-ion battery packs ensure consistent performance across extreme temperature variations encountered throughout Canadian provinces. The declining cost trajectory combined with improved energy storage capabilities positions lithium-ion technology as the foundational power source enabling widespread electric bus adoption across diverse transit system configurations nationwide.

Length Insights:

- Less than 9 Meters

- 9-14 Meters

- Above 14 Meters

9-14 meters exhibits a clear dominance with a 69% share of the total Canada electric bus market in 2025.

9-14 meters represent the predominant vehicle configuration within Canadian electric bus deployments, balancing passenger capacity requirements with urban operational maneuverability. These vehicles align with ridership demands across majority of urban transit route networks while enabling effective navigation through standard city streets and intersections. The standardized dimensions facilitate consistent depot infrastructure configurations and simplified maintenance procedures across fleet operations, reducing complexity for transit agencies managing electrification transitions.

Transit agencies prioritize this segment when replacing end-of-life diesel vehicles, maintaining service consistency while transitioning toward zero-emission propulsion technologies. 9-14 meter configuration accommodates sufficient passenger volumes for typical urban routes without requiring specialized infrastructure modifications at transit stops or depot facilities. This length category offers optimal balance between operational flexibility and capacity utilization, making it the preferred choice for Canadian municipalities implementing comprehensive fleet electrification programs across diverse community settings.

Range Insights:

- Less than 200 Miles

- More than 200 Miles

More than 200 miles leads with a market share of 57% of the total Canada electric bus market in 2025.

Extended-range electric buses capable of operating more than 200 miles on single charges have become the preferred specification among Canadian transit authorities prioritizing scheduling flexibility and operational resilience. Advanced battery pack configurations enable consistent performance across diverse weather conditions and terrain profiles encountered throughout Canadian transit networks serving varied geographic regions. For instance, in March 2024, Brampton Transit ordered 10 Nova Bus LFSe+ long-range electric buses, scheduled for 2025 delivery, supporting its zero-emission fleet transition and operational flexibility.

Transit operators report that extended-range capabilities provide essential operational buffers accommodating unexpected service disruptions without risking vehicle immobilization during peak service periods. The ability to complete full daily service assignments on single overnight charges aligns effectively with depot-based charging strategies employed by major Canadian transit agencies. Extended-range specifications also accommodate route flexibility, enabling operators to reassign vehicles across different service corridors without concerns regarding energy availability limitations throughout operational shifts.

Battery Capacity Insights:

- Up to 400 kWh

- Above 400 kWh

Up to 400 kWh leads with a share of 55% of the total Canada electric bus market in 2025.

Battery packs configured with capacities up to 400 kWh represent the mainstream specification within Canadian electric bus procurement programs, balancing range requirements against vehicle weight considerations affecting passenger capacity and infrastructure durability. Transit agencies report favorable experiences with this configuration, achieving reliable service delivery without requiring supplemental charging during operational shifts. According to sources, Winnipeg Transit confirmed its 60‑foot battery‑electric buses feature battery capacities between about 345 kWh - 520 kWh, supporting extended daily operation without mid‑route charging.

The moderate battery sizing reduces upfront vehicle acquisition costs while maintaining compliance with municipal bridge weight restrictions and pavement loading specifications across Canadian road networks. This capacity configuration offers optimal energy storage for standard urban transit routes without excessive weight penalties that reduce passenger carrying capacity. Transit operators benefit from simplified charging infrastructure requirements, as depots can accommodate multiple vehicles simultaneously without necessitating substantial electrical grid upgrades or specialized high-capacity charging equipment installations.

Regional Insights:

- Ontario

- Quebec

- Alberta

- British Columbia

- Others

Ontario dominates with a market share of 33% of the total Canada electric bus market in 2025.

Ontario maintains market leadership within the Canada electric bus market, reflecting concentrated urban population centers and substantial transit agency electrification investments across the Greater Toronto Area and surrounding municipalities. The province hosts the largest electric bus fleet in North America, with multiple transit operators actively expanding zero-emission vehicle deployments through coordinated procurement programs. Provincial and federal funding programs have channelled substantial capital toward vehicle acquisition and charging infrastructure development, supporting multiple transit agencies throughout the province.

Municipal governments across Ontario have established ambitious fleet transition timelines, targeting complete electrification within the coming decades while investing in depot modernization and workforce training initiatives. The province benefits from robust electrical grid infrastructure capable of supporting large-scale charging operations without significant capacity constraints. Regional transit authorities collaborate on shared procurement strategies and operational best practices, accelerating knowledge transfer across agencies implementing electrification programs while achieving cost efficiencies through coordinated vehicle ordering and infrastructure deployment initiatives.

Market Dynamics:

Growth Drivers:

Why is the Canada Electric Bus Market Growing?

Comprehensive Government Funding and Policy Support

The Canada electric bus market benefits substantially from multi-level government funding programs designed to accelerate transit fleet electrification nationwide. In July 2024, the federal Zero Emission Transit Fund invested C$76 Million to help York Region Transit acquire 180 zero‑emission buses and 91 battery electric chargers, and 14 on-route chargers, coupled with depot upgrades and renewable energy systems. Furthermore, the federal Zero Emission Transit Fund provides capital assistance for vehicle procurement, charging infrastructure installation, and electrification planning studies across municipalities of varying sizes. Provincial governments complement federal initiatives through additional incentive programs and regulatory frameworks mandating fleet transition timelines.

Technological Advancements in Battery Systems and Charging Infrastructure

Continuous technological improvements in battery energy density, thermal management systems, and charging infrastructure capabilities are driving expanded electric bus adoption across Canadian transit networks. Modern lithium-ion battery packs deliver substantially improved cycle life performance compared to earlier generations, extending useful vehicle service life while reducing lifetime ownership costs. In June 2025, TransLink approved funding for 102 new battery-electric buses and 64 additional bus chargers, enhancing depot charging capabilities and supporting advanced bus technologies. Moreover, advanced battery thermal management technologies enable reliable cold-weather operation essential for Canadian climatic conditions, addressing historical performance concerns that previously limited adoption in northern regions. Smart charging management systems optimize energy flows across depot facilities efficiently.

Growing Urbanization and Public Transit Ridership Demand

Expanding urban populations across Canadian metropolitan areas are intensifying demand for efficient, sustainable public transit solutions capable of serving increasing ridership levels. As per sources, in April 2025, Regina added seven zero‑emission electric buses to its public transit fleet, with an additional 13 slated for delivery in 2026 under the Zero Emission Transit Fund. Furthermore, municipal governments face pressure to expand transit service capacity while simultaneously reducing transportation-related emissions contributing to urban air quality challenges. Electric buses offer quiet operation characteristics that reduce noise pollution in residential neighbourhoods, improving community acceptance of transit route expansions. Transit agencies recognize that zero-emission vehicles enhance public perception of services, potentially attracting ridership from private vehicle usage.

Market Restraints:

What Challenges the Canada Electric Bus Market is Facing?

High Upfront Vehicle and Infrastructure Costs

Electric buses require substantially higher initial capital investment compared to conventional diesel alternatives, creating procurement budget challenges for transit agencies operating within constrained funding environments. The cost differential encompasses not only vehicle acquisition but also essential charging infrastructure, depot facility modifications, and grid connection upgrades necessary to support comprehensive fleet electrification programs across Canadian municipalities nationwide.

Limited Charging Infrastructure in Remote Regions

Geographic dispersion of Canadian communities presents challenges for extending electric bus deployments beyond major metropolitan areas where charging infrastructure investments concentrate. Remote and rural transit operations face difficulties establishing reliable charging networks, limiting zero-emission technology accessibility for communities distant from urban centers and reducing equitable access to sustainable public transportation solutions across underserved regions.

Cold Weather Performance Considerations

Extreme winter temperatures prevalent across Canadian provinces impact battery performance characteristics, reducing operational range and requiring supplemental energy consumption for cabin heating systems. Transit agencies operating in northern climates must carefully evaluate technology specifications and thermal management capabilities to ensure reliable service delivery throughout extended cold weather periods affecting overall vehicle performance.

Competitive Landscape:

The Canada electric bus market competitive environment features established North American transit vehicle manufacturers alongside global electric mobility specialists competing for expanding procurement opportunities. Domestic manufacturers maintain advantages through proximity to customer operations, enabling responsive technical support and simplified parts logistics essential for maintaining fleet availability. The competitive landscape emphasizes cold-climate vehicle optimization, charging infrastructure integration capabilities, and total cost of ownership performance as key differentiation factors. Strategic partnerships between vehicle manufacturers, battery suppliers, and charging infrastructure providers create comprehensive electrification solutions addressing transit agency requirements across vehicle and supporting systems categories.

Recent Developments:

- In July 2025, New Flyer Industries Canada received a significant order from Ottawa’s OC Transpo for 124 Xcelsior CHARGE NG™ battery-electric buses, expanding the city’s zero-emission fleet. The purchase, supported by federal and local funding, reinforces OC Transpo’s commitment to sustainable transit and cleaner public transportation.

Canada Electric Bus Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Propulsion Types Covered | Battery Electric Vehicle (BEV), Fuel Cell Electric Vehicle (FCEV), Plug-in Hybrid Electric Vehicle (PHEV) |

| Battery Types Covered | Lithium-ion Battery, Nickel-Metal Hydride Battery (NiMH), Others |

| Lengths Covered | Less than 9 Meters, 9-14 Meters, Above 14 Meters |

| Range Covered | Less than 200 Miles, More than 200 Miles |

| Battery Capacities Covered | Up to 400 kWh, Above 400 kWh |

| Regions Covered | Ontario, Quebec, Alberta, British Columbia, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Canada electric bus market size was valued at USD 390.73 Million in 2025.

The Canada electric bus market is expected to grow at a compound annual growth rate of 13.73% from 2026-2034 to reach USD 1,243.62 Million by 2034.

Battery electric vehicle (BEV) held the largest Canada electric bus market share driven by favorable total cost of ownership economics, zero tailpipe emissions capability, established charging infrastructure compatibility, lower maintenance requirements, and overnight depot charging convenience across Canadian transit networks.

Key factors driving the Canada electric bus market include comprehensive federal and provincial funding programs, technological advancements in battery systems, growing urbanization increasing public transit demand, and stringent emissions reduction policy mandates.

Major challenges include high upfront vehicle costs, limited charging infrastructure in remote areas, inconsistent government incentives, long battery replacement times, supply chain constraints, and low consumer awareness about electric mobility benefits.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)